Q: Are Other Sources Of Retirement Income Taxable In South Carolina

While retirement income sources like 401 and IRA plans, government pensions and public pensions are taxable, they are heavily deductible. For taxpayers under age 65, the deduction is $3,000. For seniors age 65 and older, the deductible is $15,000. Above that limit taxes would be paid according to the rates in the table below:

| South Carolina Taxable Income |

Earned Income Tax Credit

South Carolina residents who qualify for the federal earned income tax credit also qualify for a similar credit on their state income tax return. For the 2021 tax year, South Carolinaâs credit is worth 83.33% of the federal earned income credit.

This credit is nonrefundable and doesnât carry forward.

How High Are Property Taxes In South Carolina

South Carolinas property taxes are among the lowest in the United States. The average effective property tax rate is just 0.55%. This means homeowners can expect to pay about $550 for every $100,000 in home value.

Indeed, most South Carolina homeowners pay less than $1,000 annually in property taxes. This contributes to the low cost of housing in South Carolina. But for seniors, costs may be even lower. The Homestead Exemption in the state can significantly reduce property taxes.

Recommended Reading: What Form To File Extension Taxes

South Carolina Income Taxes

South Carolina Income Tax Range

Low: 3%

High: 6.5%

Beginning with the 2023 tax year, and each year thereafter until it equals 6%, the top rate will decrease by 0.1% if general fund revenues are projected to increase by at least 5% in the fiscal year that begins during the tax year.

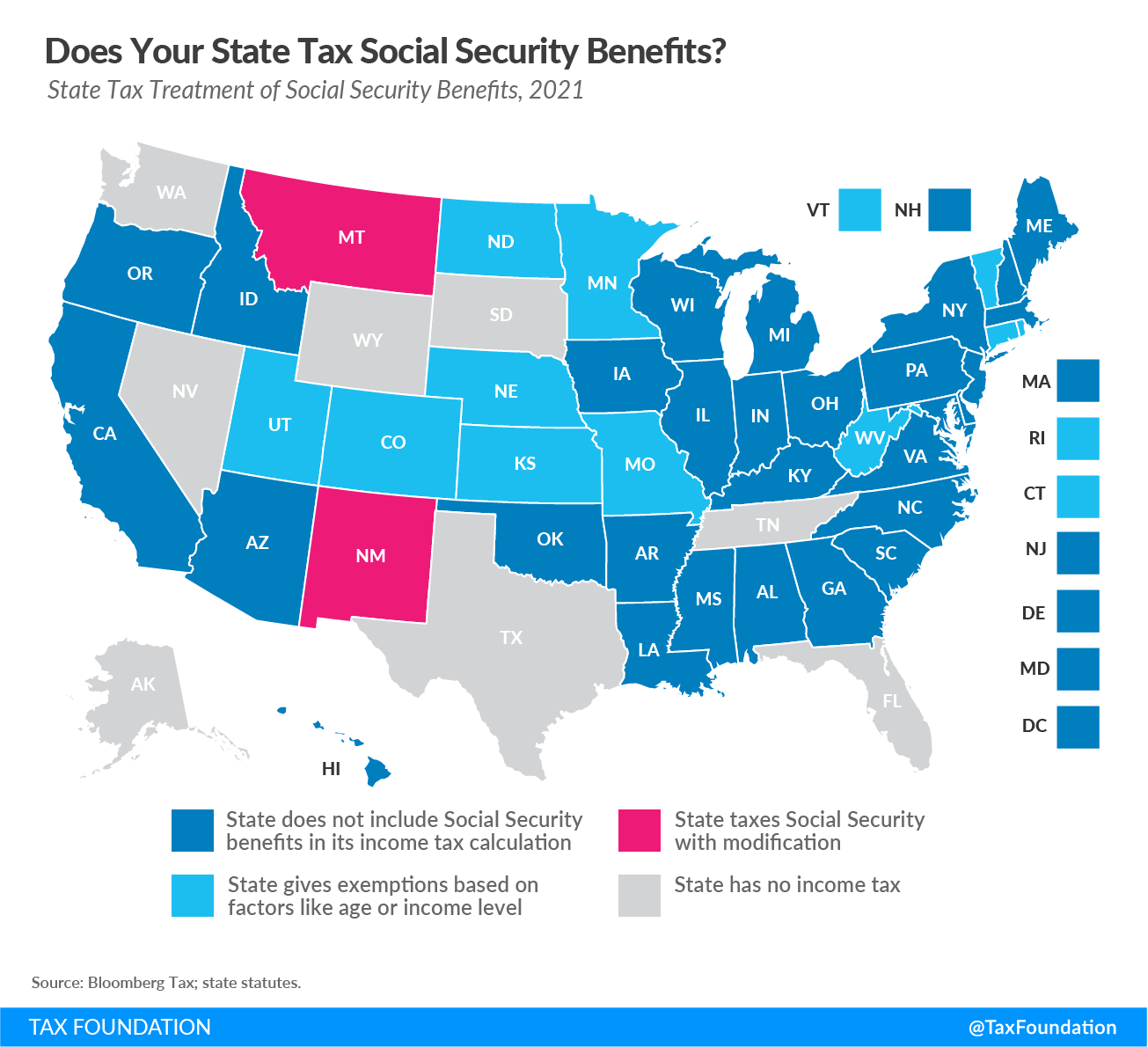

South Carolina Taxation of Social Security Benefits

Social Security benefits are not taxed by the state.

South Carolina Tax Breaks for Other Retirement Income

Taxpayers age 65 or older can exclude up to $10,000 of retirement income . Joint filers can each claim the exemption.

Taxpayers age 65 or older can also deduct $15,000 from all taxable income. However, the deduction must be reduced by the amount of retirement income otherwise excluded.

Military retirement income and Railroad Retirement benefits are fully exempt.

Overview Of North Carolina Retirement Tax Friendliness

SC Biz News” alt=”How good is S.C. for retirees … actually? > SC Biz News”>

SC Biz News” alt=”How good is S.C. for retirees … actually? > SC Biz News”> North Carolina exempts all Social Security retirement benefits from income taxes. Other forms of retirement income are taxed at the North Carolina flat income tax rate of 5.25%. The states property and sales taxes are both moderate.

To find a financial advisorwho serves your area, try our free online matching tool.

| Annual Social Security Income |

| Annual Income from Private PensionDismiss | Annual Income from Public PensionDismiss |

| Your Tax Breakdown |

| is toward retirees. |

| Social Security income is taxed. |

| Withdrawals from retirement accounts are taxed. |

| Wages are taxed at normal rates, and your marginal state tax rate is %. |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Don’t Miss: How Can I Find An Old Tax Return

South Carolina Property Tax

The property tax rate for residential property in South Carolina is 4% of the assessed value. This rate covers the house and up to five acres of land surrounding it. The first $100,000 in home value in South Carolina is exempt from school district property taxes. Homeowners over 65 are eligible for a homestead property tax exemption of $20,000.

All vehicles including cars, motorcycles, and recreational vehicles are taxed as property in South Carolina. The rate is around is 3% of the vehicle’s Blue Book value.

South Carolina would be an excellent low cost retirement option for a person or couple with a good source of income. It offers a low cost of living, low taxes, and many recreational opportunities.

| Capital: |

South Carolina Income Tax Credits:

South Carolina is one of the few states that allow the scale and purchase of certain tax credits between taxpayers. There are established exchanges that enable taxpayers to buy these credits at a discount. We are able to assist our clients in purchasing credits.

South Carolina has no estate or inheritance tax, however you estate will need to be probated if it exceeds $10,000 in probate assets. There is planning that can be done to minimize or even eliminate probate.

We recommend that if you have a will from your previous state of residence, that you have it reviewed by a South Carolina attorney to make sure it still does what you intended it to do. It is also important to create new power of attorney documents for property and health care in South Carolina. Old powers of attorney from other states may not not be effective once you become resident in South Carolina.

Read Also: When Are Irs Taxes Due 2021

What Taxes Do You Pay In South Carolina

South Carolinas general state Sales and Use Tax rate is 6%. In certain counties, local Sales and Use Taxes are imposed in addition to the 6% state rate. The general local Sales and Use Tax collected on behalf of local jurisdictions is for school projects, road improvements, capital projects, and other purposes.

South Carolina Real Property Taxes

In South Carolina, the median property tax rate is $566 per $100,000 of assessed home value.

South Carolina Property Tax Breaks for Retirees

For homeowners 65 and older, the state’s homestead exemption allows the first $50,000 of a property’s fair market value to be exempt from local property taxes. To qualify, you must have been at least 65 years old and a legal resident of South Carolina for one year, as of December 31 of the year preceding the tax year the exemption is claimed.

Read Also: Are Advisory Fees Tax Deductible

South Carolina State Tax Guide

State tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact South Carolina residents.

Retirees: Most Tax-Friendly

The Palmetto State boasts one of the lowest median property tax rates in the country. That’s the driving force behind South Carolina’s low tax burden.

Other Tax Breaks For Seniors

South Carolina taxpayers ages 65 and older do not need to file a state income tax return. In addition, Social Security benefits are not taxed by the state of South Carolina. Overall, Kiplinger rates South Carolina as a tax-friendly state for retirees. For more information on tax breaks that senior residents may be eligible for, visit the South Carolina Department of Revenue website.

Don’t Miss: How Many Years Of Tax Records To Keep

How Is South Carolina For Retirement

If you are thinking about retiring in an affordable coastal state, South Carolina is a good bet. Here is what to expect when you retire in South Carolina.

If you are thinking about spending your retirement years in South Carolina, you will enjoy the best of all possible worlds. Apart from the mild climate, South Carolina is an affordable state, and you will have more money to spend on your retirement. But, how is South Carolina for retirement?

South Carolina is a good state for retirement due to its favorable tax system, good weather, and low cost of living. Although social security benefits are exempt from taxation, you will pay income taxes on other retirement incomes. Residents also enjoy about 216 sunny days each year, world-class hospitals, plenty of outdoor activities, historical sites, and tuition-free education for seniors.

Does South Carolina Tax Pension And Social Security

No taxes on Social Security means that your retirement income goes even further in South Carolina. You can claim up to $10,000 in retirement income deductions. In addition to no taxes on Social Security, those over 65 are also able to deduct up to $10,000 in retirement income, from pensions, IRAs and the like.

Also Check: How Much Am I Going To Get Back In Taxes

Which States Do Not Tax Pensions

States That Dont Tax Pensions 2021

- Alabama: This state doesn’t tax pension income from defined benefit retirement plans.

- Alaska: Because Alaska doesn’t have an income tax, you won’t pay taxes on your pension or other income.

- Florida: Like Alaska, Florida doesn’t have an income tax, so your pension will not be taxed.

You Can Live Larger With Our Lower Taxes

South Carolina does not tax Social Security benefits and provides a generous retirement-income deduction when calculating state income tax. State income-tax rates are reasonable and property taxes are very low. Taxes are based on 4 percent to 6 percent of the market value of the home, and senior homeowners qualify for a homestead exemption. When you consider the total package of housing, taxes, utilities and daily living expenses, Myrtle Beach is one of the most affordable cities to live in, and property taxes in the area are among the lowest in America with city of Myrtle Beach residents receive an astounding 88 percent property tax credit.

You May Like: What Is The Date To Pay Taxes

You May Like: How Much Is Sales Tax In Florida

How Does South Carolina Rank For Retirement

Asked by:Cleora Mohr

Florida is better for retirement if you like warm weather, beaches, and water sports. It offers educational opportunities and good healthcare services. However, South Carolina is equally great since it offers numerous recreational activities, low retirement tax rates, and warm weather.

South Carolina Veterans Will No Longer Pay State Taxes On Military Retirement Income

DALZELL, S.C. – Veterans in South Carolina will no longer have to pay state income taxes on their military retirement, as the state joins 35 others with a full tax exemption on these benefits.

From Fort Jackson in Richland County to Parris Island along the Atlantic coast, so many American service members start their careers in South Carolina, and many more make stops along the way at the states eight military installations.

South Carolina leaders hope this new law, which Republican Gov. Henry McMaster commemoratively signed just minutes away from Shaw Air Force Base in Sumter County on Wednesday, encourages more veterans to stay in the state once they retire from their service.

This was, is, and always will be a great military state, McMaster said.

The 63K military retirees in South Carolina will no longer pay state income taxes on their retirement benefits, as @henrymcmaster ceremonially signs the bill that puts South Carolina in the group of 30+ other states with a full exemption

Mary Green

The state previously offered a partial tax exemption on military retirement income, which veterans receive if they have served at least 20 years.

For more than a decade, some lawmakers, especially those with installations in their districts, had been pushing for the General Assembly to eliminate all state taxes on these benefits, and the bill that does so unanimously passed both the House of Representatives and the Senate this year.

Copyright 2022 WCSC. All rights reserved.

Don’t Miss: Can You Claim Rent On Your Taxes

Is South Carolina A Good State To Live In Or Retire To

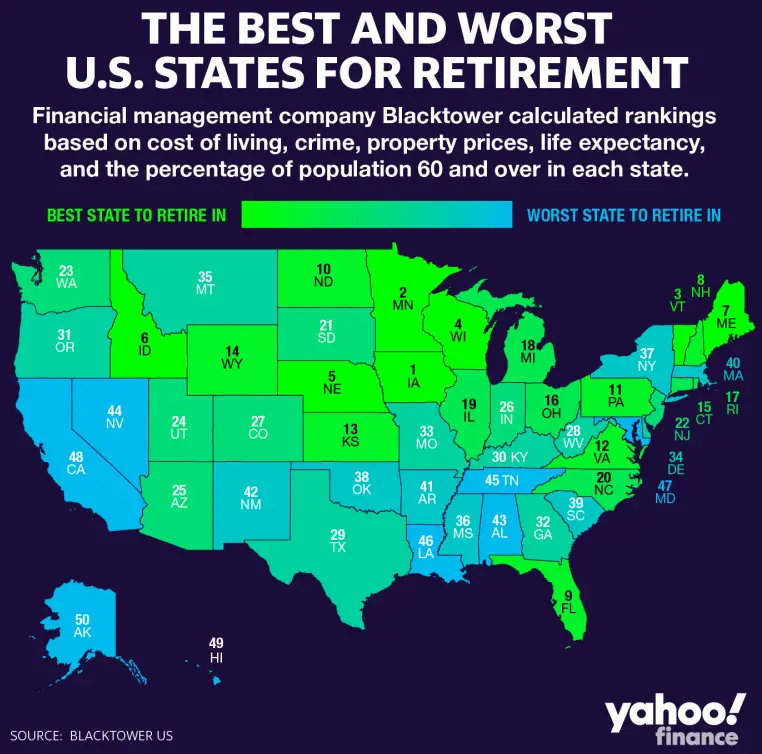

South Carolina is a good state to live in or retire to because its climate is mild, and the state is, overall, affordable. A survey by Retirement Living has ranked South Carolina as the #4 best state to retire to. South Carolina has a lower cost of living and some beautiful beaches that are warm practically year-round.

How High Are Property Taxes In North Carolina

North Carolina has relatively low property taxes. The states average effective property tax rate is 0.77%. This means that, on average, homeowners can expect to pay about $770 annually for every $100,000 in home value.

Low property taxes are one reason housing costs in North Carolina are below national averages. That also contributes to North Carolinas generally low cost of living.

Also Check: Can You Claim College Tuition On Taxes

Lead An Active Lifestyle In A Community That Cares

Over 60 miles of uninterrupted shoreline and 90 championship golf courses and over 600 fine arts events annually ensure there is plenty to do in your downtime. While we believe in making the most of playtime, the Myrtle Beach area is also a community that cares about our residents. In addition to being able to lead an active lifestyle, retirees will also find plenty of ways to give backall while meeting interesting people in the area! Religious organizations, arts groups, professional associations, community service groups and medical facilities are always in need of volunteers while they supply valuable support and assistance to the community we call home.

Jeanie Reeder vacationed along the Grand Strand growing up, but she and husband Tom traveled from their Lexington, Ky., home to Oak Island, N.C., with their children for getaways. Expecting to retire to the North Carolina coast, Jeanie and Tom looked for five years without finding the perfect spot.

When a girlfriend of Jeanies invited the couple to Barefoot Golf & Resort to see a lot she had just purchased, they visited and ended up buying a neighboring lot that very morning. Says Jeanie, That was eight years ago, and from that day on we have not looked back. We absolutely love it here! Tom is an avid golfer, and I enjoy the beach. I go every day in the summer.

Read Also: Do You Have To Claim Social Security On Taxes

South Carolina Boasts Lowest Property Taxes In The Country

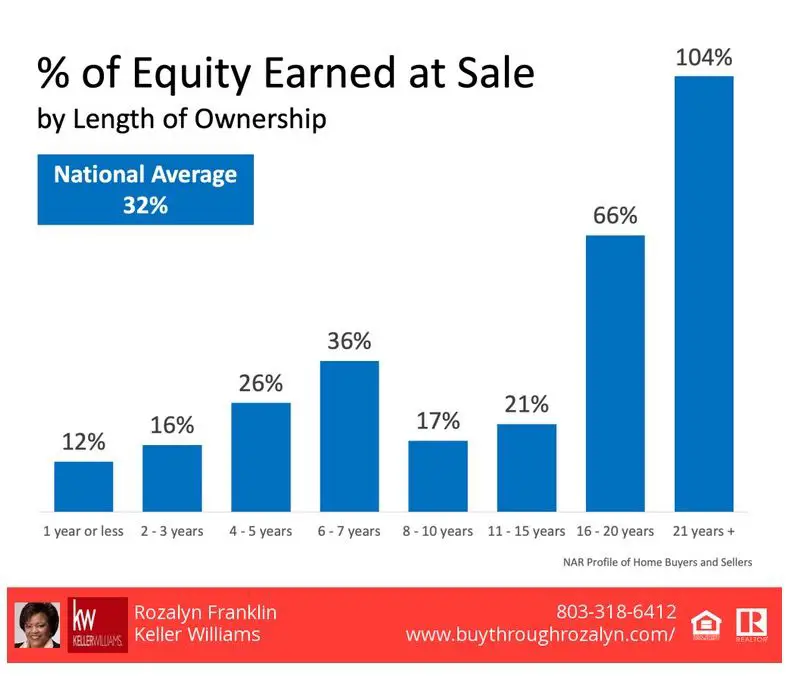

South Carolina retirement homes are one of the best investments you can make. The state has one of the lowest property tax rates in the United States. According to Investopedia, SC had thefifth-lowest property tax rate in the nation. Family residences are assessed at 4 percent, a lower ratio than commercial properties, although both are below the national average. Homeowners are then taxed at this lower ratio on the assessed value of their home.

Retirees who are 65 years of age or older, as well as disabled and legally blind people, can benefit from a $50,000 homestead exemption on the fair market value of their residential property.

In 2018, the national property tax average was 1.21 percent. A South Carolina resident pays less than half this rate on a home valued at $250,000. In Berkeley County, homes worth around $150,000 are taxed at 0.51 percent. In Dorchester County, the county collects 0.67 percent of the propertys assessed market value in taxes. In Charleston County, that number is even lower on average, the county collects 0.5 percent of the residential propertys value in taxes.

Personal property taxes in South Carolina are collected on cars, trucks, motorcycles, recreational vehicles, boats, and airplanes. There is a 5 percent tax on all vehicles, including airplanes and boats. The state assesses a personal income tax with a maximum of 7 percent in six tax brackets. The sales tax was at 6 percent in 2018.

Also Check: Where Can I File An Amended Tax Return For Free

Does North Carolina Tax Federal Retirement Income

4.8/5North Carolinaretirement benefitsincome taxesretirement incomeNorth Carolinaincome taxtaxesretireesNorth Carolinataxes

Military Retirement:Military benefits are not taxed in the State of North Carolina if the retiree had five or more years of creditable service as of August 12,1989. If this does not apply to the retiree, up to $4,000 of the retirement pay can be excluded.

Likewise, which states do not tax pensions? States without pension or Social Security taxes include:

Keeping this in view, what is the federal tax rate on retirement income?

If your provisional income is between $25,000 and $34,000 , then up to 50% of your benefits are taxable. If your provisional income is more than $34,000 , then up to 85% of your benefits are taxable.

Do I have to pay taxes on my pension in Michigan?

Under Michigan law, qualifying pension and retirement benefits include most payments that are reported on a 1099-R for federal purposes. Payments not reported in federal adjusted gross income are not taxable in Michigan and not subject to withholding.

Also Check: Do I Charge Sales Tax On Services

South Carolina Governor Henry Mcmaster Signs Bill Into Law Exempting Military Retirement Pay From Income Tax

Tuesday, May 17, 2022 9:05 AM

With Governor Henry McMaster signing H. 3247 into law on Friday, May 13, South Carolina is now one of more than three dozen states that exempt military retiree pay from taxation.

The law is effective beginning tax years after 2021 making military retiree pay 100-percent exempt from state income tax with no earned-income cap. Prior to the passage of the bill, a portion of a military retirees income was taxed with only partial exemptions in place.

Governor Henry McMaster first proposed the tax cut for military retirees in January of 2018. The legislation will incentivize Service Members transitioning from active duty to retirement to live, work, or consider relocating to South Carolina.

Were doing everything we can to incentivize our nations heroic veterans to live, work, and raise their families here in S.C., said Gov. Henry McMaster. For years, we have fought to eliminate all state income taxes on their retirement pay. Im proud to have finally signed a bill into law that will make that a reality. This is just one more way we can thank our Veterans for their sacrifice, and it adds to the long list of things that makes South Carolina the most military-friendly state in the country.

Read Also: How To Pay My Property Taxes Online

Popular Destinations In The Carolinas Retirees Are Targeting

The short list is a long one. The Carolinas are actively recruiting retirees, and local governments are friendly to the developers of the numerous active adult over-55 communities that surround beach and mountain communities.

U.S. Census Bureau population estimates from April 2010 to July 2019 note this is well before the pandemic show:

- The region straddling the North Carolina-South Carolina border that includes Myrtle Beach, Conway, and North Myrtle Beach grew a whopping 32.6% last decade with the arrival of 122,581 new residents.

- Raleigh, N.C.s population grew by 16% with the arrival of 180,756 new residents.

- South Carolinas Hilton Head Island-Bluffton-Beaufort regions population grew 15.6%, with 29,093 new residents.

- Charleston-North Charleston, S.C., gained 101,288 new citizens in that time frame, a 15.2% growth rate.

Popular retirement communities in North Carolina include Pinehurst Trace in Pinehurst and The Gables at Kepley Farm in Salisbury. Popular retirement towns in North Carolina include Brevard and Asheville in the mountains, New Bern and Oak Island, as well as Southport, Carolina Beach and Chapel Hill.

Retirement communities also dot some of the top retirement destinations in South Carolina as well, including popular destination towns Georgetown, Spartanburg, West Columbia, Greenville and Hilton Head Island.