Pay Social Security Taxes To Qualify For Benefits

Self-employed individuals have to pay Social Security taxes through their estimated tax payments and individual income tax returns. By filing a return and paying the associated taxes, you report your income so that you may qualify for Social Security retirement and disability benefits when you need them.

How To Get Copies Of Past Years Tax Returns

Heres how to obtain copies of a prior year return you filed in TurboTax Online:

If you dont see your tax year listed, you may have multiple accounts.

Hope this was helpful!

Read Also: What Do Tax Accountants Do

Collect All Necessary Documentation

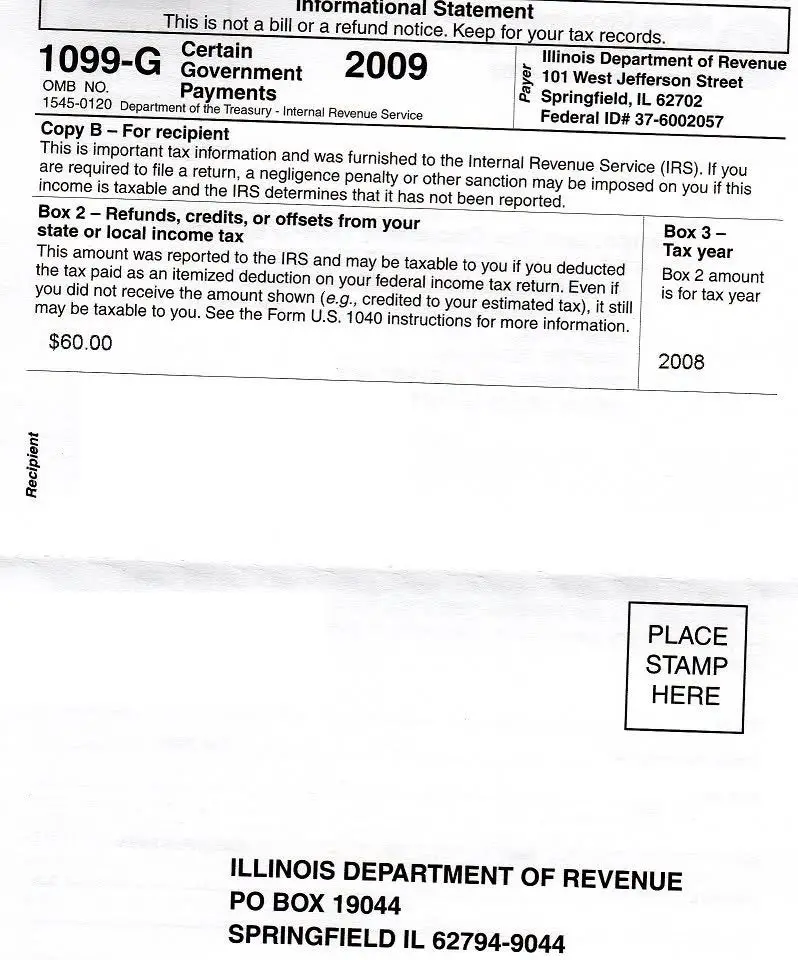

You need W2s, 1099s, and all other relevant forms for the year in question. If you are itemizing deductions, you also need receipts and records to back up your claims. If you dont have these forms, contact your employer, former employer, or a financial institution. With wages, you can often get the numbers you need from your last pay stub of the year.

If you cant get a hold of these documents, contact the IRS directly at 1-800-829-1040 or request the IRS mail you a wage and income transcript . Usually, wage and income tax transcripts go back up to 10 years. Therefore, you can obtain 1099 and W2 information, even if you cannot locate these documents.

If you are self-employed and were 1099d, IRS wage and income transcripts will help you determine your income for a taxable year. Also, you can obtain bank statements that will also help you identify income and expenses.

Also Check: Do You Have To File Taxes On Cryptocurrency

Import A Pdf For A Prior Year:

If last year you used other tax software, an accountant, or tax service, youll get the option to import a PDF when youre starting in TurboTax. A PDF imports your personal info and your AGI so you can e-file.

Select the method you used to file last year and follow the screens. The PDF needs to be your 1040, 1040A, or 1040EZ, and the program accepts PDFs from a range of providers.

But, if the PDF is password protected or a scan of a hard copy, you wont be able to import. If this happens, dont worry, well guide you through typing in your info.

*Tip: While you can import a 1040EZ return to a paid version of TurboTax, you cant import prior years to their Free Edition , so you may have to pony up for another edition

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: Do Expats Pay Us Taxes

Use A Tax Preparer Or A Software Program

Although optional, getting professional help can make the process easier. If you use a software program, make sure to use the application for that year. Most computer software such as TurboTax, dont allow you to file old tax returns online. Instead, you need to order a CD or download the software for the relevant tax year. A tax professional can handle everything generally with the software they use, including finding the right forms, for you. However, it is always best to check with the tax professional as some tax years may be unavailable.

How To Get A Copy Of Your Tax Transcript

There are three ways to get a copy of your tax transcript.

The easiest way is to use the IRSs online transcript portal, Get Transcript. To use this service to access your transcripts online, youll need to provide your Social Security number, filing status from your most recent return, date of birth and the mailing address from your most recent tax return. Youll also need a few other things: an email account, a mobile phone with your name on the account, and an account number from an eligible account to verify your identity.

You can also fill out and mail in a copy of Form 4506-T or use the Get Transcript by Mail option through the Get Transcript portal. But if you make your request that way, you should be prepared to wait 30 days to receive your copy. Finally, if youre a phone person, you can also get a copy of your transcript by calling the IRS at 1-800-908-9946. Phone orders typically take five to 10 business days.

One thing to note: The IRS is now issuing transcripts that block out portions of your Social Security number, telephone number, last name and address. Thats why youll have to provide an account number to verify your identity so they can use it to match up with your file. By limiting the amount of personal information on the transcript, the IRS hopes to help reduce the risk of identity theft.

Read Also: How To Figure Out Paycheck After Taxes

Not Free No Help When The Irs Sends A Letter And Still Waiting For Refund Four Months Later

I used the TurboTax app to file my refund in early February. The app was relatively easy to use, but it did get old going in circles sometimes. Unfortunately, the free option really is not usable. If you have to file state taxes like just about everyone, then you will have to pay $40 per state. If youre a college student in another state like me, that means two states so $80. Of course, no student discount. Honestly, that was not too bad since I was supposed to get a lot back.Unfortunately, that was not what happened. I did get some from one the state returns, but that was it. The IRS sent a letter for a health insurance form that didnt even apply to me. If you want help with that, guess what? It will cost you even more money! At that point, I wasnt paying TurboTax any more so I went off on my own. Eventually I got it figured out, but not without massive disruption to my school work. None of that help was thanks to TurboTax which sends you to FAQs that dont really apply.They have online discussions which appear to have many people with the same problem. This program is made to look easy- and it is at first- but the headache it causes later is not worth it. Never had trouble like this with H& R Block so I think Ill go back to them next year. Whatever you do, dont use TurboTax. It is seriously not worth it. Still waiting for that federal tax refund BTW.

How To Obtain Old Tax Documents

Do you need old tax documents from the IRS? Here’s the difference between a tax return transcript and an exact copy of your tax return. Learn which one is right for your situation and what steps you need to take to obtain them from the IRS.

Certain situations may require you to have access to your previously filed tax returns. The most common is during a loan application process when your lender requests prior years’ tax information to verify your stated income. You may also need old tax information to amend a prior-year tax return, compare it to your current year tax return, or defend yourself in the case of an Internal Revenue Service audit.

While you should save a copy of your business tax returns for a minimum of seven years, if a situation arises and you need to access an old tax document you do not have in your possession, what should you do?

You May Like: How Much Of Your Paycheck Goes To Taxes

Request Online With Masstaxconnect

This request requires that you log into MassTaxConnect.Please note:

- If you are not already a registered MassTaxConnect user, you will need to create a MassTaxConnect username and password by visiting MassTaxConnect and selecting “Create My Username”.

- Your request for a copy of a previously filed personal income tax return may take several days to process.

Check The Status Of Your Income Tax Refund

ONLINE:

- Click on TSC-IND to reach the Welcome Page

- Select Check the Status of Your Refund found on the left side of the Welcome Page.

-

You must have your social security number and the exact amount of the refund request as reported on your Connecticut income tax return. Enter the whole dollar amount of the refund you requested. For example, if you requested a refund of $375, enter 375.

NOTE: Please be aware that for all direct deposit refunds you must allow at least two business days after the date the refund is processed for the credit to be in the account.

TELEPHONE:

- Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962 . You will need your social security number and the exact amount of the refund request as reported on your income tax return. Enter the whole dollar amount of the refund you requested followed by the # sign. For example, if you requested a refund of $375, enter 375#. You can only check the status of the refund for the current filing season by telephone.

Paper Returns: Due to the volume during the filing season, it takes 10 12 weeks to process paper returns. Until the return is processed, your return will not appear on our computer system and we will not be able to check its status or to give you information about your refund. NOTE: Please consider using one of the electronic filing options. Visit our Online Filing Page for more information.

Don’t Miss: How To Take Taxes Out Of Check

Locate The Necessary Tax Forms

When filing back taxes, you need to use the tax forms from that year. For example, if you are preparing an individual tax return for 2015, you have to use Form 1040 for 2015. This is because the rules and credits may change from year to year. You can find most old forms online. If you cannot find one you need, contact the IRS or your states Department of Revenue. However, remember, if you are using software or a tax preparer, then you will not need to find the forms.

Why Is My Refund Different Than The Amount On The Tax Return I Filed

All or part of your refund may have been used to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt.

We also may have changed your refund amount because we made changes to your tax return. This may include corrections to any incorrect Recovery Rebate Credit amount. Youll get a notice explaining the changes. Wheres My Refund? will reflect the reasons for the refund offset when it relates to a change in your tax return.

You May Like: Who Can Claim Education Tax Credit

Copy Of Your Tax Return

There are different ways to obtain your tax return information. Most requests can be satisfied with a computer printout of your return information called a transcript. However, sometimes you need an exact copy of a previously filed and processed tax return with all attachments . Copies are generally available for returns filed for the current and past six tax years. On jointly filed tax returns, either spouse may request a copy. Only the signature from the requesting spouse is required on the Form 4506, Request for Copy of Tax Return. You should complete Form 4506 and mail it to the address listed in the instructions, along with a $43 fee for each tax return requested.

- Make your check or money order payable to “United States Treasury”

- Enter your SSN, ITIN, or EIN and “Form 4506 request” on your check or money order

- Allow 75 calendar days for us to process your request

If you’re a taxpayer impacted by a federally declared disaster or a significant fire, the IRS waives the usual fees and expedites requests for copies of tax returns for people who need them to apply for disaster-related benefits or to file amended returns claiming disaster-related losses. See Publication 3067, IRS Disaster Assistance Federally Declared Disaster AreaPDF. For additional information about tax relief in disaster situations, refer to Topic No. 107 or call the IRS Disaster Assistance Hotline at .

Access Tax Records In Online Account

You can view your tax records now in your Online Account. This is the fastest, easiest way to:

- Find out how much you owe

- Look at your payment history

- See your prior year adjusted gross income

- View other tax records

Visit or create your Online Account.The method you used to file your tax return and whether you had a balance due affects your current year transcript availability.

Request your transcript online for the fastest result.

You May Like: Has The Deadline For Taxes Been Extended

Blocking Search Engines From Indexing Its Free File Program Page

Citizens of the US that make up to $72,000 per year are eligible for free preparation and filing of tax forms through the IRS Free File program. However, TurboTaxs free file program page contains specific HTML tags which block search engines from indexing it. TurboTax has been deceiving customers which were eligible for the free submission into signing up for their commercial product. Starting December 30, 2019, under a new agreement from the IRS, TurboTax can no longer hide their free version services from search results.

Dont Miss: How Much Does Tax Take

What Is A Resale Certificate And Why Do I Need One

FULL TRANSCRIPT

Im sure youve heard all the buzz online about resale certificates, or maybe someones asked you for a resale certificate, and you dont really know what it is. Well, thats why Im making this video. A resale certificate is directly tied to sales taxes, and it would be requested from a specific state.

You May Like: What Is New York State Tax Rate

Im A Nonresident Alien I Dont Have To Pay Us Federal Income Tax How Do I Claim A Refund For Federal Taxes Withheld On Income From A Us Source When Can I Expect To Receive My Refund

To claim a refund of federal taxes withheld on income from a U.S. source, a nonresident alien must report the appropriate income and withholding amounts on Form 1040-NR, U.S. Nonresident Alien Income Tax Return PDF. You must include the documents substantiating any income and withholding amounts when you file your Form 1040NR. We need more than 21 days to process a 1040NR return. Please allow up to 6 months from the date you filed the 1040NR for your refund.

What Is Happening When Wheres My Refund Shows My Refunds Status As Approved

Weve approved your refund. We are preparing to send your refund to your bank or directly to you in the mail. This status will tell you when we will send the refund to your bank . Please wait 5 days after weve sent the refund to check with your bank about your refund, since banks vary in how and when they credit funds.

Also Check: What Are My Taxes On My Property

Go To My Account To Get The Following Documents In 5 Days Or Less:

- personal income tax returns

- information slips

- notices of assessment or reassessment

- COVID-19 support statements including the Canada Emergency Response Benefit

- statements of income and deductions for previous tax years

Or call 1-800-959-8281 to request tax and benefit documents.

If you still choose to make an ATIP request, it will take up to 30 days to get your response.

Sending In Your Tax Returns

In most cases, you cant submit old returns electronically. Instead, you need to mail them to the IRS or your state revenue department. Send your returns to the address on the tax return or tax return directions. If you receive a notice reminding you to file a return, use the address on that IRS letter.

If you are working with an IRS Revenue Officer, you should send the complete returns to that person. When in doubt, contact the IRS or state directly.

Recommended Reading: Is It Hard To Do Your Own Taxes

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.