How To Calculate Adjusted Gross Income On W2

Millions of taxpayers are not aware of Adjusted Gross Income calculation on W2, and this is leading them to calculate the boxes of Form W2 from 1 to 14 for assessing the taxes and tax savings, which is incorrect and inappropriate way of calculating your AGI on W2.

Remember! You should not add Form W2 boxes 1 to 14 for AGI-Adjusted Gross Income because, your Adjusted Gross Income is already to your box 1. So, you need not add the boxes 2-14 once again to box 1, if added then expect an interest and penalty notice from the IRS and State.

In order to avoid Penalty and Interest notices, when your employer issues you with Form W2, a copy of it would be submitted with the IRS for reference. Your submitted tax returns will be cross verified with the form W2 submitted by your employer, if there is any mismatch then IRS would possibly send you accuracy related penalty notice.

Received any penalty or interest notice? Please do not worry because, like our any other client we can help you in resolving the notices and audits without any cost at all, and you can even enjoy our $2,000 worth tax consultations and 21 value added tax service Free of Cost.

The below article will give you an idea about Form W2 boxes 12,13 and procedure to request your employer to withhold appropriate taxes for current and next year Federal and States.

Adjusted Gross Income Through From W4 Submission With Your Employer!

How To Find AGI On W2?

Where Is Your Adjusted Gross Income On From 1040?

CLAIMABLE EXPENSES:

What Is Annual Gross Income

For an individual, annual gross income equals the amount of money that you earned in a year before taxes. If youre a business, your annual gross income would be your companys revenue, less any business expenses.

Because its your gross income that reflects how much money you made during the year, it becomes an important figure in determining whether you will be required to file a tax return. According to the Internal Revenue Service , if youre a U.S. citizen, whether or not you must file a federal income tax return depends on your gross income, your filing status, your age, and whether you are a dependent.1 For additional details on who is required to file a tax return, visit the IRS website at www.irs.gov.

How To Calculate Your Agi

Heres how you work out your AGI:

- Start with your gross income. Income is on lines 7-22 of Form 1040

- Add these together to arrive at your total income

- Subtract your adjustments from your total income

- You have your AGI

Above-the-line deductions include the following:

- Educator expenses

- Tuition and fees

- Domestic production activities deduction

Self-employed workers can take advantage of above-the-line deductions. If you increase these deductions, you can lower your taxes.

Don’t Miss: How To File Taxes Doordash

Can I File My Taxes Without Last Years Agi

If you cant find your prior-year AGI, you have a couple of options. Youll need to request a copy of a return for 2018 from the IRS, which you can do any of these ways: View or download a transcript of your return online at www.irs.gov. Call the IRS at 800-908-9946 and request a hard copy transcript be mailed to you.

Your Agi: What It Is And How It Affects Your Stimulus Check Tax Refund And Child Tax Credit

Your adjusted gross income is an amount calculated from your total income, and the IRS uses it to determine how much the government can tax you. Gross income is the sum of all the money you earn in a year — including wages, dividends, alimony, capital gains, interest income, royalties, rental income and retirement distributions.

After you subtract allowable deductions from your gross income , the result is your AGI, or taxable income, which is used to calculate your income tax. Your AGI is reported on IRS Form 1040, and you can find it on Line 11 of this year’s version .

Since it’s a rough estimate of how much money you’re bringing in after deductions from all your streams of income, the IRS uses your AGI to calculate how much you get in a stimulus check, the amount of your tax refund , and your upcoming 2021 child tax credit .

For tax credits, as your AGI goes up, the amount you can get generally decreases. Here’s and example: The third check is more targeted than the first two rounds. Single taxpayers with an AGI over $80,000 will not be eligible for any stimulus money, down from a $99,000 cutoff for the first check, and $87,000 for the second check.

Read Also: Does Doordash Do Taxes

What Are Some Common Adjustments Used When Determining Agi

There are a wide variety of adjustments that might be made when calculating AGI, depending on the financial and life circumstances of the filer. Moreover, since the tax laws can be changed by lawmakers, the list of available adjustments can change over time. Some of the most common adjustments used when calculating AGI include reductions for alimony and student loan interest payments.

What Is Modified Adjusted Gross Income

When filing your taxes, you may be required to calculate your modified AGI . Your MAGI will further adjust your AGI through the addition of items such as foreign income, tax-exempt interest and Social Security benefits that are otherwise deducted.

The IRS requires you to calculate your MAGI if your income has increased between tax filings. This is because, as you rise in tax brackets, certain credits and deductions are no longer available to you, including:

- Tuition

- Student loan interest

If your income grows further, then retirement contributions, rental property losses and general education expenses will be unavailable to you as well.

Read Also: If I File Taxes Today Will I Get A Stimulus Check

Calculate Your Modified Adjusted Gross Income

Now that youve figured out your AGI, youre finally ready to calculate your modified adjusted gross income. The IRS phases out credits and deductions as your income increases. So by adding these factors back to your AGI, the IRS determines how much you really earned, giving you your MAGI.

According to Internal Revenue Code ), you should add the following to your AGI to determine your MAGI:

- Any amount excluded from gross income in section 911

- Examples include untaxed foreign income, non-taxable Social Security Benefits, tax-exempt interest, and housing costs for qualified individuals

- Any amount of interest received or accrued by the taxpayer during the taxable year which is exempt from tax

- Any amount equal to the portion of the taxpayers social security benefits.

- As defined in Section 86 ) which is not included in gross income under section 86 for the taxable year. This includes any amount received by the taxpayer by reason of entitlement to a monthly benefit under title II of the Social Security Act, or a tier 1 railroad retirement benefit.

If this looks confusing, the good news is that most people dont have any of the income described above, so its likely your MAGI is the same as your AGI.

What Is My Agi On My 2019 Tax Return

asked: What is my AGI on my 2019 tax return?

The 2019 tax return is the current-year tax return.

What stage is your 2019 return in? Is your 2019 return still in preparation? If so, the following steps will tell how to see the AGI in your unfiled return.

NOTE: If your 2019 return has already been filed, then skip the below and see my follow-up comment in the next section that follows this posting.

In an unfiled return you can view your 2019 AGI figure on the Tax Summary or on a preview of your in-progress Form 1040.

Are you still preparing your 2019 return? If so, heres how to look at the Tax Summary and also how to preview the Form 1040 and Schedules 1-3 prior to paying/filing.

- Log in and open your return.

- In the left menu column, choose TAX TOOLS, then choose TOOLS.

- In the Tools window, choose View Tax Summary.

- When the Tax Summary opens, you can review the Summary. It may have the info you want.

- Otherwise, to preview the Form 1040, look in the left menu column and choose Preview My 1040.

- That will show you the Form 1040 and schedules 1-3.

Don’t Miss: Doordash 1099 Form

How To Increase Your Deductions

If you have other personal deductions that aren’t on the list , you must deduct them as itemized deductions. Use the IRS Schedule A for this. Many of these deductions are deductible only if, and to the extent, they exceed a specified percentage of your AGI. Thus, the greater your AGI, the less you can deduct.

Losing part of your itemized deductions is terrible, but it can get even worse. Many itemized deductions get reduced if your AGI exceeds certain levels.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Restaurant Tax In Philadelphia

Lets Understand It Better With An Example

Suppose your final income is $100,000. Now calculate your specific expenses from the last year. Lets suppose those expenses are:

- Your student loan interest is $300

- Educator expenses are $700

- Your contributions to the retirement accounts are $10,000

- And your contributions to the health savings account are $5,000

Your total deductions will be $16,000. Now subtract deductions from your annual income , the value $84,000 will be your adjusted gross income.

How Your Adjusted Gross Income Affects You

Your adjusted gross income is typically the basis for your taxes, not your gross income. The adjusted gross income is a more accurate look at your actual income, which is why it often is considered more heavily. Your adjusted gross income is what will also qualify you for tax deductions and tax credits, which are figured by your income.

Some tax credits and deductions will benefit you more if your adjusted gross income is lower, which is why you want to calculate it properly. For example, if you itemize your deductions, youll reduce your medical and dental expenses by 7.5 percent of your adjusted gross income. That means you can only deduct the amount that exceeds 7.5 percent of your adjusted gross income, so the lower that number is, the more of your expenses you can deduct.

These tax credits and deductions will affect your taxable income, and you want to get that adjusted gross income to a place thats not only correct, but that will maximize your tax return.

Your adjusted gross income is also typically the basis for your state tax return, which is why its important to start your federal return first to get that number. Once youve completed your federal return and gotten to your adjusted gross income , you can move on to your state tax returns using the numbers youve already found.

Don’t Miss: Do I Have To Pay Taxes On Doordash

How Do I Get My Original Agi If I Cannot Locate My Last Years Return

To retrieve your original AGI from your previous years tax return you may do one of the following:

- Use the IRS Get Transcript Online tool to immediately view your Prior Year AGI. You must pass the IRS Secure Access identity verification process. Select the Tax Return Transcript option and use only the Adjusted Gross Income line entry.

- Contact the IRS toll free at 1-800-829-1040

- Complete Form 4506-T Transcript of Electronic Filing at no cost

- Complete Form 4506 Copy of Income tax Return

Where To Find The Prior Year Agi For Your Tax Return

- See More in: Tax Education

Adjusted Gross Income is a central calculation on any tax return, determining how much income tax you owe. The IRS uses prior year AGI as a sort of security check if youre filing your tax return electronically, the agency wont accept your return unless you enter this number correctly. The agency uses this number along with other details to verify your identity, but if youre like most people, you may not know where to find it.

Taxpayers, in a lot of cases, dont even know what an AGI is. Dont worry if youre in this boat, youre not alone, and this guide is designed to help. It defines prior year AGI and shows you exactly where to find it.

Recommended Reading: How Do You Do Taxes With Doordash

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents youll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

How To Find Your Adjusted Gross Income To E

OVERVIEW

Your adjusted gross income is an important number come tax time, especially if you’re planning to e-file. Not only does it impact the tax breaks youre eligible foryour AGI is now also a kind of identification.

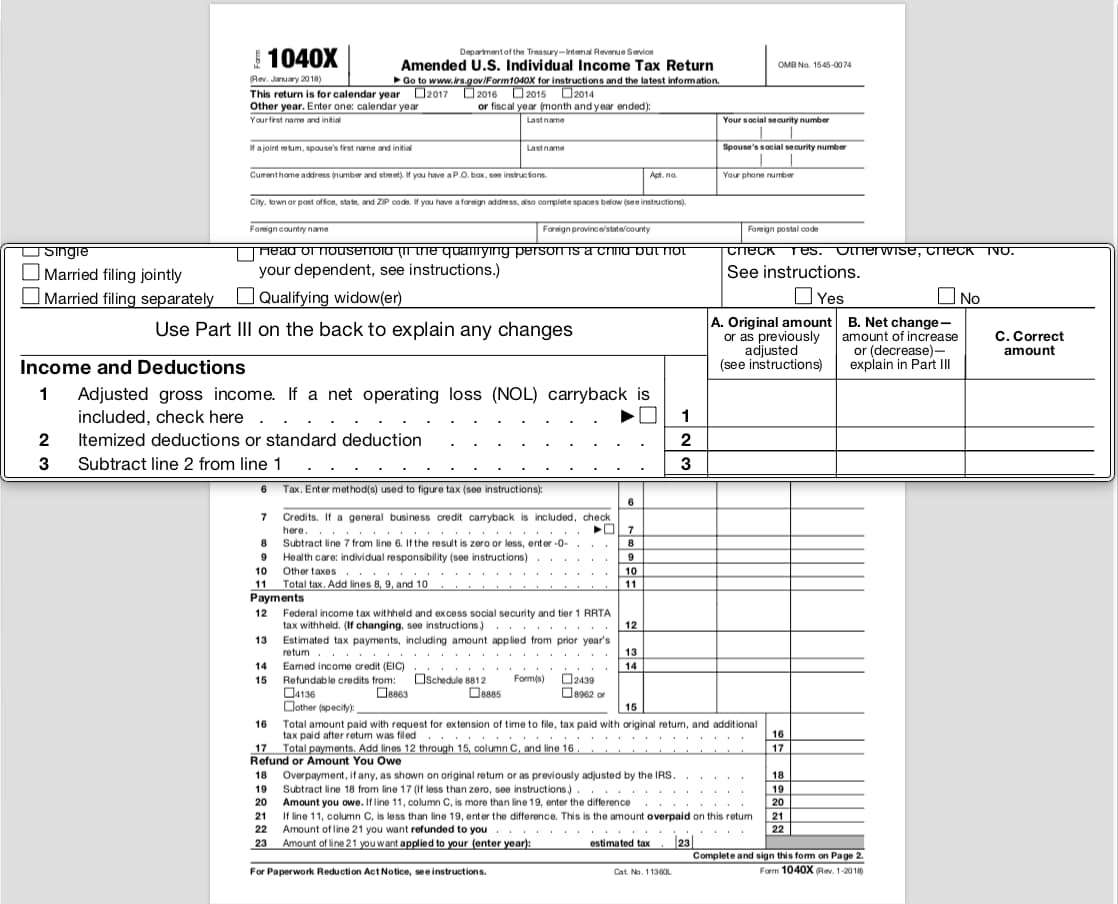

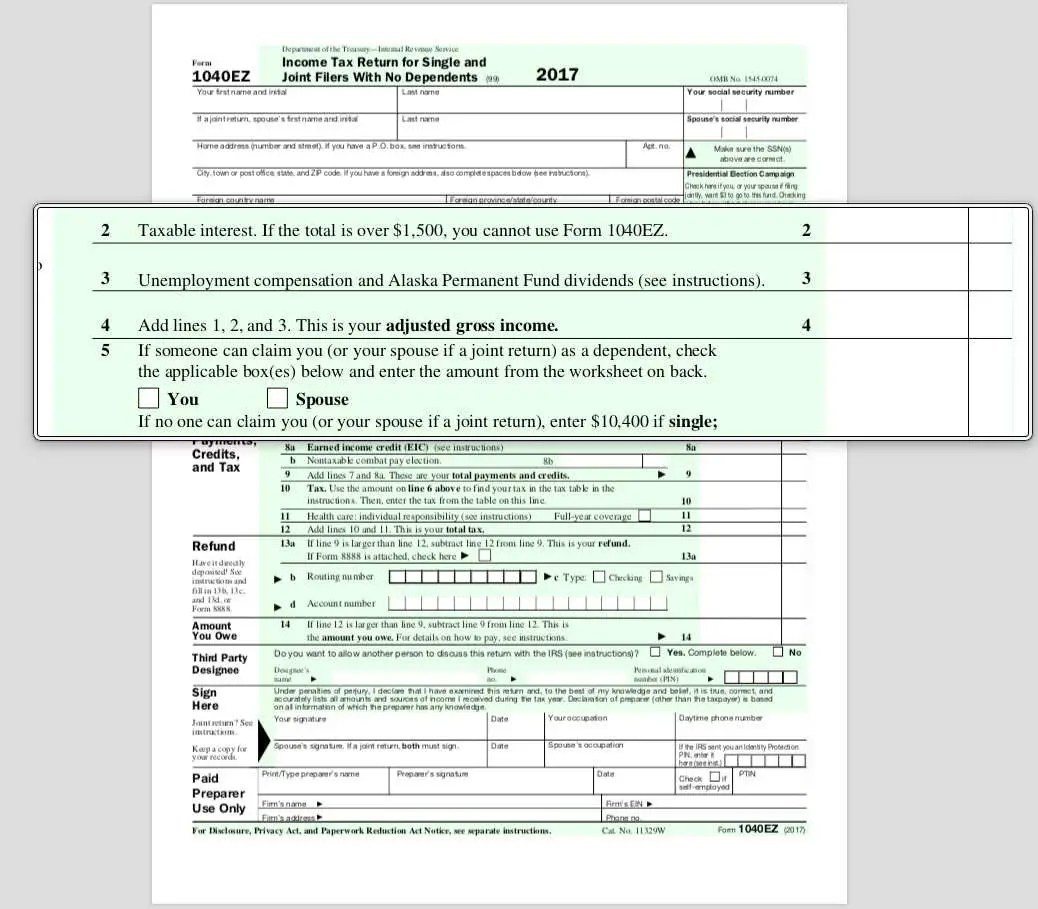

For tax years beginning 2018, the 1040A and EZ forms are no longer available. They have been replaced with new 1040 and 1040-SR forms. For those who are filing prior year returns, you can continue to use form 1040A or EZ for tax years through 2017.

If you plan to e-file your tax return, you may need to first find the amount of AGI from last year’s return in order for the IRS to verify your identity. You can find your AGI on the form you used to file your last year’s return.

Also Check: Taxes On Doordash

Calculate Magi For Ira Contributions

An individual retirement account allows you to save for retirement without going through your employer, but you must meet the income requirements. Income limits for a traditional IRA or Roth IRA are based on your tax filing status and your modified adjusted gross income, which you can determine by finding your AGI and then adding the following values to it :

-

Your IRA deduction, which you can find on line 19 of Schedule 1

-

Your student loan interest deduction, which is on line 20 of Schedule 1

-

Your tuition and fees deduction, which is on line 21 of Schedule 1

-

Any housing exclusion or foreign earned income exclusion that you claimed on line 45 of Form 2555

-

Any Foreign housing deduction, which is on line 50 of Form 2555

-

Interest you earned from a Series EE or Series I savings bond that you then used for qualified higher education expenses find this value on line 14 of Form 8815

-

Any employer-provided adoption benefits, as per line 28 of Form 8839

Learn more about how IRAs work and who should use them.

Adjusted Gross Income Vs Modified Adjusted Gross Income

In addition to AGI, some tax calculations and government programs call for using what’s known as your modified adjusted gross income, or MAGI. This figure starts with your AGI then adds back certain items, such as any deductions you take for student loan interest or tuition and fees.

Your MAGI is used to determine how much, if anything, you can contribute to a Roth IRA in any given year. It is also used to calculate your income if you apply for Marketplace health insurance under the Affordable Care Act .

Many people with relatively uncomplicated financial lives find that their AGI and MAGI are the same number or very close.

If you file your taxes electronically, the IRS form will ask you for your previous year’s AGI as a way of verifying your identity.

Read Also: Does Doordash Take Taxes Out Of Your Check

Special Instructions To Validate Your 2021 Electronic Tax Return

If your 2020 tax return has not yet been processed, enter $0 for your prior year adjusted gross income .

If you used the Non-Filers tool in 2021 to register for an advance Child Tax Credit payment or third Economic Impact Payment in 2021, enter $1 as your prior year AGI.

When self-preparing your taxes and filing electronically, you must sign and validate your electronic tax return by entering your prior-year Adjusted Gross Income or your prior-year Self-Select PIN.

Generally, tax software automatically enters the information for returning customers. If you are using a software product for the first time, you may have to enter the information yourself.

What Is Your Adjusted Gross Income

Adjusted gross income is the number you get after you subtract your adjustments to income from your gross income. The IRS limits some of your personal deductions based on a percentage of your AGI.

Thats why its so important. Your AGI levels can also reduce your personal deductions and exemptions. Many states also base their state income taxes on your federal AGI. The AGI calculation is at the bottom of Form 1040 in line 37.

Also Check: Do I Have To File Taxes For Doordash If I Made Less Than $600