What Percentage Of The Cost Of Gas In Georgia Comes From Taxes And Gas Station Profit

The diagram above shows how the prices of an average gallon of gasoline and diesel fuel are broken down among various components, including the cost of the crude oil, refining, distribution / marketing, and taxes. In most areas, state and federal excise taxes amount to about 13% of the cost of a gallon of gas. Gas stations generally only profit a few cents per gallon.

Selling With A 1031 Exchange

Since we buy houses with our own money, we are able to close when it works best for you. If you want to sell your investment property, but need to work with a buyer that can close in a very specific time frame, just fill out the form below and lets chat.

We work with investors all of the time who are 1031 Exchanging their properties so that they can avoid paying capital gains taxes in Georgia. We can close on the exact date that works for you.

Dont mess with MLS buyers who rely on financing that can fall through at the last minute, making you lose the opportunity to do a 1031 exchange and deferring your capital gains.

Is The State Of Georgia Tax Friendly For Retirees

Is Georgia tax-friendly for retirees? Yes, as Georgia does not tax Social Security and provides a deduction of $65,000 per person on all types of retirement income for anyone age 65 and older. Meanwhile, the states sales tax rate and property tax rate are both relatively moderate, and there are no inheritance or estate taxes to worry about.

Don’t Miss: Do Doordash Drivers Get Taxed

Analysis And Policy Recommendations

In recent decades, tax policy decisions at the state level have overwhelmingly contributed to increasing disparities in income and wealth between white Georgians and people of color, and more broadly widened the gap between low- to middle-income taxpayers and high-income earners and corporate interests . Moving forward, state leaders must act proactively to address this gap and to prevent it from continuing to grow. Substantive policy changes are needed across Georgias sales tax, personal and corporate income tax and in creating new avenues to lift incomes and improve economic mobility. Moreover, state leaders should also prioritize increasing new revenue to restore core areas of state spending in education, health care and human services to adequate levels and to make long-overdue investments that will benefit Georgians into the future. An adequately funded budget can help Georgia address and close racial disparities exacerbated by the states continued underfunding of core services and programs.

Add transparency to Georgias tax code

Reform the sales tax to include services

Adopt robust refundable tax credits

Update the income tax to include distinct graduated tax brackets while establishing correspondingly fair rates for varying income thresholds

Eliminate state itemized deductions in favor of larger standard deduction

Roll back costly and ineffective corporate tax credits, eliminate transferability and deferred use and institute a comprehensive system of review

Georgia Tax On Capital Gains

Cant qualify for the Capital Gains Exclusion? Theres still hope to cut your taxes and keep some of your profits.

There are numerous reasons the IRS will let you have some tax breaks on capital gains in Georgia.

Some of them include:

- Loss or change in employment.

- Health reasons like disease, illness, or injuries.

- Unforeseen circumstances like disasters, war, unemployment, divorce, etc.

There are many special conditions you can meet in order to receive a prorated, tax-free gain. If you need to sell because of a change in your health, a job change, or other unforeseen circumstances, you will be able to write-off a portion of the profit.

When you sell your house in Atlanta, Georgia, you will need to report the sale if you receive a 1099-S form from the closing Realtor in Atlanta.

Form 1099-S is used to report gross proceeds from the sale or exchange of real estate and certain royalty payments. A 1099-S form must be provided to the recipient and a copy mailed or e-filed to the IRS.

IRS Form 1099-S form is used for tax reporting purposes to report proceeds from real estate transactions. It must be used whenever you make a real estate transaction in the tax year.

Transactions can include land, permanent structures, apartments or condominiums, and more. The form needs to be used any time the exchange of real estate takes place: for a sale or an exchange.

Read Also: How To Protest Property Tax Harris County

How Often Do I Need To File Georgia Sales Tax

During the first 6 months, you must file your tax returns monthly. After that, you can continue to file monthly, or you may be able to file with a different frequency. Before doing so, you must make a written request and receive written approval. If you do this, your filing frequency depends on the amount of tax youve collected and owe, as follows:

- Quarterly: You may file your returns quarterly if your tax liability over the previous 6 months has averaged $200/month or less.

- Annually: You may file your returns annually if your tax liability over the previous 6 months has averaged $50/month or less.

After six months you may also request a different filing period, known as special period filing.

Overview Of Georgia Taxes

Georgia has a progressive state income tax. It is fairly average among states charging income tax. Property and gas tax rates for the state are also both near the national average.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 – 2022 filing season.

Also Check: Does Doordash Send 1099

States With Flat Tax Rates

Among the states that do have income taxes, many residents get a break because the highest rates don’t kick in until upper-income levels. But this isn’t the case in the 10 states that have flat tax rates as of 2021. The flat-tax states and their rates, from highest to lowest, can be seen in the table below.

| State |

|---|

| None |

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

You May Like: Does Doordash Tax Your Earnings

The Georgia Income Tax

Georgia collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. Like the Federal Income Tax, Georgia’s income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Georgia’s maximum marginal income tax rate is the 1st highest in the United States, ranking directly below Georgia’s %. You can learn more about how the Georgia income tax compares to other states’ income taxes by visiting our map of income taxes by state.

The Georgia Department of Revenue provides a dedicated Caxpayer Advocate for handling issues and disputes with taxpayers. If you have any questions or issues with your Georgia tax return, feel free to contact the Taxpayer Advocate Office at or by phone at 404-417-2251. For specific questions about your Georgia Tax Refund, call 1-877-423-6711.

There are -639 days left until Tax Day, on April 16th 2020. The IRS will start accepting eFiled tax returns in January 2020 – you can start your online tax return today for free with TurboTax .

Fewer Employees Serving More People

Georgia continues to grow rapidly, adding residents and businesses faster than the national average. The states ongoing growth brings many benefits, but also a slew of challenges on issues such as housing, transportation and public safety. Since the Great Recession, Georgias state employee workforce has shrunk while the needs of the states population and economy have grown. Georgia employed about 14,500 fewer state workers during 2017 than it did in 2008 before the economic downturn, a drop of nearly 18 percent over a decade.* Georgia added about 1 million new residents in that same span, a spike of nearly 11 percent.

As a result, a smaller number of state employees are stretched thin to cover a growing set of needs. That means a decrease in state patrol officers keeping highways safe, fewer health and safety inspectors protecting the public and fewer examiners to keep up with demand for business licenses. One positive sign is the fact that Georgias workforce grew over the last year, the first growth since the recession. State agencies added nearly 1,100 workers from 2016 to 2017, due mostly to a large boost in the number of child welfare workers in the Department of Family and Child Services. Lawmakers also included new money in the budget to increase salaries for social service case workers and state troopers to address dangerously high turnover rates in those fields.

Fewer State Employees Serving Larger Population*

Read Also: Do They Take Taxes Out Of Doordash

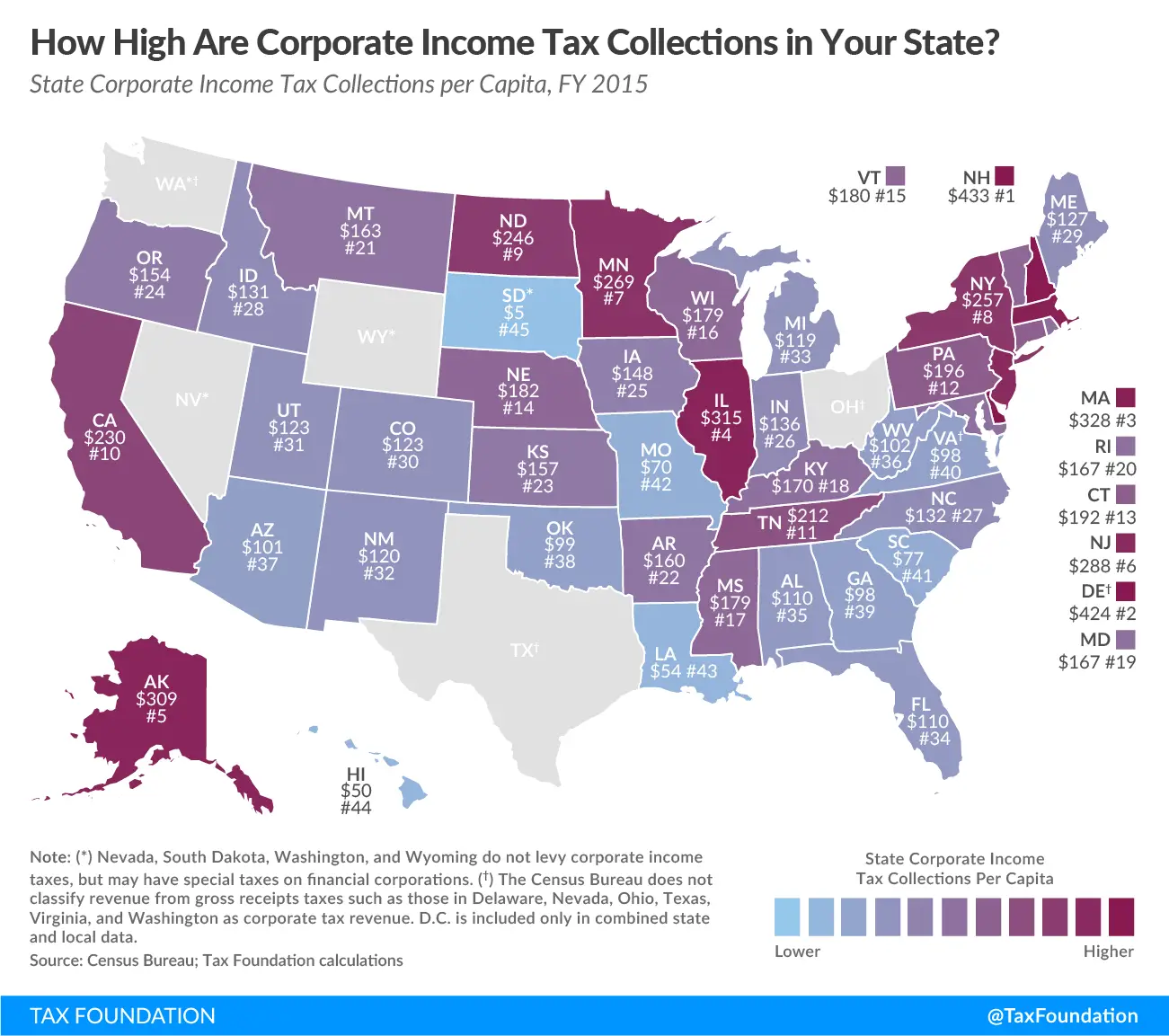

Georgia Corporate Income Tax

Some states including Georgia levy a tax on certain businesses for the right to exist as a legal entity and do business in the state. This is usually called a franchise tax, transaction tax or privilege tax. In Georgia, it’s the Corporate Income and Net Worth Tax, most often simply referred to as the Corporate Income Tax or Net Worth Tax.This tax applies to all corporations. It does not apply to LLCs unless your LLC files as a C Corporation for tax purposes.

Tax Policy In Georgia

This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

| Tax policy in Georgia |

Georgia generates the bulk of its tax revenue by levying a personal income tax and a sales tax. The state derives its constitutional authority to tax from Article VII of the state constitution.

Tax policy can vary from state to state. States levy taxes to help fund the variety of services provided by state governments. Tax collections comprise approximately 40 percent of the states’ total revenues. The rest comes from non-tax sources, such as intergovernmental aid , lottery revenues and fees. The primary types of taxes levied by state governments include personal income tax, general sales tax, excise taxes and corporate income tax.

HIGHLIGHTS

You May Like: Does Doordash Take Taxes

Gains From Stock Option Exercises

|

Residency status |

|

Generally, any compensation or in-kind benefit of an individual received as a result of an employment is considered as employment income. The value of in-kind benefits in the majority of cases is determined as the market value of the benefit less any amount paid by the employee.

Youll Typically Need To Collect Georgia Sales Tax On:

- Tangible, personal property and goods that you sell like furniture, cars, electronics, appliances, books, raw materials, etc. and

- Certain services your business may provide.

Most states dont levy sales tax on goods that are considered necessities, such as food, medications, clothing or gas. Use our sales tax calculator to determine how much you may need to pay. Also check with your accountant and the Department of Revenue to confirm whether your business will be required to collect Georgia sales tax and to ensure you pay the correct amount.

Recommended Reading: Www.1040paytax.com Review

What Are Georgias Sales Tax Deadlines

Georgia sales tax returns and remittances are due on the following schedule.

Monthly

Returns for monthly filers are due on the 20th of the following month. If the 20th falls on a weekend, legal holiday, or any day when the Federal Reserve Bank is closed, the return and payment will be due on the following business day.

| Period |

|---|

Ga State Penalty Abatement

The DOR may consider a full or partial penalty abatement if reasonable cause exists. More specifically, the default giving rise to the penalty must be due to reasonable cause and not due to gross or willful neglect or disregard of the law or regulations or instructions issued according to the law. The DOR states that reasonable cause happens from circumstances beyond the taxpayers control.

The DOR provides the following list of possible circumstances that it may consider reasonable cause concerning penalty waivers:

Realize that the reasons mentioned above are not the only circumstances in which the DOR will consider penalty abatement. Moreover, in many cases, the DOR will request documentation to substantiate the details. Lastly, if your business seeks penalty abatement for sales tax penalties, read the documentation provided by DOR here.

Read Also: Protest Property Taxes In Harris County

Property Taxes Weaponized To Tip Scales Against Black Homeowners

State property taxes in Georgia have evolved considerably over time, from the adoption of the statewide property tax in 1775 to its elimination in 2016. Before the enactment of the Fair Housing Act of 1968, discrimination in real estate was almost ubiquitous, and the vast majority of non-white Georgians were largely shut out of the opportunity to build wealth and equity through homeownership. Nevertheless, the states property tax system was weaponized throughout the early 20th century to further tip the scales against the relatively few Black Georgians who managed to become property owners.

Throughout the 19th century, the property tax grew in importance as a source of revenue for the state of Georgia. By the end of the 19th century, the statewide property tax was the primary revenue source for Georgia, accounting for $1.9 million , or approximately 74 percent of the states $2.6 million in annual revenue.

During the 20th century, the property tax was weaponized to target people of color. At a basic level, records demonstrate that property values were assessed differently for Black and white residents. For example, in 1919, reported assessments of Black- and white-owned land of similar value were nearly equal. However, in subsequent years, the state tax assessors office reassessed the white-owned properties to signal a decrease in value.

Georgia Sales Tax Penalties And Interest

Sales tax returns are considered late if not complete by the 20th of the month following the end of the sales tax period . For returns that are mailed via US mail, the return must be postmarked by the due date. For electronic payments, the Electronic Funds Transfer must be complete by the due date.

Delinquent returns/payments forfeit the Vendors Compensation amount. In the case of a delinquent filing, the entire tax collected is due.

Late returns, late payments, or partial payments are subject to the following penalties:

- Less than 30 Days Late the greater of 5% or $5.

- 30 Days Late or More the greater of 5% or $5 for each 30-day period during which the payment was late

The penalty for any single violation is not to exceed 25% or $25 in the aggregate.

If a sales tax return is fraudulent or late with willful intent to defraud the state, a penalty of 50% will be assessed.

In addition to penalties, unpaid taxes are also subject to interest. Interest is charged at the annual prime rate plus 3%, and accrues monthly. Interest begins to acrue on the due date, if unpaid.

Don’t Miss: Do You Have To Report Plasma Donations On Taxes

State Savings Account Back To Adequate Level

The Revenue Shortfall Reserve is Georgias rainy day fund, meant to provide stability during economic downturns. The fund acts like a savings account for the state to cover expenses and maintain services when revenues decline unexpectedly. Sound financial management guides lawmakers to build up the reserves during good economic times and spend it down in bad times to avoid damaging cuts to key services. Maintaining adequate reserve money is also important to keep Georgias stellar AAA bond rating, a top rating that allows lawmakers to borrow money at favorable terms and save millions of dollars in annual interest payments.

The General Assembly cannot appropriate money to the reserves through the normal budget process. Instead, any money not spent by the end of each fiscal year is automatically transferred to the fund. Georgia law says the fund cannot exceed 15 percent of the previous years net revenue. At the end of the 2016 budget year, Georgias reserves held more than $2 billion, or 9.1 percent of that years tax receipts. Now at its highest level in the past 15 years, the reserve fund holds enough money to operate the functions of state government for about 32 days.

Rainy Day Fund Tops $2 Billion Goal

Wise Is The Cheaper Faster Way To Send Money Abroad

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise for Business, you can get a better deal for paying supplier invoices and buying goods overseas. Well always give you the same rate you see on Google, combined with our low, upfront fee so youll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it’s not only money you’ll be saving with Wise, but time as well.

Read Also: How To Pay Doordash Tax