When Are The Irs Accepting Tax Returns

IRS will start accepting income tax returns on Jan. 31, 2022. * = IRS may delay start of tax season by a week or so. ** = Returns with EITC or CTC may have refunds delayed until March to verify credits. What date will the IRS start accepting returns in 2021? More In News The IRS will begin accepting and

Were Here To Support You

If the thought of tuition tax credits, provincial and federal have you a little unsurewere here to help. To make tax season as simple as possible, TurboTax has created solutions that work for all situations and preferences, including:

- TurboTax Live Assist and Review, with expert assistance, and even

- TurboTax Live Full Service*, a TurboTax expert fills out and submits your personal tax return on your behalf.

No matter your income or complexity of your return, you have an expert in your corner with TurboTax.

*TurboTax Live Full Service is not available in Quebec.

Education Tax Credits Eliminated And Sometuition Tax Credits:

Alberta‘s2019 Budget eliminates the education and tuition tax credits for 2020 andlater taxation years. Credits earned prior to 2020 can still beclaimed. Previously, Alberta’s Bill15, Tax Statutes Amendment Act, 2017 made technical changes so that theeducation tax credit and carry-forward did not rely on the existence of thefederal education tax credit and carry-forward.

BC‘s 2018 Budget eliminatedthe education tax credit for 2019 and later taxation years.

New Brunswick passed legislation toeliminate both the tuition and education tax credits effective for the 2017 andsubsequent taxation years. Their 2019 budget reinstatedthe tuition tax credit, but not the education tax credits.

Ontario‘s 2016 Budget announced that the ON tuition and education tax creditswould be discontinued. The tuition tax credit can be claimed foreligible tuition fees paid up to September 4, 2017. Education tax creditcan be claimed for months of study before September 2017. If you moved toOntario after December 31, 2017, you cannot claim any unused tuition andeducation credits from another province or territory.

The Saskatchewan2017 Budget announced the elimination of the tuition and education taxcredits effective July 1, 2017. This means that tuition fees paidin January to June 2017 can be claimed, and education amounts of $120 per monthfor part-time and $400 per month for full-time can be claimed for the months ofJanuary to June 2017.

Read Also: How Much Do I Pay In Taxes For Doordash

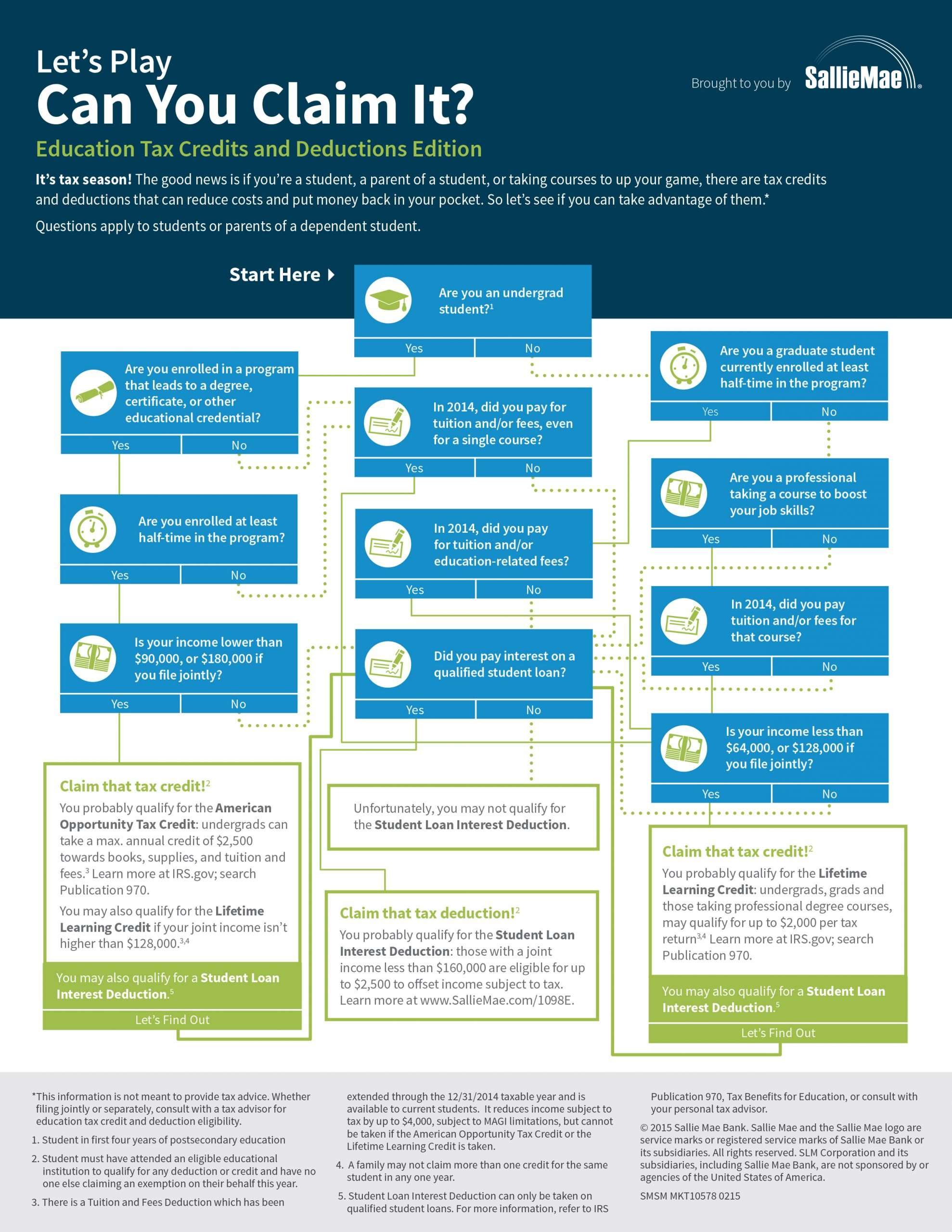

Who Cannot Claim An Education Credit

You cannot claim an education credit when:

- Someone else, such as your parents, list you as a dependent on their tax return

- Your filing status is married filing separately

- You already claimed or deducted another higher education benefit using the same student or same expenses

- You were a non-resident alien for any part of the year and did not choose to be treated as a resident alien for tax purposes

Can You Claim Education Credit For A Non Dependent

No. Whoever claims the student as a dependent is the only one who can claim expenses for the credits and deductions. You are not able to claim any education credits for a non-dependent child. To be able to claim education credit, the student in question must be a dependent claimed as an exemption on your tax return.

You May Like: Calculate Doordash Taxes

Education Tax Credits: Your Guide On How To Claim Them

Edited byHow Student Loan Hero Gets Paid

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

| The basics |

| Plus: Education tax credits: FAQs |

Other Student Tax Breaks And Write

Take note that while parents can claim more than one tax credit for their kids, college students themselves can only take one credit.

Another write-off is $4,000 per year on tuition fees. This is available to all college students and is one of the most popular ones. You can also get $2,500 in the form of a deduction for student loan payments.

Don’t Miss: How To Do Taxes On Doordash

Paying For College Is A Challenge For Many American Families

The average undergraduate in-state tuition plus required fees at a public four-year college was $8,804 for the 2016 to 2017 school year, according to the U.S. Department of Educations National Center for Education Statistics. Room and board bump the total expenses to $19,488. And if youre considering a private four-year institution rather than a public school, you can expect your costs to more than double.

But there are ways for students and their families to ease the financial burden of higher education. The federal government offers two education tax credits to help recoup some of the expenses at tax time, if youre eligible.

Taxpayers can claim either tax break for their own expenses, the expenses of a spouse or the expenses of a dependent listed on their federal tax returns. Heres some information about the valuable tax credits and five common mistakes to avoid when claiming them.

How To Deduct Up To $4000 In Education Expenses On Your Taxes

If you, or a member of your family, attended college last year, you may be eligible to deduct up to $4,000 in education expenses. The following six education tax benefit FAQ’s will help you quickly determine if you can take advantage of this tax break.

1. What is the tax benefit of the tuition and fees deduction?

The tuition and fees deduction can reduce the amount of your income subject to tax by up to $4,000. This deduction is taken as an adjustment to income. This means you can claim this deduction even if you do not itemize deductions on Schedule A .

2. Who can claim the deduction?You may be able to deduct qualified education expenses paid during the year for yourself, your spouse or your dependent. You cannot claim this deduction if your filing status is married filing separately or if another person can claim an exemption for you as a dependent on his or her tax return. The qualified expenses must be for higher education.

3. What expenses qualify?For purposes of the student loan interest deduction, these expenses are the total costs of attending an eligible educational institution, including graduate school. They include amounts paid for the following items:

- Tuition and fees.

- Books, supplies and equipment.

- Other necessary expenses .

The cost of room and board qualifies only to the extent that it is not more than the greater of:

Don’t Miss: How Much Do You Pay In Taxes Doordash

Which Students Qualify For The Aotc

A student is eligible for the AOTC only if they meet certain requirements. Specifically, the student must:

- Be taking courses toward a degree or some other recognized education qualification

- Be enrolled at least part-time for at least one academic period beginning in the tax year

- Not have finished the first four years of higher education at the beginning of the tax year

- Not have claimed the AOTC for more than four tax years

- Not have a felony drug conviction at the end of the tax year

Academic periods can be quarters, trimesters, semesters, or a summer school session. If the school doesn’t have academic terms, you can treat the payment period as an academic period.

What Is Form 1098

Form 1098-T is a form your school sends both you and the IRS to show:

- Payments received for qualified tuition and related expenses

- Scholarships or grants received

- Tuition billed by educational institution

You can use it to calculate the credit you can claim on a tax return.

The two tax credits available are the American opportunity tax credit and the lifetime learning credit . The AOTC and LLC each have different qualifications for eligibility, but either can provide a maximum annual of $2,500 per year income limitations may apply

So what if your school never sent you Form 1098-T? Are you just out of luckand maybe a whole heap of money?

No! Form 1098-T is an information return and will not affect your ability to claim an education credit so long as the school is a qualified education institution and the student meets the criteria. But many students without the right advice in their corner will end up paying the proposed tax assessed anyway.

Ive come across several cases where IRS arbitrarily denies taxpayers their education credits because they did not have Form 1098-T. In most cases, taxpayers are afraid of being harassed by the IRS and will pay the taxes being assessed by the agency even when they are not required to pay to get the IRS off their back.

But even if the IRS denies your education credit for not having Form 1098-T, you dont necessarily have to agree and pay. According to the IRS itself see FAQ 19 & 20, you can still claim an education credit if:

Don’t Miss: Do Doordash Drivers Get Taxed

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

A Student And Parent Both Claiming The Same Credit

If a parent claims an education credit for the college expenses they paid for their dependent, then the student cannot also claim the education credit on their own tax return. Parents and students should coordinate filing their tax returns to make sure theyre not claiming the credit twice for the same expenses.

Also Check: Do You Pay Taxes On Plasma Donations

Who Can Claim The Education Credits

If you have a dependent and the dependent is going to collegeand you’re the one paying for ityou can claim the education credit on your tax return. If your dependent is paying for their education themselves, they can claim education credits on their tax returnunless you claim them as a dependent.

You can’t claim the Lifetime Learning credit if you pay college expenses for someone who isn’t your dependent, and you can’t claim it if you’re . Non-resident aliens can’t claim the credit if they don’t elect to be treated as resident aliens for tax purposes, according to the IRS.

Types Of Qualified Scholarships And Grants

There are hundreds, if not thousands, of types of scholarships and grants, both on the federal and state level. Two criteria are applied in determining the eligibility of each scholarship or grant for use in this strategy:

If further information is required to substantiate the eligibility of a scholarship or grant, taxpayers can contact the student’s financial aid office to request its terms.

You May Like: Doordash Mileage Taxes

Does 1098 T Increase Refund

Yes, a 1098 T can increase your refund . Depending on your tax obligations and other credits or deductions you take, you may qualify for a refund , where youll get money back instead of owing money to the IRS. You can claim the Student Loan Interest Deduction without having to itemize your deductions.

The American Opportunity Tax Credit

The AOTC is a type of education tax credit taxpayers can receive to help cover some of the college expenses for the first four years of a student pursuing their postsecondary education.

You can receive up to $2,500 for every student. Should the AOTC take your tax bill down to zero, you claim up to 40% of the remaining credit that didnt go toward decreasing your bill.

In order to be considered eligible for the AOTC, students must:

- Be pursuing a degree

- Be enrolled at least half time for a minimum of one academic period during that tax year

- Not have finished year four of their schooling at the start of the tax year

- Not claim the AOTC for more than four years

- Not be convicted of a felony drug charge

Recommended Reading: Plasma Donation Taxable Income

Keep Track Of Letter 6419

In January of 2022, the IRS sent out a document to taxpayers called Letter 6419. This document will tell you how much money you’re entitled to from the child tax credit.

Hang onto this letter, because you’ll need this information to claim the credit on your tax return.

Make sure that the information is accurate, because if it’s not, this could delay your tax refund.

Claiming A Credit For Nonqualified Expenses

You can claim either the AOTC or the LLC to offset tuition, fees and other qualified education-related expenses required for enrollment. But only the AOTC allows you to claim expenses for books, supplies and equipment you need for your course of study that arent paid directly to the school.

Recommended Reading: Doordash Tax Percentage

Can I Use My 529 Plan And Claim Education Tax Credits

While you can claim education tax credits while using funds from your 529 college savings plan.

However, if you withdraw from your 529 plan and use an education tax credit toward the same educational expense, youll have to pay federal income tax on your 529 plan withdrawal. If you use your education tax credits to cover different expenses than the money from your 529 plan, you can skip having to pay the federal income tax.

For any remaining funds that you withdrew from your 529 plan that you dont use toward education expenses, you may have to pay a penalty as well as state income taxes on top of federal income taxes.

Educational Institutions Outside Canada

Tuition fees paid to an educational institution outside Canada

2.10 A student at an educational institution outside Canada may claim a tuition tax credit for the tuition fees paid for the year to that institution in the circumstances and to the extent set out in either or below:

Bachelors degree or equivalent

Recommended Reading: Doordash Tax Rate

Are Monthly Payments Taxable

Monthly child tax credit payments are not taxable.

However, if, when you fill out Schedule 8812 when filing your 2021 tax return, it turns out that you received more than you were entitled to, you may have to pay back the excess amount.

This may have happened if your eligibility changed during the tax year.

Coverdell Education Savings Account

You can set up a Coverdell Education Savings Account for a child under the age of 18 if your modified Adjusted Gross Income is less than $110,000 as an individual or less than $220,000 for married couples filing a joint return. Anyone, including the child, can contribute to the account during the year. The maximum contribution is $2,000 per beneficiary. Withdrawals will be tax-free when used to pay the beneficiarys qualified education costs for elementary, secondary, college, or graduate school.

Read Also: Are Raffle Tickets Tax Deductible