Scholarships Grants And Fellowships

Scholarships, grants, and fellowships are highly sought-after because they can help fund the cost of higher education, and minimize the number ofstudent loans you have to take out to cover your educational expenses.

According to the IRS, these forms of financial aid do not count as taxable income, as long as you are a degree candidate, and the money is used to pay for qualified education expenses, like tuition, required fees, books, and equipment required for coursework.

But if the funds are used to pay for room and board or other living expenses while you are in school, then you will have to pay income tax on any amount that was used to cover these.

How To File Back Taxes

If you haven’t filed taxes for some years, or skipped some years, here are the steps for filing back taxes:

Gather your W-2s, 1099s, 1098s, and info for any deductions or credits you may qualify for for the year you wish to file for.

If you lost those documents, IRS’s Form 4506-T allows you to request a transcript of your tax return information for the past 10 years even if you haven’t filed a tax return.

However, only you can generate documents re: credits and deductions.

2 . Complete and file your tax return

You can find all the documents for each year on the IRS website, then file according to instructions.

How much does a single mom get back in taxes?

While there is no average tax return for a single mother, or a married mom, or anyone for that matter, a recent LendingTree survey of 1,000 Americans found: Parents expect the highest tax returns: A third of respondents with children under 18 expect a $2,000+ return, versus 9% of those with adult children and 5% of those with no kids. Plus, 22% of married couples think they’ll get a $2,000-plus return, compared to 11% of single people.

Head Of Household Status If You’re A Single Mom

If you were unmarried on Dec. 31, 2021, earn at least 50 percent of your household income, and your kids live with you for 6 months of the year or more total, single moms can file as head of household, and claim HOH on your W4. This can afford you bigger tax breaks like a higher standard deduction and lower tax rate compared to filing as single.

As of the 2021 tax year, the standard deduction is $18,800 for head of household . This compares with $12,550 for single taxpayers and those who are married and filing separately, and $25,100 if you’re married and filing jointly or if you’re a qualifying widow or widower with a dependent child.

You May Like: When Do You File Taxes 2021

Where’s My Tax Refund When To Expect Your Money And How Much Extra The Irs Owes You

If you filed your tax return on time and still haven’t gotten your refund, at least it’s earning interest.

Katie Teague

Writer

Katie is a Writer at CNET, covering all things how-to. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Peter Butler

How To writer and editor

Peter is a writer and editor for the CNET How-To team. He has been covering technology, software, finance, sports and video games since working for @Home Network and Excite in the 1990s. Peter managed reviews and listings for Download.com during the 2000s, and is passionate about software and no-nonsense advice for creators, consumers and investors.

If you filed your tax returnelectronically and were due a refund, you probably already received it. The IRS reported that it’s processed 97% of the more than 145 million returns it received this year and issued a few more than 96 million refunds.

As a result, delays in completing paper returns have been running from six months up to one year.

How Much Will I Receive In Child Tax Credit Payments

Most families will receive the full amount: $3,600 for each child under age 6 and $3,000 for each child ages 6 to 17. To get money to families sooner, the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of $300 per child under age 6 and $250 per child between the ages of 6 and 17.

This amount may vary by income. These people qualify for the full Child Tax Credit:

- Families with a single parent with income under $112,500

- Everyone else with income under $75,000

These people qualify for at least $2,000 of Child Tax Credit, which comes out to $166 per child each month:

- Families with a single parent with income under $200,000

- Everyone else with income under $200,000

Families with even higher incomes may receive smaller amounts or no credit at all.

Don’t Miss: How To Track Your Taxes

Maximize Your Tax Credits

Tax credits are different than tax deductions and come in two flavours: refundable and non-refundable.

- A non-refundable tax credit is applied directly against your tax payable. That means if you have tax owing of $500 and get a tax credit of $100, you now only owe $400. If you dont owe any tax, non-refundable credits are of no benefit.

- A refundable tax credit, such as the GST/HST credit, means you will receive the credit even if you have no tax owing.

Here are the best ways to take advantage of tax credits:

- Basic Personal Amount: Every Canadian resident is entitled to claim the basic personal amount on his or her tax return. For 2021, the basic personal amount is $13,808. This means that instead of paying taxes on your entire income, youll only be taxed on the remaining income once the basic personal amount has been applied. In other words, think of it as your first $13,808 worth of income being considered tax-free or tax-exempt.

- Spousal Amount: If you support your spouse or common-law partner, and their net income is less than $13,808, you can claim all or a portion of the spousal amount . The amount is reduced by any net income earned by the spouse. Only one person can claim the spousal amount for the spouse or common-law partner.

Other Eligible Tax Credits:

- , and exam fees

- Medical expenses

- Donations or political contributions

Tax Breaks For College Students: How To Cut Costs And Get More Back

Modified date: Feb. 24, 2022

When youre in college, taxes are probably one of the last things on your mind. After all, why would you have to worry about taxes if you dont have a full-blown job, right?

Well, heres the thing

Even if you dont have any substantial income to report, there may be a tax break or two you could take advantage, and possibly qualify for a refund, which you can use however you like.

So, if youre a student and considering filing your taxes this year, be sure to keep these tax benefits in mind, to see if you qualify.

Also, be sure to check out our guide which explains the difference between common tax terms, including credits, deductions, and adjustments, so you understand some of the basics before you file.

Whats Ahead:

Source: Tenor.com

For all of us, non-accountants, taxes are, well confusing. So, its only natural to wonder if you should even be filing a tax return when youre a college student, especially if your parents are helping you financially.

Dmytro Serhiiev, a self-employed tax consultant with over 10 years of experience working in both the public and private sectors, says that the answer to this question is short and simple:

You dont have to file a tax return if you are a student and dont earn any income.

But if you earned more than $12,550, the IRS requires you to file a return.

Likewise, some forms of financial aid can also be considered as taxable income, these include:

Recommended Reading: What Is Schedule D Tax Form

Tax Deductions And Tax Credits Explained

Remember that a tax deduction reduces your taxable income, cutting your tax bill indirectly by reducing the income that’s subject to a marginal tax rate. A tax credit is a dollar-for-dollar discount on your tax bill. So, if you owe $1,000 but qualify for a $500 tax credit, your tax bill goes down to $500.

What if youre eligible for tax credits that are greater than what you owe say, $1,000 in tax credits with a $500 liability? Whether you get that $500 difference refunded to you will depend on whether the tax credits you qualify are refundable or not. Refundable tax credits go into your tax refund if they exceed what you owe. By contrast, some tax credits are nonrefundable, which means they have the power to reduce your tax liability down to zero but cant be refunded to you if they exceed your liability. Our tax return calculator will take all of this into account when figuring out what you can expect at tax time.

Child Care Deductions For Single Moms

Just for the 2021 tax year, heads of household who have an income or are full-time students can get the Child and Dependent Care Credit of up to $4,000 of dependent care expenses if you have only one qualifying child or other dependent, and up to $8,000 if you have two or more children or dependents. The credit percentage begins to drop off at an adjusted gross income level of $125,000 up to $438,000:

- $125,001 and $183,000, the credit percentage is phased out from 50% to 20%.

- $183,001 to $400,000, the credit percentage remains at 20%.

- $400,001 to $438,000, the credit percentage is phased out from 20% to 0%.

In a typical year, the max credit for one qualifying child or dependent is $1,050 and up to $2,100 for two or more children or dependents. The credit percentage is typically phased out starting at an AGI of $15,000.

Don’t Miss: How To Check Income Tax Return Status

When Does Netfile Open For 2022

NETFILE opens on Monday, February 21, 2022, for filing personal tax returns for the 2021 tax year. To file online, you must use CRA-certified tax-filing software products that use the NETFILE web service. You can also file previous tax years back to 2015, but returns for tax years earlier than 2014 must be done on paper.

Withholding: Why Its Done

If you work as an employee, youre certainly aware that a large portion of your wages/salary doesnt actually show up in your paycheck every two weeks. Instead, it gets withheld.

The reason for this withholding is that the federal government wants to be absolutely sure that its gets its money. The government knows that many people have a tendency to spend literally all of the income they receive . As a result, the government set up the system so that it would get its share before taxpayers would have a chance to spend it.

The amount of your pay that gets withheld is based upon an estimate of how much tax youll be responsible for paying over the course of the year.

You May Like: What Are Real Estate Taxes

Single Parent Tax Return: What You Need To Know About Filing Taxes And Tax Refunds For 2022

We get commissions for purchases made through links in this post. Here’s more on how we make money.

Headline! The IRS tax deadline for individuals is April 18, 2022.

Gah! Taxes! No one likes them , but you and I know we have to deal with them.

As a single mom or dad, there are specific considerations you must take when filing your taxes things your married parents dont have to deal with, and stuff that your friends without children have no idea about.

Consider filing for 100% FREE with TurboTax, which guarantees a max refund and can help with:

- Earned Income Credit

Why Havent You Received Your Refund

The CRA may keep all or part of your refund if you:

- owe or are about to owe a balance

- have a garnishment order under the Family Orders and Agreements Enforcement Assistance Act

- have certain other outstanding federal, provincial, or territorial government debts, such as student loans, employment insurance and social assistance benefit overpayments, immigration loans, and training allowance overpayments

- have any outstanding GST/HST returns from a sole proprietorship or partnership

- have a refund of $2 or less

Read Also: How Can I File My Past Years Taxes

Deduct Home Office Expenses

In 2020, about 2.4 million Canadians who do not normally work from home transitioned to remote work, and many workplaces made the change permanent in 2021. To help those Canadians with the costs associated with a home office, the federal government has launched a new, simplified method to claim home office expenses in 2021. Previously, remote employees needed their employer to submit a T2200 form, but there is now a flat rate method to calculate your work from home tax deduction.

Under the flat rate method, employees who worked from home at least 50% of the time for four consecutive weeks can claim $2 per day for each day worked, up to a maximum of $500 . You can still claim your work from home expenses using a T2200 form, but this simplified method makes your home office deductions more accessible for the average remote worker.

Other Eligible Tax Deductions:

- Carrying charges or interest expense to earn business or investment income

Pro tip: You can also deduct the costs of maintaining a vacant former residence.

How Long Can The Irs Collect Back Taxes

There is a 10-year statute of limitations on the IRS for collecting taxes. This means that the IRS has 10 years after assessment to collect any taxes you owe. This is a general rule, however, and the collection period can be suspended for various reasons, thus extending how long the IRS has to collect your debt.

There is no time limit, though, on how long the IRS has to pursue taxes that you owe if you never filed a return. The statute of limitations applies only to returns that have been filed.

There is also no statute of limitations for the IRS to collect back taxes if your return is part of a case that involves civil or criminal fraud.

Don’t Miss: Do I Have To File Taxes If I M Self Employed

How You File Affects When You Get Your Refund

The Canada Revenue Agency’s goal is to send your refund within:

- 2 weeks, when you file online

- 8 weeks when you file a paper return

These timelines are only valid for returns that we received on or before their due dates.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

The CRA may take longer to process your return if it is selected for a more detailed review. See Review of your tax return by the CRA for more information.

If you use direct deposit, you could get your refund faster.

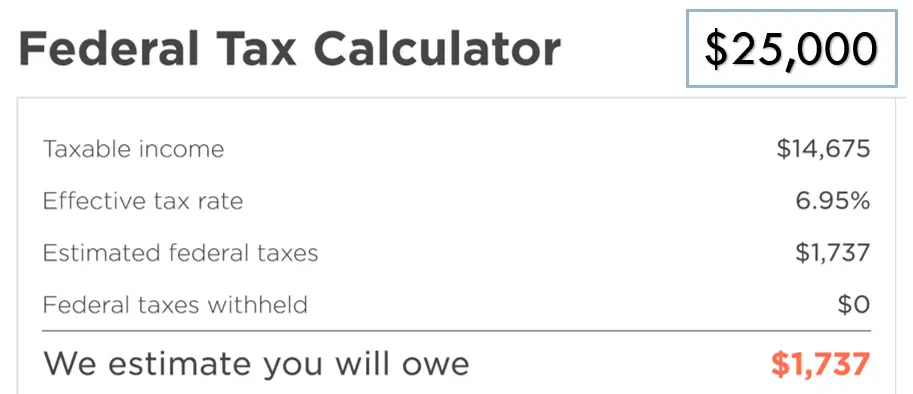

Understanding Your Tax Refund Results

Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. Because tax rules change from year to year, your tax refund might change even if your salary and deductions dont change. In other words, you might get different results for the 2021 tax year than you did for 2020. If your income changes or you change something about the way you do your taxes, its a good idea to take another look at our tax return calculator. For example, you might’ve decided to itemize your deductions rather than taking the standard deduction, or you could’ve adjusted the tax withholding for your paychecks at some point during the year. You can also use our free income tax calculator to figure out your total tax liability.

Using these calculators should provide a close estimate of your expected refund or liability, but it may vary a bit from what you ultimately pay or receive. Doing your taxes through a tax software or an accountant will ultimately be the only way to see your true tax refund and liability.

Recommended Reading: How Much Money Can You Make Without Paying Taxes

How Will The Child Tax Credit Give Me More Help This Year

The American Rescue Plan, signed into law on March 11, 2021, expanded the Child Tax Credit for 2021 to get more help to more families.

- It has gone from $2,000 per child in 2020 to $3,600 for each child under age 6.

- For each child ages 6 to 16, its increased from $2,000 to $3,000.

- It also now makes 17-year-olds eligible for the $3,000 credit.

- Previously, low-income families did not get the same amount or any of the Child Tax Credit. Under the American Rescue Plan, all families in need will get the full amount.

- To get money to families sooner, the IRS began sending monthly payments this year, starting in July.

- It is broken up into monthly payments, which means payments of up to $300 per child under age 6 and $250 per child ages 6 to 17.

- Youll get the remainder of the credit when you file your taxes next year.