The Actual Expense Method

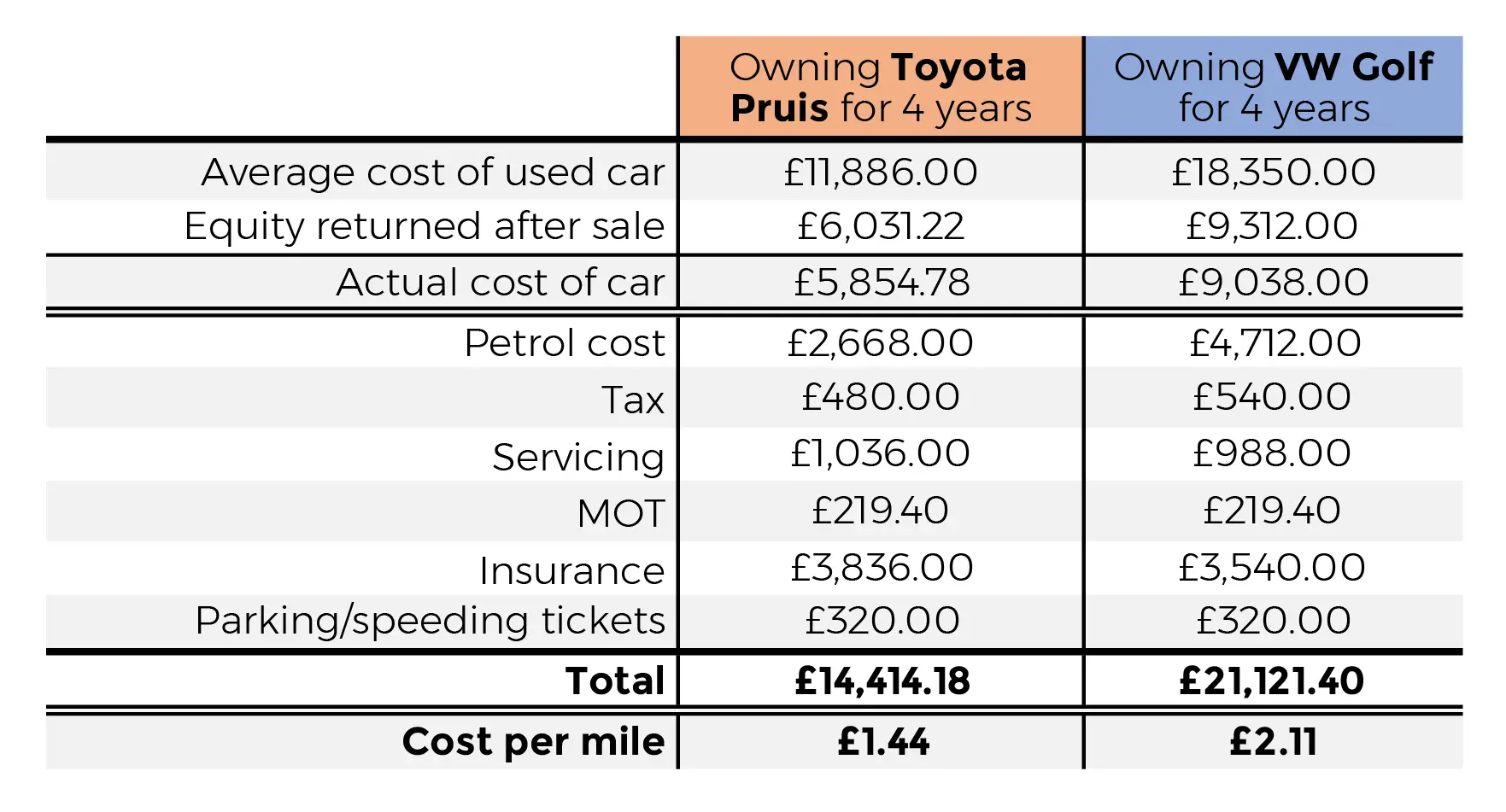

The actual expense method requires you to record every expense related to your vehicleâfrom gasoline to new tiresâand report the total on your tax return. If 100% of your use of a car is for business purposes, you can deduct 100% of your expenses. If you only partly use your car for business purposes, you can deduct a percentage.

So, if 15% of the miles you drove in 2022 were for work, you can deduct 15% of your total vehicle-related expenses per year on your tax return.

Unlike the standard mileage rate, the actual expense method takes some number-crunching in order to figure out how much you can deduct.

Hereâs an example: Say you drove 10,000 miles total in your Prius last year, and 2,000 of those miles count as business use of a car. In total, you spent $1,200 on vehicle-related expenses.

x 1200 = 240

When we divide 2,000 by 10,000, we get 0.2 . Multiplying that by 1,200 gets us 20% of the money you spent on your car last yearâor $240. So you can deduct $240 on your tax return for business mileage.

What Is The Gas Tax Or Fuel Tax

The government imposes the fuel tax on gasoline and diesel sales. Gas tax revenue is supposed to pay for building and maintaining the nation’s transportation infrastructure.

The fuel tax includes a federal tax and state taxes. The federal tax for gasoline has been 18.4 cents per gallon since 1993. State gasoline taxes vary. Keep in mind, states can also impose other fees and taxes at the pump. This is why gas prices in say, San Francisco, California are different than in a place like Atlanta, Georgia.

How To Log Mileage For Taxes In 8 Easy Steps

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

If you must drive as part of your job, you may be qualified to deduct the costs on your federal income tax return. If you qualify, get ready to document your travels as supporting evidence in the event your taxes are audited.

You May Like: Efstatus Taxactcom

Irs Raises Standard Mileage Rates For 2022

Standard mileage rates are up slightly from 2021 in two categories, according to the IRS.

Beginning Jan. 1, 2022, the standard mileage rates for using a car, van, pickup, or panel truck will be 58.5 cents per mile for work use.

The rate is up 2.5 cents from 2021, but only half of a cent from 2019, when it was 58 cents.

The mileage for driving medical products or moving purposes is also up two cents for 2022, at 18 cents per mile driven.

The IRS said the rate for driving in service of charitable organizations is unchanged for 2022 at 14 cents per mile driven. The rate was set by statute.

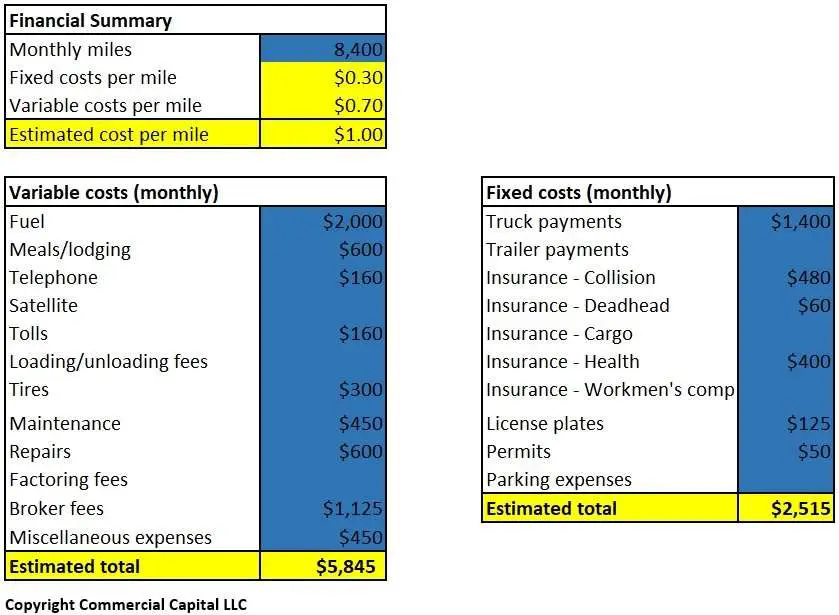

The agency said it rates the standard mileage for business use based on an annual study of the fixed and variable costs of operation. Medical and moving purposes are based on variable costs.

Options for Tax Purposes

The IRS reminds taxpayers they have the option of calculating the actual costs of using their vehicle, rather than the standard mileage rates.

Low-mileage drivers often chose to use the plan.

If taxpayers chose to use the standard mileage rate, they must opt to do so in the first year the car is available for business use.

For the years that follow, they can choose either standard mileage rate or actual expenses.

Under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses.

Employment Law Related To Mileage Reimbursement

On the federal level, there is no requirement for employers to reimburse employees for mileage when using personal vehicles for company purposes. However, all employers are federally required to reimburse employees for any work-related expense to a point. When failure to reimburse employees including for mileage and vehicle costs causes an employee’s net pay to fall below the federal minimum, employers could be open to lawsuits and the legal penalties associated with failure to pay the minimum wage.

“On the employment law side, you are required to reimburse employees for expenses,” said Danielle Lackey, chief legal counsel at Motus. “You want to make sure you’re reimbursing them enough to cover their expenses.”

Certain states including California, Illinois and Massachusetts do mandate that employers reimburse employees for mileage and vehicle expenses related to work.

Each year, the IRS sets its mileage reimbursement rate. In 2020, the standard mileage rate is $0.575 per mile. Many employers reimburse employees at this rate, but the IRS rate is a national average based on the previous year’s data. It is more useful for tax deduction purposes than for setting a true reimbursement rate for your employees.

When establishing a mileage reimbursement policy, it is important to consider that fuel costs vary significantly by geography.

Read Also: Pastyeartax

How To Claim Mileage Expenses On Your Tax Return

Youll need to claim the cost of tax-deductible business mileage in the self-employment section of your tax return. If your business turnover is less than £85,000 for 2021/2022 youll have the option to fill in the simplified version of this part of the tax return so only need to enter your total expenses. Youll need to include your business mileage claim in the figure you enter alongside your other allowable business expenses.

If your business turnover is more than £85,000 youll need to enter a breakdown of your expenses in the boxes set out by HMRC and youll need to include your business mileage in car, van and travel expenses.

Whatever your business turnover you should keep a note of what you are claiming for and how you worked it out as part of your business records, in case of an HMRC investigation and they ask for evidence of what you are claiming for to check youve paid the right amount of self-employed tax.

Related:

Learn About The Laws Surrounding Mileage Reimbursement So You Can Create A Company Policy That Meets State And Federal Regulations

- Employers are not federally required to reimburse employees for mileage and vehicle costs, but state laws may apply in some jurisdictions.

- Mileage reimbursement is federally required when failure to reimburse would decrease an employee’s net wages below minimum wage otherwise, businesses could be open to lawsuits and financial penalties.

- The IRS mileage reimbursement rate is $0.575 in 2020. While this rate is useful for tax purposes, use a fixed and variable rate program to determine a fair and efficient reimbursement rate by geography.

- This article is for small business owners who want to establish a fair and efficient reimbursement policy for mileage and vehicle costs employees incur when driving for work-related purposes.

If you don’t have a fleet of company vehicles and your employees are driving on your business’s behalf making deliveries, inspecting workplaces and gathering supplies what are your obligations regarding fuel costs, maintenance and vehicle depreciation?

There are both legal requirements and business considerations to keep in mind when determining whether you need a mileage reimbursement policy and what it should look like. This guide explains the basics of mileage reimbursement and how to devise a policy that reimburses your employees fairly and efficiently.

You May Like: Do You Have To Pay Taxes On Donating Plasma

What Is The Standard Mileage Rate

The standard mileage rate, also known as the mileage per diem or deductible mileage, is the default cost per mile set by the Internal Revenue Service for taxpayers who deduct the expense of using their personal vehicles for business, charitable, or medical purposes.

The rate is adjusted annually by the IRS and differs depending on whether the vehicle is used for business, charitable, or medical purposes. For the 2022 tax year the standard milage rate is 58.5 cents per mile driven for business use, up 2.5 cents from the rate in 2021.

Irs Mileage Rate Deduction For Volunteering And Charitable Activities

If you used your car to help a charity or to go somewhere to volunteer, the mileage can be deductible. You can deduct parking fees and tolls as well.

If you dont want to deduct your mileage, you can deduct your unreimbursed out-of-pocket expenses, such as gas and oil. However, the expenses have to relate directly to the use of your car in giving services to a charitable organization. Also, you can’t deduct repair and maintenance costs, depreciation, registration fees, tires or insurance.

» MORE:See what else counts as a charitable deduction

Read Also: How To Calculate Doordash Miles

Standard Mileage Rate Example

Tammy owns a 2014 Honda Accord and uses it for business purposes. She claims the mileage that she puts on the vehicle as a deduction when she files her taxes. To claim the business mileage, Tammy logs the miles she drives for work into a booklet she keeps in her cars glove compartment.

When she files her 2017 taxes, Tammy will use the standard mileage rate for business driving, which is $0.535. Assuming Tammy drives 3,000 miles for business purposes during 2017, her total standard mileage deduction would be $1,605 .

Interest rates are rising, but theyre still very low. Find the best rates on auto loans at Bankrate.com.

What Is The Current Irs Mileage Rate For Self

Starting Jan 1st, 2021 self-employed individuals can deduct 56 cents per business mile.From January 2022, you can use the new rate which is 58.5 cents per mile driven for business use.

The IRS also sets rates for medical, moving and charitable mileage reimbursement. See all the mileage rates, past, present and the coming tax year.

Don’t Miss: Efstatus Taxact Com Login

Deducting Business Driving Expenses Using The Standard Mileage Rate Deduction

Under the standard mileage rate, you deduct a specified number of cents for every business mile you drive. The IRS sets the standard mileage rate each year. For 2022, the standard mileage rate is 58.5 cents per mile, up from 56 cents per mile in 2021. Check the IRS website for the current year’s rate. To figure out your deduction, simply multiply your business miles by the applicable standard mileage rate.

Example. Ed drove his car 10,000 miles for his real estate business in 2021. To determine his car expense deduction, he simply multiplies his business mileage by the applicable standard mileage rate . He gets a $5,600 deduction . If he drives the same amount in 2022, he’ll get a $5,850 deduction.

If you choose the standard mileage rate, you can’t deduct actual car operating expensesfor example, maintenance and repairs, gasoline and its taxes, oil, insurance, and vehicle registration fees. All of these items are factored into the rate the IRS sets. And you can’t deduct the cost of the car through depreciation or Section 179 expensing because the car’s depreciation is also factored into the standard mileage rate .

Who Can Deduct Mileage For Charitable Reasons

If you travel to perform volunteer work, you can deduct the standard amount for the year. Alternatively, you can deduct your costs of oil and gas but not other vehicle expenses like depreciation, maintenance, insurance, and fees.

You can also deduct your costs for parking and tolls while volunteering no matter which deduction method you choose.

Read Also: Do I Have To Report Plasma Donations On Taxes

Has Road Pricing Been Used Before

Londons Congestion Charge zone and Ultra Low Emission Zone are both versions of this system currently in use in Britain.

Drivers pay to use certain roads in the capital, which are monitored using hundreds of ANPR cameras.

Drivers must remember to pay online to use these roads – if they forget, they could receive a huge fine.

Electric and hydrogen-powered vehicles are exempt from these charges, as are most motorcycles and scooters.

Several bridges, motorways and tunnels have tolls for use, including the Dartford Crossing and the M6 Toll.

In Europe, large amounts of the motorway network cost drivers money to use, in the form of tolls collected either automatically or in person at toll booths.

But nowhere has successfully implemented a nationwide per-mile road pricing scheme.

Use Automated Solutions To Track Mileage

Some software, like Motus’ mileage reimbursement application, can eliminate over-reporting of mileage by your drivers and make documenting your mileage reimbursement easy.

“Employers often ask employees to manually track miles we found the number of miles tracked by auto-capture versus manual capture is 20% lower,” Lackey said. She added that “people are not necessarily lying or trying to cheat the system,” but often just rounding up to the nearest mile.

Don’t Miss: Www.1040paytax.com Official Site

Communicate Your Policy Clearly

Employees should clearly understand your reimbursement rate and policy, including when expenses will be reimbursed and to whom they should send expense reports. Software can automate some of the process, automatically sending mileage reports to supervisors for approval. Clearly state the payment method of reimbursement as well for example, will it be added to an employee’s paycheck each cycle?

Key takeaway: Leverage software solutions that use data-driven insights to streamline your mileage reimbursement policy and set optimal rates.

How To Claim Mileage On Your Taxes

If youre claiming a deduction for business mileage, youll report it using Schedule C on Form 1040. To claim mileage deductions for moving, medical treatment, or charitable deductions, youll need to itemize on your return. Youll do so using Schedule A on your Form 1040.

No matter what type of mileage youre deducting, be sure to keep thorough records. Keep a mileage log if you use the IRS standard mileage rate, or hold onto receipts if youre deducting your actual costs. Be sure to store them with your other tax records so youre covered in the event of an audit.

Read Also: Do I Have To File Taxes For Doordash

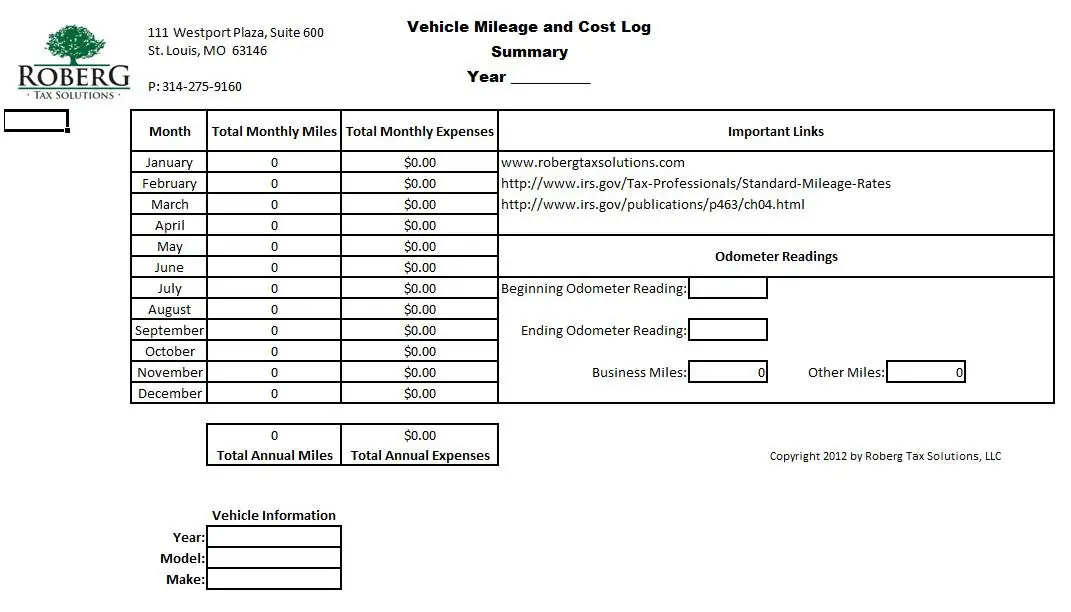

How Do You Keep A Mileage Log

The IRS is strict about how you must log miles for tax deductions, so its important to plan out how you will keep records before you start driving. Here are some tips that can help you:

Keep a separate bank account or credit card for business expenses. This can be a great way to keep personal and driving expenses separated. You will also be able to look back to your bank and credit statements for records as youre filing your taxes. Regardless of how you record your miles, this separation of accounts can aid your recordkeeping.

Record mileage on paper or in a spreadsheet. One option is to write down the details for each trip you make.

To record your mileage for each trip, you will need to note the following items:

- Date

The Best Way To Track Your Mileage And Travel Expenses

Using software like Landlord Studio, which has a built-in mileage tracker, will save you time and simplify the process f tracking your travel and mileage expenses. Whats more is that at the end of the tax year, you can instantly generate a mileage report to calculate your overall deduction for the year. This report can be generated on any device whenever you need it and all data is securely stored in the cloud for posterity.

If you choose to track your actual expenses or have other travel expenses such as airfares Landlord Studio can be used to easily record and categorize these and reports run at the end of the year.

All reports can be downloaded or shared directly from the software with your accountant or business partners.

Tracking your mileage tax deduction for rental property accurately is key to maximizing your tax deductions and avoiding being penalized by the IRS. Landlord Studio makes it easier to stay compliant by allowing you to track your travel expenses and then create relevant reports at the tap of a button.

Also Check: How To Find Your Employer’s Ein

Business Mileage For Self

Self-employed workers can deduct miles they drive in their personal cars for business. You cannot deduct the cost of driving into a regular office, but otherwise it doesnât matter if your going to meet a client or buy work supplies. You will need to claim your business miles as expenses in Part II of Schedule C.

If you plan to get reimbursed for business miles, you need to keep a detailed mileage log. Without records, the IRS may not accept your mileage. Your log should include the dates, miles traveled, and reasons for all of your mileage. Ideally you can include odometer readings as further proof. This is a lot of work, but there are apps and services that make it easier.

Learn more about our best tax filing services for 2022.

The Standard Mileage Rate Method

First, you can claim a deduction per business mile driven. The IRS sets the rate for each calendar year, starting in January. The current rate for 2021 is $0.56 or 56¢ per mile for business. You must qualify to be able to use the standard mileage rate, though . The new rate for 2022 is set at 58.5 cents per mile driven for business use but it is not something you should use until January, 2022.

You May Like: How Do Doordash Taxes Work

How To Track And Keep Records Of Your Mileage

The IRS defines adequate records. For all transportation, the IRS asks that you log the following:

- “the mileage for each business use”

- “the total mileage for the year”

- the time , place , and purpose

The record must also be “timely” – in other words, recorded at or near the time of the expense . Weekly diaries, logs, trip sheets, account books, or similar records are deemed adequate.

In addition, you need to be able to show the business vs. personal use of your vehicle as a percentage. That means keeping a log of all trips and then calculating the share used for business. See how to do the calculation in the section below.

In today’s digital world, you can take advantage of a mileage tracking app to save a lot of time. Driversnote and other similar apps not only log your miles for you but also store and generate adequate records whenever you need them.