Most Don’t Have To File An Amended Return

Most taxpayers don’t need to file an amended return to claim the exemption. If the IRS determines you are owed a refund on the unemployment tax break, it will automatically correct your return and send a refund without any additional action from your end.

The only reason to file an amended return is if the calculations now make you eligible for additional federal credits and deductions not already included on your original tax return, like the Additional Child Tax Credit or the Earned Income Tax Credit. The IRS said it will be sending notices in November and December to people who didn’t claim the Earned Income Tax Credit or the Additional Child Tax Credit but may now be eligible for them.

If you think you’re now eligible for deductions or credits based on an adjustment, the most recent IRS release has a list of people who should file an amended return.

The average IRS refund for those who paid too much tax on jobless benefits is $1,686.

When Will I Get The Refund

Unemployment tax refunds started landing in bank accounts in May and ran through the summer, as the IRS processed the returns.

The first phase included the simplest returns, made by single taxpayers who didn’t claim for children or any refundable tax credits.

More complicated ones took longer to process.

In mid-July, the IRS issued 4million refunds, of which those by direct deposit landed in bank accounts from July 14.

Meanwhile, households who receive the cash refund by paper check could expect this from July 16.

Another batch of payments were then sent out at the end of July, with direct deposits on July 28 and paper checks on July 30.

The IRS didn’t announce payouts in August, September nor October – but on November 1, it noted another 430,000 refunds had been paid out.

These refunds were worth a collective $551million.

The IRS also said it’ll issue another refund batch before the end of the year, but as of December 30, it’s yet to confirm when and how many it applies to you.

It comes as Erin Collins, of the independent Taxpayer Advocate Service within the IRS, in September revealed that 13million accounts had been processed so far.

She added that there were still about 436,000 returns yet to be processed, as they were waiting in the Error Resolution System as of September 11.

This mean they had to be manually reviewed by the IRS, after which the refund was either released or the error confirmed.

These Are The States That Will Either Mail Or Electronically Deliver Your Form 1099

California

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at and select 1099G at the top of the menu bar on the home page.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed by: logging into your account at selecting 1099G at the top of the menu bar > View next to the desired year > Print or Request Paper Copy.

You can also request a paper copy by calling 1-866-333-4606.

Florida

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at myflorida.com and go to My 1099-G & 49Ts in the main menu.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed at 1099grequest.myflorida.com.

Illinois

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at ides.illinois.gov. Illinois Department of Employment Security will send an email notification with instructions to access the document from the Illinois Department of Employment Security website.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed by calling 338-4337.

Indiana

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at in.gov. You will find your Form 1099-G on your Correspondence page.

If you opted into electronic delivery:

Michigan

Mississippi

Utah

Read Also: Doordash Taxes California

The Irs Printed Its 2020 Tax Forms And Turbotax And Other Companies Programmed Software Before The Relief Was Approved By Congress How Do I Claim My $10200 Deduction

You need to file an Unemployment Compensation Exclusion form when you do your taxes, Oware said. Heres a link to it on the IRS website if you are filing on paper: tinyurl.com/unemploymenttax. Follow the worksheets instructions when filling out your forms.

The IRS also says its working with the software companies such as TurboTax to update their software for the 2020 tax season, so people who qualify for the tax break on unemployment benefits should hold off on filing until those programs are brought up to date.

Note: The IRS recognizes that some people received incorrect 1099-G forms, and its website advises filers to only report the actual amount they received.

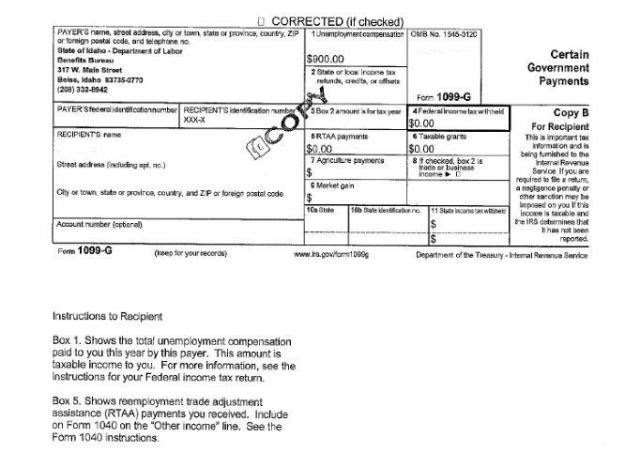

Information Needed For Your Federal Income Tax Return

Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. The 1099-G form provides information you need to report your benefits. Use the information from the form, but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS. You can file your federal tax return without a 1099-G form, as explained below in Filing Your Return Without Your 1099-G.

A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you, including:

- Unemployment benefits

- Federal income tax withheld from unemployment benefits, if any

- Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments

Recommended Reading: Ntla Tax Lien

How To Check The Status Of The Payment

One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected.

These letters are sent out within 30 days of a correction being made and will tell you if you’ll get a refund, or if the cash was used to offset debt.

Sadly, you can’t track the cash in the way you can track other tax refunds.

Another way is to check your tax transcript, if you have an online account with the IRS.

This is available under “View Tax Records”, then click the “Get Transcript” button and choose the federal tax option.

After this, you should select the “2020 Account Transcript” and scan the transactions section for any entries as “Refund issued”.

If you don’t have that, it likely means the IRS hasn’t processed your return yet.

This summer, frustrated taxpayers spoke out over tax refund delays after the IRS announced the cash for unemployed Americans.

Households who’ve filed a tax return and are due a refund get an average of $2,900 back – we explain how to track down the cash.

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

You May Like: Is Money From Plasma Donation Taxable

What Is Form 1099

Form 1099-G reports the total amount of taxable unemployment compensation paid to you. This includes:

- Unemployment Insurance benefits including Federal Extensions , Pandemic Additional Compensation , Pandemic Emergency Unemployment Compensation , and Lost Wages Assistance

- Pandemic Unemployment Assistance benefits

- Disability Insurance benefits received as a substitute for UI benefits

- Disaster Unemployment Assistance benefits

- Paid Family Leave benefits

Form 1099-G also reports any amount of federal and state income tax withheld.

Irs Schedule For Unemployment Tax Refunds

With the latest batch of payments on Nov. 1, the IRS has now issued more than 11.7 million unemployment compensation refunds totaling over $14.4 billion. The IRS announced it was doing the recalculations in phases, starting with single filers with no dependents and then for those who are married and filing jointly. The first batch of these supplemental refunds went to those with the least complicated returns in early summer, and batches are supposed to continue for more complicated returns, which could take longer to process.

Recommended Reading: Tax Deductions Doordash

When Should I Receive My Unemployment Tax Form

Go the website of your state’s labor department. Navigate to the page that provides information on unemployment claims. This page should explain your states time frame to mail 1099-Gs to residents who received unemployment benefits during the tax year in question. In most cases, 1099-Gs for the previous year are mailed on or before January 31. For example, if you collected unemployment in 2018, the 1099-G should have been mailed by January 31, 2019. While on your states website, copy the contact information so you can contact the office directly if necessary.

If I Repaid An Overpayment Will It Be Reflected On My 1099

No. DES reports the total amount of benefits paid to you in the previous calendar year on your 1099-G, regardless of whether you repaid any overpayment. If you repaid part or all of an overpayment during the previous calendar year, you may be able to deduct the repaid amounts on your income tax return. The repaid amount should be reported on the tax return submitted for the year the repayment was made.

Don’t Miss: How Taxes Work With Doordash

New Exclusion Of Up To $10200 Of Unemployment Compensation

If your modified adjusted gross income is less than $150,000, the American Rescue Plan enacted on March 11, 2021, excludes from income up to $10,200 of unemployment compensation paid in 2020, which means you dont have to pay tax on unemployment compensation of up to $10,200. If you are married, each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to $10,200. Amounts over $10,200 for each individual are still taxable. If your modified AGI is $150,000 or more, you cant exclude any unemployment compensation. If you file Form 1040-NR, you cant exclude any unemployment compensation for your spouse.

The exclusion should be reported separately from your unemployment compensation. See the updated instructions and the Unemployment Compensation Exclusion Worksheet to figure your exclusion and the amount to enter on Schedule 1, line 8.

When figuring the following deductions or exclusions from income, if you are asked to enter an amount from Schedule 1, line 7 enter the total amount of unemployment compensation reported on line 7 and if you are asked to enter an amount from Schedule 1, line 8, enter the amount from line 3 of the Unemployment Compensation Exclusion Worksheet. See the specific form or instructions for more information. If you file Form 1040-NR, you arent eligible for all of these deductions. See the Instructions for Form 1040-NR for details.

Withholding Taxes From Your Payments

If you are receiving benefits, you may have federal income taxes withheld from your unemployment benefit payments. Tax withholding is completely voluntary withholding taxes is not required. If you ask us to withhold taxes, we will withhold 10 percent of the gross amount of each payment before sending it to you.

To start or stop federal tax withholding for unemployment benefit payments:

- Choose your withholding option when you apply for benefits online through Unemployment Benefits Services.

- Review and change your withholding status by logging onto Unemployment Benefits Services and selecting IRS Tax Information from the Quick Links menu on the My Home page.

- Review and change your withholding status by calling Tele-Serv and selecting Option 2, then Option 5.

Recommended Reading: How To Get Pin To File Taxes

What Is The Irs Form 1099

These statements report the total amount of benefits paid to a claimant in the previous calendar year for tax purposes. The amount reported is based upon the actual payment dates, not the week covered by the payment or the date the claimant requested the payment. The amount on the 1099-G may include the total of benefits from more than one claim.

What To Know About The Unemployment Tax Break

The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American Rescue Plan Act of 2021. The tax break is for those who earned less than $150,000 in adjusted gross income and for unemployment insurance received during 2020. At this stage, unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

The $10,200 tax break is the amount of income exclusion for single filers, not the amount of the refund . The amount of the refund will vary per person depending on overall income, tax bracket and how much earnings came from unemployment benefits. So far, the refunds have averaged more than $1,600.

However, not everyone will receive a refund. The IRS can seize the refund to cover a past-due debt, such as unpaid federal or state taxes and child support. One way to know if a refund has been issued is to wait for the letter that the IRS is sending taxpayers whose returns are corrected. Those letters, issued within 30 days of the adjustment, will tell you if it resulted in a refund or if it was used to offset debt.

As the IRS continues issuing refunds, they will go out as a direct deposit if you provided bank account information on your 2020 tax return. A direct deposit amount will likely show up as IRS TREAS 310 TAX REF. Otherwise, the refund will be mailed as a paper check to whatever address the IRS has on hand.

You May Like: Do They Take Taxes Out Of Doordash

Check Back For Updates To This Page

For the latest updates on coronavirus tax relief related to this page, check IRS.gov/coronavirus. We’re reviewing the tax provisions of the American Rescue Plan Act of 2021, signed into law on March 11, 2021.

The tax treatment of unemployment benefits you receive depends on the type of program paying the benefits. Unemployment compensation includes amounts received under the laws of the United States or of a state, such as:

- State unemployment insurance benefits

- Benefits paid to you by a state or the District of Columbia from the Federal Unemployment Trust Fund

- Railroad unemployment compensation benefits

- Disability benefits paid as a substitute for unemployment compensation

- Trade readjustment allowances under the Trade Act of 1974

- Unemployment assistance under the Disaster Relief and Emergency Assistance Act of 1974, and

- Unemployment assistance under the Airline Deregulation Act of 1978 Program

- Federal Pandemic Unemployment Compensation provided under the Coronavirus Aid, Relief, and Economic Security Act of 2020

- Benefits from a private fund if you voluntarily gave money to the fund and you get more money than what you gave to the fund.

If you received unemployment compensation during the year, you must include it in gross income. To determine if your unemployment is taxable, see Are Payments I Receive for Being Unemployed Taxable?

Get Paper Unemployment Tax Forms

If you decide not to file electronically, you also have the option of filing your unemployment taxes using paper forms. You must use our original forms, and mail them back to us. We do not accept copies because our unemployment tax forms use unique ink that allows the information to be scanned into our computer system. Copy machines cannot reproduce the ink, so when someone submits a copy of the form, the information must be hand-keyed into the system.

If you file using a tax/wage form that is not an Agency original form, you may have to pay a penalty.

To request our paper forms:

Send an email to or call 855-TAX-WAGE

Don’t Miss: How To Do Taxes On Doordash

Look Up Your 1099g/1099int

To look up your 1099G/INT, you’ll need your adjusted gross income from your most recently filed Virginia income tax return .

Please note: This 1099-G does not include any information on unemployment benefits received last year. If you’re looking for your unemployment information, please visit the VEC’s website.

Note: We will not mail paper 1099G/1099INT forms to taxpayers who chose to receive them electronically unless we receive a request for paper copies of these forms from the taxpayer. We will automatically mail paper forms to taxpayers who did not opt to receive them electronically.

What If I Haven’t Filed A Tax Return

TAXPAYERS had until May 17 to file an extension if they needed more time to submit their returns.

If you didnt file a tax return or an extension, but should have, you need to take action – or the penalties you face may increase.

If you file your return over 60 days late, youll have to pay a $435 fine or 100% of the tax you owe – whichever is less.

However, there is no penalty for filing a late return after the tax deadline if a refund is due, said the IRS.

If you didn’t file and owe tax, file a return as soon as you can and pay as much as possible to reduce penalties and interest.

You won’t have to pay the penalties if you can show “reasonable cause” for the failure to do so on time – we explain how in our guide.

You May Like: Does Doordash Take Taxes Out For You