Why Life Changes Affect Child Tax Credit Payments

The monthly 2021 Child Tax Credit payments were based on what the IRS knew about you and your family from your 2019 or 2020 tax return. Changes in income, filing status, the birth or death of a child, or having a child move into or out of your household may have affected the amount that you are eligible to receive when you file your 2021 tax return.

This section will help you understand how certain life events will impact your Child Tax Credit eligibility.

How Does Adoption Tax Credit Work

Tax benefits for adoption include both a tax credit for qualified adoption expenses paid to adopt an eligible child and an exclusion from income for employer-provided adoption assistance. The credit is nonrefundable, which means its limited to your tax liability for the year.

- A , like the adoption tax credit, is a sum that is directly negated from taxes owed by the individual. Some credits are refundable, meaning that if the total amount of taxes owed dips below $0, the taxpayer will actually get money back in the form of a tax refund. The adoption tax credit, however, is nonrefundable.

Benefits And Credits For Your Children

When you register your child’s birth, you can use the Automated Benefits Application to register for the following benefits and credits:

A tax-free monthly payment made to eligible families to help with the cost of raising children. You can receive up to $6,400 per year for each child under 6 years old, and $5,400 for each child from 6 to 17 years old.

A tax-free quarterly payment of up to $560 per year, made to modest-income families to get back some of the goods and services tax/harmonized sales tax theyve paid. If you are eligible for the GST/HST credit and have children, you could also get up to $147 per year, for each child under 18 years old.

A tax-free benefit for families who care for a child under 18 who is eligible for the disability tax credit. The child disability benefit is paid monthly along with the Canada child benefit.

Also Check: Can You Write Off Miles For Doordash

Child Tax Credit Expansion

Be sure to file your 2021 taxes in the coming weeks to claim your expanded Child Tax Credit. If you received advance payments last year, you will receive the second half of your credit after filing up to $1,800 per child. Families should be ready with the letter the Internal Revenue Service sent starting in December or check the amount of their payments by using the CTC Update Portal or their IRS Online Account.

If you didnt receive advance payments, you will receive the full value of the credit after filing up to $3,600 per child.

If your family welcomed a new child in 2021, file your 2021 tax return to claim your benefits.

Most people can file taxes for free through the IRS Free File Program. Additionally, if your familys income falls below $58,000, you can receive help filing your taxes through the IRSs Volunteer Income Tax Assistance sites. Coloradans who qualify for help filing their taxes can visit Colorado VITA for assistance.

Visit ChildTaxCredit.gov to check your eligibility and for more information.

You may qualify for the full CTC if:

-

You have at least one child age 17 or younger, and

-

You are a single individual earning $75,000 per year or less, a head of household earning $112,500 or less, or a married couple earning a combined $150,000 or less.

-

You may qualify for a portion of the CTC if:

-

You have at least one child age 17 or younger, and

How Will The Child Tax Credit Give Me More Help This Year

The American Rescue Plan, signed into law on March 11, 2021, expanded the Child Tax Credit for 2021 to get more help to more families.

- It has gone from $2,000 per child in 2020 to $3,600 for each child under age 6.

- For each child ages 6 to 16, its increased from $2,000 to $3,000.

- It also now makes 17-year-olds eligible for the $3,000 credit.

- Previously, low-income families did not get the same amount or any of the Child Tax Credit. Under the American Rescue Plan, all families in need will get the full amount.

- To get money to families sooner, the IRS began sending monthly payments this year, starting in July.

- It is broken up into monthly payments, which means payments of up to $300 per child under age 6 and $250 per child ages 6 to 17.

- Youll get the remainder of the credit when you file your taxes next year.

Read Also: How Can I Get My 1099 From Doordash

You May Have To Repay The Credit Next Tax Season

But parents could also owe some of the tax credit back next year, since the IRS is basing the value of the advance payments off of 2020 tax information in most cases. If a child turns turn 6 or 18 in 2021, the family would qualify for a lesser tax credit in the case of the child turning 6, or no credit if he or she turns 18, for example.

Household income might also increase this year relative to last year, making parents ineligible for the payments, or eligible for a lesser amount. The payments start to phase out for individuals earning an adjusted gross income over $75,000, and married taxpayers filing jointly earning over $150,000.

Taxpayers who receive more money than they are eligible for will report the excess amount on their 2021 tax return as additional income tax, reducing their tax refund or increasing how much they owe the IRS. If taxpayers owe, the IRS has said it can work out an installment payment plan with them. It is also waiving repayment obligations in some cases.

The agency will send taxpayers a form in January 2022 detailing how much was disbursed to them during 2021.

To avoid repaying the credit, taxpayers can update their personal information including changes in the number of qualifying children you have, income and filing status with the IRS through the agency’s Child Tax Credit Update Portal. Taxpayers can make changes throughout the rest of 2021.

Tax Year 2021/filing Season 2022 Child Tax Credit Frequently Asked Questions Topic B: Eligibility Rules For Claiming The 2021 Child Tax Credit On A 2021 Tax Return

A1. You qualify for the Child Tax Credit if:

- You have a qualifying child, as described in Q B2

- Your qualifying child has a Social Security number that is valid for employment, as described in Q B9 and

Q B2. Who is a qualifying child for purposes of the Child Tax Credit?

A2. For tax year 2021, a qualifying child is an individual who did not turn 18 before January 1, 2022, and who satisfies the following conditions:

A8. No.

Also Check: How To Get Tax Form From Doordash

Heres How The Expanded Child Tax Credit Works For 2021

On March 6th, the Senate voted to pass the 1.9 trillion stimulus plan which includes provisions to make the Child Tax Credit available to more families. Millions of American Families could receive advance payments of this credit as early as July. Up to half of the credit could be paid in monthly installments of $250-$300 for each qualifying child. Democrats hope to make these changes permanent in separate legislation. Here we provide an overview of the 2020 CTC and discuss the expansion of the CTC for 2021.

When Do We Recalculate Your Benefit

We will recalculate your benefit when one of the following situations applies and, if applicable, send you a CCB notice:

- at the beginning of every payment period based on the tax returns that you and your spouse or common-law partner filed for the previous year

- after any reassessment of either your or your spouses or common-law partners tax return that affects the amount of your benefit

- after a change in your marital status

- after a change in the number of eligible children in your care

- after you tell us about changes to your situation that could affect your benefit. For more information, see When should you contact us?

Don’t Miss: Appeal Cook County Taxes

Reporting Changes To Your Circumstances

It’s important to keep HMRC up to date with changes to your income or family circumstances, as some things such as having a new baby, you and your partner getting divorced, or your child moving out could change how much youre entitled to.

Some changes must be reported within one month of taking place. Failing to do so could end up with you receiving an overpayment that youll have to pay back later, and if HMRC thinks youve failed to fulfil your responsibilities you could be fined up to £300.

Find out more: our guide to tax credit and changes in circumstance explains the important changes you must tell HMRC about

How The New Child Tax Credit Payments Are Different

It’s important to understand that with these payments, the IRS is essentially prepaying a tax credit that you usually receive when you file your taxes, said Ben Wacek, a Minnesota-based CFP and founder of Guide Financial Planning.

“If you don’t usually receive a refund, then the advance payments could actually cause you to owe more when you file your 2021 taxes,” he said.

For a 10-year-old child, the credit was worth $2,000 in 2020, which lowered a family’s tax bill by that amount when they filed their return, Wacek explained. In 2021, the credit will be $3,000 for the same child, but half of it will be paid out in advance.

When that same family files their taxes next spring, there will only be $1,500 left of the child tax credit to lower their tax bill. Everything else being equal, they will owe $500 more in 2021 than they did in 2020, Wacek explained.

“For this reason, if you usually owe when you file your taxes or cut it close, you might want to consider opting out of the advance payments or setting a portion of them aside to cover your tax bill in April,” he said.

Also Check: Do You Have To Do Taxes For Doordash

Do You Get A Monthly Check When You Adopt A Child

As a foster parent, you will receive a check each month to cover the cost of caring for the child, and the child will also receive medical assistance. If you adopt that child, you will continue to receive financial and medical assistance. Remember that for a U.S. waiting child you should not be asked to pay high fees.

What If I Filed A 2020 Tax Return But The Irs Still Hasnt Processed My 2020 Tax Return

The IRS will use your 2019 tax return to determine if youre eligible for advance payments and if you are, the amount you will get. Once your 2020 tax return is processed, your payment amount may change.

Because of the IRS delay on processing tax returns, your advance payments may not be adjusted in time. You will have to file a 2021 tax return to receive any missing money that you are owed.

Don’t Miss: Do Doordash Take Out Taxes

How The $3000 Child Tax Credit Could Affect Your Tax Bill

Next week, millions of families across the country will begin to receive monthly checks from the federal government when advance child tax credit payments begin to hit bank accounts.

Many families already have big plans for those payments, worth up to $3,600, or $300 per month, for each qualifying dependent under 6, and $3,000, or $250 per month, for each dependent aged 6 to 17. But they should be aware that they could also affect their 2021 tax bill in a few ways.

For one, the six payments being made through the end of the year are advances of the credit, worth half of the full amount that parents will ultimately receive. When a parent files their 2021 tax return, he or she will claim the rest in a lump sum.

The credit is refundable, which means that if a taxpayer doesn’t owe taxes, or owes less than the lump sum amount, they will receive the rest of the value of the credit in their tax refund.

What Counts As Income

When applying for tax credits, or renewing your tax credits, there are some types of income you have to report no matter how much you earn.

These are:

- income from trusts, settlements and estates

- foreign income.

You dont have to declare income from tax-free savings interest or rent received through the rent-a-room scheme.

Also Check: Doordash 1099

How Does The New Bill Expand The Child Tax Credit In 2021

The new bill, known as the American Rescue Plan, includes the following changes to this tax credit for tax year 2021:

1. It increases the credit amount. It increases the credit amount from $2,000 to $3,000 for children 6- 17. The credit is increased to $3,600 for children less than 6 years old.

2. It eliminates refund limitations and provides advanced payments of credit. It makes the entire credit refundable, meaning parents will receive a refund for any portion not used to offset federal income tax liability. Under the new bill, the tax credit will be paid in advance. The IRS may begin advanced payments in July on a monthly basis if feasible.

- $3,000 tax credit could be paid in $250 monthly installments

- $3,600 tax credit could be paid in $300 monthly installments

3. It lowers the adjusted gross income limits. For 2020, the credit amount is reduced by $50 for each $1000 of a taxpayers AGI exceeds the income limit. This rule makes high-income earners ineligible for the CTC. The income limit for Married Filing Jointly was $400,00 and for all other filers, it was up to $200,000.

Under the new bill the 2021 CTC will be phased out for taxpayers who exceed the following threshold amounts:

- $150,000 for joint filers

- $112,500 for head of household filers

- $ 75,000 for all other filers

When Should You Apply

You should apply for the CCB as soon as any of the following situations happen:

- your child is born

- a child starts to live with you

- you begin a new shared custody arrangement

- you or your spouse or common-law partner meet the eligibility conditions under Are you eligible?

Notes

If you are an Indian as defined in the Indian Act, or you cared for a child under a kinship or close relationship program, you may be eligible for child benefits for a prior year.

Although regular payments for the Canada child tax benefit, the national child benefit supplement, and the universal child care benefit are no longer being issued after June 2016, you can still request child benefits for prior years, if applicable.

Your application for the CCB is considered late if it includes a period that started more than 11 months ago. If your application is late, you may not get payments for the entire period requested.

If your application is late, you must attach clear photocopies of all of the following documents for the entire period requested:

Also Check: Do I Have To File Taxes For Doordash

Additional Tax Breaks For Families

Taxpayers with dependents who dont qualify for the child tax credit may claim the credit for other dependents. The maximum credit amount is $500. To take the credit, your dependent must meet certain conditions.

For example, the dependent you claim must be age 17 or older and have an individual taxpayer identification number. Other dependents also include dependent parents or other qualifying relatives supported by the taxpayer and dependents living with the taxpayer who arent related to the taxpayer.

Here are some additional facts about the credit for other dependents:

- The credit begins to phase out when the taxpayers income is more than $200,000 .

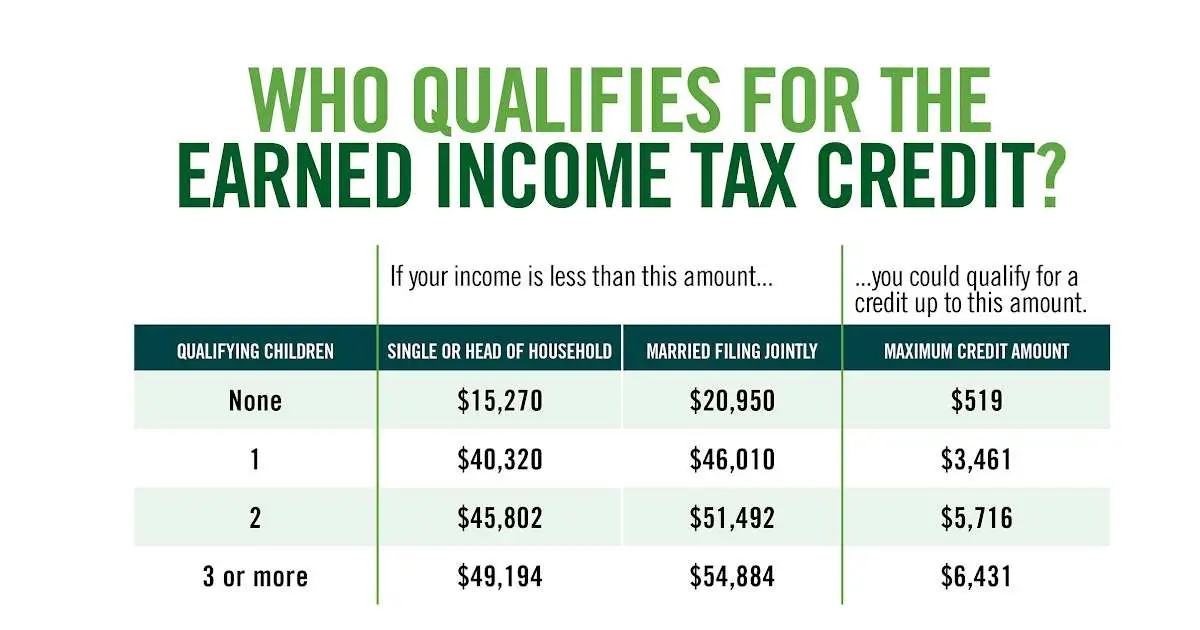

- Taxpayers can claim the credit for other dependents in addition to the child and dependent care credit and the earned income credit.

- The dependent must be a U.S. citizen, national or resident alien.

- A taxpayer can claim this credit if they claim the person as a dependent on the taxpayers return.

- The dependent cannot be used to claim the child tax credit or additional child tax credit.

Child and Dependent Care Credit

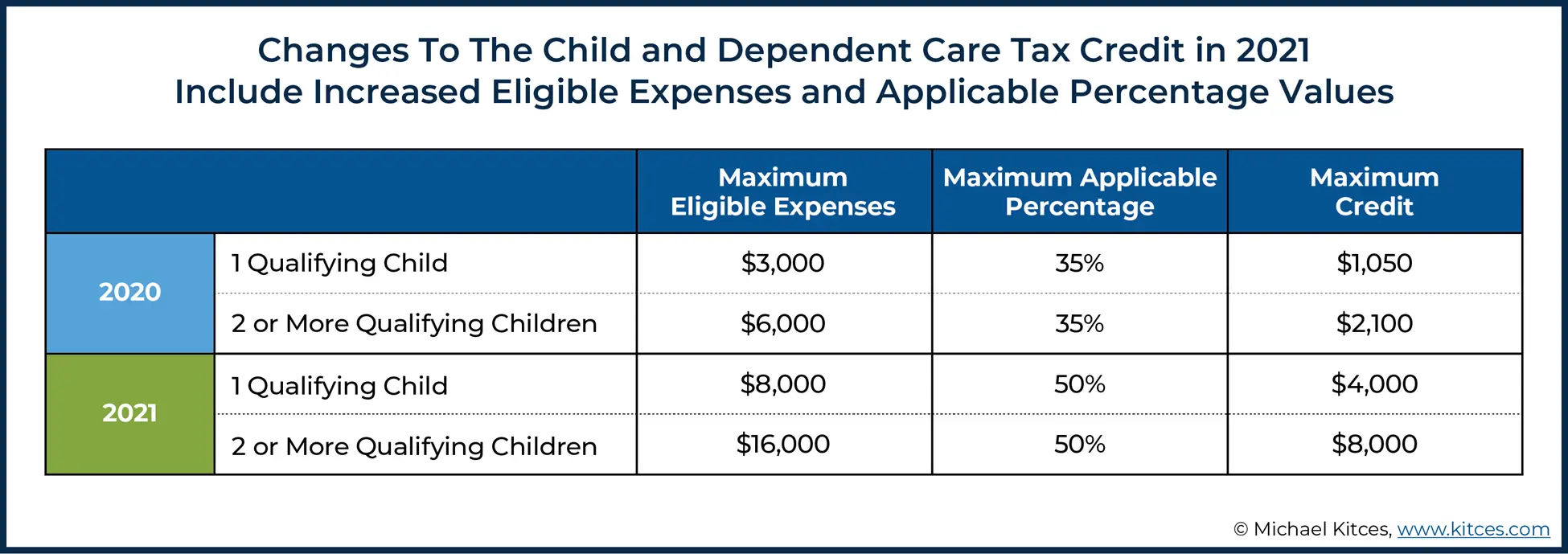

Changes to Child and Dependent Care Credit

The new bill would expand the Child and Dependent Care Credit and make it fully refundable to families making less than $125,000. The credit would be increased to cover up to 50 percent of qualifying childcare expenses up to $4,000 for one child and $8,000 for two or more children for 2021.

People Who Are Eligible For The Full Credit Amount

These people are eligible for the full 2021 Child Tax Credit for each qualifying child:

- Families with a single parent with income of $112,500 or less.

- Everyone else with income of $75,000 or less.

For the 2021 Child Tax Credit, the age of each qualifying child whether they were older or younger than 6 years old at the end of 2021 will determine the Child Tax Credit amount that their parents or guardians are eligible to receive.

Recommended Reading: Does Doordash Tax Your Earnings