Misclassification As An Independent Contractor

Some workers are incorrectly classified by their employersas independent contractors rather than as employees. Their earnings would not have any tax withheld in this case because independent contractors are responsible for remitting their own estimated taxes to the IRS as the year goes on.

Use Form 8919 to calculate the amount of Social Security and Medicare tax on your earnings in this case. Report this additional amount on your annual tax return.

How Do I Affect Withholding Now

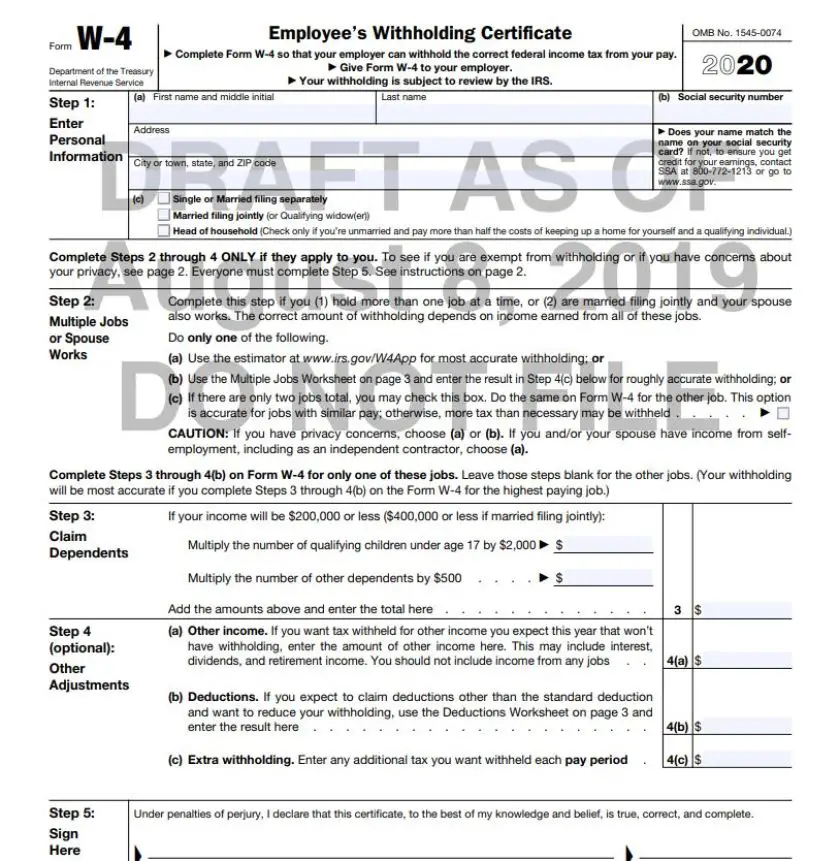

Since the 2020 W-4 is far simpler than it has been in the past, it might seem harder to change your total withholding. The loss of allowances on the form might seem especially irksome, but not to worry. There are still plenty of ways to affect your withholding.

First, its important to fill out the multiple jobs or working spouse section using the worksheet on the third page of the W-4 so that the IRS has a proper record of how much money total you bring in.

Second, the total number of dependents you claim also has a significant effect on your total withholding, so make sure you claim the correct number of dependents in Step 3.

Finally, Section 4 of the W-4 is a bit more open ended. Here youll be able to state other income and list your deductions, which can be used to reduce your withholding. Use the worksheet on page 3 of the W-4 to figure out your deductions. Finally, you can also use the extra withholding section to make your total withholding as precise as possible.

If you have a complex tax situation, it may be wise to work with a financial advisor who specializes in tax issues.

Dont Miss: How Does Doordash Do Taxes

Withholding Taxes On Wages

If you’re an employer, you need to withhold Massachusetts income tax from your employees’ wages. This guide explains your responsibilities as an employer, including collecting your employee’s tax reporting information, calculating withholding, and filing and paying withholding taxes.This guide is not designed to address all questions that may arise nor does it address complex issues in detail. Nothing contained herein supersedes, alters or otherwise changes any provision of the Massachusetts General Laws, Massachusetts Department of Revenue Regulations, Department rulings, public written statements or any other sources of law or published guidance.Updated: September 15, 2022

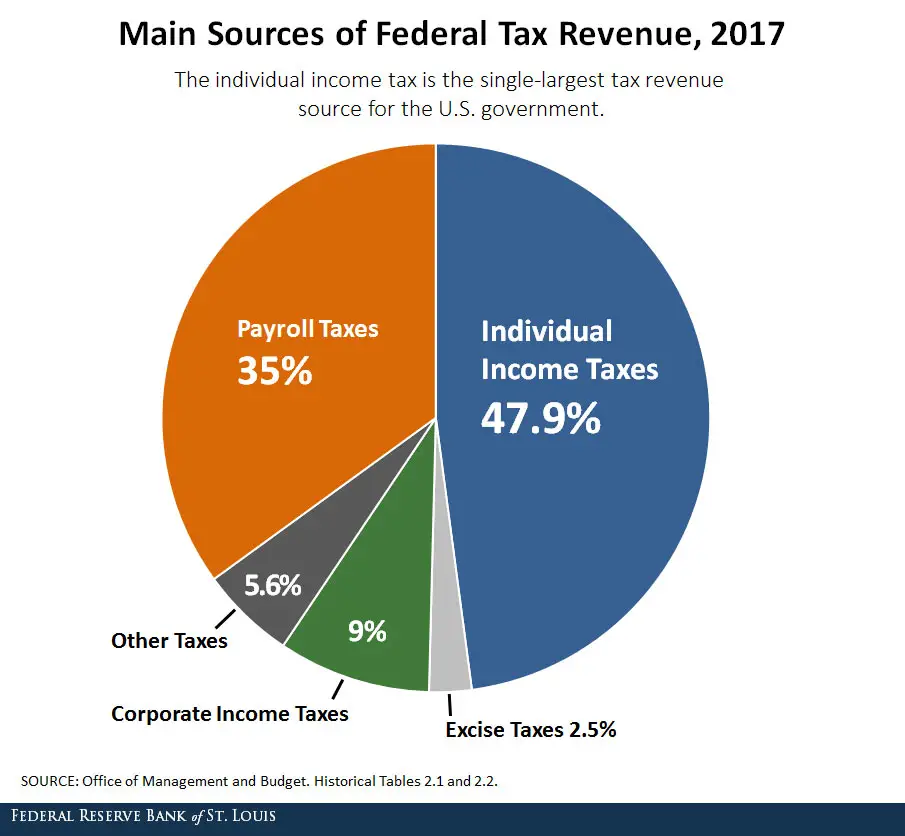

Read Also: What Does Payroll Tax Mean

How To Calculate Tax Medicare And Social Security On A $200000 Salary

The aim of this $2,000.00 salary example is to provide you detailed information on how income tax is calculated for Federal Tax and State Tax. We achieve this in the following steps:

Which Turbotax Is Best For You

Figuring out all these specifics can be stressful. But doing your income taxes doesnt need to be, when you use TurboTax Online.

However, if you do feel a bit overwhelmed, consider TurboTax Live Assist & Review and get unlimited help and advice from a real person as you do your taxes. Plus, theres a final review before you file. Or, choose TurboTax Live Full Service and have one of our tax experts do you return from start to finish.

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Don’t Miss: How To Report Ppp Loan On Tax Return

Review The Employees W

Next, make sure you have the correct form. Youll need to refer to the employees Form W-4 to find the following information relevant to the withholding tax calculations, including their filing status, number of dependents, additional income information, and any additional amounts that the employee requests to be withheld.

How You Can Affect Your California Paycheck

Though some of the withholding from your paycheck is non-negotiable, there are certain steps you can take to affect the size of your paycheck. If you choose to save more of each paycheck for retirement, for example, your take-home pay will go down. Thats why personal finance experts often advise that employees increase the percentage theyre saving for retirement when they get a raise, so they dont experience a smaller paycheck and get discouraged from saving.

Should you choose a more expensive health insurance plan or you add family members to your plan, you may see more money withheld from each of your paychecks, depending on your companys insurance offerings.

If your paychecks seem small and you get a big tax refund every year, you might want to re-fill out a new W-4 and a new California state income tax DE-4 Form. The California DE-4 forms tells your employer how many allowances youre claiming and how much to withhold from each of your paychecks. If you take more allowances, you might get a smaller refund but you should get bigger paychecks. Conversely, if you always owe tax money come April, you may want to claim fewer allowances so that more money is withheld throughout the year.

Read Also: How To Find My Tax Id Number Online

Federal Income Tax Withholding

To figure federal income tax, use your Form W-4 and IRS Circular E, which can be found online. Federal income tax withholding is based on your filing status, taxable wages and number of allowances. You can find your filing status on line 3 of the withholding allowance certificate section of your W-4 your number of allowances is on line 5. Look for the Circular E withholding tax table that matches your filing status, taxable wages and number of allowances. For example, your taxable wages for the biweekly pay period are $900 and you claimed Single filing status with three allowances on your W-4. According to Page 52 of the 2015 Circular E, your withholding would be $36. If you meet the criteria for being exempt, as stated on line 7 of the W-4, no federal income tax should be withheld.

Whats New As Of January 1 2021

The major changes made to this guide since the last edition are outlined.

This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective January 1, 2021. At the time of publishing, some of these proposed changes were not law. We recommend that you use the new payroll deductions tables in this guide for withholding starting with the first payroll in January 2021.

The federal Basic Personal Amount has been changed to the following:

- Where NI $151,978, BPAF = $13,808

- Where $151,978 < NI < $216,511, BPAF= $13,808 ×

- Where NI $216,511, BPAF = $12,421

For 2021, employers can use a BPAF of $13,808 for all employees, while payroll systems and procedures are updated to fully implement the proposed legislation.

If the employer uses a BPAF of $13,808 for its employees, employees with net income above $151,978 can ask for additional tax to be deducted, by completing the form TD1.

The federal income tax thresholds have been indexed for 2021.

The federal Canada employment amount has been indexed to $1,257 for 2021.

The Ontario income thresholds, personal amounts, surtax thresholds and tax reduction amounts have been indexed for 2021.

Also Check: How Do You File Self Employment Taxes

Payroll Hourly Paycheck Calculator

This calculator uses the withholding schedules, rules and rates from IRS Publication 15.

APL Federal Credit Union

© 2018 APL Federal Credit Union. .All rights reserved. 800.367.5796 · 11050 Johns Hopkins Rd. · Laurel, MD 20723

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Best Practices For Filing Payroll And Income Taxes

Whether you manage it yourself, have a staff member to help or outsource the task, its important to put enough resources into tax compliance to do it right. Errors in determining the amount owed, or delays in making payments or filing returns, could lead to fines and other financial penalties that your business cant afford. Small-business owners can ensure that their business expenses remain manageable and their taxes are paid on time with these best practices:

Recommended Reading: When Are Us Taxes Due 2021

State Income Tax Withholding

For employees living in a state with an income tax, the state government will automatically deduct a set amount from your paycheck and deposit it in the state revenue agency.

Your employer gathers all of your personal information, including income levels, to determine withholding amounts.

If you owe taxes to more than one state you may want to either ask your employer to withhold payments for the other state or set up additional withholding in your work state.

Don’t Use This Tool If:

- You have a pension but not a job. Estimate your tax withholding with the new Form W-4P.

- You have nonresident alien status. Use Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens.

- Your tax situation is complex. This includes alternative minimum tax, long-term capital gains or qualified dividends. See Publication 505, Tax Withholding and Estimated Tax.

You May Like: What Papers Do You Need For Taxes

Federal Withholding Term Definitions

Before we get into calculations, lets define a couple of key terms related to federal withholding tax tables:

Gross pay: The full amount of your salary before deductions, withholdings, and contributions are taken out of it

Net pay: Your take-home pay, once deductions, withholdings, and contributions are removed from your gross pay

Withholdings: The amount taken out of an employees paycheck to pay their income taxes during that pay period

Deductions: The amount taken out of an employees paycheck to pay for specific benefits/donations the employee has chosen, such as retirement or health care

These are all common terms that have to do with withholding tax, so it is important to understand these definitions as an employer.

How Do I Use An Income Tax Withholding Table

Since the federal income tax withholding brackets can change annually, reviewing these tables every year is essential. The best way to do this is through Circular E from the IRS. This document is a helpful guide for small business owners and businesses in general. It is an easy step-by-step manual that will help calculate what to take from your employees regarding the income tax based on how much you are paying them.

About Us

You May Like: Has The Deadline For Taxes Been Extended

What Percentage Of Federal Taxes Is Taken Out Of Paycheck For 2020

The federal income tax has seven tax rates for 2020: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. The amount of federal income tax an employee owes depends on their income level and filing status, for example, whether they’re single or married, or the head of a household.

Theres No Income Tax In Your State

If the tax was not withheld from your paycheck, it might also be because your state does not charge income tax. If you live in Alaska, Florida, Nevada, Tennessee, South Dakota, New Hampshire, Washington, Texas, or Wyoming, you will not have to pay income taxes. However, they might charge dividends and interests , so you might want to do a little bit of research on that.

States that do not charge income tax will have their own way of raising revenue for the maintenance of their infrastructure. One common way to do so is sales tax. Florida, for instance, takes a 6% tax on sales, whereas Tennessee takes a 9.55% sales tax. Washington charges a 49.4 cent fuel tax for every gallon of gasoline, which is among the nations highest rates.

So, if you live in one of the states mentioned above and you see that there is no income tax, dont stress yourself out. Youll be paying that tax money one way or another, only that you wont be paying it through federal income tax.

Recommended Reading: Are All Donations Tax Deductible

Overview Of California Taxes

California has the highest top marginal income tax rate in the country. Its a high-tax state in general, which affects the paychecks Californians earn. The Golden States income tax system is progressive, which means wealthy filers pay a higher marginal tax rate on their income. Cities in California levy their own sales taxes, but do not charge their own local income taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Will I Owe If I Claim 1

While claiming one allowance on your W-4 means your employer will take less money out of your paycheck for federal taxes, it does not impact how much taxes you’ll actually owe. Depending on your income and any deductions or credits that apply to you, you may receive a tax refund or have to pay a difference.

Also Check: How Much Do Charitable Donations Reduce Taxes 2020

When You Need To Update Your W

To avoid surprises at tax time, it’s a good idea to periodically check your withholding. Otherwise, there are some key life changes that definitely warrant an update. Those include:

- When you’re married and either of you starts or stops working

- When you or your spouse are working more than one job

- When you have significant nonwage income, such as interest, dividends, unemployment compensation, or self-employment income, or the amount of your nonwage income changes

- When you’ll owe other taxes on your return, such as self-employment tax or household employment tax

- When you have a life change that affects the tax deductions or credits you may claim

- When any qualified dependent turns age 17, as the deduction for dependents decreases

- When there are tax law changes that affect the individual tax rules

If you find that you need to make changes to your withholding, you can do so at any time simply by submitting a new Form W-4 to your employer. To check on your withholding amount and to see whether you need to make changes to your W-4, the IRS has a comprehensive Withholding Calculator on their website. You’ll need your most recent paystub as well as last year’s tax return. You won’t need to enter any personally identifiable information that ties the numbers you enter to you, but the more accurate the numbers you use, the more effective the calculator will be. Check it out here.

How To Use A Withholding Tax Table

So now that you understand what a withholding tax table is and how to calculate withholding tax, lets talk about how to use a withholding tax table. Its relatively simple when you break it down into four key steps:

Read Also: Can You Deduct Food Donations On Your Taxes

You Didnt Earn Enough

If no federal income tax was withheld from your paycheck, the reason might be quite simple: you didnt earn enough money for any tax to be withheld. According to some changes in the W-4, Employee Withholding Certificate , earnings that are too low might not have their income taxes withheld at all.

When it comes to how the withholding is calculated, several other things are taken into consideration as well. This includes your pay frequency, the rate of your payments, the number of dollars for the dependents, as well as your filing status. When deciding whether taxes should be withheld or reduced from your payroll, they will take all those aspects into account.

For example, a person that gets a $1,000 paycheck every week will be taxed differently compared to someone that gets a $1,000 paycheck every month.

Your filing status will also change the way your taxes are withheld. For example, filings from a single person will have more withheld tax compared to someone that is married or is the acting head of a household. Since you will be the one taking charge of your family on a smaller salary, taxes would not be withheld.