Payments In Lieu Of Taxes

Local governments provide services to nonprofits even though they don’t pay property taxes. Because of nonprofits’ tax-exempt status, homeowners and for-profit businesses foot the bill for providing benefits such as streetlights and law enforcement to the nonprofit organizations in their community. To ease the burden on taxpayers, some cities require all property owners, including nonprofits, to make payments in lieu of taxes. Other municipalities impose fees for specific services such as fire protection or snow removal.

Do Nonprofits Pay Taxes Its Complicated

by The Charity CFO | Dec 21, 2021

Many nonprofit founders think that they wont have to worry about taxes.

Unfortunately, its just not true.

Tax-exempt doesnt mean that you dont have to pay any taxes. It simply means that you dont have to pay most federal and state income taxes.

But even thats not always the case. And after that, it gets more complicated quickly.

So if youre new to nonprofit accounting, you shouldnt make too many assumptions about which taxes you will have to pay.

In this article, well do our best to answer the most the most common tax-related questions for 501 nonprofits. But you should consult your lawyer or tax professional to confirm the details of your specific tax situation.

A note on the term nonprofit:

There are 27 different nonprofits types in the federal tax code. For simplicitys sake, were going to focus on 501 charitable organizations in this article, because it is the most common type and deals with a range of tax compliance issues.

Nonprofits Eligible For Property Tax Exemptions

Most American states grant full or partial property tax exemptions to nonprofit organizations that use the property in question for educational, religious, and charitable purposes.

Take a look at some basic requirements that nonprofits need to fulfill in most states to be eligible for property tax exemption:

- The name of the nonprofit organization needs to contain the propertys legal title

- The organization needs to be the owner of the property in question

- The property needs to be used for the above-mentioned purposes

Nonprofits who engage in activities that arent closely related to the organizations basic purpose need to pay both income and property taxes.

Also Check: H& r Block Form 5498

How To Become A Tax Exempt Corporation In Indiana

You do not form an Indiana Tax Exempt Corporation you form an Indiana Nonprofit Corporation and then apply to the IRS for Tax Exempt status. The IRS requires that certain language is included in the Articles of Incorporation before it will grant tax exempt status to any Indiana Nonprofit Corporaton. more

Consider A Property Tax Loan

If you are looking for property tax relief and do not qualify for an exemption, you might consider a property tax loan. Property Tax Loans are available for residential and commercial properties located throughout the state of Texas. Property tax loans offer a low cost, low payment, and flexible alternatives to tax assessor payment plans. Property tax loans can be an excellent option for many Texas property owners who are not prepared for the annual lump sum payment due to the tax assessor.

Recommended Reading: How Do I File Taxes With Doordash

Do Nonprofit Organizations Pay Property Taxes

Related

Nonprofit business structures aren’t one-size-fits all. Many different types of nonprofit entities exist, such as trade associations, labor organizations, private foundations and public charities. One thing these nonprofit entities have in common is that they must fulfill federal requirements to be classified as tax-exempt. If an organization meets certain requirements, it can get out of paying income and property taxes.

Do Nonprofits Pay Sales Tax In Ct

Sales Made by Nonprofit Organizations Nonprofit organizations that make sales of goods or services are generally required to obtain a Connecticut Sales and Use Tax Permit and to collect sales tax on those sales. A nonprofit organization may make sales at up to 5 fundraising events per year without collecting sales tax.

Also Check: Www.myillinoistax

How To Start A Nonprofit In Indiana

As part of our SureStart nonprofit formation service, all Articles of Incorporation prepared by Foundation Group are drafted to meet strict IRS requirements. Bylaws are the rules used by the officers and directors to govern the organization. Indiana does not require a copy of the bylaws to be filed with the state.

Do Nonprofit Employees Have To Pay Income Tax

Yes, nonprofit employees have to pay the same taxes as employees of for-profit companies.

This one isnt directly related to your companys tax obligations. But its a question we get a lot, so were sure your employees will ask.

All of your employees will need to pay all federal and state income taxes, as well as payroll taxes, on all eligible income and any taxable fringe benefits.

The law is very clear on this, tax exempt status is a benefit given to organizations, not to the individuals that work for it.

Thats a wrap on our nonprofit tax rundown! We know its a lot to take in, so if you still have questions

Recommended Reading: Doordash Taxes California

Nonprofit Organizations Must Meet These Requirements To Obtain And Maintain Tax

*Whats a Form 990? Nonprofits that arent religious or political file must file an annual tax return using IRS Form 990. Its a tool for the IRS to ensure compliance and collect financial information about tax-exempt organizations. Find out more about the 990 here.

Businesses Versus Nonprofit Organizations

When a business generates revenue, it may choose how it wants to use that money. The leaders of the business, whether it is a sole proprietorship, a partnership or a corporation, may reinvest the money in the business, pay it to stockholders, give themselves bonuses or almost anything else.

In contrast, NPOs must put any revenues they have back into the organization. NPOs can pay salaries to their employees and directors, and they may be allowed to hold some assets or cash from year to year.

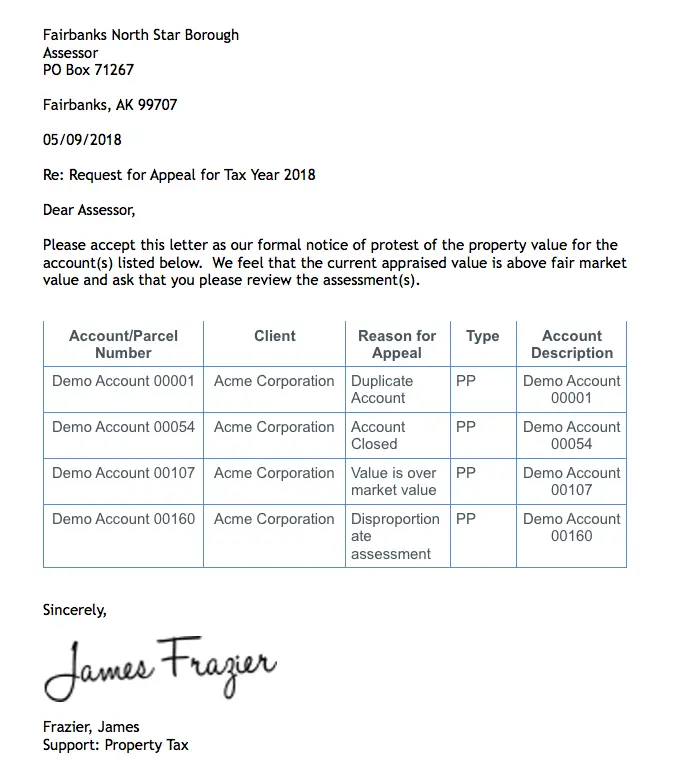

Also Check: Protest Property Taxes In Harris County

Have More Questions About Nonprofit Taxes

The truth about nonprofit taxes is that its complicated.

Weve done our best to simplify the core topics here. But if youd like to be sure that youre complying with all local, state, and federal requirements, you cant rely on a google search or a blog article. Because mistakes could cost you money, or even put your nonprofit status at risk.

Instead, seek out an experienced nonprofit accountant that you can trust.

At The Charity CFO, you get a dedicated service team that learns the details of your organization so we can give you expert advice on how to approach any nonprofit tax situation.

Plus, well help modernize your bookkeeping and accounting systems to help save you time and money. So you can spend less time worrying about taxes, and more time executing your mission with confidence.

If youre looking for a financial partner you can trust to have your back, click below and let us show you how we can help.

Are Nonprofits Exempt From Property Taxes

The real and tangible personal property of nonprofit organizations is, by law, subject to taxation. Eligible nonprofits who experience financial hardship imposed by property taxes can apply for a property tax exemption in most American states. Nonprofits should obtain exemptions for both real and tangible property to avoid paying unnecessary taxes.

Since each state has different rules when it comes to property tax exemption for nonprofits, you should contact your local office to find out more info.

Don’t Miss: Doordash 1099

Does The Organization You Represent Have To File A Non

Under subsection 149, an organization may have to file Form T1044, Non-Profit Organization Information Return for a fiscal period ending after December 31, 1992, if it is:

- a non-profit organization described in paragraph 149

- an agricultural organization, a board of trade or a chamber of commerce described in paragraph 149

However, the organization will only have to file an NPO information return if:

- it received or was entitled to receive taxable dividends, interest, rentals, or royalties totalling more than $10,000 in the fiscal period

- the total assets of the organization were more than $200,000 at the end of the immediately preceding fiscal period

- it had to file an NPO information return for a previous fiscal period

Notes

Corporations operating only to provide low-cost housing for the aged, where no income is payable to or available for the personal benefit of any proprietor, member, or shareholder, do not have to file form T1044. Subsection 149 does not apply in such cases, since these corporations are exempt from Part I tax under paragraph 149.

Registered charities, registered Canadian amateur athletic associations, and registered national arts service organizations do not have to file form T1044.

When calculating whether or not you have to file an NPO information return, you should only include the amounts your organization received or was entitled to receive in the form of taxable dividends, interest, rentals or royalties in the fiscal period.

Example

How Do I Avoid Property Taxes In Missouri

Also Check: Amended Tax Return Online Free

How To Apply For The Exemption

Your town lister makes the initial determination of whether a property is exempt from tax under the law. You may complete Form PVR-317, Vermont Property Tax Public, Pious, or Charitable Exemption application to present to the lister. The application will help you gather the necessary information the lister needs. It is important that you provide clear and detailed information about the property and its uses. Incomplete information will result in the exemption being denied.

What Are Property Taxes And Who Needs To Pay Them

Individuals and legal entitiescorporations, organizations, and similarwho own property in the U.S. need to pay property taxes on a yearly basis. Local governments charge property taxes to fund services beneficial to the community, including libraries, schools, hospitals, road constructions, law enforcement, etc.

The property tax depends on:

Also Check: Efstatus Taxactcom

Do Nonprofits Pay Taxes Do Nonprofit Employees Pay Taxes

Categories: FinanceTopic Tags: Taxes

We often get questions from our readers about whether a nonprofit organization must pay taxes, or whether individuals working at a nonprofit must pay taxes. While there are lots of details to get into depending on the situation, heres a summary about nonprofits and the taxes they may or may not have to pay!

Do nonprofit organizations have to pay taxes? It depends!

Most nonprofits do not have to pay federal or state income taxes. However, here are some factors to consider when determining what taxes a nonprofit may have to pay:

- Type of nonprofit. There are 29 different types of nonprofits in the IRS tax code. And there are several types of 501 charitable organizations, including Religious, Charitable, Educational, and Scientific! Each type of tax-exempt organization has different compliance requirements, and this includes taxation.

- State and local tax requirements. Where you are located and operate matters! For example, in California, nonprofits pay sales taxes, but charitable organizations may not need to in New York, Texas, or Colorado when buying things in the conduct of their regular charitable functions and activities. However, your organizations may need to apply for the exemption.

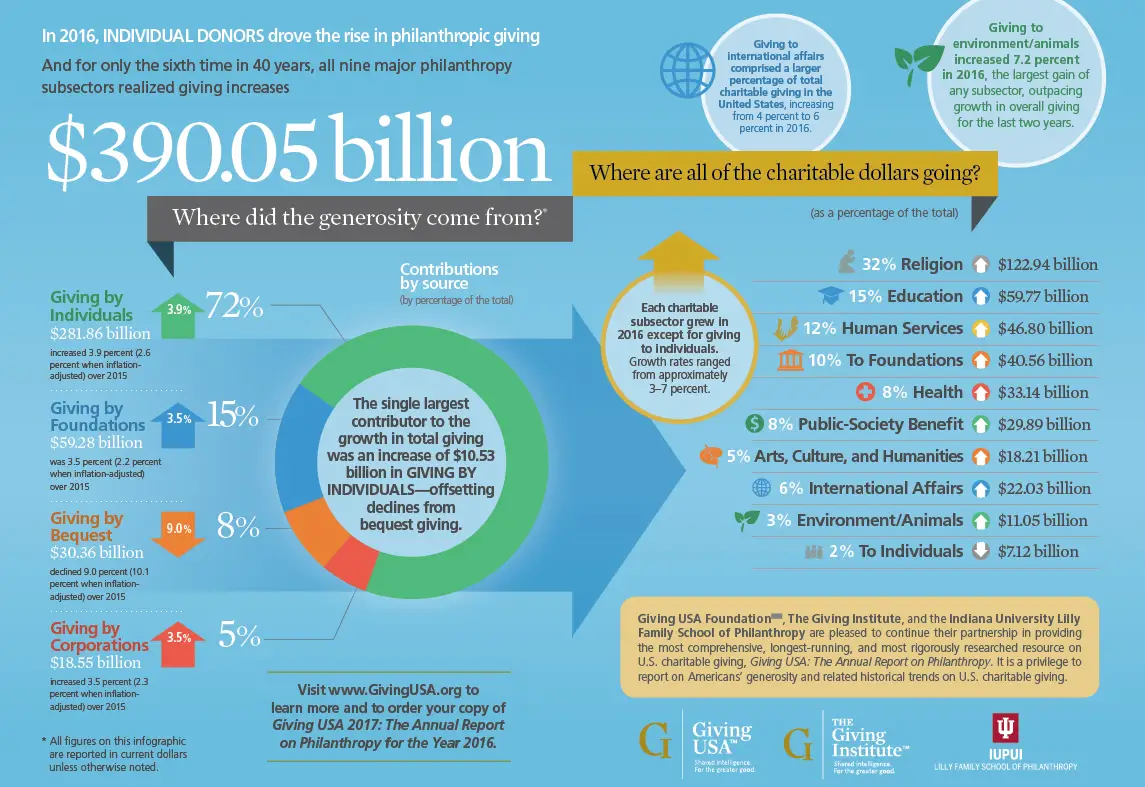

Property tax is another common tax that some nonprofits need to pay. Many states allow certain types of nonprofits to file for an exemption on paying property taxes. This may require an annual filing to maintain the exemption.

In case you missed it

Property Tax Exemptions For Nonprofits

Did you know that just because a nonprofit organization is exempt from income tax, does not automatically qualify it to be exempt from property taxes? A general rule is that property is subject to tax unless the organization obtains approval of exemption, even if the organization is a 501 public charity. Because property taxes are regulated at the state and local level, exemption from property taxes and how to obtain exemption varies.

Depending on the state, exemption from taxes on both real property and tangible personal property may be pertinent to your nonprofit organization. Since most state and local governments tax both types of property, it is important for nonprofit entities to be sure they are correctly exempt to avoid any unnecessary taxes. Filing the appropriate exemption application and forms by the required due date is essential. Certain states do not allow late filing of exemption applications and/or returns. Once the property tax is assessed and billed, it can be challenging to have the tax abated. Following is a brief summary of Indiana, Ohio, and Kentucky exemption rules.

You May Like: Opi Plasma Center

Statement Of Assets And Liabilities At The End Of The Fiscal Period

Assets

Record all the organization’s assets based on their cost. If you use another method of accounting, please tell us the method you have used.

If the organization uses the accrual method, report amounts on lines 108 to 119 where they apply.

Line 108 Cash and short-term investments

Report the total amount of the organization’s cash and short-term investments that are on hand at the end of the organization’s fiscal period. Cash includes cash on hand and cash deposits. Short term investments include treasury bills and term deposits. We consider any investment that has a maturity period of one year or less to be a short-term investment.

Line 109 Amounts receivable from members

Report the total funds owing to the organization from members at the end of the organization’s fiscal period. Include such amounts as loans, mortgages, and amounts connected to the sale of the organization’s goods and services to these people.

Line 110 Amounts receivable from all others

Report the total funds owing to the organization from all persons other than members at the end of the organization’s fiscal period. Include such amounts as loans, mortgages, and amounts connected to the sale of goods and services. Do not include the amounts you reported on line 109.

Line 111 Prepaid expenses

Report the total amount of all prepaid expenses at the end of the organization’s fiscal period. Include such amounts as prepaid rent and prepaid insurance.

Line 112 Inventory

Line 114 Fixed assets

What Is A Non

An NPO, as described in paragraph 149, is a club, society, or association that is not a charity and that is organized and operated solely for:

- social welfare

- pleasure or recreation

- any other purpose except profit

To be considered an NPO, no part of the income of such an organization can be payable to or available for the personal benefit of any proprietor, member, or shareholder, unless the proprietor, member, or shareholder is a club, society, or association whose primary purpose and function is to promote amateur athletics in Canada.

An NPO is exempt from tax under Part I of the Act on all or part of its taxable income for a fiscal period if it meets all of the above requirements for that period.

Note

Although a factual determination must be made in each case, most residential condominium corporations qualify as non-profit organizations under paragraph 149 because they are usually operated for a purpose other than profit.

For more information on whether the organization qualifies as an NPO described in paragraph 149, see Interpretation Bulletin IT-496R, Non-Profit Organizations.

Recommended Reading: Efstatus.taxact 2014

Do Non Profits Pay Property Tax In Ct

In general, a nonprofits real property is exempt only to the extent it uses the property exclusively for one or more of the exemptions stated purposes. If it uses the property for the stated purposes and for other purposes, the nonprofit may be taxed for the portion of the property used for other purposes.

Taxes For Nonprofit Organizations And Corporations

Aiming for altruistic ideas rather than profits, nonprofit organizations include groups, societies and clubs that operate for the benefit of society. They are similar to businesses and charities. However, there are nuanced differences between all three of these categories, and the Canada Revenue Agency has different reporting requirements for each type of entity.

Recommended Reading: Property Tax Protest Harris County

Making Changes To Your Return

If you want to change your NPO information return, send us a letter with an explanation of the changes you want to make, fill out a new return, or make corrections on a photocopy of the original return. Make sure you include all of the same information that was on the original return except for the lines that you are changing. Clearly print the word AMENDED at the top of page 1 and send the letter or the amended return to:

Jonquière Tax Centre PO Box 1300 LCD Jonquière Jonquière QC G7S 0L5

Do Nonprofit Organizations Pay Taxes

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Nonprofit organizations are exempt from federal income taxes under subsection 501 of the Internal Revenue Service tax code. A nonprofit organization is an organization that engages in activities for both public and private interest without pursuing the goal of commercial or monetary profit. To be exempt from federal taxes, nonprofit organizations have to meet certain rules.

Key criteria that nonprofits must meet to be tax exempt include:

Nontaxable nonprofits are more likely to generate donations, where the donor can use the donation to lower their own tax liability.

Recommended Reading: If I File Taxes Today Will I Get A Stimulus Check