What If I Made A Mistake On My Tax Return

If you made a mistake on your tax return, its not the end of the world and it can be corrected. You just need to fix the error so it doesnt become an even larger issue like a tax lien or levy.

- A lien occurs when the IRS assesses a tax debt or liability against you, and your spouse, and sends you a bill. Typically, it gets to a lien situation if you refuse to pay and a levy if you neglect or ignore the notice or simply refuse to enter into an agreement to pay the IRS.

- A levy is a legal seizure of your property to satisfy a tax debt. A levy can take your property or property someone else holds for you such as wages, retirement accounts, bank accounts, etc., and in very rare circumstances, can even seize and sell your vehicle, real estate, and other personal property.

If you amend your tax return and then owe the IRS more money, but dont have the funds to pay the bill, you can enter into an Installment Agreement with the IRS. This is a payment play thats typically divided into short and long-term categories.

Don’t miss out on every credit and deduction you deserve!

Where’s My Amended Return

Track the progress of your amended tax return using the IRS’s online tracking tool.

You can also the progress of your amended tax return by calling the IRS.

-

It can take three weeks for an amended return to show up in the IRSs system and up to 16 weeks to process an amended return.

-

If nothing has happened after 16 weeks, call the IRS again or ask someone at a local IRS office to research your amended return.

Can I Change My Federal Income Tax Return

Once you have dropped your original income tax return in the mailbox or sent it off electronically, you can no longer change that return.

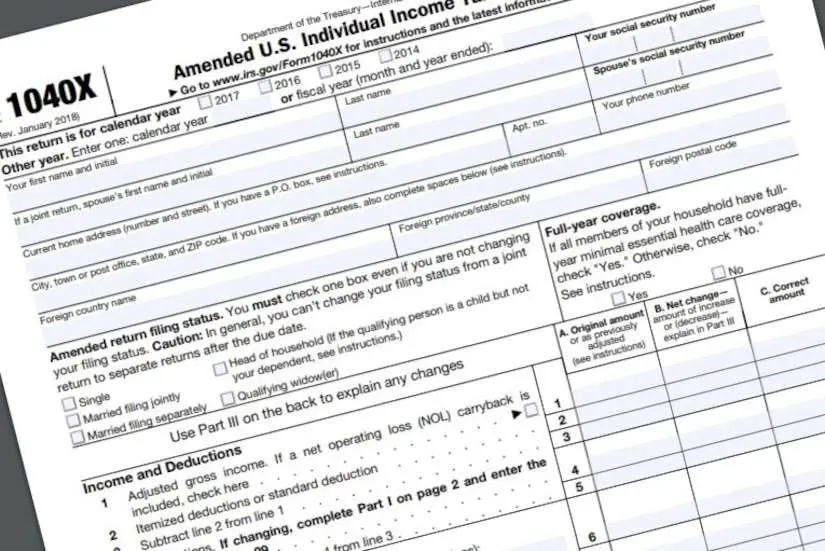

If you want to make changes after the original tax return has been filed, you must file an amended tax return using a special form called the 1040X, entering the corrected information and explaining why you are changing what was reported on your original return. You don’t have to redo your entire return, either. Just show the necessary changes and adjust your tax liability accordingly.

You generally must file an amended return within three years of the date you filed the original return or within two years after the date you paid the tax, whichever is later.

Recommended Reading: Is Door Dash 1099

Get Income Tax Refunds From Previous Years Or Fix Mistakes

by Kimberly Lankford, AARP, April 7, 2021

En español | If you file your income tax return and then discover that you missed some important breaks or made mistakes, it’s not too late for a second chance. You have up to three years after the tax-filing deadline to file an amended return, which means you still have time to file an amended return for 2017, 2018, 2019 or 2020, if you have already filed. .

If you can take advantage of additional tax credits or deductions, you may get back extra money in a refund or you may be able to stop the clock on possible penalties if you’re fixing a mistake. Here are some common reasons for filing an amended return and the steps you need to take.

What Should I Do

Before filing an amended tax return:

- If youre not sure what amounts your original return showed or you want to see any adjustments the IRS may have made, you should get a transcript.

- Verify the information the IRS has on file for you matches the tax year information youre amending.

- For a record of your tax return, request a tax return transcript.

- For a record of any adjustments the IRS may have made to your account, in addition to the amounts reported on your original return, get a Record of Account.

Gather your documents such as a copy of the return you are amending, all IRS Forms W-2 or W-2C, IRS Forms 1099 or 1099C, etc. that support the changes you wish to make. Be sure to keep copies for your records.

- Review and follow all the Form 1040-X Instructions before submitting your amended tax return. Be sure to read the Special Situations section for instances that have special conditions or rules you need to follow.

Filing an amended tax return

If you need to amend your 2019, 2020 and 2021 Forms 1040 or 1040-SR you can do so electronically using available tax software products, as long as you e-filed the original return. You should contact your preferred tax software provider to verify their participation and for specific instructions needed to submit your amended return and to answer any questions. Amended returns for other years must be filed by paper.

To file your amended tax return:

Don’t Miss: Doordash On Taxes

Amending Special Taxes And Fees Returns For Motor Fuels Cigarette Manufacturers And Distributors Or International Fuel Tax Agreement:

Motor Fuels Electronic Filing Program

There are two options to correct or amend a return that you already submitted.

Within the same business day as your original submission, and we will cancel your original submission. You may then submit the new tax form when you have made the corrections or amendments. Please note that the original submission will not be considered a valid filing and applicable due dates will apply to your new file submission. *The subject line of the email should be: , Amended Filing Notification for XXXX Period.

After the business day of your original submission, submit your corrected or amended file as if were an original. The electronic file maps for each file format provide coding options for submitting correcting or amending files, but the CDTFA does not utilize these coding options at this time. Once you have successfully submitted the corrected or amended file, with the following information: date of submission, tracking number, account number, period, and reason for/summary of the correction or amendments

Cigarette Manufacturers and Distributors Electronic Filing Program To amend a return online, select “Amend a prior eFiled Report”. Include all transactions previously reported and amendments.

IFTA Currently, we do not have an electronic method for you to amend your IFTA return. To amend or correct a return for diesel fuel, please do the following:

Is There A Penalty For Filing An Amended Tax Return

There is no penalty for simply filing an amended return. But if your mistake caused you to underpay tax, you will owe that additional tax. If you amend your tax return before the April deadline and pay the remaining tax you owe, you won’t have to pay a penalty. If you don’t file until after the deadline, the IRS may assess penalties and interest for the additional tax.

You may also be wondering whether filing an amended tax return increases your chances of the dreaded IRS audit.

“Requesting a high refund on an amended return does carry a high risk of being audited,” Stranger says, “But otherwise, I haven’t seen it overall increase risk more than any other return filing.”

You May Like: Does Doordash Give 1099

What If Ive Missed The Deadline For Making Changes

If you want to make a tax return correction but have missed the relevant deadline, you should write to HMRC.

When writing to HMRC, make sure you include the following details:

- the tax year for which you want to make a correction

- the reason why you think youve paid an incorrect amount of tax

- the amount you think you’ve either over or underpaid

Amending Your Income Tax Return

OVERVIEW

What if you’ve sent in your income tax return and then discover you made a mistake? You can make things right by filing an amended tax return using Form 1040X. You can make changes to a tax return to capture a tax break you missed the first time around or to correct an error that might increase your tax.

Don’t Miss: How Do You Pay Taxes For Doordash

What To Expect From An Amended Tax Return

You dont have the rest of your life to file amended tax returns. If you dont file an amended return within three years of filing the original return , youll miss your chance to get a refund. The more you owe the IRS, or the more the IRS owes you, the more careful you should be to avoid missing that deadline.

Expect to wait up to a few months to see the results of your amended your tax return. The IRS is already swamped with the regular volume of tax returns it gets. Add in amended returns and youre looking at a bit of a wait. The good news is that the IRS makes it easy to check the status of your amended refund on its website beginning three weeks after you send the amended return.

Submit The Amended Forms

The amended forms must be submitted via post at an IRS Service Center. Three weeks after youve mailed the return, you can begin tracking the amended return. The returns are processed manually, so the entire process can take up to 16 weeks or more, especially if the return is incomplete, has errors, or has been subjected to identity fraud.

- No electronic filing: Amended returns cannot be filed electronically. You can, however, prepare them online and print them out. When asked how to amend the 2020 tax return electronically, the IRS communicated that it would start accepting electronic returns sometime in the future.

| NOTE:Those born before 1955 can file for an amendment with Form 1040-SR. Thankfully, with so many tax forms available, you can quickly learn how to do your own taxes. |

Don’t Miss: Irs Gov Cp63

If You Are Claiming An Additional Tax Refund

If you are filing an amended tax return to claim an additional refund, youll have to wait until you have received your original tax refund before filing a Form 1040X. Amended returns take up to 12 weeks to process.

You may cash your original refund check while waiting for the additional refund.

Also you generally MUST file the amended return within three years from the date you filed your original return, or within two years after the date you paid the tax in order to get the extra refund.

Can You Change A Tax Return Once Submitted Canada

Tax returns will only be accepted by the Canada Revenue Agency on a one-year basis. A new return cannot be filed following the mistake you made . If you would like to correct the original, you can do so by adjusting the software. If you wish to apply for an adjustment, you must wait until after you have received your Notice of Assessment.

You May Like: How Much Do You Pay In Taxes Doordash

How To Claim A Refund If Youve Made A Mistake

If youve paid too much tax because you made a mistake on your tax return, youll need to make any amendments within the first year of filing it.

You wont have to pay a penalty if youve taken reasonable care to fill out your tax return correctly. However, HMRC can issue penalties if youve understated tax or misrepresented your tax liability because youve been careless.

Gov.uk explains how penalties are calculated:

- if a penalty arises because of a lack of reasonable care, the penalty will be between 0 and 30 per cent of the extra tax due

- if the error is deliberate, the penalty will be between 20 and 70 per cent of the extra tax due

- if the error is deliberate and concealed, the penalty will be between 30 and 100 per cent of the extra tax due

Make sure you keep on top of bookkeeping for your business or hire an accountant if youre not sure of anything.

Can I Amend My Tax Return Online Electronically

The simple answer is no, but there is more to know about the no. Lets walk through the basics of amending a tax return.

If you discover an error after filing your taxes, you may need to amend your tax return. You should file an amended return if there’s a change in filing status, income, deductions or credits. This is a reality as receipts are lost, records jumbled or the exclamation of: I thought you kept that record. It is more common than you might think to experience errors on a tax return since humans can easily misinterpret definitions of terms and expectations.

You can and should file an amended return if there is a change in filing status, income, deductions or credits.

Please note that the IRS may have already corrected mathematical or clerical errors on a return. They also may accept returns without certain required forms or schedules. In these instances, there is no need to file an amended return, but you can contact us, and we can help you amend your return.

If you need to amend a tax return, here are some important tips:

- Dont file an amended return after an audit starts. If you have been selected to be audited, you find it better to not file an amended return after the audit starts. It is not likely the auditor will get your amended return quickly enough, filing it may create confusion. Discuss any proposed change with the revenue agent conducting the audit.

Also Check: Raffle Tickets Tax Deductible

If You Filed The Wrong Form For Your Tax Return

What if I accidentally filed form 1040 instead of form 1040NR / 1040NR EZ?

Nonresidents who file their tax returns with form 1040 instead of the return for nonresidents may claim credits or take deductions to which they are not entitled. This means their tax return will be inaccurate and they could get into trouble with the IRS later on. This is another case when you will need to amend your tax return.

Major Irs Milestone Helps Taxpayers Correct Tax Returns With Fewer Errors Speeds Processing

IR-2020-182, August 17, 2020

WASHINGTON Marking a major milestone in tax administration, the Internal Revenue Service announced today that taxpayers can now submit Form 1040-X electronically with commercial tax-filing software.

As IRS e-filing has grown during the past 30 years, the 1040-X, Amended U.S. Individual Income Tax Return, has been one of the last major individual tax forms that needed to be paper filed. Today’s announcement follows years of effort by the IRS, and the enhancement allows taxpayers to quickly electronically correct previously filed tax returns while minimizing errors.

“The ability to file the Form 1040-X electronically has been an important long-term goal of the IRS e-file initiative for many years,” said Sunita Lough, IRS Deputy Commissioner for Services and Enforcement. “Given the details needed on the form, there have been numerous challenges to add this form to the e-file family. Our IT and business operation teams worked hard with the nation’s tax industry to make this change possible. This is another success for IRS modernization efforts. The addition helps taxpayers have a quicker, easier way to file amended returns, and it streamlines work for the IRS and the entire tax community.”

Currently, taxpayers must mail a completed Form 1040-X to the IRS for processing. The new electronic option allows the IRS to receive amended returns faster while minimizing errors normally associated with manually completing the form.

Don’t Miss: Doordash Pay Taxes

How Long Will My Amended Tax Return Take To Process

According to the IRS, it can take up to 16 weeks to process the 1040x once it is received.

How to check an amended tax return status

The IRS Wheres My Amended Return? tool allows you to follow the processing stages of your amended return from receipt until completion. You can track if your return is in received, adjusted, or completed status.

How long does it take to get a refund from an amended tax return?

There is no set time that an amended tax refund will take to get to you, so you usually just have to be patient.

Is amending a tax return a red flag?

Thousands of people have to amend their US tax return each year, so dont worry about whether youll receive an audit due to your amended tax return. As long as you provide the IRS with the required information on your amended tax return, everything should be fine.

Dont hesitate to contact the Sprintax team if you need help with amending your return!

Amended Tax Return Filing Instructions

If youre wondering how to amend a tax return, you wont have to completely redo your tax returns. If you initially filed your federal income taxes using Form 1040, 1040A, 1040EZ, 1040EZ-T, 1040NR or 1040NR-EZ youre in luck. IRS Form 1040-X, Amended U.S. Individual Income Tax Return, will be your go-to for correcting errors on your tax returns.

Much of the information you include on Form 1040-X will overlap with what you included on your original 1040. Of course, youll need to correct the errors that led you to amend your tax return in the first place. Youll also need to provide supporting documentation. Reporting income from a source you forgot to include on your original returns? Provide the W-2 form for that income. Adding a new deduction such as a charitable donation? Attach the receipt providing proof that you donated.

Pretty simple, right? While you previously couldnt e-file Form 1040-X, the IRS announced in 2020 that it now permits taxpayers to submit the form electronically with commercial tax-filing software. However, youll have to print and mail it, if you prefer. The address you send your amended tax return to will depend on the particulars of your filing situation. If youre using tax preparation software youll be walked through this process.

You May Like: Is 1040paytax Com Real