Why Does A Business Need An Ein Number

The EIN is the businesss identifier and tax ID number. You use it to file taxes, apply for loans or permits, and build business credit. If you ever get a request for your TIN, or tax identification number , its the same as the EIN.

If youre a sole proprietor working for yourself, you wont need the number until you start to hire employees and contractors. Then, you will use it to register a tax withholding account.

Tin Search: Finding Your Tin Number

If youre a Canadian business owner looking for your TIN number, weve got good news: its easy to find.

For individual residents of Canada , your TIN number is your nine-digit SIN.

So long as you know your SIN, youre good to go!

However, for corporations , your TIN is your nine-digit Business Number issued by the Canada Revenue Agency .

So, lets talk about how to find your BN.

Online Business Tax Application Checklist

- Current: Online Business Tax Application Checklist

Welcome to the Indiana Department of Revenue online Business Tax Application . The basic information required to fill out the application is listed below. Please review the list to make sure you have this information prior to starting the online process. It is recommended that you print this document, record the needed information on it, and then refer to it as you complete the BT-1. Register your business with the department via INBiz.

Information required for the online BT-1 application:

Also Check: Paying Taxes On Doordash

What Do I Need A Tin For

Once you know what your TIN is, you may be wondering when and why youll need it. You as a taxpayer will need to provide your TIN on all tax returns and other documents sent to the IRS. Even if you do not have a number issued to you by the IRS, your SSN must be on forms submitted to it. You have to provide your taxpayer identification number to others who use the identification number on any returns or documents that are sent to the IRS this is especially the case for business transactions that may be subject to Reverse-Charge procedures. This may also be the case when you are interacting with a bank as an entity.

Aside from using your EIN for tax returns and business to business transactions also known as B2B youll need to keep your SSN in mind for other purposes too. As well as for personal tax returns, your Social Security number is vital in daily life, because without it you wont be able to get a job or collect Social Security benefits if necessary. It is also a confidential piece of identity information, so avoid just telling anyone what it is. Keep it safe with other important documents.

Click here for important legal disclaimers.

- 06.12.19

Tax Id And Tax Number: Everything You Need To Know

Where can you find your tax ID and tax number? We’ll explain everything here!

Tax ID and Tax Number: Everything You Need to Know!In Germany, there are various numbers for different types of income and tax purposes. This can get quite confusing: tax identification number , VAT identification number, tax number, eTIN what is used for what? Well clear this all up for you!

Recommended Reading: Www.myillinoistax

Businesses Located Inside Missouri

- Corporate Income Tax and Corporate Franchise Tax –

- If you are a Limited Liability Company , register for Corporation Income tax only.

- If you are a corporation required to file Missouri Corporation Income tax but not Corporation Franchise tax, register for Corporation Income tax only.

- If you are a corporation not required to file Missouri Corporation Income but meet the requirements for franchise tax, register for franchise tax only.

- If you are a corporation that meets the requirements for both income and franchise tax, register for both.

- Corporation Franchise tax is a tax based on assets that corporations pay in advance for engaging in business with Missouri.

- Corporate Income tax is a tax based on the income made by the corporation.

What Is The Difference Between A Tax Id Number And A Corporate Number

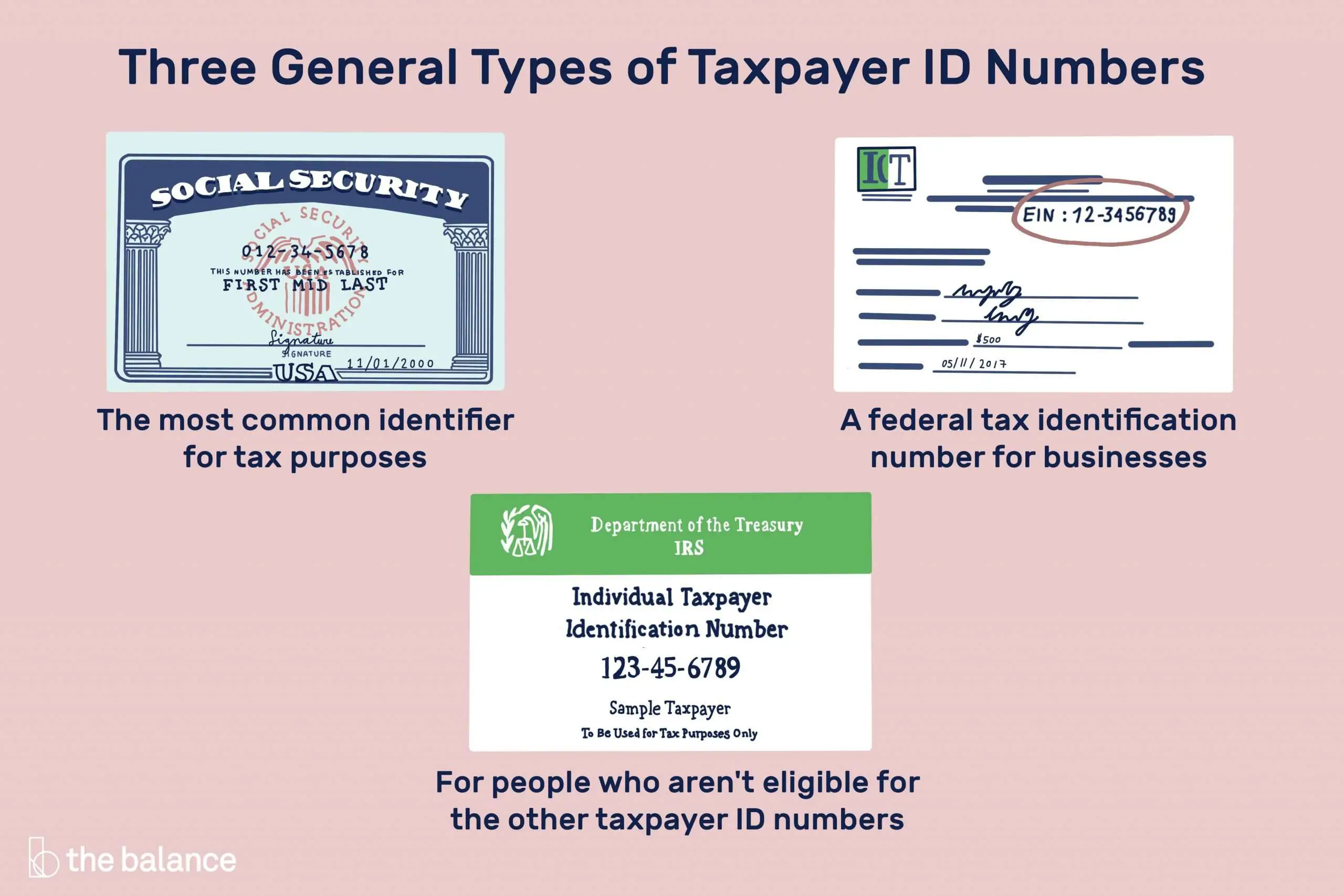

The term taxpayer identification number refers to five different types of numbers used to identify taxpayers:

- Social Security numbers

- Taxpayer identification numbers for pending U.S. adoptions

- Preparer tax identification numbers

For businesses, EINs are the most relevant tax ID numbers. These help the government track business taxation at the federal level. Sole proprietorships and single-member LLCs may use Social Security numbers as their businesss tax ID number.

The terms corporate number and EIN can be used interchangeably. The official term used by the IRS and other government entities is employer identification number or federal tax identification number.

Tax ID numbers are used for federal taxation and apply to both individuals and businesses, whereas corporate numbers and EINs apply solely to businesses.

Key takeaway: There are five different kinds of tax identification numbers, including employer identification numbers. Corporate numbers and EINs are considered the same.

Recommended Reading: Efstatus Taxact 2016

Find Out If Your Business Needs A Tax Id Number To Operate In Canada

The tax ID number is part of the 15-character program account number assigned to your business by the Canada Revenue Agency . The program account number consists of three parts:

- Nine-digit Business Number that identifies your business

- Two-letter identifier for the program type

- Four-digit reference number for the program account

An account number would look like this: 123456789 RT0001

Think of your Business Number as your business tax ID number because that’s why it exists. The CRA assigns your company a Business Number when you first register for any one of the four major program accounts you will need to operate your business:

The nine-digit tax ID number is the same across program accounts the numbers for the program ID and account number will change based on which of the four it’s referring to. You can apply for the number through The Canada Revenue Agency’s Business Registration Online service.

Note that in Quebec, the Business Number does not include your GST/HST accounts. You must register for a separate GST/HST account with Revenu Québec. Its General Information Concerning the QST and the GST/HST provides further clarification.

Several other tax accounts, such as Excise Tax, require a tax ID number/Business Number if they apply to you.

Florida Tax Id Number Application

Home » Apply Online » Florida Tax ID Number Application

You can spend hours reading information online about how to incorrectly in Florida. Why trust sites that are lacking true and fact-based information? Even if you own a Corporation or , you will want to go to a professional, expert assistance service where you will find a proper step by step guide. The is your professional guide to help walk you through the online application process for a Tax ID Number in Florida.

Recommended Reading: Donating Plasma Taxes

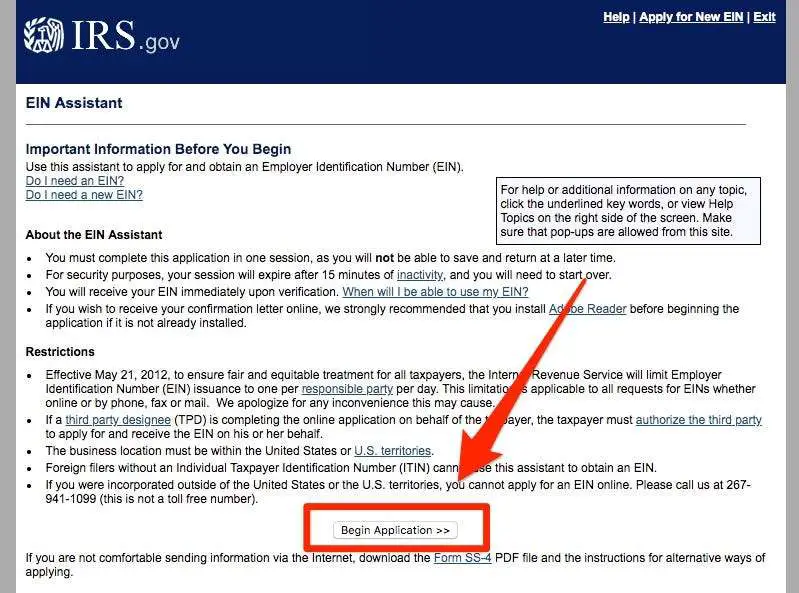

How To Apply For A Business Tax Identification Number

You can apply for a Business Tax Identification Number Online at our website tap.state.nm.us.

You will click Apply for a New Mexico Business Tax ID and follow the prompts. Upon completion and approval of the online application you may log in with the credentials set up during the application.

Any entity other than a sole proprietor/individual owner that does not have employees must obtain a Federal Employer Identification Number . The IRS issues this number. To contact the IRS, call 1-800-829-4933, or click FEIN online.

There is no fee to register or obtain a Business Tax Identification Number.

You may also submit an ACD-31015 Business Tax Registration to any district tax office with an appointment. Applications submitted by mail are processed in the order received and processing times may vary. We then mail the Registration certificate for your Business Tax Identification Number to you. Applications for Business Tax Identification Numbers are also available at many city, village and town halls around the state.

Contact The Irs Directly

The IRS is the ultimate resource for looking up a tax ID number. There is a business and specialty department reachable Monday-Friday from 7 am 7 pm EST. Their number is 800-829-4933. Keep in mind, you will need to answer a few authorization questions for security purposes before you get your TIN. Additionally, the government website has a plethora of helpful content if you still have tax ID lookup questions.

Also Check: Is Freetaxusa Legit

Still Cant Find Your Ein Number Dont Give Up

If you still cant find your EIN, dont lose hope. It might be listed in documents buried deep in your filing cabinet or other space you use for storing documents. Take the time to sort through all paperwork related to your business and your EIN might turn up sooner than you think.

If your business has applied for anything, find any copies of those applications and take a close look. A business bank account statement or even your businesss online account profile might have your EIN number.

How Can I Get A Tin

You can get a tax identification number by applying directly to the correct agency. For instance, you can get a Social Security number through the Social Security Administration. If you need an Individual Taxpayer Identification number or one for a business, you may be able to obtain one directly from the Internal Revenue Service.

You May Like: Does Doordash Take Taxes

Other Ways To Apply For An Ein Number

If you dont have online access to the IRS website, you can apply for an EIN in several other ways. One way is to apply by fax, where you fill out the form and send it via fax. The return information, including the newly issued EIN, will be sent via fax within four business days.

To apply via mail, youll wait for about four weeks to get your EIN number. Simply mail the SS-4 form to your IRS office, and you should get your new EIN via mail. International applicants can apply via phone to get their EIN.

Frequently Asked Questions: Ein Number Lookup

Do I need an EIN if Im self-employed?

You dont need an EIN if youre self-employed you can simply use your Social Security number. Some people who are self-employed choose to apply for an EIN instead of using their Social Security number to reduce the risk of identity theft its less likely for someone to break into your accounts when you keep business finances and personal finances separate.

I have a sole proprietorship with a DBA . Do I Need an EIN?

Having a DBA doesnt impact whether or not you are required to have an EIN for your sole proprietorship. The same rules apply to a sole proprietorship with a DBA as apply to a sole proprietorship without a DBA.

Per the IRS, A sole proprietor without employees and who doesnt file any excise or pension plan tax returns doesnt need an EIN. Once you hire employees or file excise or pension plan tax returns, you will immediately require an EIN.

Is there a difference between an EIN and a TIN?

No, there isn’t a difference between an Employer Identification Number and a Taxpayer Identification Number . Both refer to the nine-digit number issued by the IRS to identify your business.

Is there a difference between an EIN and a FEIN?

No, there is not a difference between an EIN and a Federal Employer Identification Number . A FEIN can also be referred to as a Federal Tax Identification Number.

Don’t Miss: Doordash Pay Taxes

Understanding The Tax Identification Number

A tax identification number is a unique set of numbers that identifies individuals, corporations, and other entities such as nonprofit organizations . Each person or entity must apply for a TIN. Once approved, the assigning agency assigns the applicant a special number.

The TIN, which is also called a taxpayer identification number, is mandatory for anyone filing annual tax returns with the IRS, which the agency uses to track taxpayers. Filers must include the number of tax-related documents and when claiming benefits or services from the government.

TINs are also required for other purposes:

- For credit: Banks and other lenders require Social Security numbers on applications for credit. This information is then relayed to the to ensure the right person is filling out the application. The also use TINsnotably SSNsto report and track an individual’s .

- For employment: Employers require an SSN from anyone applying for employment. This is to ensure that the individual is authorized to work in the United States. Employers verify the numbers with the issuing agency.

- For state agencies: Businesses also require state identification numbers for tax purposes in order to file with their state tax agencies. State taxing authorities issue the I.D. number directly to the filer.

How Do You Get A Tax Id Number

To obtain a Tax ID Number, you must complete Form W9C , which includes information about your business activities and financial affairs. If you are not required to have one, you may use this form to request a Tax ID Number.

If you are requesting a Tax ID Number because you are self-employed, you will be asked to provide additional information about your business activities. For example, if you own a consulting firm, you would answer questions about how much you earn from your business, what type of services you offer, and whether you pay wages to employees.

If you are requesting a Tax ID Number for your sole proprietorship, partnership, limited liability company, corporation, or any other entity, you will be asked whether you are a U.S. citizen or permanent resident alien. In addition, you will be asked about your citizenship status, country of residence, and foreign address.

Once all the information has been entered into the appropriate fields, click Submit Application. This completes the process. You will then receive a letter confirming your application.

The IRS issues Tax IDs within 30 days after receiving your completed application.

You May Like: Is Donating Plasma Taxable

Purpose Of The Tin And Ein

TIN’s and EIN’s establish your business’s identity, much as your Social Security number establishes yours. The IRS needs your TIN or EIN when you file your business’s taxes or, in the case of LLCs, LLPs and partnerships whose tax liabilities are passed on to their owners, when you file the business’s annual reports outlining financial performance.

What Is A Tin

Before we launch into what a tax ID lookup is, its important that we get some of the terms down first.

TIN stands for Taxpayer Identification Number. This is a nine-digit number issued by the Internal Revenue Service or Social Security Administration . It identifies an individual or business for tax purposes.

In actuality, TIN is an umbrella term. The acronym encompasses a variety of different tax identification numbers that fall under it.

Also Check: Form Acd-31015

Why You Need To Know Your Business Tax Id Number Or Ein

Any legal US business needs to have an EIN number. While the main reason a business needs an EIN is for filing taxes, there are several other important reasons why you need to know your business EIN or tax number:

- To file a tax return

- To check your business credit score

- To open a business bank account

- To apply for a business credit card

- To apply for a business loan

- To issues an IRS Form-1099 to an independent contractor

How Do I Get A Florida State Tax Id Number

In addition to a federal tax ID number, your Florida business may also need a Florida state tax ID number. This is also a unique identifying number for your business, but it has a different format, and is issued by the state government, rather than the federal government.

Youll need a state tax ID number if youre going to hire employees in the state of Florida, if youre selling taxable goods and services in the state, or if youre going to owe excise taxes on goods like alcohol or tobacco.

To get your Florida state tax ID number, your first step is to acquire a federal tax ID number. Once you have that, you can apply for your Florida state tax ID through one of several different methods, which should be familiar to you. Its possible to apply for your Florida state tax ID number via phone, mail, or fax, but its faster and more convenient to apply for it online. Be advised that it may take 4 to 6 weeks to receive your Florida state tax ID number, even if you apply online.

Read Also: Doordash How Much To Save For Taxes

Who Can Access My Account Information

- The owner listed on your account from your initial registration application and any additions that have occurred since then can access your account information.

- Persons / companies who the owner have completed a Missouri Power of Attorney Form 2827 for can access the information/years that are specified on the Power of Attorney.

- Checking the authorization box on a return will allow that person to discuss that particular return only with the Department.

- Confidentiality – Missouri Statute 32.057, RSMo ensures that your tax records are protected and confidential – the Department will not release tax information to anyone who is not listed on the Department’s records as owner, partner, member, or officer for your business. If the owner of your business changes, you must notify the Department to update your account information.