How Much Is The Child Care Tax Credit

As mentioned, the Child Care Tax Credit is up to $8,000 for a single dependent and $16,000 for two or more. These numbers are the maximum amount you can claim. Otherwise, the amount you can claim is a percentage of qualifying expenses, starting with up to 50 percent if your AGI is less than $125,000, 20 percent if its below $400,000 and above $185,000, and nothing at all if your AGI is above $400,000.

These numbers are a sampling of the percentages to see the full range you need to peruse the table provided by the IRS. In short, the exact amount of the Child Care Tax Credit depends on your income and your qualified expenses. Keep in mind that the CDCTC is just one of many ways to pay less taxes.

What’s Your Relationship With The Family You Babysit For

Do you have a written contract? A contract stating that you’re an independent contractor or an employee can be a good place to start. Although the overall facts of the situation are more important than what the contract says.

How permanent is the relationship? A babysitter who babysits regularly and indefinitely has more of an employer relationship. While one that works on a job by job or as-needed basis is evidence of an independent contractor relationship.

Do you get any benefits? Employers provide benefits like a pension plan, vacation pay, sick pay, or insurance. In most cases an independent contractor doesn’t get any benefits, just the money they earn from doing the job.

Child Care Expense Deduction Limits

While this tax credit is designed to help you recoup some of what you have paid in toward daycare or babysitting services throughout the year, there is a limit to how much you can claim on your tax return. In fact, it is easy to assume that you can write off your child care deductions for the entire year. However, that is not the case, and the IRS has set limits to how much you can actually claim for the child care tax credit. If your income at least $15,000 for the year, you can deduct 35 percent of your child care or babysitting expenses from your taxes. However, if your income is $43,000 or above for the year, you can only deduct 20 percent of your child care costs when you file your income tax return. The IRS also limits the number of children for which you can claim child care expenses. You are entitled to use the tax credit for no more than two of your children. Even if you have more than two children in daycare or at a babysitter’s while you work, you can only use the expenses that you pay for two when using this particular tax credit. When child care expenses have taken a toll on your family’s budget, you might want to get some of that money back whenever possible. The IRS allows you to recoup some of what you paid for child care and babysitting services on your tax return. You can claim the child and dependent care tax credit for up to two of your children for whom you pay child care costs throughout the year.

Recommended Reading: Is Freetaxusa A Legitimate Company

What Expenses Aren’t Covered

As with the difference between overnight and day camps, not every type of expense is considered valid by the IRS.

- If you send your child to private school, the tax agency notes that you can’t claim that as an expense under the Child and Dependent Care Credit since K-12 tuition is considered an educational expense, not a child care expense.

- Care won’t qualify if it’s provided by relatives who are dependents or spouses. Basically, the IRS is saying that you can’t pay your older teenage child to take care of a younger child, then get a tax credit for that. As for paying your husband or wife to take care of their own child, forget it.

One issue worth noting: If you paid for any child care through a Flexible Spending Account which allows people to set aside pre-tax income to pay for preschool and other kid-related costs you won’t be able to use those expenses to claim this credit. That’s because doing so would allow taxpayers to claim two tax benefits with the money.

Can I Claim My Newborn Baby As A Dependant On My Taxes

Yes, absolutely. Even if they’re born at 11:59 on December 31st of the tax year. There’s a rumor or misconception that your baby has to be six months old before you can claim them on your taxes, but that simply isn’t true.

That probably comes from the idea that a child normally has to live with you for at least six months for their childcare expenses to qualify. But the IRS makes an exception for children born during that tax year, and they are treated as having lived with you for the entire year.

Of course, you can’t claim your baby if you put it up for adoption or foster care. You also can’t claim your unborn baby on your tax return.

Also Check: How Does Doordash Affect Taxes

Do Your Earnings Limit How Much Can You Claim

Notably, the total amount of your child care credit cannot exceed your earned income for the year, or that of your spouse.

Going back to the prior example, let’s say you and your husband pay a nanny $10,000 to care for your two children. You earn $200,000 that year, but your husband, who is writing a novel, earns only $900. Even though you would otherwise be entitled to write off $1,200 , because your husband earned only $900, you could only claim a child care credit of $900.

However, there are two exceptions to this rule:

- The first exception applies if you or your spouse was disabled for all or part of the yearthat is, not physically or mentally capable of self care.

- The other exception is if you or your spouse was a full-time student for at least part of five months during the year .

If either exception applies, you may treat the nonearning spouse as earning $250 in earned income per month that he or she was disabled or a full-time student during the year . Thus, if one of these exceptions applies, the nonearning spouse could be deemed to have up to $3,000 in earned income, or $6,000 if you have more than one child.

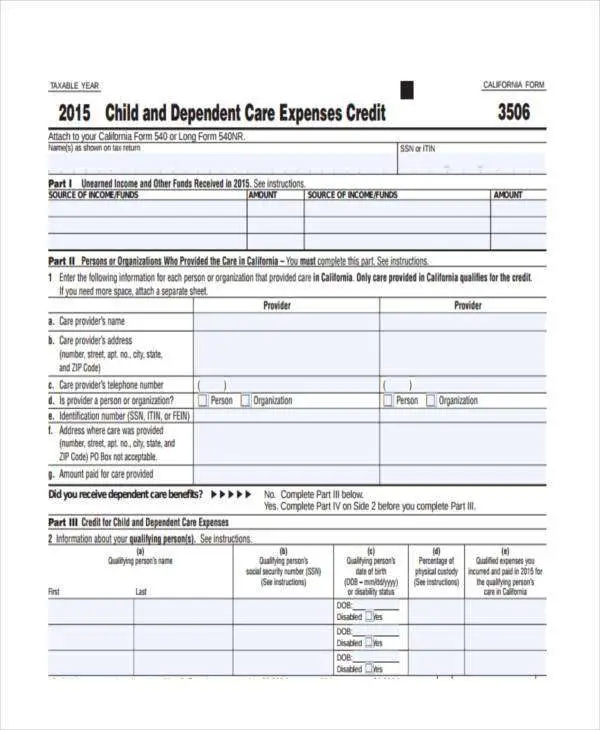

T: Child Care Expenses Deduction

You can use form T778: Child care expenses deduction toclaim child care expenses you paid for your child in 2021.

You can claim child care expenses if you or your spouseor common-law partner paid someone to look after an eligible child sothat you can:

- Earn income from employment

- Attend school or

- Carry on research or similar work, for which you received a grant

For your expenses to qualify, you or your spouse must have paid forchild care while the child lived with you. As a rule,only the payments for services provided in Canada by a Canadian resident canbe deducted on your return.

If youre married or in a common-law relationship, the person with the lower net income mustbe the one to claim the child care expenses. However, there are certain situationsthat allow the person with the higher net income to claim theseexpenses. Refer to Part C or D of form T778 tosee if any of these scenarios apply to you.

Remember: You’ll need your receipts to claim your child careexpenses! Every receipt needs to be made out to the person who paid for the childcare expenses. If the child care services were provided by an individual, thereceipt should also show the caregiver’s SIN . You don’thave to submit your receipts if you’re filing electronically, but you do needto keep them in case the Canada Revenue Agency asks to see them.

You can claim the cost of the following child care services:

If the child care is provided by an individual, he or she cant be:

The maximum amount you can claim is:

Don’t Miss: How Does Doordash Work For Taxes

Do I Give My Cleaning Lady A 1099

If you pay a housekeeping service or you pay a person who advertised as a housekeeper but who also does a lot of other clients, then you are hiring a small business person. You dont issue them any tax forms such as a 1099-MISC unless you are a small business yourself and your business has hired this person.

Qualifying Child And Expenses

If your child is under age 13, or is over age 13 and is a disabled dependent whom you claim on your tax return, you may qualify for the child care tax credit. You can include amounts you pay your mom to babysit so you can work or go to school, but you must have some earned income during the year for qualified expenses to count for the credit.

You May Like: Do You Have To File Taxes With Doordash

Use It Or Lose It Or Not

Under the regular tax rules, money left over in a dependent care account at the end of the year is lost. Thus, when determining your annual contribution to a dependent care account, it usually pays to be conservative.

However, there are special rules for 2020 and 2021. Your employer may allow the entire unused balance in a dependent care account at the end of 2020 can be carried forward into 2021, and any balance at the end of 2021 can be carried forward into 2022.

Care Of A Qualifying Individual

The care may be provided in the household or outside the household however, don’t include any amounts that aren’t primarily for the well-being of the individual. You should divide the expenses between amounts that are primarily for the care of the individual and amounts that aren’t primarily for the care of the individual. You must reduce the expenses primarily for the care of the individual by the amount of any dependent care benefits provided by your employer that you exclude from gross income. In general, for 2021, you can exclude up to $10,500 for dependent care benefits received from your employer. Additionally, in general, the expenses claimed may not exceed the smaller of your earned income or your spouse’s earned income. If you or your spouse is a full-time student or incapable of self-care, then you or your spouse is treated as having earned income for each month that you or your spouse is a full-time student or incapable of self-care. Your or your spouses earned income for each month is $250 if there is one qualifying person . See the topic Earned Income Limit in Publication 503 PDF for further information.

Don’t Miss: How Do You File Taxes With Doordash

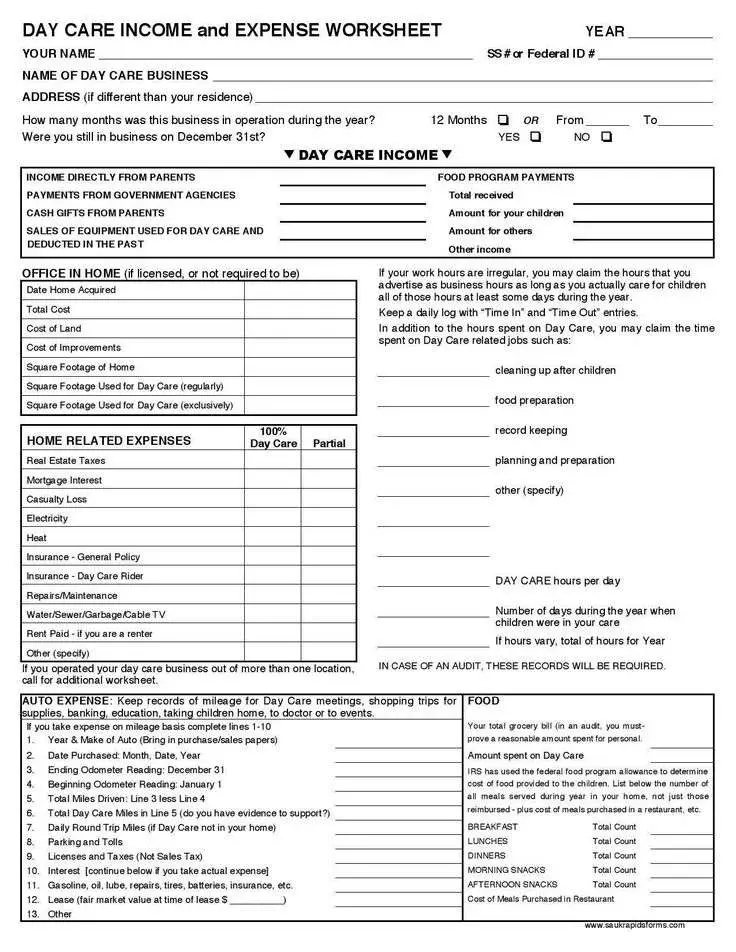

Here Are Some Expenses That You Could Argue You Incur In The Line Of Doing Business

Communication costs. Do you need to have a phone to keep in contact with the family you babysit for? Calling and texting are pretty necessary to arrange babysitting jobs. You might consider internet or other wireless services too if you communicate a lot by email about work.

Keep in mind that if you use a phone for personal use as well, then you can only deduct the portion that you use for business purposes as an expense. If you spend a hundred minutes on the phone each month but only 5 minutes of those are regarding babysitting, then you could only deduct 5% of your phone bill as an expense. That same logic applies to every other item on this list.

Office supplies. Do you make flyers to hang up on bulletin boards at your church or local rec center to advertise your babysitting jobs? Does your babysitting client expect you to give them a receipt or invoice? The paper, printer, ink and other supplies you use may be considered business expenses.

Licenses and certifications. If any certifications are required for your profession, you can deduct it. In some places, this only applies to mandatory certifications. In other places, a babysitter could deduct things like the cost of CPR or first aid training. If you pay a fee to be part of any kind of professional babysitting association or service, that qualifies too.

Insurance. If you have any kind of babysitting insurance to protect you from liability, it’s a business expense.

Can You Write Off Babysitting Expenses

Matthew Taylor 9 February 2019

Parents can deduct qualifying childcare expenses for a tax credit on their annual tax returns. But what about babysitters who incur expenses in the course of doing business?

Can you write off babysitting expenses as a babysitter? If you’re operating as an independent contractor, you can deduct expenses you incur while babysitting. If you’re treated by your babysitting family as an employee, however, you won’t be able to use any expenses on your tax return.

In this article, we’ll go over what kind of expenses a babysitter can claim on their expenses, and how to know if you’re considered an independent contractor or an employee as a babysitter.

You May Like: Reverse Ein Search

Does The Childcare Tax Credit Apply To Anything Else

Yes, surprisingly it applies to a lot more things than you would think. Along with babysitting and daycare, qualifying expenses include the cost of a maid, housekeeper, cleaning person, or cook who provides care for your child. Before and after school child care also qualify, as well as expenses related to a home care provider or nurse.

What Is The Child And Dependent Care Tax Credit

The child and dependent care tax credit was designed by the IRS for parents who work and must pay for child or dependent care like a babysitter or daycare. This tax credit pertains specifically to young children or disabled dependents. In order to claim it on your tax return, you must ensure that your children or disabled dependents meet the specific age requirements outlined by the IRS. The IRS allows taxpayers to claim the credit for up to two children. You could get a tax credit of up to $3000 for one child and up to $6000 for two children. The credit will then be applied to any tax debt you owe to the IRS. If there is money left over after it is applied to your outstanding balance, it will be refunded to you. Because of the amount of money you could potentially receive from this credit, the IRS requires taxpayers to fulfill the criteria in order to claim it legally on their taxes. Your tax return will be reviewed thoroughly to ensure you are using the tax credit as it is intended.

Read Also: Doordash Write Offs

What Every Parent Needs To Know About Deducting Child

Jamie Golombek: Here are the rules surrounding the deduction, its limits, and a recent interpretation that could prevent you from claiming a deduction

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Do I Have To Be A Contractor To Deduct Babysitting Expenses

In most cases, yes.

Usually, you’re considered an employee if the family you babysit for has direct control over what work you perform and how you do it. In that case, your employer can deduct taxes from your pay and you won’t be entitled to any deductions.

A full-time babysitter who works a regular schedule is more likely to be considered an employee. Contrast that with a part-time babysitter who is essentially a freelancer, working for multiple clients and taking on different jobs or rejecting certain hours as they see fit.

You’re able to take deductions for expenses regardless of whether the babysitting requires you to travel to client’s homes, or if you do the babysitting within your own home.

To claim your babysitting expenses, you’ll need to fill out Schedule C of your tax form and attach it to your Form 1040 for a regular personal income tax return.

As a babysitter, you might get a form 1099-MISC from the families you babysit for if your pay for the year exceeded $600. It just breaks down how much income you earned during the year. You still need to report your babysitting income on your tax return though, even if you don’t get a 1099 form from every family you worked for.

You May Like: Doordash 1099 Form

How Much You Can Receive

Families can receive up to:

- $6,000 per child under the age of seven

- $3,750 per child between the ages of seven and 16

- $8,250 per child with a severe disability

The Ontario Child Care Tax Credit is calculated as a percentage of your Child Care Expense Deduction. The Child Care Expense Deduction provides provincial and federal income tax relief toward eligible child care expenses.

The topup is calculated as an additional 20 per cent to the credit entitlement.

Babysitting Income Where Do I Enter It

If the amount is less than $3500 you can enter it as casual income . Click “Income” then “Other Income Sources” then “Income not reported on a t-slip“

If the amount is over $3500 you should complete the business portion of the return. Your business name is just your own name, and your business address is your own address. As you don’t have a business number you do not need to include one. However you will also be able to deduct expenses against the income in order to reduce the tax liability.

Don’t Miss: How Much Taxes Do You Pay For Doordash

What Child Care Expenses Can You Claim

- You can claim child care costs paid to day nursery schools and daycare centers, caregivers such as nannies, overnight boarding schools and camps that provide lodging, day camps and day sports schools.

- To be eligible, the primary purpose of the day camp or day sports school must be to provide child care.

- In Canada, if you pay an individual person such as a nanny or babysitter, you must provide their social insurance number. Note that the CRA requires proof of expenses in the form of receipts and that you may be selected for a review or audited.

Parents should take precautions when choosing a daycare or child care provider. One of these is to make sure ahead of time that proper receipts will be issued. Child care providers are required to issue receipts showing either their business number or social insurance number. Ask for a receipt each month, advises Robert Stone, a personal tax professional and founder of Mr. Taxes.ca.It is better to ask ahead of time than to try to get receipts at the end of the year.