Norway Salary Calculator 2022/23

Calculate your take home pay in Norway , with the Norway Salary Calculator. A quick and efficient way to compare salaries in Norway, review income tax deductions for income in Norway and estimate your tax returns for your Salary in Norway. The Norway Tax Calculator is a diverse tool and we may refer to it as the Norway wage calculator, salary calculator or Norway salary after tax calculator, it is however the same calculator, there are simply so many features and uses of the tool that we refer to the calculator functionally rather than by a specific name, we mention this here to avoid any confusion.

Why Is It Important To Have Accurate Paychecks

Having accurate paychecks isnt just important for employees. Its an essential part of operating your business legally. Fail to pay employees fairly under federal, state, or local laws, and you may find yourself facing thousands of dollars in fines. Underpaying employee overtime is one of the most common labor law violations businesses commit. If you live in California, New York, or Texas, where local laws go beyond federal requirements, youll want to be especially diligent.

Caution For Employers Using Software Programs In

For Canada Pension Plan purposes, contributions are not calculated from the first dollar of pensionable earnings. Instead, they are calculated using the amount of pensionable earnings minus a basic exemption amount that is based on the period of employment.

As of 2019, the Canada Pension Plan is being enhanced over a 7 year phase-in. For more information, go to Canada Pension Plan Enhancement.

If used improperly, some payroll software programs, in-house payroll programs, and bookkeeping methods can calculate unwarranted or incorrect refunds of CPP contributions for both employees and employers. The improper calculations treat all employment as if it were full-year employment, which incorrectly reduces both the employee’s and employer’s contributions.

For example, when a part-year employee does not qualify for the full annual exemption, a program may indicate that the employer should report a CPP overdeduction in box 22 Income tax deducted of the T4 slip. This may result in an unwarranted refund of tax to the employee when the employee files his or her income tax and benefit return.

When employees receive refunds for CPP overdeductions, their pensionable service is adversely affected. This could affect their CPP income when they retire. In addition, employers who report such overdeductions receive a credit they are not entitled to because the employee worked for them for less than 12 months.

Recommended Reading: How To Appeal Cook County Property Taxes

Take Home Pay Calculator To Find Your Pay Dns Accountants

Use DNS Take Home Pay calculator to calculate your take-home pay per paycheck for both hourly and daily jobs after taking into account the deductions for income tax, insurance contributions, employee loans, etc. Using DNS calculator, you can properly calculate and check your gross salary, take-home salary, taxable income, etc.

Features of the Calculator: You can experience multiple features of taking Home Pay Calculator introduced by DNS:

- For the individuals employed under Pay-As-You-Earn , Take Home Pay Calculator plays a very significant role for the UK employees to easily and properly calculate the tax and insurance contribution due amount on the salary. DNS Calculator is specially designed to stay you away from a monotonous and time-consuming way of calculating your take-home salary.

- Calculating your monthly and yearly take home is just a click away. Using Take Home Pay Calculator you can check your take-home salary from anywhere in the UK, you just need an internet connection and youre done! Using your computer, laptop, mobile, tablet you can do the calculation from your home or anywhere in the UK.

- Take Home Pay Calculator introduced by DNS in the UK is a combination of industry-leading technology and award-winning 24×7 customer support. So you can ensure about getting 100% quality!

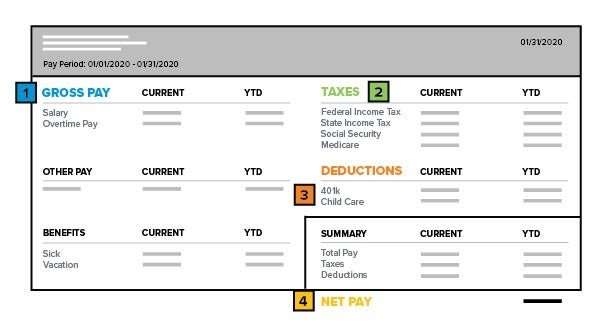

What Is Gross Pay

Gross pay is an employees income before taking out deductions. Unless you gross-up an employees wages, gross pay is usually the sticker price you offer.

You can find weekly gross pay for salaried employees by dividing their yearly salary by 52 weeks. For hourly workers, multiply the employees hourly pay by the number of hours worked.

You May Like: Do I Have To Pay Taxes On Doordash

How Do I Work Out My Tax

You can work out your tax by following these four stages:

1. Work out whether your income is taxable or notSome income is taxable and some is tax free. You start by adding up all amounts of income on which you are charged to income tax for the tax year.You can then take certain deductions from this figure, such as trade losses.

2. Work out the allowances you can deduct from your taxable income There are several different tax allowances to which you might be entitled. However, at this stage of the tax calculation there are only two which are relevant: the personal allowance and the blind persons allowance.Every man, woman and child resident in the UK has a personal allowance. For most people, the personal allowance for the tax year starting on 6 April 2021 and finishing on 5 April 2022 is £12,570.Despite its name, you do not have to be completely without sight to claim the blind persons allowance. So if you have very poor eyesight, check if you are entitled.You can find out more information on these allowances on What tax allowances am I entitled to?. Note, however, that some so-called allowances are in fact nil rates of tax that are applied at step 3 below, and some are given as a tax credit or tax reduction at step 4 below.

Similarly, if you live in Wales and are a Welsh taxpayer, there are Welsh rates of income tax set by the Welsh Assembly that apply to your non-savings and non-dividend income. The UK rates apply to your savings and dividend income.

Taxability Of Salary Income

| Taxability | |

| Rent free unfurnished accommodation provided to Central and State Government employees | License fees determined in accordance with rules framed by the Government for allotment of houses shall be deemed to be the taxable value of perquisites. |

| Rent free furnished accommodation | Taxable value of perquisites shall be computed in the following manner:a) Taxable value of perquisite assuming accommodation to be provided to the employee is unfurnishedb) Add 10% of the original cost of furniture and fixtures or actual higher charges paid or payable .c) Less: The value so determined shall be reduced by the amount of rent, if any, recovered from the employee |

| Unfurnished rent free accommodation provided to other employees | Taxable value of perquisitesIf house property is owned by the employer, the taxable value of perquisite shall be:15% of salary, if the population of the city where accommodation is provided exceeds 25 lakhs10% of salary, if the population of the city where accommodation is provided exceeds 10 lakhs but does not exceed 25 lakhs7.5% of salary, if accommodation is provided in any other cityIf house property is taken on lease or rent by the employer, the taxable value of perquisite shall be Lease rent paid or payable by the employer or 15% of the salary, whichever is lower |

You May Like: How Much Taxes Does Doordash Take Out

Cost Of Living In Madrid

The median pre-tax pay in Madrid is 2,791 EUR per month. According to the results of our survey, a single person on this salary and with no dependants could afford to:

- rent a one bedroom apartment

- have a standard lifestyle, affording to go out a few times per week

For more information, including details on how Madrid compares to Barcelona, check out our dedicated Cost of Living page.

Effect On The Significance Of Cash Isas

With the introduction of the Personal Savings Allowance, its no longer the case where a Cash ISA in general beats non-ISA savings accounts for the reason that the difference in net interest is caused by the subtraction of income tax. With the threshold being set at £1,000 for basic rate tax-payers, individuals will need more than £85,000 in savings in a best-buy 2.42% AER savings account before having to look for income tax protection. Being said that, there are still reasons to consider using the annual ISA allowance as this allowance is a permanent tax cover that adds up each year. In other words, if an individual starts to earn interest above the Personal Savings Allowance , under the present guidelines an individual will not be able to transfer that whole amount into an ISA in one go. The PSA is only relevant to taxable savings which means that individuals can keep on subscribing to an ISA while also earning the PSA equivalent of interest in a non-ISA savings account.

You May Like: How Does Taxes Work With Doordash

How Do I Create A Paycheck For An Employee

Employers typically have two basic options for creating paychecks:

Input Any Additional Pay The Employee Receives

If the employee is salaried, you will only see two fields: bonus and commission. Fill in those amounts, if applicable.

If the employee is hourly, you should see four fields: overtime worked, bonus, commission, and salary. This is your opportunity to add in any additional pay they should receive this pay period. If the employee earned overtime, input in the number of overtime hours they worked. One thing to keep in mind for California employees is that this calculator does not account for double-time pay. The tool calculates overtime pay using time and a half.

You May Like: Do You Have To Do Taxes For Doordash

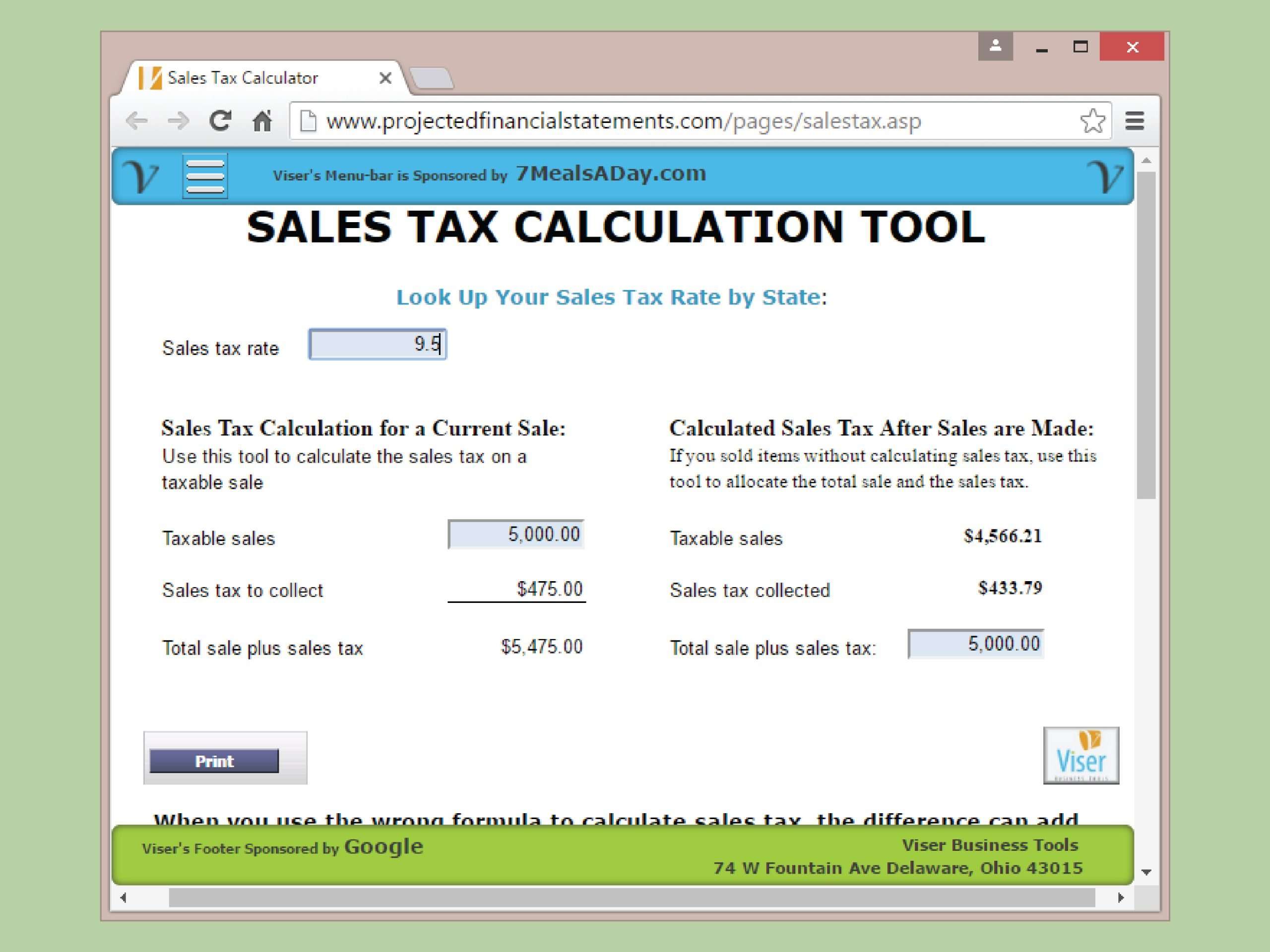

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

Faqs Related To Salary Calculator

1. What do I need to know to use the salary calculator?

You should only know your gross salary and total bonus. Once you provide the data, the calculator will show the other relevant salary components in no time.

2. How does the calculator determine the basic pay?

It calculates the basic salary as a percentage of the CTC. You may change the percentage based on your requirements.

3. Can I find the TDS on the salary calculator?

You cannot find the TDS on the salary calculator separately. You can easily find the TDS amount on your salary slip.

4. Does the salary calculator show the deductions?

Yes, the calculator shows the professional tax and provident fund deductions. It also reflects the total deductions.

The in-hand salary calculator is a free tool that you can use anytime. Its powerful mechanism offers you the required data in a jiffy and without any errors. When using the calculator, be careful about providing the correct amounts required to get accurate results.

In this article

Jupiter deploys high level security standards to keep your money safe

SECURITY PARTNERS

BANKING PARTNERS

Don’t Miss: Doing Taxes For Doordash

Gross Salary Vs Net Salary

Your gross salary will usually appear as the highest number you see on your salary statement. It’s a reflection of the amount your employer pays you based on your agreed-upon salary. On the other hand, your net salary is what you take home after all contributions and taxes are deducted from your gross salary. It’s equivalent to gross pay minus all mandatory deductions. For instance, if you normally earn £1,200 while £350 is taken as deductions, then your gross pay will be £1,200, and the net pay will be £850. The gap between your gross pay and net pay is the deductions.

In most cases, net pay will appear in a larger font or bolded to make it easier to distinguish it.

Common Allowances On Your Payslip

A personal allowance is an income you can receive that is tax-free. Your employer may apply this to your pay cheque before calculating how much income tax to deduct from your gross salary. Most UK-based employees under the age of 65 are entitled to personal allowances. Here are some forms of allowances:

-

Tax-free personal allowance: In the 2019/2020 financial year, the tax-free personal allowance given was up to £12,500. This figure, however, is subject to limits based on your income level. If you earn more than £100,000 per year, then your allowance is reduced by £1 for every £2 earned above the £100,000 mark.

Read Also: Deductions For Doordash

Calculating Income Tax Rate

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called marginal tax rates,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are referred to as brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2021 tax year, which are the taxes due in early 2022.

Gross Pay Vs Net Pay: Definitions And Examples

What you earn from a job can determine the taxes you pay and represent your career growth thus far. It’s important to understand the difference between your gross pay and your net pay to help you manage your personal finances and create new goals for career advancement and earnings increases. In this article, we explore what gross salary is, what deductions are taken from it and how to properly calculate your earnings.

Read Also: Door Dash 1099

How To Use The Maternity And Sick Pay Calculator

Enter your annual salary in the field above, and select how frequently you get paid, and how many days per week you work.

If you have some leave paid at a fraction of your normal pay, you can enter the number of days and the rate at which you get paid . You can do this for 2 different rates of pay in a pay period.

If you are entitled to Statutory Sick Pay, and your employer’s policy means you will receive it, enter the number of such days in the Statutory field. More information about Statutory Sick Pay is available from Citizens Advice.

Similarly, if you are entitled to Statutory Maternity / Paternity Pay, enter the number of such days in the Parental Leave field. Note that, currently, statutory pay for the first six weeks of maternity leave is 90% of your average weekly earnings – for this period, use the 90% pay field rather than Parental Leave. More information about Statutory Maternity Pay is available from Gov.UK.

If you will have some unpaid leave, enter the number of days in the unpaid leave field.

Enter the rest of your details into the advanced options if necessary, and press the “Calculate!” button.

Important! These results are based on the information that you enter, and it is not guaranteed that your employer’s leave policy matches what you have entered. Not all employers calculate the effect of reduced pay the same way, so the calculator’s results may not match exactly.

What Is Gross Salary

Gross salary refers to the full payment an employee receives before tax deductions and mandatory contributions are removed. This amount is equal to your base salary plus all benefits and allowances, such as special allowances, overtime pay, medical insurance, travel allowance and housing allowance.

Related:

You May Like: License To Do Taxes

What Should You Do With Your Paycheck Stub

Pay stubs are used to verify payment accuracy and may be necessary when settling wage/hour disputes. For this reason, employees may want to save their pay stubs, but arent required to do so. Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments.

Is A Pay Stub The Same As A Paycheck

Although paychecks and pay stubs are generally provided together, they are not one in the same. A paycheck is a directive to a financial institution that approves the transfer of funds from the employer to the employee. A pay stub, on the other hand, has no monetary value and is simply an explanatory document.

Also Check: Do You Have To Claim Plasma Donation On Taxes

Federal Income Tax Withholding

Employers withhold federal income tax from their workers pay based on current tax rates and Form W-4, Employee Withholding Certificates. When completing this form, employees typically need to provide their filing status and note if they are claiming any dependents, work multiple jobs or have a spouse who also works , or have any other necessary adjustments.

How To Use The Pro

To use the pro-rata salary calculator, enter the full-time annual salary in the “Full-time Salary” box and the number of weekly hours that are considered “full-time” into the “Full-time weekly hours” box. If you are working out the new salary by number of hours worked, enter the pro-rata number of weekly hours into the “Pro-rata weekly hours” box. If you want to see a percentage of your current salary, enter that percentage into the “% of full-time salary” box.

Find out the benefit of that overtime! Enter the number of hours, and the rate at which you will get paid. For example, for 5 hours a month at time and a half, enter 5 @ 1.5. There are two options in case you have two different overtime rates. To keep the calculations simple, overtime rates are based on a normal week of 37.5 hours.

New! If your main residence is in Scotland, tick the “Resident in Scotland” box. This will apply the Scottish rates of income tax.

If you know your tax code, enter it into the tax code box for a more accurate take-home pay calculation. If you are unsure of your tax code just leave it blank and the default code will be applied.

If you have a pension which is deducted automatically, enter the percentage rate at which this is deducted and choose the type of pension into which you are contributing. Pension contributions are estimates, click to learn more about pension contributions on The Salary calculator.

You May Like: Do Taxes Get Taken Out Of Doordash