Donotpaythe Easy Way To Save Money

If it looks like your wallet has a hole and the money keeps pouring out for unnecessary expenses, it might be time to come up with a better saving strategy.

DoNotPay uses AI-powered technology to identify the best opportunities for some serious penny-pinching or earning a few extra bucks:

| Saving Money |

Donotpay Can Help You Apply For A Property Tax Exemption In Bexar County

Applying for a property tax exemption in Bexar County is not easy, but DoNotPay can help you overcome all the hurdles.

Our app can check your location and give you customized advice on what exemptions are available in your area. The guide comes with two sections:

| Property Tax Exemptions | |

|

|

What If My Mortgage Company Is Supposed To Pay My Taxes

HB 923 of the 80th regular session of the Texas Legislature stipulates that if an Assessor mails a bill to the authorized agent, i.e., mortgage company, it is not necessary to mail a bill to the owner of record. As a courtesy, tax statements will be mailed to the mortgage company and owner of record.You may forward your tax statement to your mortgage company if your taxes are paid from an escrow account.

Recommended Reading: Tsc-ind Ct

How To Apply For Texas Property Tax Exemptions For Seniors With Donotpay

Getting a property tax exemption is always helpful, even if you live in one of the states with low property taxes. DoNotPay will help you pay property taxes in Texas, Florida, Illinois, or any other American state.

To reduce your property tax bill, log in to your DoNotPay account and follow these steps:

DoNotPay will determine which exemption you can apply for and will generate a personalized guide on how to do it based on the answers you give us. Check out some of the states and counties DoNotPay can help you with:

Veteran Property Tax Exemption

Members of the Armed Forces and veterans are often able to exempt themselves from various taxes, including property tax. The details vary widely by what state youre in, but its any potential veterans exemption is definitely worth checking on. Depending on your situation, you may be able to exempt a certain amount of property value or even get a complete waiver from property taxes. There may also be tax benefits available for qualifying unremarried surviving spouses. In either case, that could potentially save you thousands.

Also Check: Paying Taxes On Doordash

Can I Ask For A Payment Plan To Pay My Property Taxes

You may be able to ask for a payment plan to pay your property taxes. When a person with a homestead exemption is delinquent in the payment of taxes, the tax collector is required to enter into a repayment installment plan of 12 to 36 months if the homeowner requests a plan, as long as the homeowner has not entered into a plan in the prior 24 months. Interest accrues at 12 percent a year. Persons with an over-65, disability, or disabled veterans exemption can spread out their tax payments over a year in four installments without penalty or interest. To use the installment payment plan option, you must include a notice about this with your first payment. The payments are due before February 1, April 1, June 1, and August 1.

More Of What We Can Do For You

Our multifaceted app can call and record the conversation with the customer service of the company that just won’t let you go! If you are having trouble canceling an unwanted service via the traditional channels, use DoNotPay to get it over and done with!

We can help you stop the persistent robocalls and robo texts from the nagging company and request a refund for unused services in a matter of minutes.

We’ll also lend a helping hand in stopping spam mailwhether it’s electronic or paper. Our Spam Collector product unsubscribes you from unwanted emails and cleans up your physical mailbox too!

Also Check: How To File Your Taxes

C Tax Exemptions For Veterans

Texas Tax Code 11.22 offers partial exemptions to disabled veterans and their surviving children and spouses. Tax Code 11.132 gives residence homesteads partial exemption applicable to residence homesteads given to disabled veterans via charity. Exemptions are also extended to surviving spouses provided they dont remarry. Tax exemption amount is determined by the service-connected disability percentage.

Do You Need Help With All That Paperwork

Saving money is great, but cutting the time wasted on bureaucracy sometimes sounds even better. DoNotPay joins the best of both worlds and helps you avoid boring paperwork while preventing future unnecessary charges and expenses.

With our help, you can enjoy free trials without any risk, file insurance claims, or handle issues with .

You wont have to waste time on researching the right procedures or pay for help if you need to stop stalkers and harassers or put together all sorts of legal documents.

Recommended Reading: How To File Taxes Doordash

B Tax Exemptions For Disabled Persons And Individuals Aged 65 Years And Above

Disabled persons, as well as elderly persons , can enjoy additional $10,000 residence homestead tax exemptions from school districts as per Texas Tax Code 11.13c. Section 11.13d allows taxing units to offer separate residence homestead tax exemption of $3,000 or more.

Elderly individuals aged 65 or more must be living in their property to qualify for local option exemption. Surviving spouses can enjoy exemption if the older homeowner dies. However, they must be aged 55 or more at the time of their spouses death. They also need to live in the property in question and apply for an exemption.

What Property Qualifies As A Homestead

A homestead is a house or other residential structure that you own, together with up to 20 acres where the structure sits if the land is used for residential purposes. A manufactured home on a rented lot qualifies as long as you own the home. Manufactured homes must meet additional requirements for a “Statement of Ownership and Location,” but if you did not receive the paperwork from the prior owner and cannot locate the seller after making a good faith effort, you can submit the affidavit in Form 114-A.

Recommended Reading: Taxes Grieved

Donotpay Can Do Your Paperwork For You

Feeling like you’re in bureaucratic hell?Our app will draft the paperwork you need and get you out of any hurdle before you know it!

We can compose most of the documents that you require for any administrative purpose in your jurisdiction, most notably:

- Legal forms for the small claims court disputes in your state

- Court scripts so you don’t get lost for words in front of the judge

Whats The Difference Between A Property Tax Exemption Vs Deduction

We touched on this a bit earlier, but before we wrap up, we should take a moment to go over the difference between the property tax exemption and a deduction.

If you have a property tax exemption, you dont have to pay that particular tax. If you have a deduction, that simply lowers the income that you have to pay the tax on.

To take a simple example, the standard deduction on federal taxes for the 2020 tax year is $12,400 for single people and those married and filing separately. That amount is removed from their income for the purposes of the tax return.

Don’t Miss: Protesting Harris County Property Tax

Have You Inherited Your Home

Homeowners who have inherited their home may qualify for a money-saving homestead exemption. A new Texas law enacted in 2019 makes it easier for heir property owners to qualify for a homestead exemption by creating more accessible application requirements. Property owners who are receiving a partial homestead exemption on heirship property can now apply for a 100 percent homestead exemption even when the home has co-owners.

Please click here to see the entire brochure.

For any questions or additional assistance, you are encouraged to call an HCAD representative at the numbers and location listed on the contact page.

Property Taxes In Texas

Property taxes are based on the assessed current market value of real estate and income-producing tangible personal property.

“Income” is the key word when it comes to personal property. Your vehicle might be considered tangible personal property, but it’s not subject to a tax as long as you never use it to earn a living. Driving it back and forth to your place of employment is okay.

For real estate, appraisals are performed by county districts. The appraiser will compare your home to other similar homes that have recently sold in the area, and it will determine the value from there.

The appraised value of your real estate is then multiplied by the local tax rate to determine your tax bill. These rates are set by counties and school districts. They’re based on yearly budgets and how much revenue the districts need to cover their costs.

Local governments regularly hold public hearings to discuss tax increases, and citizens of Texas can petition for a public vote on an increase if it exceeds certain limits.

Owners of agricultural or timberland property can apply for special appraisals based on the value of crops, livestock, and timber produced by the land. This can result in lower appraisals and lower taxes.

Read Also: Doordash Tax Tips

Overview: Texas Property Tax

Texas doesnt have a state property tax. Property taxes are locally assessed and administered. States charge property taxes to pay for roads, schools, emergency response services, and other public services. In fact, Texas property taxes contribute most of the tax funding available to the local government . However, Texas property taxes can become a burden to property owners.

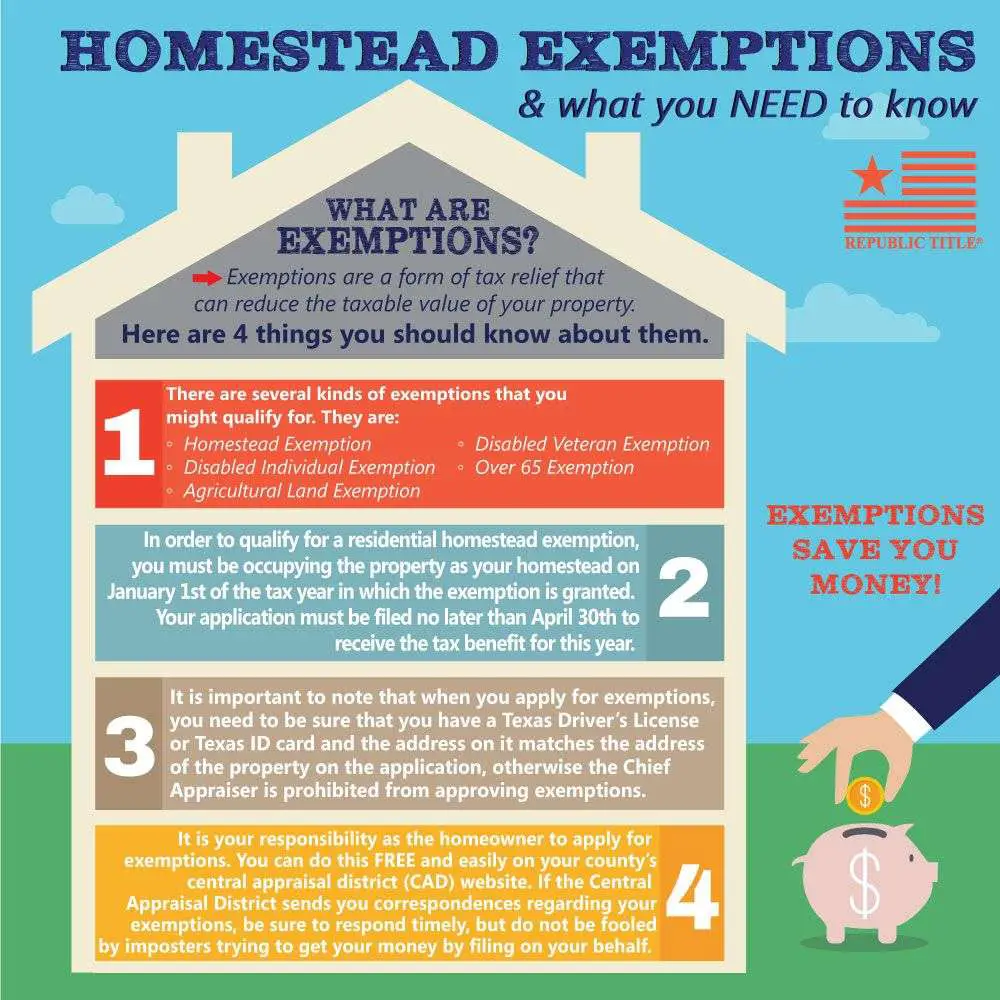

Homestead Exemptions In Texas: How They Work And Who Qualifies

If youre a homeowner or home buyer in Texas, youve probably heard of homestead exemptions. Maybe thats what brought you to our site. Youve come to the right place! Below, you can learn all about Texas homestead exemptions, their basic requirements, and the application process.

What Is a Texas Homestead Exemption?

At its core, a Texas homestead exemption is basically a tax break for qualifying homeowners. Its one of the many perks of buying and owning a home in the Lone Star State. A homestead exemption allows you to write down your property value, so you dont get taxed as much.

As you probably know, residential property taxes are a major revenue source for the state of Texas. They help fund public schools, libraries, streets and roads, and more. They also compensate for the lack of state income tax. Texas is one of several states that do not impose a statewide income tax. As a result, they tend to lean more heavily on homeowners to generate necessary revenues.

And thats where the Texas homestead exemption comes into the picture. The residence homestead exemption, as its officially known, is one of several tax breaks associated with homeownership. The state offers additional exemptions for military veterans, disabled persons, homeowners over 65, etc. But those are the subject of another article.

Click here for general information on homestead exemptions. Find your county here.

How Does the Standard Exemption Work?

So how does that exemption work?

Read Also: Do I File Taxes For Doordash

The Texas Franchise Tax

Texas has no individual income tax as of 2021, but it does levy a franchise tax of 0.375% on some wholesalers and retail businesses. The rate increases to 0.75% for other non-exempt businesses. Also called a “privilege tax,” this type of income tax is based on total business revenues exceeding $1.18 million.

Sole proprietorships and some general partnerships are exempt from the franchise tax.

Franchise tax reports are due annually on May 15 or the next business day when this date falls on a weekend or a holiday. Interest on past-due franchise debts begins accruing 61 days after the due date, and penalties of up to 10% can apply after 30 days.

Applying For Property Tax Exemption In Texas

Property owners seeking property tax exemptions in Texas can apply with appraisal districts. Filling should be done before 1st May. Appraisal district chief appraisers decide if exemptions are given or denied.

Some exemptions may demand filing once, while others may require annual filing. Majority of one-time exemptions allow chief appraisers to ask for new applications verifying eligibility for exemption.

While chief appraisers decide whether applications for tax exemptions are approved or denied, property owners can appeal unfavorable decisions. Consequently, taxing units can challenge tax exemptions given to property owners.

Generally, property is taxable in Texas unless the owner or persons with interest to the property i.e., heirs can meet every legal requirement for an exemption. Property tax exemption forms ask all/most of the information required to grant to deny an exemption. In most cases, exemption is granted or denied based on the propertys use, a propertys qualifications for tax exemption, and the owners eligibility.

Also Check: Does Doordash Tax Tips

What Are The Requirements

There are two kinds of homestead exemptions available to qualifying homeowners: homestead exemption for school taxes and homestead exemption for taxes other than school taxes.

Before applying for either, you must first meet the following criteria:

You must own/occupy your home

Your home must be located in Texas and

You must be a United States citizen, you must have lived in the State of Texas for the past year, and you must be 18 years or older.

To meet the ownership requirements, you must own the home and it must be your legal residence in Texas. If someone else owns the home but you are living there, then you may still qualify for homestead exemptions. Just because the person who technically owns your home does not live in Texas, doesnt mean that you cant live there and still receive homestead exemptions.

Before January 1, 2022, homestead exemptions could not be filed until the year after a home was purchased. However, as of 2022, homeowners may file for a homestead exemption immediately upon closing on their property, so long as an exemption has not yet been filed for that tax year.

Falling For Scams Is Less Likely With Donotpay

Thanks to AI technology, DoNotPay is a great resource for protecting your privacy and finances from potential scammers. Our bots can help you report robocalls, keep your inbox clean from spam email and shady text messages, or even deal with stalking and harassment, if it comes to that.

In case the issues escalate, skip the expensive lawyers and sue the offenders in small claims court with ease.

Another great way to increase your online security is to use our virtual credit cards and sign up for any free trial without risking unwanted charges. You can even avoid sharing your contact info with our Burner Phone feature.

Recommended Reading: How Much Is Sales Tax On A Car In Nc

How Do Property Taxes Work

Real property tax is handled a bit differently than personal property or income taxes. Property taxes are based on the assessed value of your home. In all cases, this is based on your property value. However, whether its your full property value depends on the jurisdiction youre in.

For example, the taxable portion of your homes value given by an assessor may be limited to some portion of its actual value pursuant to state law. If the valuation is $250,000, the taxable value of the property may only be $125,000, for example.

Property taxes are assessed using a unit called a mill. Mill might strike you as meaning million, but for the sake of tax math, you want to think back to science class and the metric system. Mills are assessed based on every $1,000 of property value.

The above concept is important to know because when tax policies are put to vote, its often in a millage. What youre voting for or against is a tax of a certain amount per $1,000 of property value. Special local assessments are often put to a vote.

Im going to give an example of the way local taxes are worked out. Before I get into this, these budget numbers are purely pulled out of thin air. City managers and school district officials, please dont write us.

What Is Property Tax

Property tax funds local amenities and is levied on every property in Bexar County. While some states offer low property tax rates, Bexar County has a reputation as being one of the most costly locations to own property in.

If you own any of these, you will be liable for property tax:

- Residential homes

- Business premises

- Non-removable building fixtures

Bexar County expects you to pay your property tax by January 31 for the previous calendar year. Failure to pay your property tax could have serious consequences, up to and including the loss of your property.

Don’t Miss: How To Appeal Cook County Property Taxes

Other Property Tax Exemptions In Texas

Although they are not common, there are a few other Texas property tax exemptions that might apply to your situation.

According to Tax Code Section 11.27, you may qualify for a Texas property tax exemption if you have a solar or wind-powered energy device installed on your property. The Texas Comptrollers website has the property tax forms to apply with the chief appraiser of the appraisal district where your property is located.

And finally, Tax Code Section 11.134 entitles the surviving spouse of a first responder killed or fatally injured in the line of duty to a total property tax exemption on their residence homestead if they have not remarried since the death of the first responder.