Why Is The Sales Tax On Cars In New York So High

New York has significantly higher car sales taxes than most other states in the nation. In fact, some states, such as Alaska and New Hampshire, don’t even tax car owners. According to Blunt Money, a primary reason for the high car sales tax in New York is related to politics and the revenue requirements of the state. Additional reasons why sales taxes are high in New York include:

- A deficiency in the overall budget of New York State

- The price of maintenance to repair roads after winter months

- Expenses of removing snow

- Higher cost of living overall

New York State Sales Taxes

Whether youre a New York resident or a visitor, youll pay a sales-and-use tax on goods purchased in the state. The state charges a flat 4% rate, but your actual rate can vary based on any local sales tax imposed by the city, county or school district in which the sale occurs. For example, the sales tax rate for New York City is 8.875%, while its 7.5% in Ontario County.

Also, theres an additional sales tax of 0.375% on sales made within the Metropolitan Commuter Transportation District.

Check the states website for a list of sales-and-use tax rates by jurisdiction. Or you can use the states online tool to look up the rate by address.

New York Payroll Taxes

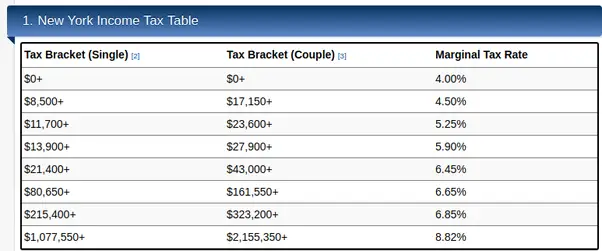

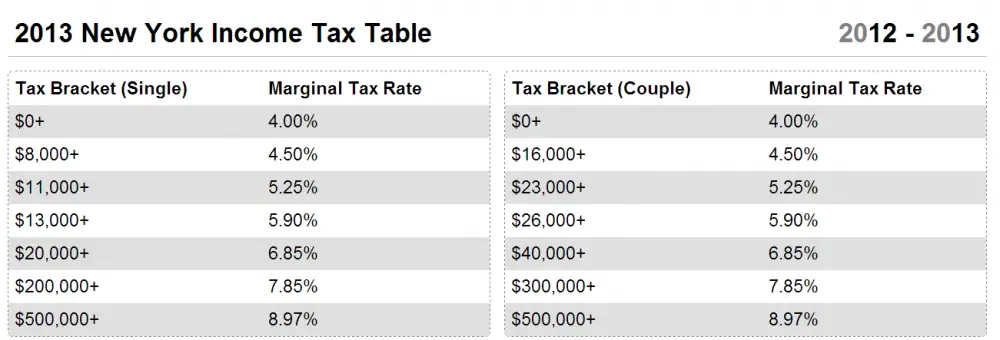

Calculating taxes in New York is a little trickier than in other states. The state as a whole has a progressive income tax that ranges from 4.00% to 8.82%, depending on an employees income level. There is also a supplemental withholding rate of 9.62% for bonuses and commissions.

In New York state, an employees tax burden can also vary based on location. Specifically, residents of New York City or Yonkers are subject to additional income taxes:

- New York City surcharge: a 2.907% to 3.876% income tax is deducted from taxable wages.

- Yonkers surcharge: People who work in Yonkers and Yonkers residents pay a tax of less than 1%, based on a number of factors.

You can find detailed instructions on how to apply these local New York payroll taxes through the NY Department of Taxation. Taxes should be paid to the state on an ongoing basis using the following forms:

- Form NYS-1: Monthly Withholding Payment. Before you can fill out your NYS-1, youll need to register as a new employer.

- Form NYS-45: Quarterly Withholding Reconciliation, Wage Reporting, and Unemployment Insurance. Here are detailed instructions.

Also Check: Plasma Donation Taxes

The Tax Rate Paid By Owners Varies Widely Within Each Of The Major Property Types

Perhaps more concerning to taxpayers than discrepancies in rates between different property types is the wide disparities in ETRs among similar properties. Properties of the same type and valued at the same amount often pay very different tax bills. These disparities exist among all property types.

Among small homes the median ETR is 0.87 percent and ranges from a low of almost zero to a maximum of 1.2 percent, with about 5 percent of homes at the maximum rate. A single-family home worth $500,000, for example, could see a tax bill anywhere from less than $100 to $6,000.

For condos and coops, the median ETR is 1.02 percent, which would mean a tax bill of $9,180 for a $900,000 unit.9 At the higher end of the distribution 5 percent of all units pay ETRs above 1.21 percent or $10,890 in taxes for a $900,000 apartment. As with small homes, some coops and condos have an ETR close to 0 percent that leads to a very low tax bill.

These disparities generally have two causes: tax law provisions intended to limit annual growth in tax bills and exemption programs that reduce tax bills for eligible properties.

To see how wide the disparity is in effective tax rates by type of property, click here.

Tax Law

The city estimates the market value of each property and calculates tax liabilities based on an assessed value that is a fraction of the market value. There are different assessment rules for each type of property. The growth in assessed value is constrained through caps or phase-ins.

What Is Sales And Use Tax

When you read about sales tax in New York, youll see talk of Sales and Use Tax. What is use tax and why do you have to pay it?

As you might know, sales tax applies to goods and services you buy within a state. Use tax is an equivalent tax that you pay on items that you purchase outside of the state. It ensures that out-of-state retailers dont benefit just because they dont have to pay the in-state sales tax. The use tax in New York is the same as the sales tax. The two taxes are also mutually exclusive so if you pay one of them, you wont have to pay the other.

Lets look at an example to show how use tax works: Imagine youre a New York resident and you buy a computer somewhere within the state. The seller will collect the regular New York sales tax. But if you buy a computer from New Hampshire, the seller wont collect the New York sales tax. That means you can get the computer without paying the full tax on it. So New York collects a use tax. New York requires residents to report their out-of-state spending in their New York income taxes.

Also Check: Form 1040 State Tax Refund

The Basics Of New York State Taxes

The New York State Department of Taxation and Finance administers the various types of tax that you may be subject to in the Empire State. That includes income tax, sales tax, property tax, estate taxes and other taxes.

Whether you live or work in New York, or are a visitor, its important to know what types of taxes you may be on the hook for, and how much you can expect to pay. Heres a summary of what you can expect from each type of tax note that tax rates can change from year to year, so check the Department of Taxation and Finance website for the most up-to-date information.

Like the federal tax system, the Empire State has a progressive schedule for income taxes, which means that lower-income taxpayers typically pay a lower marginal rate than those with higher incomes. Your tax rate is determined not only by your adjusted gross income, or AGI, but also by your filing status.

While tax rates may be updated each year, here are the and tax brackets for the 2019 tax year.

| New York state income tax rates |

| Tax rate |

| $60,001 and more | $90,001 and more |

Also, the city of Yonkers has a resident income tax surcharge of 16.75%, which is withheld from your paycheck if youre a W-2 employee.

Jurisdiction Reporting Codes And Rate Changes

When you file your sales and use tax returns, you must report the sales tax collected for each jurisdiction separately. The Tax Department has assigned a specific reporting code for tax due for each local jurisdiction, which allows for proper accounting of the tax collected. As long as you use Sales Tax Web File or use the sales tax returns available from the Tax Department for the reporting period you are filing, the correct codes and rates will be provided to you.You can learn about rate changes in a few different ways:

Subscription service – We encourage you to register to receive e-mail notifications related to sales tax, including rate changes. These e-mail notifications include links to recently updated Web content and publications that list sales tax rates for localities.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

Fee On Hotel Occupancy In New York City

In addition to the state and local sales taxes on hotel occupancy, a hotel unit fee in the amount of $1.50 per unit per day applies to hotels located in New York City. These fees are reported on Schedule N, Selected Services in New York City. See TSB-M-05S, Fee on Hotel Occupancy in New York City, for additional information on the hotel unit fee, and for the definition of a unit in a hotel.

More Help With Taxes In New York

So, get help with H& R Block Virtual! With this service, well match you with a tax pro with New York tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your NY taxes, including federal deductions for paying state taxes.

Prefer a different way to file? No problem you can find New York state tax expertise with all of our ways to file taxes.

Related Topics

Do you own real property in Louisiana ? Get your Louisiana property tax questions answered with help from the experts at H& R Block.

You May Like: Efstatus/taxact

What Is The Nyc Real Property Transfer Tax

The NYC Real Property Transfer Tax is a seller closing cost of 1.4% to 2.075% which applies to the sale of real property valued above $25,000 in New York City. Although its commonly referred to by brokers, buyers and sellers simply as the NYC Real Property Transfer Tax, this jargon technically includes two separate Transfer Taxes: a NYS Transfer Tax and a NYC Transfer Tax.

There are three specific NYC & NYS Transfer Tax rates for residential property which are as follows:

-

1.4%: sales below $500k

New York Income Taxes

New York States top marginal income tax rate of 8.82% is one of the highest in the country, but very few taxpayers pay that amount. The state applies taxes progressively , with higher earners paying higher rates. For your 2020 taxes , only individuals making more than $1,077,550 pay the top rate, and earners in the next bracket pay nearly 2% less. Joint filers face the same rates, with brackets approximately double those of single filers. For example, the upper limit of the first bracket goes up from $8,500 to to $17,150 if youre married and filing jointly.

Don’t Miss: How Do I Protest My Property Taxes In Harris County

New York Property Tax

Property taxes are assessed exclusively by counties and cities in New York State, which means that rates vary significantly from one place to the next. Effective rates – taxes as a percentage of actual value as opposed to assessed value – run from less than 0.7% to about 3.5%.

Surprisingly, the city with the lowest effective property tax rate is New York City, where property taxes paid total an average of just 0.88% of property value. The reason for that relatively low rate is that the taxable value of most residential property in New York City is equal to just 6% of the market value. That is, if your home is worth $500,000, you will only be charged taxes on $30,000 of that amount. Outside of New York City, however, rates are generally between 2% and 3%.

Regardless of city, if you are looking to refinance or purchase a property in New York with a mortgage, check out our guide to mortgages in New York. Weve got details on average mortgage rates and other information about getting a mortgage in the Empire State. You can also use our New York property tax calculator to find out what you would pay in property taxes in New York.

What Is The Llc Tax Rate In New York

Businesses are generally are taxed on the income the derived from the state in which they were formed. Generally, this is referred to as a corporate income tax.

You may be wondering what is the LLC tax rate? Or how is an LLC taxed? In New York, corporate income tax can vary greatly depending on the entity type, tax elections made, and other financial considerations. Understanding the New York corporate tax structure can be difficult, but it is important for understanding how these taxes apply to your business and for ensuring your business is paying the appropriate amount of taxes to the state.

In New York, corporate income tax appears in the form of a corporation franchise tax when applied to New York C-corporations and New York S-corporations. For New York limited liability companies, limited liability partnerships, and general partnerships, corporate income tax is referred to simply as a filing fee.

Also Check: How Much Does H& r Block Charge For Doing Taxes

New York Is Dealing With Economic Pain

Cuomo said in January he planned on raising taxes if the White House didn’t help the state recover from its $15 billion deficit, Insider’s Grace Dean reported. It’s the highest deficit in New York’s history, exceeding the previous high of $10 billion, which Cuomo said was “very, very hard” to manage.

In an address, Cuomo attributed New York’s deficit to the state being “assaulted by the federal government” in recent years as well as to the cost of COVID-19, which caused the state’s revenues to fall by $5.1 billion.

As the epicenter of the US’ first wave of COVID-19, New York City was slammed with small-business closures and saw many of its top-earning residents move to take advantage of lower taxes in other states. Urbanism expert Richard Florida told Insider the flight of the wealthy caused a lot of financial pain for superstar cities like New York.

Cuomo called for the federal government to provide New York with emergency pandemic relief. He said that if Washington gave the state only $6 billion in a “worst-case scenario,” he would hike taxes to cover the difference.

“We have a plan in place, a strength that we have not had before and I believe our future is bright, but Washington must act fairly if we are to emerge on the other side of this crisis,” he said.

The Times attributed Cuomo’s change of mind to the economic fallout of the pandemic, a growing progressive influence in the legislature, and the governor’s own “waning influence.”

The Nyc Earned Income Credit

The New York City Earned Income Tax Credit is equal to 30% of your allowable federal Earned Income Tax Credit reduced by your NYC Household Credit if you qualify for and claim that.

Full-year residents and part-year residents of NYC who qualify for and claim the federal Earned Income Credit can claim the New York City Earned Income Credit.

New York State offers an Earned Income Credit as well. You can still qualify for an NYC Earned Income Credit even if you don’t qualify for the state credit, and you can claim both if you do qualify for the state credit. This tax credit is also refundable.

Read Also: How To File Taxes Without Income To Get Stimulus Check

Transfer Taxes When Selling Combined Apartments

NYC will by default charge sellers the higher transfer tax rates for non-residential properties if you sell two or more units within the same building within a 12 month period.

This can impact many sellers of combined apartments who have not fully merged the apartments in the eyes of New York City.

To fully combine two apartments, you will first of course need approval from your buildings board. Then you will need the NYC Department of Buildings approval. After the renovations are complete, you will need a Letter of Completion as well from them. If have condominium units, you will also need to amend the condo declaration in order to merge the tax lot. For condo owners, only after this step is done will they begin receiving a single property tax bill vs a property tax bill for each unit.

If you havent merged the tax lot, our partner lawyers have had a 100% success rate so far in appealing a higher transfer tax rate. You will need a affidavit from an architect demonstrating that the combined units are truly one apartment.

Pro Tip: You should avoid paying the sponsors transfer taxes when buying two or more new construction units. This is especially important if you buy one unit first, and then decide to purchase a second one some time later in the same building. Because of the 12 month look back described above, you may be retroactively hit by the higher transfer tax rate for non residential properties on both deals.

How Do Property Taxes Work

Let’s define a couple of key terms before we get into the details of how property taxes work. First, you must become familiar with the “assessment ratio.” The assessment ratio is the ratio of the home value as determined by an official appraisal and the value as determined by the market. So if the assessed value of your home is $200,000, but the market value is $250,000, then the assessment ratio is 80% . The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes.

Wondering how the county assessor appraises your property? Again, this will depend on your countys practices, but its common for appraisals to occur once a year, once every five years or somewhere in between. The process can sometimes get complicated. In a few states, your assessed value is equal to the current market rate of your home. The assessor determines this by comparing recent sales of homes similar to yours. In other states, your assessed value is thousands less than the market value. Almost every county government explains how property taxes work within its boundaries, and you can find more information either in person or via your local governments website.

To put it all together, take your assessed value and subtract any applicable exemptions for which you’re eligible and you get the taxable value of your property.

Don’t Miss: Prontotaxclass