How To Determine How Much Home You Can Afford

Buying a house is exciting, especially as you tour new places and eventually fall in love with a home. But how do you determine your price range? To set realistic expectations, consider your personal finances, borrowing options, and the total costs of buying.

Heres what well cover:

How To Look Beyond The Monthly Mortgage Payment

Given the how much house can I afford rule of thumb, you now know that you can afford a monthly mortgage payment of $970. But thats only so helpful. Youre still probably wondering how much house you can afford?

Well, the answer depends on how much money youve saved. When you buy a house, youre going to need money upfront for closing costs and a down payment.

Closing costs are the fees associated with finalizing your loan, including application, origination, appraisal, credit report, title and attorney fees. Closing costs typically run about 5% of the purchase price of your home.

When obtaining a mortgage, you also have a down payment on your house, which is the money you pay upfront. The good news is that this sum is subtracted from your total mortgage amount. The more money you set aside for your down payment, the less youll have to spend each month on mortgage payments.

The cost of your down payment will vary based on the purchase price of your home and the type of loan you obtain. Conventional loans require borrowers to pay a more significant percentage of the purchase price upfront than do government-backed mortgages.

Conventional loans typically require a down payment of 3 20% of the purchase price. Yet, if you put down less than 20%, your lender will require you to pay private mortgage insurance fees to safeguard the mortgage company in the event that you default on your loan.

How To Calculate How Much House You Can Afford

Okay, all you really have to do is crunch a few numbers to figure out how much house you can afford. And if math isnt your thing, hang in there. Well walk you through it step by step. Weve never lost a patient.

And for you married folks, make sure you go over the results with your spouse. You both need to be on the same page when it comes to your budget and what you can actually pay. After all, shopping for your home sweet home will feeldare we sayromantic once you and your sweetheart set shared expectations.

Simply follow the steps below.

Recommended Reading: Michigan Gov Collectionseservice

What Is The 28/36 Rule

Lenders may determine your ability to afford a new home by using the 28/36 rule. Breaking it down, the rule establishes that:

- Housing expenses should be no more than 28% of your total pre-tax income. This includes your monthly principal and mortgage interest rate, annual property taxes, and private mortgage insurance payments .

- Total debt should not exceed 36% of your total pre-tax income. This includes the housing expenses mentioned above credit cards, car loans, personal loans, and student loans so long as these monthly debt payments are expected to continue for 10 months or more.

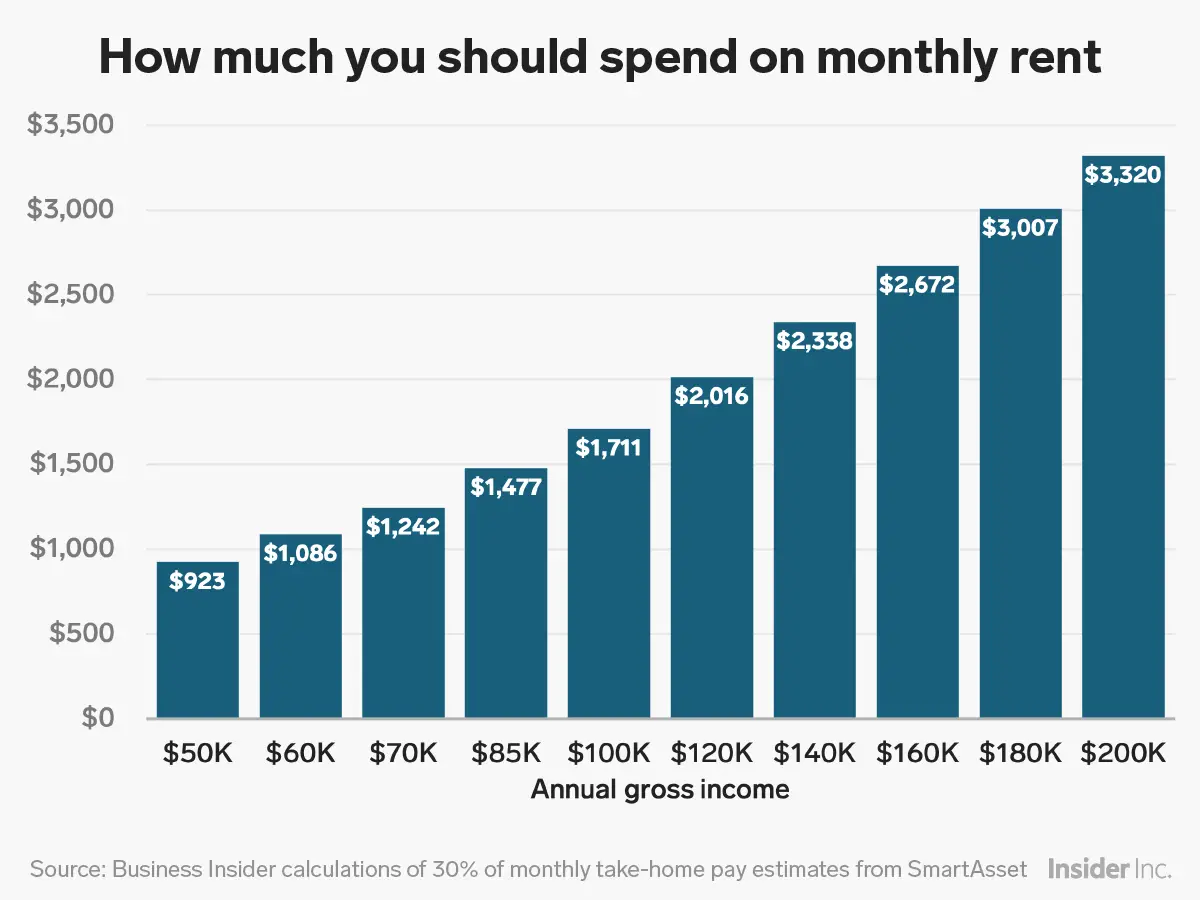

In concrete numbers, the 28/36 rule means that a borrower who makes $5,000 a month should not spend more than $1,400 on housing costs every month. If youre a renter, thats the most you should spend on your lease to maintain good financial health.

However, for a homeowner, $1,400 should cover your monthly mortgage payment, as well as homeowners insurance premiums and property taxes.

Budget For Homeowner Costs

Beyond the costs of purchasing a home, youll likely have expenses related to owning and maintaining your home:

Homeowners insurance

Lenders will require that you carry homeowners insurance, which protects your property in case of damage. The amount will vary depending on your homes value and location. Certain areas that are prone to floods or earthquakes may have higher premiums.

Property taxes

You will also pay property taxes to your local government. This amount is based on the value of the property and land and is used to cover costs such as infrastructure, school, law enforcement, and fire service.

Maintenance and repairs

Maintenance includes the ordinary expenses that come with owning a home, such as painting, taking care of a lawn, fixing appliances, and cleaning living spaces. The average homeowner spent $2,289 a year on maintenance and repairs in 2016, according to Bureau of Labor StatisticsConsumer Expenditure Survey. If youre preparing your home for sale or just curious about general upkeep, review our home maintenance and repair checklist.

The average Homeowners Association fee is $200 to $300 per month for a typical single-family home, according to Realtor.com. This money usually covers shared amenities and services for a community such as a pool or gym, trash removal, snow removal, or maintenance to common areas.

Read Also: Do You Have To Pay Taxes On Plasma Donations

The 28/36 Rule For Affordability

A quick and easy way to determine how much you can afford to spend on housing is the 28/36 rule. This means your monthly mortgage payment should be no more than 28% of your pre-tax income, and your total debts should be no more than 36% of your total pre-tax income, says Austin Weyenberg, founder of the personal finance blog The Logic of Money.

So if you earn $5,000 a month before taxes, then your monthly mortgage payment shouldnt exceed $1,400. Keep in mind that your monthly payment calculation should include property taxes and homeowners insurance.

In this scenario, you could also have up to $400 in other monthly debt payments, such as student loans or car payments, and still be under 36% in total debts. This is why paying off your other debt is a great way to increase the flexibility of your home buying budget.

Three Homebuyers’ Financial Situations

| $0 | $185,000 |

House #1 is a 1930s-era three-bedroom ranch in Ann Arbor, Michigan. This 831 square-foot home has a wonderful backyard and includes a two-car garage. The house is a deal at a listing price of just $135,000. So who can afford this house?

Analysis: All three of our homebuyers can afford this one. For Teresa and Martin, who can both afford a 20% down payment , the monthly payment will be around $800, well within their respective budgets. Paul and Grace can afford to make a down payment of $7,000, just over 5% of the home value, which means theyâll need a mortgage of about $128,000. In Ann Arbor, their mortgage, tax and insurance payments will be around $950 dollars a month. Combined with their debt payments, that adds up to $1,200 â or around 34% of their income.

House #2 is a 2,100-square-foot home in San Jose, California. Built in 1941, it sits on a 10,000-square-foot lot, and has three bedrooms and two bathrooms. Itâs listed for $820,000, but could probably be bought for $815,000. So who can afford this house?

House #3 is a two-story brick cottage in Houston, Texas. With four bedrooms and three baths, this 3,000-square-foot home costs $300,000. So who can afford this house?

Also Check: Have My Taxes Been Accepted

Aim To Put 20 Percent Down

The amount of mortgage you can afford also depends on the down payment you make when buying a home. In a perfect world, we recommend a 20 percent down payment to avoid paying mortgage insurance, Neeley says.

When your down payment is less than 20 percent, your costs rise. You typically have to pay private mortgage insurance, which can cost up to 1 percent of the entire loan amount each year until you build up 20 percent equity in your home. On a $240,000 mortgage, thats $200 per month.

Keep in mind that you will have other ongoing costs related to homeownership as well, including taxes, insurance, and utilities. All of these expenses need to be estimated before you settle on a monthly mortgage payment.

How Much House Can I Afford With A Va Loan

With a military connection, you may qualify for a VA loan. Thats a big deal, because mortgages backed by the Department of Veterans Affairs typically dont require a down payment. The NerdWallet Home Affordability Calculator takes that major advantage into account when computing your personalized affordability factors.

Remember to select ‘Yes’ under ‘Loan details’ in the ‘Are you a veteran?’ box.

For more on the types of mortgage loans, see How to Choose the Best Mortgage.

Don’t Miss: How To Buy Tax Liens In California

Fixed Rate Vs Adjustable Rate

A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A5/1 ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment.

What Percentage Of Your Income Can You Afford For Mortgage Payments

Modified date: May. 31, 2021

These questions often come up among first-time home buyers:

- What percentage of my monthly income can I afford to spend on my mortgage payment?

- Does that percentage include property taxes, private mortgage insurance , or homeowners insurance?

Today we tackle these questions to help make your home buying experience a little easier.

Whats Ahead:

You May Like: How To Get Stimulus Check 2021 Without Filing Taxes

Ways To Lower Your Total Monthly Debt Payments

The key to reducing your debts is to create a budget and debt payment plan. By creating a list with your total monthly income on one side and all of your expenses on the other, you can quickly identify unnecessary expenditures, eliminate them and allocate extra funds to paying off your loans early. After coming up with your budget, you can use one of the following debt payment plans to chip away at your debts.

Although you can choose to focus on either increasing your monthly income or lowering your debts, its recommended that you do both simultaneously. Doing so will enable you to improve your DTI faster and ensure you can qualify for a mortgage when its time to apply.

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

You May Like: Do You Have To Pay Taxes On Plasma Donations

Top 10 Most Expensive Places To Buy A House

Clearly, theres a huge price range among the more expensive versus the cheaper places across the country. If youre in the position to be flexible enough to move where the cost of living is cheaper, your money can go a lot further. Or else, you can use these numbers to determine how much income youd need to earn in order to afford to live in specific places across the US.

Factors That Determine How Much House You Can Afford

Income is an important factor when you apply for a mortgage.

If you make a $100k salary annually, lenders will weigh that heavily in your mortgage application.

It indicates that you likely have the income needed to cover a decentlysized mortgage payment.

However, lenders dont just look at income when they qualify you for a home loan. They also look at:

- The property youre buying

Heres what each of these factors mean to a lender.

Lenders want to see that you have a history of good credit management and ontime payments, and that youre not paying too many other debts on top of a mortgage.

To get the best mortgage rate, aim for a credit score of 720 or higher and a DTI ratio below 36%.

These indicators show that youre a responsible borrower whos not likely to default on their mortgage loan.

Down payment and LTV

In addition, lenders consider your down payment and LTV when deciding which mortgage programs you qualify for and how low of a rate youll get.

To get the best mortgage rate, aim for a down payment of 20%. Although its not required, a bigger down payment lowers your rate and increases your home buying power.

The higher your down payment is, the less risk the lender takes on since youll be asking for less money. This means a lower rate and bigger home buying budget.

LTV is a similar metric, which measures how much youre borrowing vs. how much the home is actually worth.

Low down payments are always an option

However, these things are by no means required.

You May Like: Plasma Donation Taxable

What Is A Jumbo Loan

A jumbo loan is used when the mortgage exceeds the limit for Fannie Mae and Freddie Mac, the government-sponsored enterprises that buy loans from banks. Jumbo loans can be beneficial for buyers looking to finance luxury homes or homes in areas with higher median sale prices. However, interest rates on jumbo loans are much higher because lenders don’t have the assurance that Fannie or Freddie will guarantee the purchase of the loans.

How Much Mortgage Can I Afford

Even though Martin can technically afford House #2 and Teresa can technically afford House #3, both of them may decide not to. If Martin waits another year to buy, he can use some of his high income to save for a larger down payment. Teresa may want to find a slightly cheaper home so sheâs not right at that maximum of paying 36% of her pre-tax income toward debt.

The problem is that some people believe the answer to âHow much house can I afford with my salary?â is the same as the answer to âWhat size mortgage do I qualify for?â What a bank is willing to lend you is definitely important to know as you begin house hunting. But ultimately, you have to live with that decision. You have to make the mortgage payments each month and live on the remainder of your income.

So that means youâve got to take a look at your finances. The factors you should be looking at when considering taking out a mortgage include:

- Income

- Private mortgage insurance

- Local real estate market

Plugging all of these relevant numbers into a home affordability calculator can help you determine the answer to how much home you can reasonably afford.

But beyond that youâve got to think about your lifestyle, such as how much money you have leftover for travel, retirement, other financial goals, etc. You might find that you donât want to buy the most expensive home that fits in your budget.

You May Like: Buying Tax Liens In California

Your Down Payment Amount

The more you can save money to put towards your home purchase, the better. A higher down payment amount means youd have to borrow less money to buy a home and would require less financing to make that deal happen. Not only that, but a higher down payment amount means you may be able to afford a more expensive house.

Conventional loans typically require a minimum down payment of 5% of the purchase price of a home, though you can avoid paying Private Mortgage Insurance premiums by putting at least 20% down. PMI payments will have to be paid along with your mortgage until your loan amount dips under 80% of the market value of your home. In this case, youd be saving an extra payment each month by making a minimum 20% down payment.

Other mortgage types require smaller down payment amounts. For instance, FHA-backed home loans require a minimum of 3.5%. There are even some mortgage arrangements such as VA loans and special programs for first-time homebuyers that require no down payment.

Regardless of the minimum down payment amount required, youd be better off putting down as much as you can, well above any minimum requirements. Thats because a higher down payment amount will reduce your loan-to-value ratio, which is a measurement of the loan amount you take out versus the market value of the property. The closer the loan amount is to the propertys value, the higher your LTV will be.