People Have Lots Of Questions About The $3000 Or $3600 Child Tax Credit And The Advance Payments That The Irs Is Sending Monthly To Most Families And We Have Answers

The child tax credit is bigger and better than ever for 2021. The credit amount is significantly increased for one year, and the IRS is making monthly advance payments to qualifying families from July through December.

But the changes are complicated and won’t help everyone. For instance, there are now two ways in which the credit can be reduced for upper-income families. That means some parents won’t qualify for a larger credit and, as before, some won’t receive any credit at all. More children will qualify for the credit in 2021.And, next year, when you file your 2021 tax return, you will have to reconcile the advance payments you received with the actual child tax credit you are entitled to.

It’s all enough to make your head spin. But don’t worry we have answers to a lot of the questions parents are asking right now about the 2021 child credit. We also have a handy 2021 Child Tax Credit Calculator that lets you estimate the amount of your credit and the expected advance payments. Once you read through the FAQs below and try out the calculator, you should feel more at ease about the 2021 credit.

Question: What were the rules for the 2020 child tax credit?

Up to $1,400 of the child credit is refundable for some lower-income individuals with children. However, you must also have at least $2,500 of earned income to get a refund.

Question: What changes did Congress make to the child tax credit?

Choose Your Filing Status

Your filing status helps determine how much tax you pay each year, so its important to choose the correct status. Currently, the IRS has five filing categories, which are determined by your marital status as of the last day of the tax year:

How Tax Refunds Work

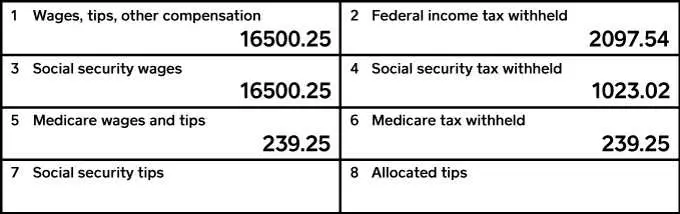

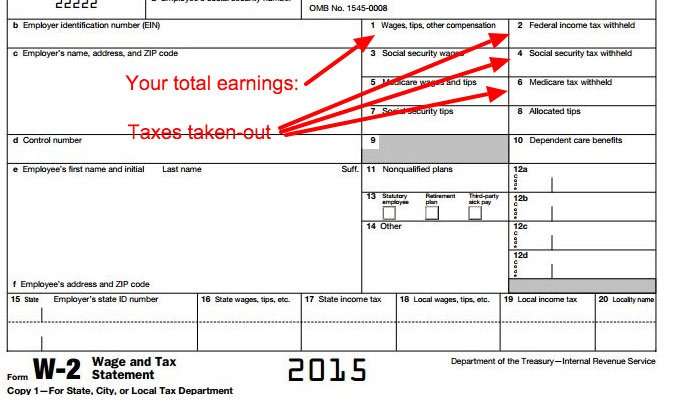

As a U.S. resident, you must pay a portion of all your earnings to the federal government to meet your tax obligation. Your employer is responsible for collecting taxes from every paycheck and paying the IRS on your behalf.

How much you pay in federal withholding depends on your earnings and how you fill out IRS Form W-4, which goes to your employer and includes your filing status and number of dependents. The more dependents you claim, the more money you get to keep each pay period.

In addition, taxes for Social Security and Medicare are withheld from your check. These are called FICA taxes. In 2021, the FICA tax rate is the same as the past year at 7.65 percent, 6.2 percent for Social Security and 1.45 percent for Medicare.

There is a wage ceiling for Social Security taxes. For 2021, it is $142,800, more than last years limit of $137,700. Gross income above that threshold is exempt.

When its time to file your taxes, you tally all your earnings, deductions and any tax credits you might have to see what your true tax obligation is for the year. If you had too much money withheld from your pay, the IRS owes you a refund. If too little was deducted from your pay, you will owe the IRS the difference.

Recommended Reading: How Can I Make Payments For My Taxes

How Much Will I Get Back In Taxes

Its all in the math. Although that may not have been your favorite subject in school, you can perform some fairly simple mathematical calculations to determine the amount of your anticipated tax refund. Youll need to use your tax return form and other paperwork, such as pay stubs, a profit-and-loss statement or 1099 forms, to gather the pieces of your tax return puzzle so you can put everything together.

When And How Will I Receive The New Child Tax Credit

The IRS will pay the child tax credit in monthly installments from July through December. Qualifying families will receive the payments via direct deposit or check. Since the payments are equivalent to half the credit, you will be able to claim the remaining amount on your 2021 tax return, due in 2022.

The IRS will send these payments automatically, and most taxpayers will not need to take any action. It will use either your 2019 or 2020 tax return or information you provided via the non-filer tool.

You May Like: Do You Have To Pay Taxes On Plasma Donations

Tax Breaks For Middle Income Families

If you spend money on child care, you may be eligible for a tax credit. The child and dependent care tax credit allows you to claim a percentage of your qualifying care expenses on your tax return. Before you claim your child care credit, there are a few stipulations you should understand first.

TL DR

The amount of money you get back from any child care expensive is determined by the amount you spent and your income for that tax year.

What To Know About The Unemployment Tax Break

The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American Rescue Plan Act of 2021. The tax break is for those who earned less than $150,000 in adjusted gross income and for unemployment insurance received during 2020. At this stage, unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

The $10,200 tax break is the amount of income exclusion for single filers, not the amount of the refund . The amount of the refund will vary per person depending on overall income, tax bracket and how much earnings came from unemployment benefits. So far, the refunds have averaged more than $1,600.

However, not everyone will receive a refund. The IRS can seize the refund to cover a past-due debt, such as unpaid federal or state taxes and child support. One way to know if a refund has been issued is to wait for the letter that the IRS is sending taxpayers whose returns are corrected. Those letters, issued within 30 days of the adjustment, will tell you if it resulted in a refund or if it was used to offset debt.

As the IRS continues issuing refunds, they will go out as a direct deposit if you provided bank account information on your 2020 tax return. A direct deposit amount will likely show up as IRS TREAS 310 TAX REF. Otherwise, the refund will be mailed as a paper check to whatever address the IRS has on hand.

Read Also: File Missouri State Taxes Free

Calculating Medical Expense Deduction Savings

To figure how much youll save from the amount that you deduct on your taxes for your medical expenses, multiply the amount of your medical expenses deduction by your marginal tax rate. Your marginal tax rate is the tax rate you pay on your last dollar of income. For example, if you can claim a $2,000 deduction for medical expenses, and you fall in the 22 percent tax bracket, you will save an additional $440 on your income tax return.

Why You’re Getting A Refund

Most Americans do indeed get a refund from the IRS after filing their tax returns. In 2020, nearly 170 million people filed tax returns, including traditional non-filers who submitted information to get their economic impact payments. That year, the IRS issued nearly 126 million refunds, accounting for about 74% of all filers.

The average 2020 refund was $2,549, about $321 less than the average 2019 refund of $2,870. This year, the IRS had received about 76 million individual tax returns through March 19 and has issued nearly 50 million refunds. The average refund size so far is $2,929, according to the agency.

Taxpayers receive refunds from the IRS when they overpay what taxes they owe on their annual adjusted gross income. This generally happens because employers withhold more than needed to pay taxes from their employee’s paychecks. At the end of the year, when taxpayers file, the IRS cuts them a check for the amount they overpaid.

On the flip side, people may owe the IRS money at the end of the year if they underpaid their taxes on any income they made. This can happen if someone selected the incorrect withholding amount, isn’t setting aside money from a side hustle or gig work, and isn’t making estimated tax payments throughout the year.

Then, the American Rescue Plan was passed, which made the first $10,200 of unemployment income taxfree for those with adjusted gross income less than $150,000 in 2020

Read Also: Where’s My Tax Refund Ga

Tax Rates And Brackets

| Tax rate |

|---|

| $311,026 and more |

Federal income tax is progressive, so your taxable income can fall into more than one tax bracket. The highest tax bracket that applies to your income determines your marginal tax rate. For each tax bracket and filing status, calculating federal tax means applying the tax rate for that bracket to the portion of your taxable income that falls within the bracket thresholds, plus any additional amount of tax associated with that bracket.

Heres an example of how federal income tax calculation works.

If youre a single filer with taxable income of $9,000, your marginal tax rate is the lowest 10% because your total taxable income falls within the threshold for the lowest tax bracket.

But what if youre a single filer earning taxable income of more than $518,401? Your marginal tax rate is the highest , because $518,401 is the lowest threshold amount for that tax bracket, which is the final one your income falls into. But only the portion of your income that exceeds $518,400 will be taxed at 37%. All the lower tax brackets also apply to the portions of your income that fall within those brackets – the 10% rate applies to the first $9,875 of your taxable income, 12% to the next $30,249 and so on.

How Much Tax Do You Owe

Your refund is based on how much tax you owe, offset by how much tax you’ve already paid. Any amount you’ve overpaid will be returned to you. After you’ve completed your tax return to reflect your filing status, income, exemptions and deductions, refer to the tax tables included with Form 1040. The amount you enter on Line 43 of the 1040 is your taxable income. Find this amount in the income categories on the tax tables, and then find the column of your filing status. Where these two amounts intersect, youll find the tax you owe. If the tax you paid, which is entered on Line 74 of the 1040, is greater than the tax you owe , the difference is the amount that will be refunded to you.

Don’t Miss: Otter Tail County Tax Forfeited Land

Progressive System Marginal Rates

The federal income tax is progressive, meaning that tax rates increase as your taxable income goes up.

For example, in 2020,

- Income is taxed at seven different rates:

- 10, 12, 22, 24, 32, 35 and 37 percent.

Filing Status & Dependents

The filing statuses are single, married filing jointly, married filing separately, head of household, and qualifying widow. If you support a child or relative, they may qualify as your dependent. There are different requirements for qualifying children and qualifying relatives, but both types of dependents must be a U.S. citizen, U.S. national, or U.S. resident alien. You must be the only taxpayer claiming them, and they must be filing single or married filing separately if they’re required to file their own return. For more, see Who Can I Claim as a Dependent?

Recommended Reading: Turbo Tax 1099q

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Rrsp Contributions Lower Your Taxable Income

Lets say you earned $60,000 in 2020 and contributed $2,000 to a Registered Retirement Savings Plan. If you record and claim those RRSP contributions on your taxes this year, your taxable income will be $60,000 $2,000 = $58,000.

Because you paid income taxes on an income of $60,000 but now your actual income is $58,000, the government will give you an income tax refund for the taxes paid on that $2,000. If you live in Ontario, this will result in an income tax refund of approximately $584!

A $584 refund on a $2,000 RRSP contribution represents a 29% instant return on your investment.

Also Check: How To Appeal Property Taxes Cook County

How To Track Your Refund And Check Your Tax Transcript

The first way to get clues about your refund is to try the IRS online tracker applications: The Where’s My Refund tool can be accessed here. If you filed an amended return, you can check the Amended Return Status tool.

If those tools don’t provide information on the status of your unemployment tax refund, another way to see if the IRS processed your refund is by viewing your tax records online. You can also request a copy of your transcript by mail or through the IRS’ automated phone service by calling 1-800-908-9946.

Here’s how to check your tax transcript online:

1. Visit IRS.gov and log in to your account. If you haven’t opened an account with the IRS, this will take some time as you’ll have to take multiple steps to confirm your identity.

2. Once logged in to your account, you’ll see the Account Home page. Click View Tax Records.

3. On the next page, click the Get Transcript button.

4. Here you’ll see a drop-down menu asking the reason you need a transcript. Select Federal Tax and leave the Customer File Number field empty. Click the Go button.

5. The following page will show a Return Transcript, Records of Account Transcript, Account Transcript and Wage & IncomeTranscript for the last four years. You’ll want the 2020 Account Transcript.

6. This will open a PDF of your transcript: Focus on the Transactions section. What you’re looking for is an entry listed as Refund issued, and it should have a date in late May or June.

How Much Do You Get Back In Taxes For A Child In 2020

There are multipletax breaks for parents, including the child tax credit. For 2020, the child tax credit is worth a maximum of $2,000 per qualifying child. Up to $1,400 of that amount is refundable meaning if the credit reduces your tax bill to zero, you could receive the difference back as a refund. Tax reform expanded the credit to also include a $500 nonrefundable credit for qualifying dependents who arent children, and boosted the phase-out limits to an AGI of more than $400,000 for taxpayers who are married filing jointly and $200,000 for everyone else. The higher limits mean that more people could qualify for the credit.

Also Check: How To File Missouri State Taxes For Free

Timing And Frequency Of Advance Payments

Question: When will the IRS start making payments, and how many payments will I get?

Answer: The IRS will make six monthly child tax credit payments to eligible families from July to December 2021. The first two rounds of payments were made on July 15 and August 13. After that, payments will be issued on September 15, October 15, November 15 and December 15.

Most payments will be directly deposited into bank accounts. Families for which the IRS does not have bank account information could receive paper checks or debit cards in the mail. Most eligible families do not have to do anything to get these payments. The IRS has a tool on its website for families who want to update their bank information with the IRS.

Question: How much will a family get each month?

Answer: The advance payments account for half of a family’s 2021 child tax credit. The amount a family receives each month varies based on the number of children in the family, the ages of the kids and the amount of the family’s adjusted gross income. For example, families who qualify for the full $3,000 credit per child get monthly payments of $250 per child for six months. Families with higher incomes who qualify for the $2,000 credit get monthly payments of $167 per child for six months. .

Use our 2021 Child Tax Credit Calculator to see how much you’ll get !

Verifying Eligibility For Advance Payments

Question: I think I qualify for monthly payments of the child tax credit, but I want to be sure that I am automatically enrolled in the IRS’s system. Is there a way to check this?

Answer: Yes, you can do this online using the IRS’s Child Tax Credit Update Portal. Once you have gone through all the steps to create an account and log on, you will be able to verify your eligibility for monthly payments and check on the status of those payments.

If the tool says a payment was issued, but you haven’t received it, then you can fill out IRS Form 3911 and send it to the IRS to start a payment trace. You’ll have to wait at least five days from the anticipated direct deposit date and at least four weeks for mailed checks before the IRS can begin a trace on any missing payment.

Recommended Reading: What Does Agi Mean For Taxes