California Property Taxes Under Prop 13

To understand how Proposition 15 would affect property taxes for commercial real estate, one must first understand how property taxes are assessed today. California commercial and residential property taxes are limited by Proposition 13, whereby property tax is fixed at 1% of the original purchase price, with annual increases thereafter capped at a maximum of 2% per year. Prior to the passing of Proposition 13 in 1978, local governments set property tax rates to fund local services, and the average property tax rate in California was 2.67 percent. Also prior to Prop 13s limitations on property tax increases, California property tax rates were based on changes in market value, and annual increases were subject to the changing fiscal needs of local governments. The citizens tax revolt at the time was based on the notion that California property taxes were excessive, and their market increases were unrestricted and subject to abuse by legislators and county tax assessors.

How Property Taxes In California Work

California property taxes are based on the purchase price of the property. So when you buy a home, the assessed value is equal to the purchase price. From there, the assessed value increases every year according to the rate of inflation, which is the change in the California Consumer Price Index. Remember, there’s a 2% cap on these increases.

This means that, for homeowners who have been in their house for a long time, assessed value is often lower than market value. The same is true of homeowners in areas that have experienced rapid price growth in recent years, such as San Francisco and San Jose.

Homeowners in California can claim a $7,000 exemption on their primary residence. This reduces the assessed value by $7,000, saving you at least $70 per year. You only need to claim this exemption once, and its important to do so shortly after you buy.

If you’re considering buying a home in California with a mortgage, youll want to take a look at our guide on mortgage rates and getting a mortgage in the Golden State.

A financial advisor in California can help you understand how homeownership fits into your overall financial goals. Financial advisors can also help with investing and financial plans, including taxes, homeownership, retirement and more, to make sure you are preparing for the future.

What Is The Property Tax Rate In Oakland

4.8/5

| City | Average Effective Property Tax Rate |

|---|---|

| Livermore |

Similarly, you may ask, how do I figure out property tax?

Property taxes are calculated by taking the mill levy and multiplying it by the assessed value of your property. The assessed value estimates the reasonable market value for your home. It is based upon prevailing local real estate market conditions.

Subsequently, question is, are property taxes based on purchase price or appraised value? Property taxes are based on the value of the property being taxed, with the owners of the real estate being taxed responsible for paying the tax. The taxing authority performs an appraisal of the value of the real property and then assesses a millage tax in proportion to that value.

In this regard, how much is the property tax in California?

California’s overall property taxes are below the national average. The average effective property tax rate in California is 0.79%, compared with a national average of 1.19%.

How much is property tax on a house?

Figuring Out How Much You’ll Likely Pay in Property TaxesSo, for example, if your home is deemed to be worth $200,000 and your local tax rate is 1.5%, your property taxes would be $3,000 annually .

You May Like: Have My Taxes Been Accepted

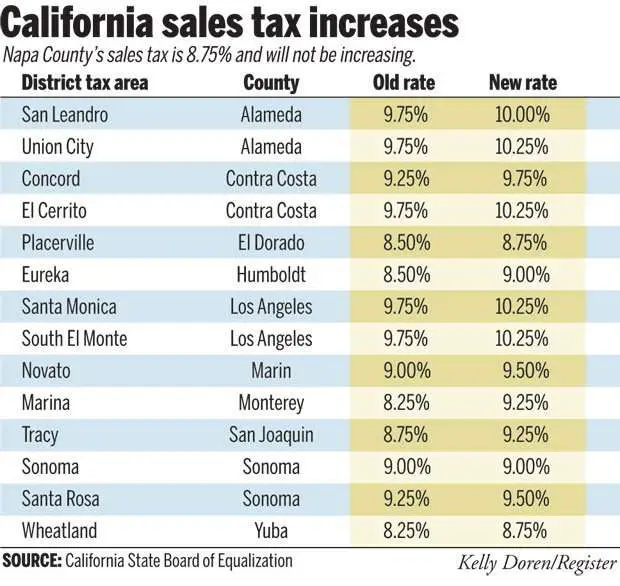

Other California State Excise Taxes

California is known for tacking additional excise taxes onto certain products. You’ll pay an extra 33% if you buy fruit from a vending machine there.

And, like most states, California also adds an additional tax to cigarettes and gasoline. A pack of cigarettes will cost you an extra $2.87 there. The tax used to be just 87 cents, but legislation ramped it up by an additional $2 on April 1, 2017.

Gasoline will run you an additional 12 cents a gallon under legislation that began increasing the tax incrementally effective November 1, 2017. That’s the highest rate in the country. As of 2020, the average California driver pays $2.93 per gallon compared to the national average of $1.90.

The issue went to the ballot in November 2018 when opponents of the tax sought to implement a law that would prohibit any new transportation fuel taxes without a majority public vote. The measure was defeated.

Property Tax Red States Vs Blue States

When analyzing the property tax rates by state, its noticeable that blue states have higher effective taxes on properties. Among the 10 states with the highest effective tax rate on median owner-occupied homes, seven are Democrat. The top four states with the highest property taxes are blue.

The situation is different when focusing on the states with the lowest property taxes. Here, six among the leading ten states are Republican. So, the conclusion is that red states tend to have looser taxation on personal properties.

According to the latest uninsured rates by states, Republican states also have more uninsured residents. Red states are also the most federally dependent states in America. So, having low property taxes doesnt necessarily place them in a better position than blue states.

Also Check: Efstatus.taxact.com.

Find The Tax Relief Company That’s Best For You

We’ve weighed the pros and cons of some major players in the space.

Services

|

Services

|

Services

|

Who Pays Property Taxes At Closing In California

Buyers pay their prorated tax at closing, as do sellers who have not yet paid their taxes for the year. Count the number of full months from July 1 through and including the day before closing. Multiply that figure by 30, which is Californias customary measure of a month for the purposes of real estate transactions.

You May Like: Is Past Year Tax Legit

Donotpay Keeps Your Privacy Intact

DoNotPay can help you surf the web safely and securely. No need to provide your personal information to every company whose service you’d like to take for a test drive. Our Virtual Credit Card and Burner Phone products shield your data from prying eyes and dishonest merchants.

Feel like subscribing for a free trial? Make it truly free and avoid automatic membership renewals with our card. It can also help identify spammers and potential scammers who send bothersome robocalls and robo texts your way. As soon as they act on the virtual card number, DoNotPay will unmask them and demand compensation!

Capital Gains Tax In California

California tax law includes no special provisions for capital gains tax, so the state doesn’t give you a break for long-term gains on assets you hold onto for over a year unlike federal law. You’ll pay taxes on your profits at your personal income tax rate regardless of the duration of ownership if you sell any property or asset for more than your tax basis or investment in it.

You’ll end up paying the second-highest capital gains tax rate in the worlda combined 32.3%if your sale is such that you must also pay the federal long-term capital gains tax rate of 20%.

Don’t Miss: How Do I Get My Pin For My Taxes

All About Property Taxes

When you purchase a home, you’ll need to factor in property taxes as an ongoing cost. After all, you can rely on receiving a tax bill for as long as you own property. Its an expense that doesnt go away over time and generally increases over the years as your home appreciates in value.

What you pay isnt regulated by the federal government. Instead, its based on state and county tax levies. Therefore, your property tax liability depends on where you live and the value of your property.

In some areas of the country, your annual property tax bill may be less than one months mortgage payment. In other places, it can be as high as three to four times your monthly mortgage costs. With property taxes being so variable and location-dependent, youll want to take them into account when youre deciding on where to live. Many areas with high property taxes have great amenities, such as good schools and public programs, but youll need to have room in your budget for the taxes if you want to live there.

A financial advisor in your area can help you understand how homeownership fits into your overall financial goals. Financial advisors can also help with investing and financial plans, including taxes, retirement, estate planning and more, to make sure you are preparing for the future.

Property Taxes For San Diego County Real Estate

Under California State law , real property is reassessed only when a change-in-ownership occurs, or upon completion of new construction. Except for these two instances property assessments cannot be increased by more than 2% annually, based on the California Consumer Price Index. The property tax rate is 1%, plus any bonds, fees, or special charges.

This amounts to about 1.25% of the purchase price. As a general rule, you can calculate your monthly tax payment by multiply the purchase price by .0125 and dividing by 12. For example, if you purchase a $500,000 property, the taxes will be around $520 per month. Unlike some other states, different cities in California do not have tax rates that differ greatly.

One major difference in California is that taxes go up only 2% a year, for as long as you own the home.

Also Check: Is Plasma Donation Taxable Income

How Impound Accounts Work

Often, your property taxes are wholly, or partially, rolled into your monthly payment, so you will most likely never have to pay the full amount out of pocket. If you overpay throughout the year, youll receive a refund come tax time. If you underpay, youll receive a bill for the difference.

In order to determine the final figures for your specific situation, you can consult your lender to break down the specifics of your loan or, if youre in the process of buying a house, include these questions in the purchasing process so you know exactly what to expect.

What Constitutes California Property Tax Exemptions

One way to reduce your property taxes is to file for a property tax exemption. California allows property tax relief to some citizens under certain circumstances. Unlike other states, Californias property tax exemptions are established by the State Constitution. Here is an overview of the most common exemptions:

| California Property Tax Exemption | |

|

|

|

Senior citizens who buy a new home |

Citizens older than 55 can transfer the base-year value of their previous home to their new one if:

|

|

Disaster relief |

Individuals whose home has been destroyed or damaged by a natural disaster can have the property tax rate reduced until their home is repaired |

|

Family transfer |

People who obtain their property from parents or children will not face a full home value assessment |

Don’t Miss: Have My Taxes Been Accepted

How Much Is Property Tax In California

In the modern civilized world, taxes are something weve all heard about and most likely paid. Income taxes, sales taxes, excise taxesThere are all sorts of taxes one has to pay. Many people focus on income taxes that are paid to their federal and state governments but the truth is property taxes make up a large portion of the overall tax bill for many California taxpayers. A lot of local governments in California such as K-12 schools, counties, and community colleges get the base for their budget from revenue from property tax bills.

Property taxes play a huge rule in Californias finance but many elements of this system are quite complex and unknown to the public. This is why in this article were going to explain some important things about property taxes, such as how much is property tax in California, when are California property taxes due, what does the property tax bill include, and many more.

Whats on the property tax bill in California?

A lot of the taxpayers money goes on property bills so its good to know what the bill actually includes. The ordinary California property tax bill consists of five levies:

Additional taxes that pay for the local voter-approved debt. Just like the 1 percent tax, its ad valorem this means its based on the assessment for the propertys value. Together, the 1 percent rate and the voter-approved debt rates comprise around 90 percent of the revenue from property tax bills in California.

Other Essential Property Tax Trends

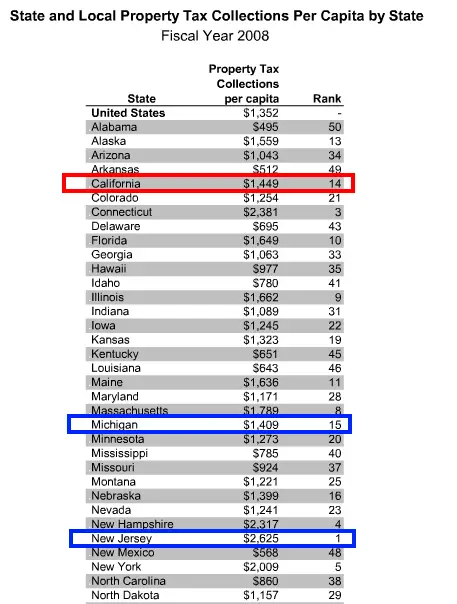

Besides our list of property taxes by state, we also analyzed a few other essential trends associated with this type of tax. In the section below, we will go over the importance and effects of property tax in each state. Learn how vital of an income source this tax is as well as what percentage of personal income it represents.

Before we move on, however, lets first see the stats for the USA as a country. The state property tax contributes 30.08% towards the overall income. The total property tax as a percentage of state-local revenue is 16.93%, while the property tax percentage of personal income stands at 3.12%. Finally, the per-capita property tax in the US is $1,618.Scroll down to find all about these vital property taxes by state segments.

Don’t Miss: When Do You Do Tax Returns

When Do Secured Property Taxes Become Delinquent

Secured property taxes officially become delinquent when the first installment is paid later than 5:00 p.m. on December 10th, or when the second installment is paid later than 5:00 p.m. on April 10 of the following year. For the purposes of exact designation, the county and the BOE also considers a property tax bill paid on time if it is mailed out and postmarked before these dates, too. What this means is that you can mail a check at the very last minute and still qualify as having paid on time with no penalty fees.

However, its important to note that you shouldnt leave your property taxes to the very last minute unless its absolutely necessary. Mailing a check on deadline day may force you to become delinquent simply because USPS doesnt process the letter through their system on time, and that can lead to big-time fees.

More Nifty Features That’ll Make Your Day

You may not have breach of privacy issues or reasons to bring someone to court, but you surely have ample motivation to save or earn a few dollars here and thereespecially if we catch you unawares!

DoNotPay can show you how toreclaim funds that you didn’t know were under your name or make adenied warranty appeal to any company. We streamlined the processes of requestingrefunds,college fee waivers,airline flight compensation,parking infraction dismissals, as well as applying toclinical trials that pay!

Also Check: Is Donating Plasma Taxable

Calculating Property Taxes In California

California Property Tax Calculator

Californias overall property taxes are below the national average. The average effective property tax rate in California is 0.79%, compared with a national average of 1.19%.

The California Property Tax Calculator provides a free online calculation of ones property tax. Simply type in the propertys zip code and select the assessed home value. Instant results include the Average Tax Rate Percentage and the annual Property Tax. Also includes the average property tax rate in the specific county, the State of California, and nationally.

San Diego County

The San Diego County Treasurer Tax Collector website provides an online payment system for property owners to determine their property tax and pay their tax bill online.

Property owners can easily search their tax bill by inputting their mailing address, parcel/bill number, or unsecured bill number. Then, they view the bill and select the installment and add it to their shopping cart for payment.

In addition, the San Diego County Tax Collector site provides a link to a private vendor called ParcelQuest which provides free information from the San Diego County Assessors Office.

Los Angeles County

The Los Angeles County Assessor provides useful information explaining California property taxes on its website.

In addition, their website provides a Supplemental Tax Estimatorcalculatorfor Los Angeles County property owners. This provides estimated taxes for a recently purchased property.

How To Avoid Late Payments On Your Property Taxes

In order to avoid late penalties , its important to factor in your property taxes throughout the course of the year so the bill doesnt come as a sudden and significant surprise.

One strategy is to divide up your estimated taxes for the year by 12, and budget the monthly amount into your savings. That way the money will be set aside and ready to go when you need to pay your bill.

Impound accounts are another way to ensure your property taxes get paid on time.

Also Check: Pastyeartax.com Reviews