Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

Special 2021 Rules For Hurricane Ida Victims

The IRS announced on Aug. 31, 2021 that filing extensions have been provided for certain victims of Hurricane Ida. Residents of Louisiana have until Jan. 3, 2022 to file any returns or make estimated tax payments that would have been due on or after Aug. 26, 2021.

Some residents of New York and New Jersey have received the same extension. This extension applies to those who live in areas designated by the Federal Emergency Management Agency . You can search to see if your zip code qualifies at DisasterAssistance.gov.

Residents of all 82 Mississippi counties and the Mississippi Choctaw Indian Reservation have until Nov. 1, 2021 to file any returns or make any payments that were due beginning Aug. 28, 2021.

Free Federal Tax Filing Services

The IRS offers free services to help you with your federal tax return. Free File is a service available through the IRS that offers free federal tax preparation and e-file options for all taxpayers. Free File is available in English and Spanish. To learn more about Free File and your free filing options, visit www.irs.gov/uac/free-file-do-your-federal-taxes-for-free.

You May Like: How To Correct State Tax Return

Why Do I Owe So Much In Taxes What Can I Do About It

While some taxpayers prefer to have more in their paycheck vs. receiving a refund, many of us look forward to getting money back at tax time.

- If you owe taxes this year and hoped for a refund instead, you can update your withholding. Its likely that youll owe again next year unless you complete a new Form W-4 and increase your withholding. The sooner in the year you submit this change to your employer, the sooner your new withholding will take effect on your paycheck. We can help you understand how to fill out a new Form W-4. Plus, our W-4 calculator is a great resource.

- If you owe the IRS money and cant pay, there are options. We can help you understand how you can pay back taxes if your tax bill is too much to pay right now. H& R Block specializes in helping taxpayers in this situation and our tax pros can explain the steps to take.

Back Up What Exactly Is Gross Income

Its all the money youve made in the tax year. For most people, that mainly includes earned income from your salary, wages, tips or bonuses. It also includes unearned income, like dividends and accrued interest, as well as any gambling winnings. It does not include tax-exempt income, such as child support payments, most alimony payments, workers comp, and more.

Gross income should not be confused with your adjusted gross income or your taxable income. You can determine your AGI by taking your gross income and subtracting certain deductions, including contributions to a traditional IRA, 401 and other qualified retirement plans, interest paid on student loans and contributions to a health savings account. Taxable income is your AGI minus your standard deduction or any itemized deductions you claim.

So if my gross income falls below those minimums, I dont have to file a tax return? Correct. But it might be a good idea to file anyway. Thats because you may qualify for certain tax credits and get a little extra cash from Uncle Sam, even if you owe nothing.

Recommended Reading: Can You File Missouri State Taxes Online

How Do I Know If I Owe The Irs Back Taxes And How Much

There are four ways to know if you owe the IRS money.

If you owe back taxes, ignoring letters doesn’t make the IRS, or your tax debt go away. In fact, it can make things worse. Just like any other collections agency, expect letters and additional fees until the issue is resolved. As a government entity, the IRS can also garnish wages, put a lien on your property, and keep future refunds.

Don’t expect to wait them out: The IRS rarely forgives debts and has 10 years to collect them before they are written off. This is known as a Collection Statute Expiration Date . Usually, once that date is passed, the IRS has no choice but to forgo your debt. But beware, there are exceptions: The CSED can be extended through various means, such as entering into an installment agreement, having property seized, or entering a period of non-collectability.

Nearing your CSED date? You may qualify for a partial reduction of your debt by either submitting partial payment installment agreement or an offer in compromise.

How Much Do I Have To Make To Owe Taxes

The upside of having to pay taxes? It means you make enough money to have Uncle Sam want a cut. Congratulations!

The Internal Revenue Service sets a minimum income on which it will collect taxes. Unfortunately, its not a simple one-size-fits-all threshold. In general, how much you can make in a year before you face a tax bill depends on a few factors: your filing status, your age, and whether youre being claimed as a dependent.

Don’t Miss: Www.1040paytax.com Official Site

How Does Tax Reform Impact Withholding

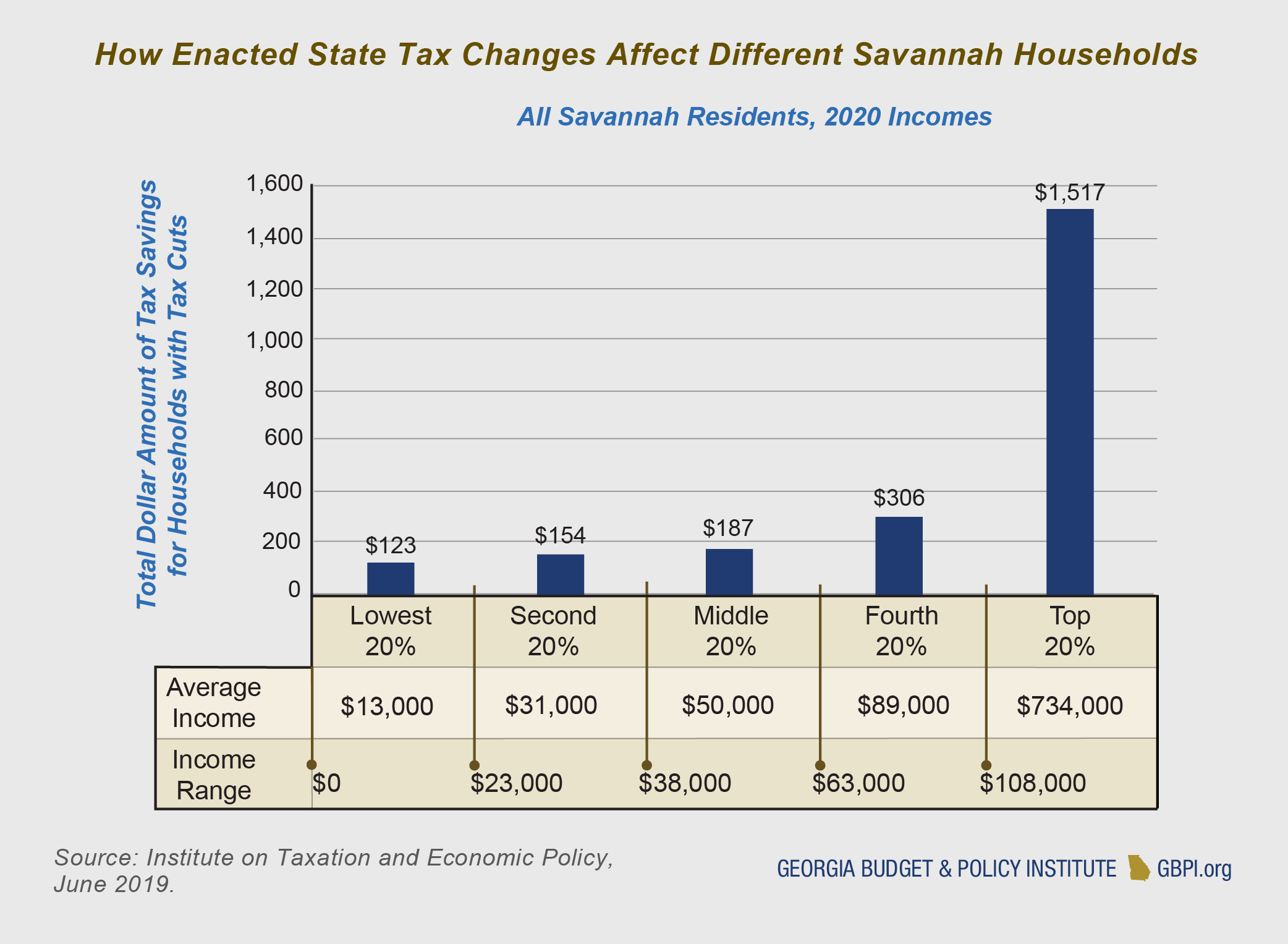

Changes in tax law can impact how much you owe the federal government each year. While minor changes happen frequently, the Tax Cuts and Jobs Act of 2017 brought significant changes for both individuals and businesses.

One of the major changes for individuals is that standard deductions have become much higher. On the flip side, the Tax Cuts and Jobs Act also eliminated personal exemptions. IRS rules also impact claiming your boyfriend or girlfriend as a dependent in some situations.

Many people are disenchanted with the current tax system: Only 18% of respondents in a recent GOBankingRates survey believe that their taxes are being spent effectively. This frustration may end up affecting tax policy so it wouldnt hurt to pay attention to tax reform measures and to cast your ballot in the next election.

How To Check The Status Of Your Coronavirus Stimulus Check

If you’re trying to find out the status of your coronavirus stimulus payment, go to the IRS’s Get My Payment page. You can learn whether your payment has been issued, and if it’s coming by direct deposit or mailed check.

Learn more about the stimulus payments, including whether you qualify for one and what, if anything, you may have to do to get yours.

You May Like: How To Buy Tax Lien Properties In California

If You Cannot Pay In Full

If you are not able to pay the full amount:

- file on time to avoid paying a late-filing penalty

- make a partial payment to reduce the amount of interest you need to pay on unpaid amounts

You can set up a payment arrangement to give yourself more time and flexibility to repay what you owe. For details: Arrange to pay your personal debt over time

If you are unable to pay, you can discuss your options with the CRA.

Tips For Financial Planning

- Consider talking to a financial advisor about the best ways to manage your state and federal tax filing to avoid a large tax bill. If you dont have a financial advisor yet, finding one doesnt have to be complicated. SmartAssets financial advisor matching tool makes it easy to find professional advisors in your local area in minutes. Youll just need to answer a few brief questions to get your personalized recommendations. If youre ready, get started now.

-

Use SmartAssets tax return calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance due amount.

Also Check: Do I Need W2 To File Taxes

How Long Do You Have To Pay If You Owe Back Taxes

This can vary from making at least a partial payment now to up to 72 months to pay off your taxes in installments. To better understand your options and the implications, there are ways to take action.

The IRS phone number can be found in the top right-hand corner of the notice or letter. Typically, you only need to contact the IRS if you dont agree with the information, if they requested additional information, or if you have a balance due.

Information Needed For Your Federal Income Tax Return

Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. The 1099-G form provides information you need to report your benefits. Use the information from the form, but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS. You can file your federal tax return without a 1099-G form, as explained below in Filing Your Return Without Your 1099-G.

A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you, including:

- Unemployment benefits

- Federal income tax withheld from unemployment benefits, if any

- Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments

Don’t Miss: How Can I Make Payments For My Taxes

Common Reasons Why You Might Owe Taxes This Year

Although most types of income are taxed, there are several reasons why you might owe the Internal Revenue Service, despite having money withheld from your paycheck all year. Explore some of the most common explanations for owing taxes and how you can avoid making underpayments in the future. Plus, find out what to do if your tax bill is exceptionally large and what payment options you have to get yourself out of tax debt with the IRS.

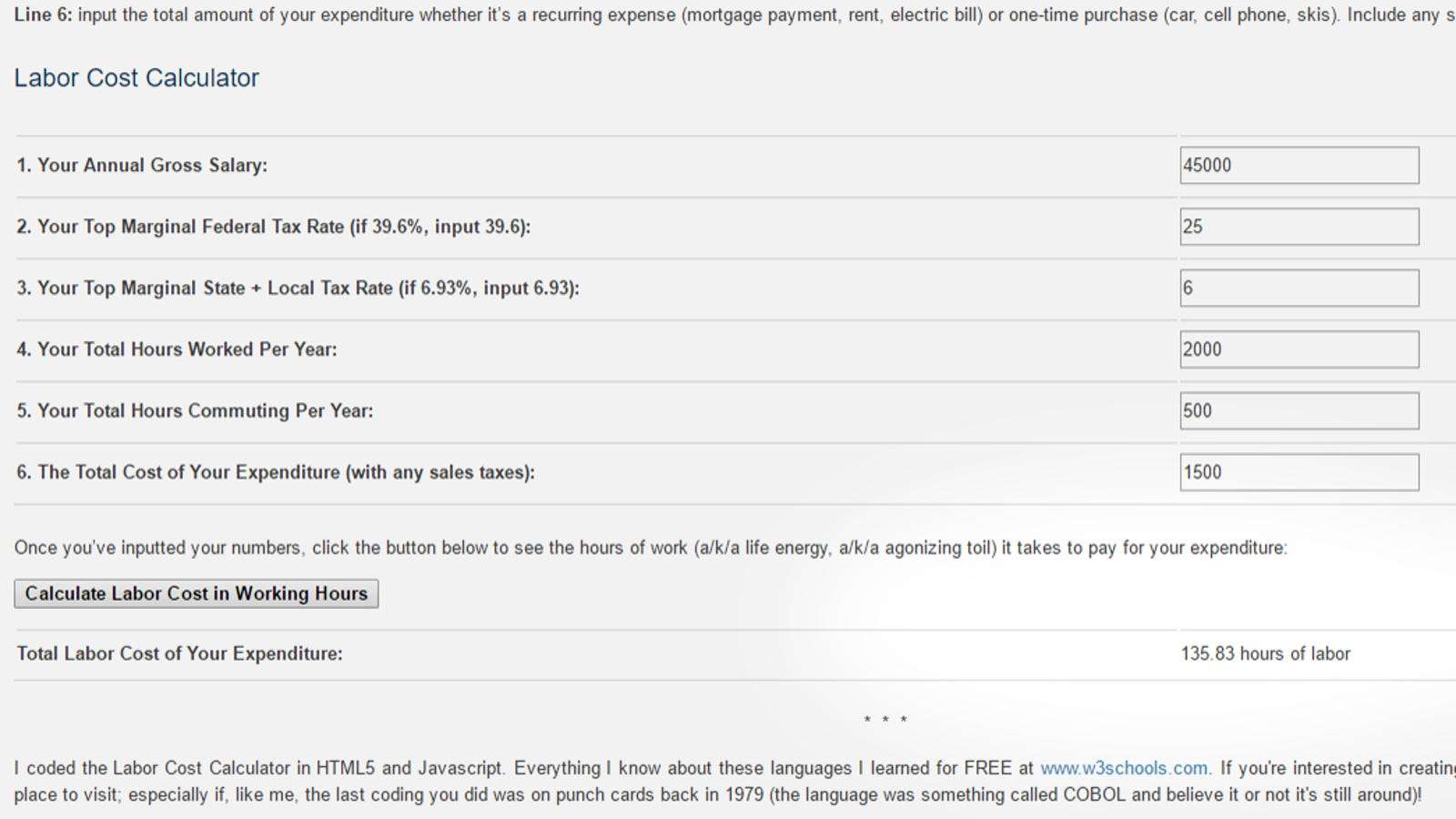

Use The Irss Withholding Calculator

The IRS also provides a withholding calculator that has been updated for 2018. It asks you to enter your filing status, dependency status, job transitions, which credits you plan to take and their amounts, income, tax withholding, and amount of itemized deductions .

This calculator is much more thorough than my simple spreadsheet above. If you have a complicated tax return, this is the more appropriate calculator to use to determine how much money you should set aside for federal income tax payments.

If you have a complicate financial life , you should use either Form 1040-ES or the IRS calculator to help you determine how much money to set aside for tax from each paycheck because they take into account many of the elements that will be present on your yearly federal tax return. If you are a single-income household and have a simple financial life, my spreadsheet will get you the answer of how much money to self-withhold from each of your fellowship paychecks faster.

Whichever way you do the calculation, be sure to follow through on setting up your automated self-tax withholding. Its the next best solution to having tax automatically withheld from your income by your university!

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

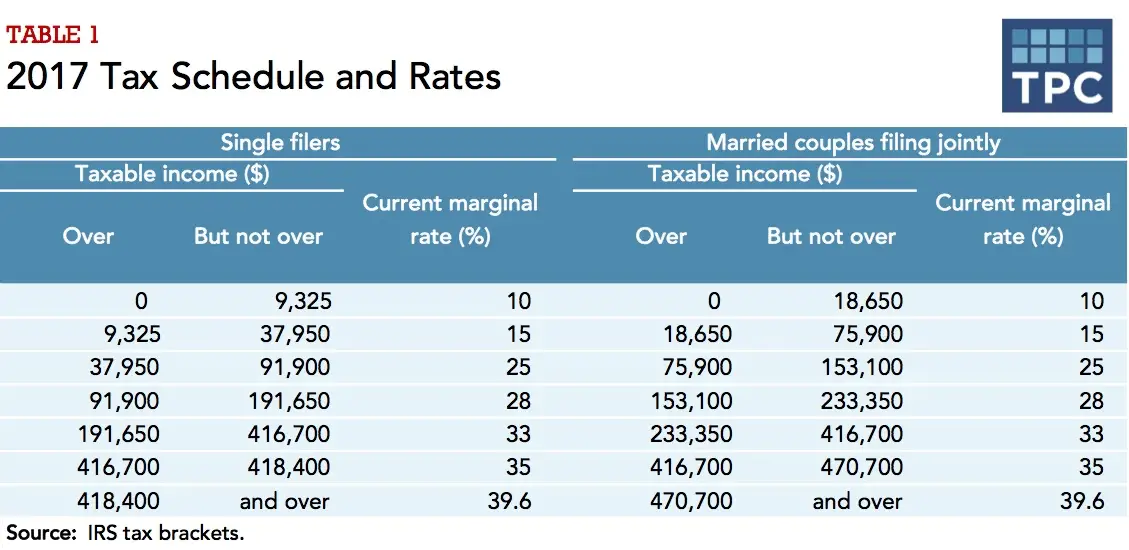

How The Calculation Works For A Single Taxpayer

One notable thing about this kind of tax setup is that the amount of taxes owed by someone steadily increases as that person’s amount of income increases. It’s not a monumental change when people jump from one tax bracket to another.

Answers to your tax questions

Let’s run through how this would work for an imaginary person calculating taxes for 2020: John, who earns $40,000. To keep it simple, let’s say he makes all his money from his work salary, has no dependents, and no itemized deductions.

For his 2020 taxes, John would subtract the standard deduction and take zero personal exemptions, since they were eliminated with the GOP tax law

That makes his taxable income $27,600, putting him in both the 10% and 12% tax brackets.

Here’s how to estimate how much he would owe in taxes:

Pay As Quickly As Possible

If you owe tax that may be subject to penalties and interest, dont wait until the filing deadline to file your return.

Send an estimated tax payment or file early and pay the IRS as much tax as you can.

Even if you choose to file an extension, any taxes owed are still due on the filing deadline. Therefore, if you dont pay by April 15, you are subject to those extra penalties and fees.

You May Like: How To File Taxes Without Income To Get Stimulus Check

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

How Will I Know Why I Owe The Irs

Youve now read the answer to why do I owe money on my tax return? and more specifically, why do I owe taxes for 2020 returns?

As part of our commitment to keeping you informed, H& R Block is here to help you understand what could affect your refund or if youll owe tax.

- If you use our online tax filing options, youll be able to see your refund results in real time. Plus, we explain why your results move up or down.

- If you visit one of our tax offices, your tax pro can walk you through each credit and deduction to explain how it affects your refund.

Related Topics

Learn more about tax filing requirements and tax filing information with the experts at H& R Block.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

What Is Withholding Tax

To understand why you owe taxes this year, you need to know how income tax works. Most working Americans pay taxes to the federal government and their state government on their earnings each year. From a federal perspective, withholding tax is the amount taken out of your paycheck and paid directly to the government before you even see it. In most cases, youll pay a withholding tax for your state taxes as well, although there are a few states that dont charge income tax.

Read: What Happened To These Real People Who Didnt Pay Taxes

Your employer will base the withholding amount on how much money you earn, as well as other important details you provide on your Form W-4. If you dont fill out this form correctly, you could have too little taken out of your paycheck each pay period, ultimately resulting in underpaying your taxes.

How Do I Calculate Estimated Taxes For My Business

Lots of business owners get caught with tax surprises at startup or when they begin to make a profit. The surprise comes because they don’t realize they must pay estimated taxes on their business income.

Learn how to do a quick general calculation to find out how much you might have to pay in estimated taxes and when you are required to file.

If your business is in Texas or another area where FEMA issued a disaster declaration due to winter storms in 2021, the IRS has extended the filing and payment deadlines for estimated taxes April 15, 2021, to June 15, 2021.

Read Also: Buying Tax Liens In California

What Happens If I Dont File My State Taxes

Not filing state taxes when one is required to do so may result in numerous charges and penalties. A taxpayer may face interest charges on the amount owed, late payment penalties, and late filing penalties.

Generally, if one doesnt owe additional state taxes more than the amount he or she paid through withholding and estimated taxes, then that person wont face penalties.

The rules for filing state taxes may vary from state to state. As such, its best to learn all about state rules when it comes to filing state taxes not only to avoid fees and penalties, but also to take advantage of refunds you may be qualified for.

Do you have other questions about filing state taxes? Ask us in the comments section below!

If you owe back taxes, visit taxreliefcenter.org for more information on tax relief options.

Up Next:

Do I Have To Claim The Credits

No, you never have to take advantage of tax breaks, but why wouldnt you? Yes, filing taxes can be an intimidating hassle. But it can be well worth it. And taking advantage of any available tax breaks while minimizing your tax bill is a smart way to give yourself a financial boost.

Acorns does not provide legal or tax advice. Please consult your tax and/or legal counsel for specific tax or legal questions and concerns.

Stacy Rapacon is a freelance writer, specialized in personal-finance topics including investing, retirement, and smart spending. Her work can also be found on Kiplinger.com, U.S. News and World Report, CNBC, and other publications.

You May Like: Form 1040 State Tax Refund