Irs Free File Program Delivered By Taxslayer

- 72k AGI or Less and Age 51 years old or younger

- OR qualify for EITC

Website URL

Intuit TurboTax is proud to sponsor IRS Free File Program delivered by TurboTax, donating free Federal and State tax returns nationwide for:

Taxpayers with Adjusted Gross Income of $39,000 or less

Active Duty Military with Adjusted Gross Income of $72,000 or less

Taxpayers eligible for the Earned Income Tax Credit

Accuracy & Simplicity: Download your W2 and transfer prior year TurboTax data

Qualified taxpayers can prepare and e-file their federal and state return online for FREE, with America’s #1 best-selling tax preparation product year after year.”

More Common Types Of Deductions

Moving expenses

You may be able to claim certain moving expenses you paid in the year if both of the following apply:

- you moved to work or to run a business, or you moved to study as a full-time student enrolled in a post-secondary program at a university, college or other educational institution

- you moved at least 40 kilometres closer to your new work or school

If you are using certified tax software, it may ask if you have any moving expenses. The software may also ask you about your move or your expenses to confirm you are eligible for the deduction. It will then calculate your deduction and enter it on the correct line.

Resources are available

After you finish this lesson, this resource link will be available:

- Moving expenses

Test yourself

Sorry, that’s incorrect.

Sebastien did not move at least 40 kilometres closer to his new school, so he cannot claim his moving expenses as a deduction.

That’s correct.

Answer: “No”

Sebastien did not move at least 40 kilometres closer to his new school, so he cannot claim his moving expenses as a deduction.

Other payments deduction

You should calculate the other payments deduction for the following types of non-taxable income:

- workers’ compensation benefits

- social assistance payments

- net federal supplements

Northern residents deductions

The northern residents deductions consists of two parts:

- a residency deduction

- a deduction for travel benefits you received from your employer

Resources are available

- Northern residents deductions

Do Not Forget Deductions

When filing your annual tax returns, one thing that you should always remember is to include deductions. This means that if there are any expenses that were incurred in the course of running your business , be sure to add them up and deduct them from your total income so as not to pay for it twice.

Keep all the paperwork that you have used to claim any deductions for donations or charitable donations they are issued to you. Also, download a copy of all your information slips when you receive them from your employer, financial institution, broker, or other sources.

Also Check: Efstatus.taxact 2014

How To Search For A Provider

This interactive search allows you to enter the either your full 5 digit zip code, or select your state.

Search results will be sorted in alphabetical order by the business name. Use the arrow at the bottom right of the page to advance to the next page.

Note: The inclusion in this database does not constitute any endorsement by the IRS of the e-file Providers listed in this database or any of the products or services that they provide. You should always be sure to conduct your own due diligence when selecting an e-file Provider.

Types Of Tax Credits And Benefits

There are two types of tax credits:

Benefits can help with various living expenses, such as raising children, housing, loss of income and medical expenses.

Read the Canada Revenue Agencys General Income Tax and Benefit Guide and Forms Book to learn more about which tax credits you can claim.

With the Ontario Child Care Tax Credit, you could get back up to 75% of your eligible child care expenses. It applies to eligible child care options, including care in centres, homes and camps.

The Low-Income Workers Tax Credit provides up to $850 each year in Ontario personal income tax relief to low-income workers, including those earning minimum wage.

Read Also: Amended Tax Return Online Free

How And When To File Your Tax Return

Learn how to fill out your return using tax preparation software or on paper.

The deadline for filing personal income tax returns and paying outstanding income tax is . After April 30, penalties and interest start to apply to any outstanding balance owed.

If you are self-employed or filing for someone who has passed away, please see the CRAs website for filing deadlines.

If I’m Getting A Tax Refund When Can I Expect To Receive It

E-filing will deliver your tax refund much faster than traditional mail. Taxpayers using TurboTax and electing to have their refunds deposited directly into their bank accounts will get their fastest refunds possible.

Refunds from tax returns filed on paper can take up to six weeks, depending on the time of year you file your tax return.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

Read Also: How To Get Stimulus Check 2021 Without Filing Taxes

Calculating Your Provincial Or Territorial Tax

Youll do a similar calculation to figure out the provincial or territorial taxes you might owe. The tax rates and income tax brackets are different from one province or territory to another.

Current provincial and territorial tax rates and income tax brackets

Provincial and territorial tax rates

| Quebec | You can view the provincial tax rates for Quebec on the Revenu Québec web site. |

Resources are available

After you finish this lesson, these resource links will be available:

- Provincial and territorial tax and credits

- Income tax rates for Revenu Québec

Take Advantage Of Templates

A template can be very helpful in this situation because it allows you to customize it based on your needs. You can download a 1099 template to ensure that you do not miss any detail, and it also makes the process easier as you will have a guideline to refer to as well as an organized list of items to include in your tax return filing.

A tax template does not require any special software or knowledge so you can easily use it to file your taxes. The most important part of the template is the tables, which include all the information that you need to include in filing your tax returns. This includes deductions, income, personal details, and other items. You can refer to these tables when completing your return.

Read Also: Tax Lien Investing California

Why Provide Information About Yourself

When you fill out your income tax and benefit return , you must provide personal information so the Canada Revenue Agency can identify you and accurately calculate the benefits and credits you may be entitled to.

- Income tax and benefit return

This is Step 1 in filling out your tax return.

The CRA uses the information you provide in Step 1 of your tax return to send you important mail and to calculate certain benefits. Incorrect or incomplete information can cause delays or inaccurate calculations, so it is important to provide the information to the best of your knowledge.

The CRA ensures your information is kept confidential.

You cannot update certain personal information on file with the CRA, such as your address or name, by entering the new information into the certified tax software. Be sure to update this information with the CRA before you use the software.

You may be able to update this information using My Account. By registering for My Account, you can have access to helpful services to complete your tax return more easily.

You can also contact the CRA to make changes to your personal information.

After you finish this lesson, these resource links will be available:

- Updating your personal information

Will My Tax Return Data Be Kept Confidential

Yes. You’ve got no worries about data falling into the wrong hands or being misused because the IRS, the states and tax preparers are under the same rules of confidentiality for e-filed returns as they are for paper returns. They may not reveal or discuss any information contained in your return unless you authorize them to do so. Tax software developers also must operate under these rules, and they must protect customer confidentiality during the e-filing process. To ensure the integrity of your electronically filed tax return, always use only proven, high-quality e-filing software.

You May Like: How To Correct State Tax Return

Netfile Your Own Return

Netfile is CRAs electronic tax return filing system for the general public, but it has some restrictions. Not everyone is eligible to use Netfile. For example, Netfile does not accept returns from non-residents. If you are eligible, however, you can use approved tax software to prepare your personal return and file it using this service.

Netfile also does not accept amended returns, you would need to use the Refile system to submit those.

Your Online Efile Account

Use your EFILE number and password to:

- Maintain your account

Note: For an electronic record to be deemed a return of income filed with the Minister in prescribed form:

-

a confirmation number must be generated by the EFILE web service.

All returns filed with the Canada Revenue Agency are processed in cycles. Accepted returns are entered in the next available cycle. Cycle processing usually begins in mid-February and Notices of Assessment for returns processed in the first cycle should be issued by the end of that month.

Also Check: Buying Tax Liens California

Common Amounts Included In Your Total Credits

Total income tax deducted

This amount represents the total income tax deducted directly from any of your sources of income. The most common example of this is the income tax your employer takes off of your pay. It is shown on your information slips, such as in box 22 of your T4 slip.

- T4 slip

If you are using certified tax software, you enter the amount shown on all of your information slips, and the software will automatically enter the total on the correct line.

Canada Pension Plan overpayment

This is an amount you can claim if you contributed more to the CPP than you had to during the year. This might happen if you worked for more than one employer during the year or if your employer deducted CPP contributions when you were under 18 years of age, when you were not required to contribute.

Certified tax software will automatically calculate how much you should have contributed to the CPP based on your income and give you a credit for any overpayment.

If you were a resident of Quebec on December 31 of the tax year, and you contributed only to the QPP, claim an overpayment on your provincial income tax return for Québec.

Employment insurance overpayment

You can claim this amount if you contributed more to EI than you had to for the year. This might happen if you worked for more than one employer during the year.

Certified tax software will automatically calculate how much you should have contributed to EI based on your income and give you a credit for any overpayment.

Calculating Your Net Federal Tax

The next step is to calculate your non-refundable tax credits. You will then subtract your federal non-refundable tax credits from the total taxes you calculated on your income. The result of this calculation is your net federal tax.

Basic personal amount

The first federal non-refundable tax credit is the basic personal amount. The basic federal personal amount is $13,808 for the 2021 tax year. In general, anyone with a taxable income below this amount does not have to pay federal income tax.

Example: The basic personal amount

The federal taxes Giovanni calculated on his income will be completely eliminated, because he had taxable income of less than $13,808.

The non-refundable tax credit rate

Your non-refundable tax credits are also multiplied by a nonrefundable tax credit rate. This means that you do not apply the full value of your non-refundable tax credits against the taxes you owe on your income. A percentage, pre-determined by the government, lowers the taxes you owe on your income.

Test yourself

That’s correct.

Answer: “$3,000”

The tax calculated on Marias income will be reduced by a percentage of her non-refundable tax credits. This amount is calculated like this:

- $20,000 ×multiplied by 15% =equals $3,000

Sorry, that’s incorrect.

The tax calculated on Maria’s income will be reduced by a percentage of her non-refundable tax credits. This amount is calculated like this:

- $20,000 ×multiplied by 15% =equals $3,000

Also Check: Does Contributing To Roth Ira Reduce Taxes

Providing Your Date Of Birth Language Of Correspondence And Email Address

Date of birth

You must provide your complete date of birth. The CRA uses your date of birth to check your identity.

The CRA must have your complete date of birth on record for you to submit your return electronically. You can contact the CRA to confirm what information is on file before doing your taxes electronically.

Language of correspondence

You must choose either English or French. The CRA communicates with you in the official language of your choice.

Email address

Enter your email address if you would like to receive some of your CRA mail electronically through My Account instead of by regular mail. If you choose this option, the CRA will email you to tell you when correspondence is waiting for you in your My Account.

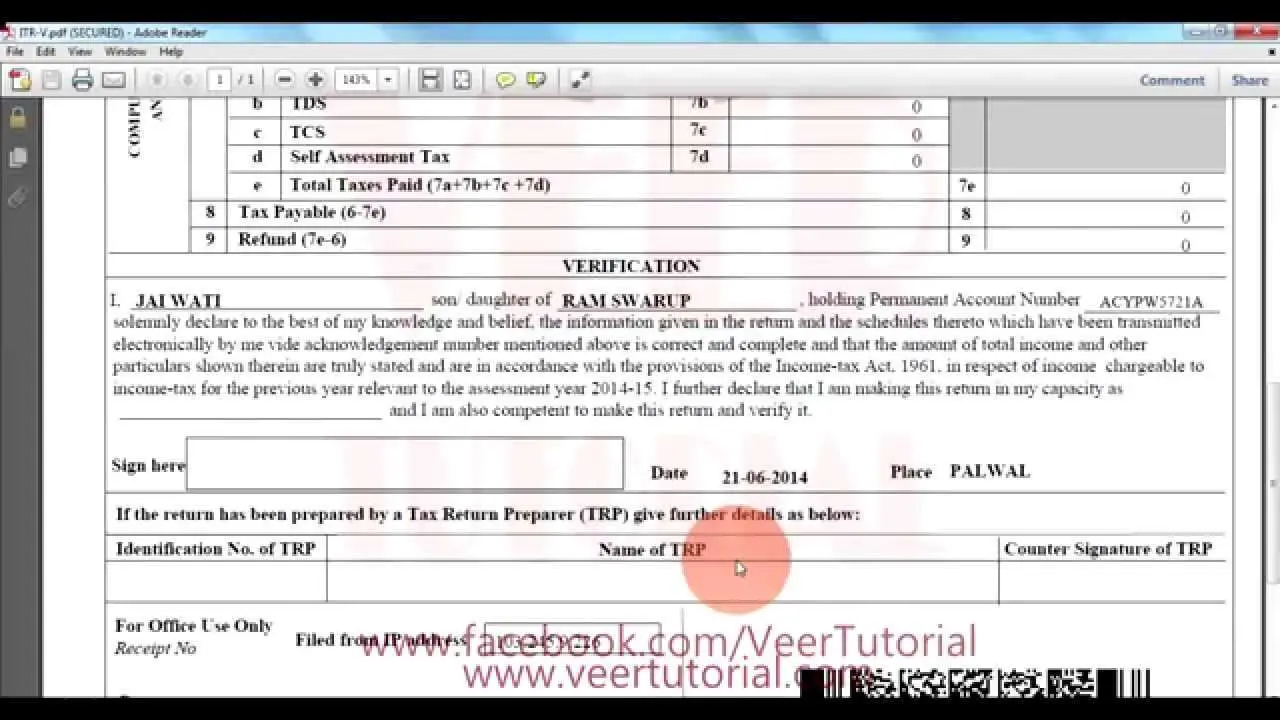

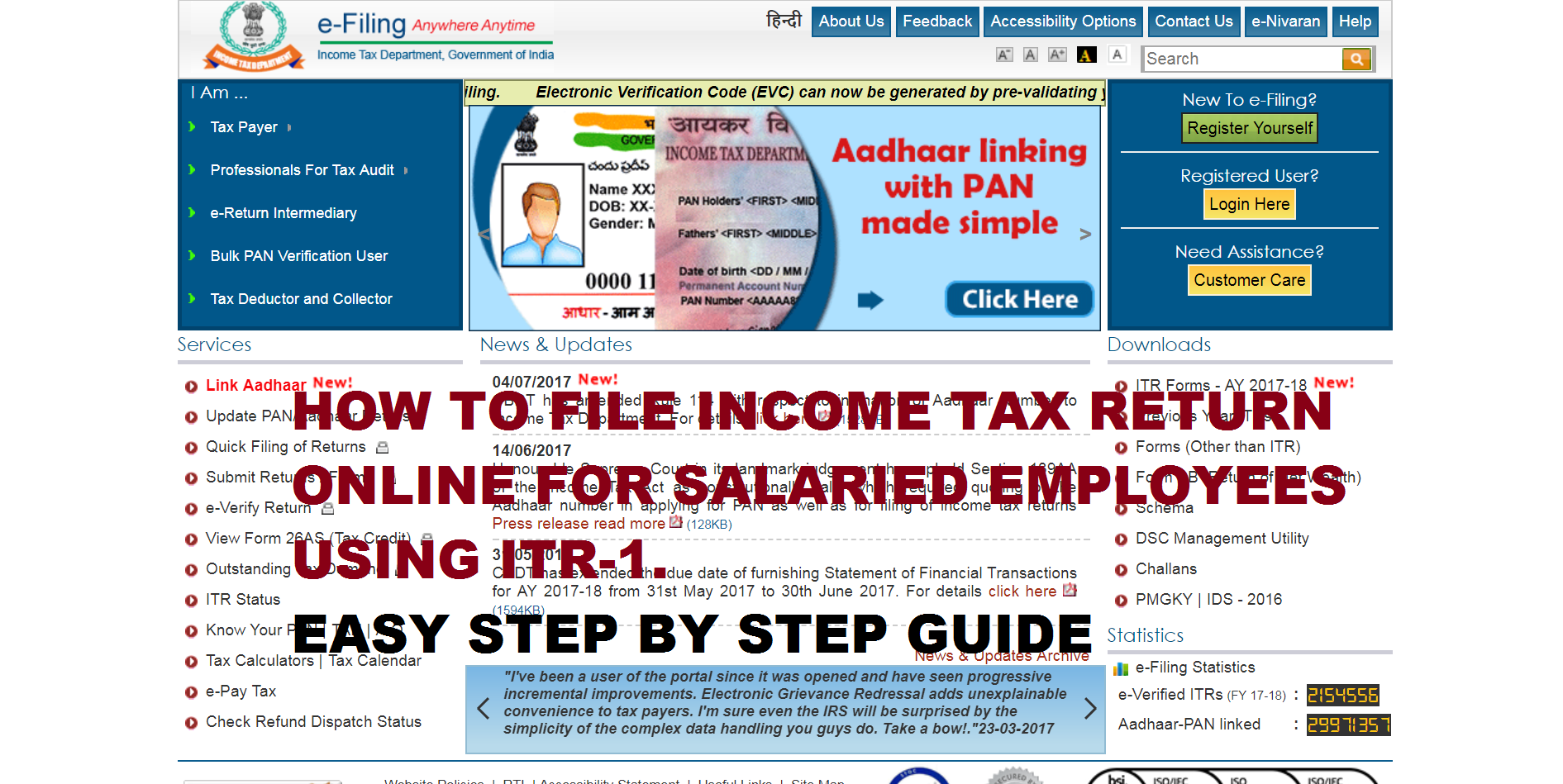

A Step By Step Guide On How To E

Calculate your income tax liability as per the provisions of the income tax laws. Use your Form 26AS to summarise your TDS payment for all the 4 quarters of the assessment year. On the basis of the definition provided by the Income Tax Department for each ITR form, determine the category that you fall under and choose an ITR form accordingly.

Follow the steps mentioned below to e-file your income tax returns using the Income tax e filing portal:

Step 1: Visit the official Income Tax e-filing website and Click on the Login button.

Step 2: Next, Enter Username then Click continue and After enter your Password.

Step 3: Once you have logged into the portal, click on the tab e-file and then click on File Income Tax Return.

Step 4: Select the Assessment year for which you wish to file your income tax returns and click on Continue.

Step 5: You will then be asked whether you wish to file your returns online or offline. In this case you need to choose the former which is also the recommended mode of tax filing.

Step 6: Choose whether you wish to file your income tax returns as an individual, Hindu Undivided Family , or others. Choose the option individual.

Step 7: Choose the income tax returns you wish to file. For example, ITR 2 can be filed by individuals and HUFs who dont have income from business or profession. Similarly, in case of an individual, they can choose the option ITR1 or ITR4. Here you will have to click Proceed with ITR1.

Also Check: Have My Taxes Been Accepted

Providing Your Province Or Territory Of Residence

You must indicate your province or territory of residence on December 31 of the tax year for which you are filing a return. This is usually the province or territory where you were living, but it may be different if you were living away from your usual home.

- Tax year

Your province or territory of residence determines what benefits and credits are available to you and what provincial or territorial tax rate you are subject to, as these are decided by the provinces and territories. If you are using certified tax software, the software will fill out the appropriate forms and schedules for your province or territory of residence based on information you enter as you complete your return.

- Schedules

Example: Living away from your usual home

Lucy usually resides in Nova Scotia but was going to school in Alberta. They should indicate that their province of residence was Nova Scotia.

Filing Your Own Return

You can use commercial software to complete your income tax return and file it online using the integrated NetFile Québec feature.

When you file your income tax return online, do not send us any paper copies of the return.

When can I file my income tax return using NetFile Québec?

2020 income tax return

- You can file your 2020 income tax return as of February 22, 2021.

Returns from previous years

- You can file your original 2017, 2018 and 2019 income tax returns in the four-year period following the taxation year covered by the return .

- If you did not file an income tax return for 2017, 2018 or 2019 taxation year, and we sent you a notice of assessment for the year covered by the return, you cannot file an original return using authorized software. You have to mail the return to us.

Amended income tax returns

- You can file an amended 2017, 2018 or 2019 income tax return as of February 22, 2021.

You May Like: When Do You Do Tax Returns

Types Of Taxable Income

You have to report any taxable income you earn inside and outside Canada when you file your tax return. This includes:

- any full-time or part-time work

- self-generated income

- rental income, including renting out a portion of your home

- investments

- your pension

You do not have to report certain non-taxable amounts as income, including:

- allowances

- elementary, secondary and post-secondary school scholarships