How Do I Know Which Forms To Use

There are both federal and provincial/territorial TD1 forms and worksheets. And you should complete one for each employer or pension plan you may have administered.

Everyone should fill out a Federal TD1 form. In addition

- Employees who claim more than the Basic Personal Amount have to complete the provincial/territorial TD1 form of their province/territory of employment.

- Pensioners who claim more than the basic personal exemption must complete the provincial/territorial TD1 form of their province/territory of residence.

You can find the provincial/territorial forms and worksheets here.

What Is A T4a Form

The T4A is an official document for tax purposes. It provides the amount of funds a student has received in scholarships, bursaries, awards and prizes from January to December in any given year.

The tax form for the current tax year will be available for printing at goSFU in late February of the next year.

For more information on filing your income tax return, please go to www.canada.ca/en/revenue-agency/services/forms-publications/publications/p105/p105-students-income-tax-2016.html.

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

Read Also: How Can I Make Payments For My Taxes

Consider Filing Online To Avoid Delays

Due to COVID-19, the CRA may take 10 to 12 weeks to process paper returns. The CRA will process them in the order they are received.

If you choose to file by paper, file as early as you can to avoid any interruptions to any benefit and credit payments.

COVID-19 may cause delays in processing paper returns, and processing changes to your return, as well as delivering notices of assessment and cheques in the mail. The CRA will process paper returns and any changes requested in the order it receives them.

Since these delays do not impact the processing of electronic returns, the CRA encourages you to file your 2020 return or any adjustments online. This will help you get any refund faster and avoid interruptions to any benefit and credit payments. If you are registered for direct deposit, you will receive your payments without delay.

You can file as early as February 22, 2021 with NETFILE. The CRA has a list of NETFILE certified tax preparation software to help you with your taxes, some of which are free. You may also be able to make online changes to your T1 tax return using the ReFILE service directly from your EFILE or NETFILE certified tax preparation software, or with our Change my return service available in My Account.

Filing online is fast, easy, and convenient.

Visit the Get Ready webpage for tax tips, to see what you need to know before you file your taxes, and to learn about deadlines, new benefits and credits, and other helpful tax-filing information.

Need Help With Your Taxes Or Have Tax Questions

If you have a modest income and a simple tax situation, a volunteer may be able to do your taxes for free through the Community Volunteer Income Tax Program. This year, volunteers may be able to complete and file your taxes virtually by videoconference, by phone, or through a document drop-off arrangement.

To get answers to frequently asked questions about filing your taxes, go to canada.ca/cra-questions-answers.

Also Check: How Can I Make Payments For My Taxes

Tax Situations Requiring A Specific Return Or Form

There are exceptions, such as if you had residential ties in another place, where you would need a specific tax return.

You will also need to file a provincial income tax return for Quebec.

For details: What to do when someone has died

For details: Leaving Canada

Use the income tax package for the province or territory with your most important residential ties.

For example, if you usually live in Ontario, but were going to school in Quebec, use the income tax package for Ontario.

Factual resident

This may also apply to your spouse or common-law partner, dependant children, and other family members.

do not

You may be considered a deemed resident of Canada if you:

- do not have significant residential ties with Canada

- are not considered a resident of another country under a tax treaty between Canada and that country

Use the tax package for non-residents and deemed residents of Canada.

If you are not a factual resident of Canada, or a deemed resident of Canada, you may be considered a non-resident of Canada for tax purposes. Use the tax package for non-residents and deemed residents of Canada.

If you earned employment income or business income with a permanent establishment in a certain province or territory, complete the following instead:

Deadlines For Making Tax Forms Available To You

The IRS has established deadlines by which employers and financial institutions must mail you these forms or make them available electronically. Here are the deadlines for when youre supposed to receive some of the most common forms people need to file their 2020 tax returns.

- 1099-S, Proceeds from Real Estate Transactions Feb. 1

- Schedule K-1, Partner’s Share of Income, Deductions, Credits, etc. March 15

Recommended Reading: How Can I Make Payments For My Taxes

What Is A Td1

TD1, Personal Tax Credits Return, is a form used to determine the amount of tax to be deducted from an individual’s employment income or other income, such as pension income.

There are federal and provincial/territorial TD1 forms. Individuals complete the forms and give them to their employer or payer who should keep the completed forms with their records. Do not send us a copy.

Where Do I Find The Disability Tax Credit Form

The Disability Tax Credit Form that you need to complete can be and is called the Disability Tax Credit Certificate. There are two full pages of instructions to help you through and if you need additional assistance you can also call their 1-800 number for assistance. You are looking for Form T-2201 specifically, which is called t2201-12e.pdf on their website if youre having trouble finding it just do a simple Google search for Canada disability tax credit T-2201 form. It is available in E-text, Braille and large print versions as well. If you prefer, you can order printed copies.

Recommended Reading: File Missouri State Taxes Free

Which Form Should Be Used

In addition to completing the federal TD1:

- Employees who claim more than the basic personal amount have to complete the TD1 that corresponds to their province or territory of employment. To determine which is the province or territory of employment, go to Which provincial or territorial tax tables should you use?

- Pensioners who claim more than the basic personal amount have to complete the TD1 that corresponds to their province or territory of residence.

- Individuals paid by commissions and who claim expenses can elect to use Form TD1X, Statement of Commission Income and Expenses for Payroll Tax Deductions, to take into consideration the expenses in the calculation of their income tax.

Note

What If I My Disability Tax Credit Claim Is Denied

If youre disability tax credit application is denied, you may file a formal objection to appeal within 90 days. Your form will then be re-evaluated by the Appeals Branch. Alternatively, you can contact us at Disability Credit Canada and we can assist you in improving your application with our expert team of case builders. You can also read our Disability Tax Credit Ultimate Resource Guide for further, help in regards to your application.

Use Our Simple Calculator to Estimate Your Disability Tax Credits & Benefits

You May Like: Can Home Improvement Be Tax Deductible

How To File Taxes Using Sprintax

Read all the steps before logging in to Sprintax in Step 4.

Review Documents and Information You May Need

Determine which forms and documents from the list below that are relevant to you. If you had U.S. source income, you will receive one or more forms indicating the type, source and amount of income received. Learn more about income types at our U.S. Income Tax Basics page.

Follow the Instructions in Sprintax to Complete Federal Tax Forms

If You Did Not Have U.S. Income: Sprintax will generate a completed Form 8843 for you and each of your dependents.

If You Had U.S. Income: Sprintax will generate:

- a completed Form 8843 for you

- a federal tax return, with either a 1040NR-EZ or form 1040NR, depending on your circumstances.

- a W-7 application for an ITIN if you do not have an SSN or an ITIN. See Special Situations below

Complete Your State Tax Return, If Applicable

After you finish your federal return, Sprintax will inform you if your income necessitates a state tax return as well. If so, you may choose to use Sprintax for an individual fee of $29.95. It is optional, however, and you may want to complete a NY State or other state tax return on your own.

Log In and Create a Sprintax Account

When you log in through the Columbia Portal below with your UNI and password, it will take you to the Sprintax/Columbia page where you need to create a Sprintax account with a new username and password.

How Do You Get Canada Revenue Agency Tax Forms

As of 2015 the website for the Canada Revenue Agency publishes printable tax forms in “.pdf” format. The agency no longer automatically mails printed tax packets to residents but does permit taxpayers to order them on the website or by phone. Postal outlets and Service Canada offices also carry the printed forms, notes About.com. TAXES.CA publishes a list of links to provincial and territorial tax forms for those regions that use documents separate from the Canada Revenue Agency.

The forms and publications page of the Canada Revenue Agency website contains links to forms grouped by topic, cultural group, document type, and form or publication number. Links lead to pages explaining how to get forms in audio, braille or large-print formats, as well as to customized forms for those who file a large number of documents and to the online form for ordering paper forms and publications. The page also provides a top-10 listing of commonly viewed forms and publications.

Some Canada Revenue Agency documents are available only in paper format because of the technology they require, including some payment forms and remittance vouchers. Contact the agency at the toll-free number noted on the agency web page that discusses these documents in order to request them.

You May Like: How To Get Tax Preparer License

Tax Forms And Publications

In addition to the forms available below, the District of Columbia offers several electronic filing services to make filing your taxes simpler, faster, safer, while also providing a faster turnaround time for your refund. For more information, visit our service centers for Individual Income Tax and Business Tax filers.

- Individual Income and Business Returns

- Personal Property Returns

Why Does My Tax Receipt Not Equal The Tuition I Paid For The Year

If your enrolment starts in one tax year and ends in the next tax year, then the tuition for all courses is pro-rated for each year, based on the number of days attended in each year. The society fee is not tax deductible and is not included. The entire activity fee is included on the tax receipt in the final year.

Note that the above is based on your enrolment dates, not payment dates. If you paid in 2019 for classes that started in 2020, you will not be eligible to claim those fees on your 2019 taxes. They will be included on your 2020 T2202 instead.

Also Check: How Much Does H & R Block Charge To Do Taxes

Personal Income Tax Rates

The rates are based on the following income tax brackets:

| Tax Rate |

|---|

| $314,928.01 and up |

The dividend tax credit rate for dividends paid out of income taxed at the general corporate income tax rate will be adjusted on January 1, 2021, corresponding with the acceleration of the general corporate income tax rate reduction announced June 29, 2020 in Albertas Recovery Plan.

When Do I Have To Complete This Form

Do I have to complete the form yearly?

You dont have to complete the form every year, only when your situation changes.

You only have 7 days after the change to submit a new form to your employer. If your employer does not have a TD1 form for you, he will make deductions allowing only for the basic personal amount.

What Edition of TurboTax Is Right for Me?

Answer a few simple questions on our product recommender and we can help guide you to the right edition that will reflect your individual circumstances.

*TurboTax Live Full Service is not available in Quebec.

Also Check: How Much Time To File Taxes

Prior Year Forms & Instructions

Make your estimated tax payment online through MassTaxConnect. Its fast, easy and secure.

- Form 1-ES, 2021 Estimated Income Tax Payment Vouchers, Instructions and Worksheets

- Form 2-ES, 2021 Estimated Tax Payment Vouchers, Instructions and Worksheets for Filers of Forms 2 or 2G

- Form UBI-ES, 2021 Estimated Tax Payment Voucher for filers of Forms 3M, M-990T and M-990T-62

Income and Fiduciary Vouchers these estimated tax payment vouchers provide a means for paying any taxes due on income which is not subject to withholding. This is to ensure that taxpayers are able to meet the statutory requirement that taxes due are paid periodically as income is received during the year. Generally, you must make estimated tax payments if you expect to owe more than $400 in taxes on income not subject to withholding. Learn more.

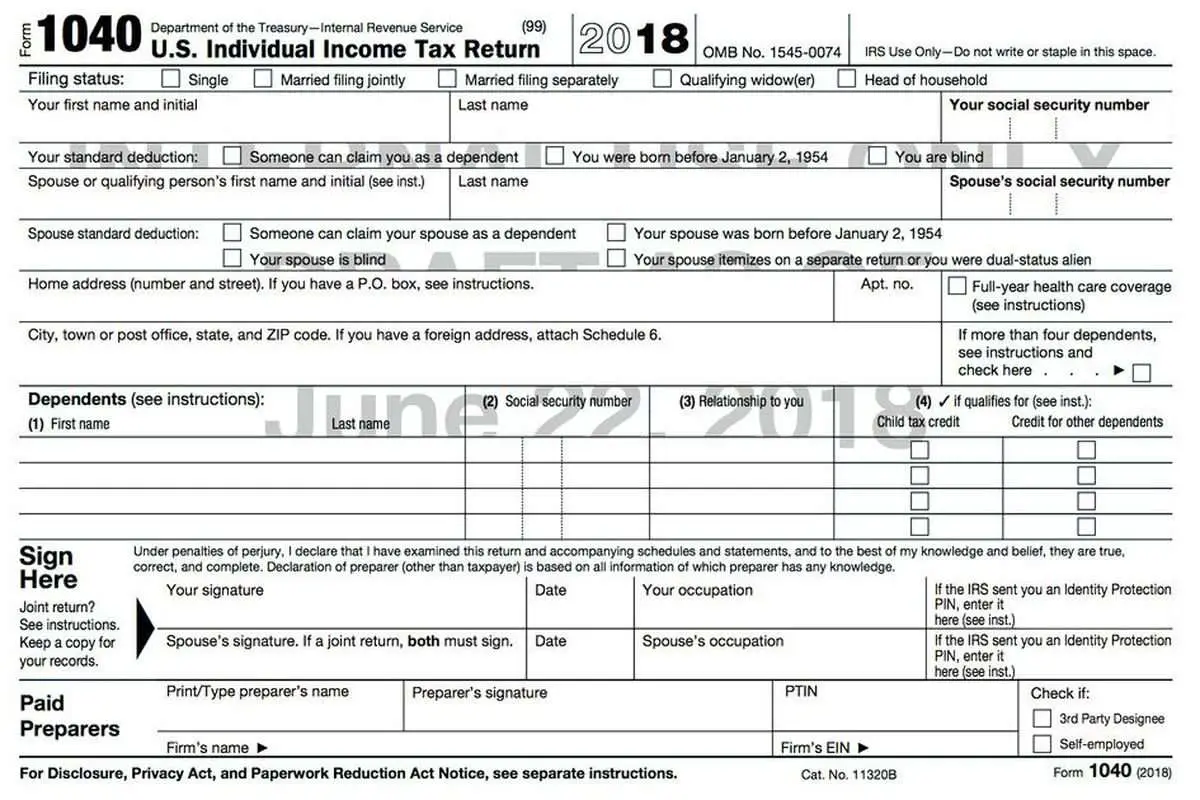

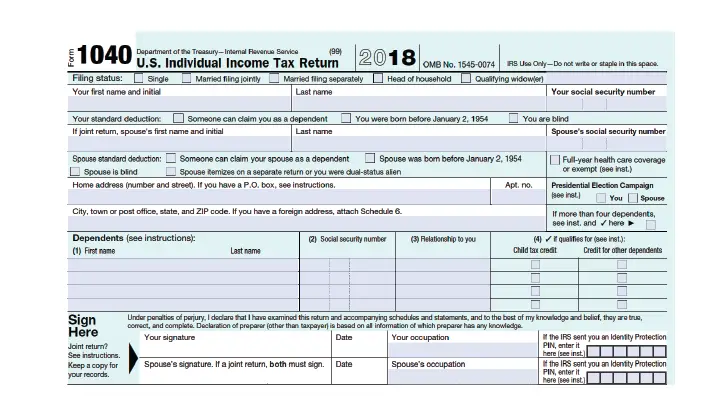

How To Find And File Your Federal Tax Forms

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

If bureaucracies are good at anything, its creating paperwork, and the Internal Revenue Service is the king of all bureaucracies, especially when it comes to tax forms. Most paperwork needed for filing your federal tax return can be completed and submitted electronically, but youll need to acquire some forms, on paper or via the web, to get the job done. Well explain how to find and obtain the forms you need, how often the IRS updates its forms, and the options for filing your tax forms online.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Mailing Addresses For Massachusetts Tax Forms Including Amended Returns

- Form 1 or a Form 1-NR/PY:

- Refund: Mass. DOR, PO Box 7000, Boston, MA 02204

- Payment: Mass. DOR, PO Box 7003, Boston, MA 02204

Visit Mailing addresses for Massachusetts tax forms for other form addresses.

Where To Get Copies Of Tax Forms Due To You

Before you can file, youll need tax forms from the financial institutions with which you have accounts. They should either arrive in the mail, or you’ll receive information on how to access them online. These forms report how much interest youve earned on high-yield savings accounts and certificates of deposit, how much money you made or lost from selling investments, and the amount of any distributions youve taken from retirement accounts.

Youll also need tax forms documenting your earned income and the taxes youve already paid. The most common of these is Form W-2 employees receive it from their employers. Freelancers and independent contractors should receive Form 1099-MISC from each client who has paid them $600 or more . You might also receive a 1099-MISC for certain other types of income, such as prize money.

In addition, you may receive forms documenting any interest youve paid on a student loan or mortgage. This interest may be tax-deductible, depending on your circumstances.

Traditionally, financial institutions, employers, and clients mailed paper copies of these forms to you. Today, you may need to retrieve them yourself by logging into your account online. Sometimes this service is optional, but other times it will be the only way you can get the forms you need.

You May Like: How To Buy Tax Lien Properties In California