How To Change Or Cancel Your Pad Plan

To change or cancel Pre-Authorized Debit, please complete and return the PAD form with your signature and initials where indicated:

- Tick the box that applies to you in section 3 of the formnew, change or cancel.

- If you ticked ‘change’ for a change of bank accounts, please include a copy of a VOID cheque from the new bank account.

Please note:

- Changes or cancellationsmust be received by the 22nd of the month to take effect the following month. Please send the PAD form and/or the void cheques to the tax office .

- If you sell your property, it’s your responsibility as the property owner to instruct the City of Burnaby to discontinue the prepayment plan BEFORE the property is sold. This is important since we may continue to draw payments from your bank account until advised.

- IMPORTANT: Any overpayment will be applied to the new owners. There will be NO refunds on any prepayments, even after the sale of a property. Credits must be adjusted between purchasers and vendors on the Statement of Adjustments.

How To Pay Your Business Taxes Online

- Participating financial institutions

Many of these financial institutions also provide business customers with non-resident payment options.

Secured Property Taxes Terms

Annual Secured Property Tax BillThe annual bill, which includes the General Tax Levy, Voted Indebtedness, and Direct Assessments, that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1, due in two installments.

Adjusted Annual Secured Property Tax BillA bill that replaces the Annual Secured Property Tax Bill due to the following reasons: a change or correction to the assessed value of the property the allowance of an exemption that was previously omitted the correction of a Direct Assessment placed on the property from a municipality or special district or the inclusion of a penalty for failure to comply with certain requirements of the Office of the Assessor prescribed by law .

Ad ValoremAccording to the value Based on value. For example, the Office of the Assessor calculates property taxes based on the assessed value of a property.

Non-Ad Valorem Not according to the value.

AssessmentThe rate or value of a property for taxation purposes.

Assessors Identification Number A 10-digit number that identifies each piece of real property for property tax purposes, e.g., 1234-567-890.

California Relay ServiceA telecommunications relay service that provides full telephone accessibility to people who are deaf, hard of hearing, or speech impaired.

Current YearThe current fiscal tax year in which the Department of Treasurer and Tax Collector issues an Annual Secured Property Tax Bill.

Testate

Don’t Miss: Where’s My Tax Refund Ga

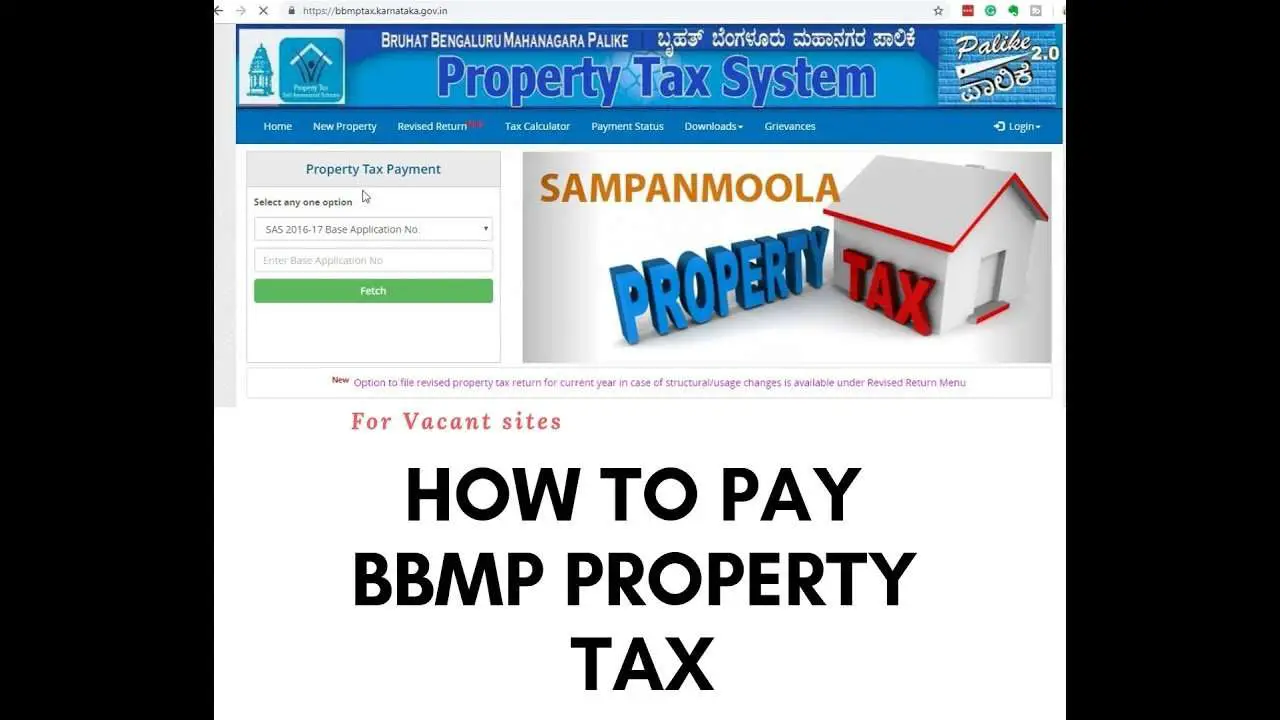

Online Property Payment Fees:

Bernalillo County contracts for online payment services. FIS charges a convenience fee for online processing services. Credit card fee is 2.35% . Checking is a flat non-refundable $0.50 fee per e-check. Bernalillo County does not retain any portion of the convenience fee. For example, if your total tax amount is $1,000, the total charge is computed as follows:

Tax Receipts And Statements

The City will issue residents a receipt for property tax payment, record of payment or duplicate tax statement upon request.

- Refunds are processed on a first in, first out basis

- Please allow four to six weeks to process

- Should your refund be as a result of an Assessment reduction an application will be sent to you automatically upon processing your reduction. Please do not complete or submit a separate refund form.

Also Check: How Do I Get My Pin For My Taxes

Avoid The Line Pay Online

Using your MyPropertyAccount you can register your property tax, utilities and dog licensing accounts for eBilling. Pay via online or phone banking with your financial institution.

Sign up for eBilling

Log in to MyPropertyAccounts and change your bill delivery method to email by May 1st of the year to get your bill online.

Paying At The Automatic Banking Machine

Pay through the ABM at your bank. Keep your receipt for your payment records.

Pay by Mail

Mail your cheque or money order payment and remittance stub with Home Owner Grant application completed, if eligible.

Make cheques payable to City of Surrey and include your folio number on the cheque. Post-dated cheques are accepted. Make sure the cheque is dated on or before the property tax due date.

Send in your payment a minimum of 3 days before the property tax due date. We must receive your payment by or before the July 2 due date. If your mail is lost or delayed, and does not arrive by the due date, you may receive a penalty charge.If your payment cannot be processed due to an error on a cheque, insufficient bank funds or a returned item you will be charged a late payment penalty.

Don’t Miss: How Can I Make Payments For My Taxes

Online By Payment Card

You can now pay property taxes online with MasterCard, VISA, American Express , Interac Online, MasterCard Debit or Visa Debit.

- You will require the 19 digit property tax roll number. View sample tax bill

- Interac Online, MasterCard Debit and Visa Debit allow you to pay online using money from your bank account. If your bank doesnt offer Interac Online it likely offers either Mastercard or Visa Debit. Interac Online Frequently Asked Questions.

- A service fee is applied by the service provider, Paymentus Corporation.

Go to the Paymentus website to make a property tax payment by payment card. Please verify that you are in the secure site by ensuring that the web address starts with https and is

If you choose to make an online property tax payment with a credit card, Interac Online or Debit you may do so at any personal or public internet access point.

Roll Number Is The Account Number

Make sure the Calgary property tax account number registered in your banks bill payment profile matches the 9-digit property tax roll number shown on your tax bill or statement, entered without spaces or dashes. If an invalid 9-digit roll number is used it may result in a Payment Alignment fee of $25.

Roll number location on a property tax bill

Roll number location on a property tax statement of account

Apply payment to the correct property – check your roll number

The property tax roll number is linked to the property NOT the owner.

When you sell a property, that propertys tax roll number does not follow you to your next property.

Your new property will have its own roll number, which appears on your bill.

You must register your new propertys 9-digit roll number as the account number before making payment. Not changing the roll number registered with your bank will result in your payment being applied to your previous property, not your current bill. If your previous roll number is used to make the payment, it may result in a Payment Alignment fee of $25.

Need a copy of your tax bill? Visit Property Tax Document Request.

Keep your receipt as proof of the date and time of payment.

Recommended Reading: What Does H& r Block Charge

Bills Paid By Mortgage Companies Agents Or Tenants

If your bills are to be paid by a mortgage company, agent or tenant:

- Forward your interim tax bill to the mortgage company, agent or tenant.

- Email the City at to have future bills redirected.

If paid by a mortgage company, you will receive a receipt after payment of your final bill in July. If your tax bills are not paid by the due dates, you will receive reminder notices. It is your responsibility to inform the City in writing when a mortgage company, agent or tenant will no longer be paying your tax bill.

If you have registered for payment through your mortgage, and you receive a bill, we have no record of your mortgage company on your account. Contact your bank for instructions. You should request that your bank contact us to ensure we record their interest on your account. This will ensure all future bills will be sent to them. To avoid a penalty on your account you should contact your bank immediately.

Your Propertys Assessed Value

Your property is assessed at the amount indicated in this field. This amount acts as a basis for calculations of the property taxes.

Provincial legislation requires that the assessment reflect the market value of your property as of July 1st of the previous year.

All properties are assessed using similar factors that real estate agents and appraisers use when pricing a home for sale.

If your property was only partially completed as of December 31, your assessment reflects the value of the lot plus the value of the building, based on the percent complete.

If the building is completed during the current year, a supplementary assessment and tax notice will be sent to the assessed person reflecting the increase in assessment from new construction.

Read Also: Can Home Improvement Be Tax Deductible

Where Can I Pay My Property Tax

If you have recently refinanced or paid off your mortgage, you are responsible for filing a Change of Address Form with the Supervisor of Assessments office to ensure that you receive future tax bills.

Per 35 ILCS 200/20-15, the failure of the taxpayer to receive the bill shall not affect the validity of any tax, or the liability for the payment of any tax. If you did not receive your bill, please contact our office at 888-5180 or email the Treasurers Office and we will mail a duplicate bill.

The Treasurers Office offers several different options to pay your tax bill. Due to COVID-19 please consider one of the following payment options before choosing to pay in person:

Walk The Home With The Assessor

Many people allow the tax assessor to wander about their homes unguided during the evaluation process. This can be a mistake. Some assessors will only see the good points in the home such as the new fireplace or marble-topped counters in the kitchen. They’ll overlook the fact that several appliances are out of date, or that some small cracks are appearing in the ceiling.

To prevent this from happening, be sure to walk the home with the assessor and point out the good points as well as the deficiencies. This will ensure you receive the fairest possible valuation for your home.

Recommended Reading: How Does H And R Block Charge

Understand Your Tax Bill

If you feel you are paying too much, it’s important to know how your municipality reaches that figure on your bill. Sadly, many homeowners pay property taxes but never quite understand how they are calculated. It can be confusing and challenging, especially because there may be a disconnect between how two neighboring towns calculate their property taxes.

Property taxes are calculated using two very important figuresthe tax rate and the current market value of your property. The rate at which taxing authorities reset their tax rates is based on state lawsome change them annually, while others do so in different increments, such as once every five years. Municipalities set their tax ratesalso known as millage or mill ratebased on what they feel they need to pay for important services.

An assessor, hired by the local government, estimates the market value of your propertywhich includes both the land and structureafter which you receive an assessment.

The assessor may come to your property, but in some cases, an assessor may complete property assessments remotely using software with updated tax rolls. Your local tax collector’s office sends you your property tax bill, which is based on this assessment.

In order to come up with your tax bill, your tax office multiplies the tax rate by the assessed value. So, if your property is assessed at $300,000 and your local government sets your tax rate at 2.5%, your annual tax bill will be $7,500.

Property Tax Overpayments At Year

If an overpayment has created a credit less than $3,000 on your tax account at the end of the year, the credit will be transferred and applied to the next upcoming tax billing. This only occurs if there has not been an ownership change within the year of the credit and that the account is in good standing. If there are arrears on the account, such as other charges the credit will not be automatically transferred.

Read Also: Otter Tail County Tax Forfeited Land

Pay Directly To The City

to pay property tax directly to The City of Calgary. See for more information.

The Tax Instalment Payment Plan is a monthly instalment plan that allows you to pay your property taxes by monthly pre-authorized debit, rather than in a single annual payment. Find out more about the Tax Instalment Payment Plan .

Reduce the risk of late payment penalties by requesting and returning your TIPP agreement early.

TIPP payment not honoured by your bank – making a replacement instalment

Making a replacement instalment, like all other tax payments, can be made through one of the other property tax payment options listed on this page. Replacing a payment before it becomes dishonoured will not stop the next monthly TIPP instalment from being withdrawn or prevent service fees. For more information on replacement instalments, see non-payment and service charges.

Making a lump sum payment to lower your monthly payment amount

Your monthly TIPP payments can be lowered by making a lump sum payment and requesting a recalculation. If you decide to make a lump sum payment, it cannot be automatically withdrawn. A lump sum payment, like all other tax payments, can be made through one of the other property tax payment options listed on this page.

Third floor, Calgary Municipal Building800 Macleod Trail S.E.

Cheque or money order

Avoid last minute lineups and late payment penalties by bringing your cheque to Corporate Cashiers today, post-dated on or before the due date.

Every Homeowner Pays Property Taxes Heres How

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

A property tax bill is part of the homeownership experience. Local governments collect these taxes to help fund projects and services that benefit the entire communitythings such as roads, schools, police, and other emergency services. There are two primary ways to pay your property tax bill: as part of your monthly mortgage payment or directly to your local tax office.

Read Also: Where’s My Tax Refund Ga

How To Pay Your Individual Taxes Online

- Participating financial institutions

1 These financial institutions also provide non-resident payment options.

Should You Pay Property Taxes Through Your Mortgage

Home ownership isnt cheap. Theres the actual cost of the place, your monthly mortgage payments, home insurance, heating, and more. These are some of the most obvious costs, but there are some other housing costs that arent quite as obvious and theyre not small!

Once cost, often overlooked by both first-time homebuyers and seasoned homeowners, is your monthly share of your property tax bill. Most of the time, your lender will collect property tax in your mortgage payment, then pay your municipality on your behalf. However, there are some times when this is not ideal. Read on to learn when yo pay your property taxes through your mortgage.

Don’t Miss: How Can I Make Payments For My Taxes

Forms: Property Account Assessment And Taxes

School Support Declaration – for corporations

Mailing Address and Ownership Changes

Corrections or changes to mailing addresses, owner names and changes of ownership are administered by Alberta Land Titles. The City of Edmonton receives these updates electronically once they have been processed by Alberta Land Titles.

You can request a change of mailing address by submitting a Change of Address form. Changes or corrections to owners name and changes of ownership can be made by submitting the appropriate forms to Alberta Land Titles.

If you receive a “Please wait….” message opening PDF forms1. Right click on the link2. Choose the option to Save or Download the form to a known location on your computer, such as your desktop3. Locate the file on your local computer4. Open the file using Adobe Reader