History Of The Solar Investment Tax Credit

In the early days of solar energy, residential systems were far more expensive than they are now. By many homeowner standards, however, theyre still expensive today. For example, in 2009, it cost $8.50 per watt to install solar panels the current cost per watt, as of publishing, is about $2.40 to $3.22.

This point-of-entry cost into the world of renewable residential solar power dramatically limited the number of homeowners who could take advantage of solar for their home.

The solar investment tax credit was established by the Energy Policy Act of 2005, which established standards for renewable fuels, mandated an increase in the use of biofuels and established renewable energy-related tax incentives.

Under this law, the original policy was set to expire at the end of 2007. However, the solar ITC has been so popular that its expiration date has been extended multiple times.

Solar panel costs have decreased dramatically in the last 20 years, but the ITC can still save individuals and businesses a great deal on their federal taxes.

Today, solar systems are far less expensive due to changes in the industry and the manufacturing of certain parts that make up the solar system. Solar panels, lithium batteries and inverters are all far less expensive to make and buy now than they were in those early days.

How Much Does It Cost To Go Solar

Considering solar for your home or business? Get a quick and easy solar panel cost estimate with our simple solar calculator.

Answer a few questions to get a tailored solar estimate based on your location and energy usage. The calculator takes the federal tax credit into account . Well also highlight a few solar kits in our shop that match your needs.

Summary Data For Ontario

| Average retail electricity price | 16.32 cents / kWh |

| Average annual consumption per household | 8,580 kWh |

| Yes |

Ontario is the leader for grid-connected PV systems in Canada. Thanks to generous feed-in tariff programs, solar energy really took off in the province. While those feed-in tariff programs are now closed, homeowners and businesses in Ontario will soon benefit from the new GreenON Solar Rebate program .

At 16.32 cents/ kWh, the electricity prices in the province are above the national average of 12.61 cents / kWh. When it comes to average electricity consumption per household, residents of this province consume 8,580 kWh per year, below the national average of 13,300 kWh.

Currently, Ontario has 3 financial incentive programs and 1 regulatory programs supporting the adoption of solar energy.

Ontario is a grid parity province, making solar power cheaper than the residential utility rates. The incentives listed below can significantly reduce the cost of installation of solar panels for your home or business.

You May Like: Www.1040paytax.com

What Doesn’t Qualify For The Solar Tax Credit

- Solar installed in an income property in which you don’t maintain your own residence.

- A system thats leased. In that case, the company that leases it to you gets the credit, though it can pass along all or part of the savings as a discount to you.

- A solar system that’s used to heat a swimming pool or hot tub. The IRS is vague, though, about whether you can prorate your creditthat is, claim a portion of the credit if only a portion of the energy is used to heat your home. Talk to a tax expert for advice.

The Irs Is Still Offering Incentives For Switching To Solar Heres How Much You Could Save On Your Taxes And Electricity Bill

Solar-panel companies are aggressively marketing their products this season.

In my own neighborhood in a New York City suburb, door-to-door salespeople have been making the rounds. Reps from two different solar companies have stopped by, and thats in addition to multiple mailings Ive received.

Their pitch: Hurry if I want a big federal tax credit for a new solar-panel system, because itll be gone at year-end.

“Residential solar installers are notorious for using deadlines like this to create a sense of urgency with customers, and that’s definitely been the case this year,” says Michelle Davis, a solar-industry analyst with the market research company Wood Mackenzie.

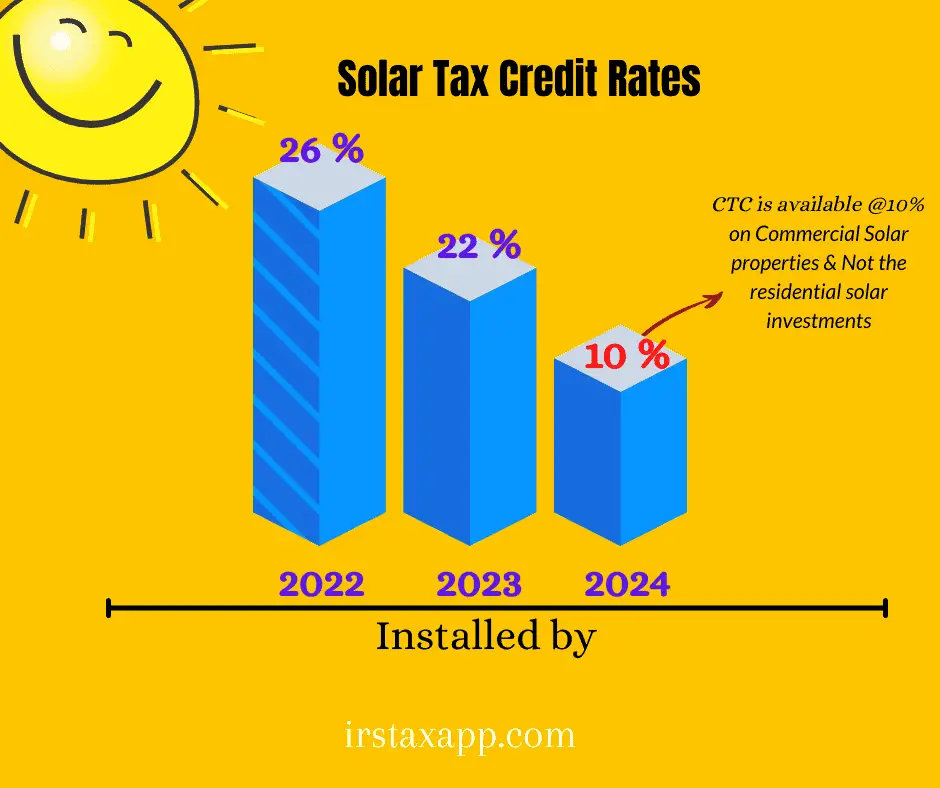

If youve heard the same hard sell, dont believe it. The federal credit is still available next year, both for existing homes and new construction. Its just slightly smaller: 26 percent of purchase and installation costs vs. 30 percent for 2019. For 2021, the credit will be worth 22 percent.

After that, it really does expire for individuals.

The Residential Renewable Energy Tax Credit, as the IRS calls it, can be an attractive way to save on the significant cost of installing solar panels or roofing. An average-sized residential solar systemabout 400 square feet of solar panelscosts $18,000, according to the Solar Energy Industries Association, an industry group. The tax break reduces the cost by $4,680, to $13,320.

Don’t Miss: Www Aztaxes Net

How To Claim Your Tax Credit

To claim the ITC you will need to file under IRS Form 5695. Youll receive your tax credit the following year when you file your taxes for the year in which you installed your panels. If you dont qualify for the entire tax credit in the first year you can roll over the amount for up to 5 years.

Now that you have your very own solar system, the solar Investment Tax Credit is yours for the claiming. How exactly do you go about it?

Well walk you through the exact, step-by-step process of filing for the federal solar tax credit.

Of course, we recommend talking to a tax professional to make sure youre not missing anything. But if youre a do-it-yourselfer who knows your way around a tax form , this guide walks you through basic filing.

What Does The Credit Cover

Homeowners who install and begin using a solar PV system can claim a federal solar tax credit that currently covers 26% of the following costs:

- Labor costs for solar panel installation, including fees related to permitting and inspections

- All additional solar equipment, such as inverters, wiring and mounting hardware

- Energy storage devices that are powered exclusively through the solar panels, including solar batteries

- Sales taxes paid for eligible solar installation expenses

Read Also: How Much Does H& r Block Charge For Doing Taxes

Impact Of The New Itc Extensions

The ITC has resulted in an extremely effective subsidy in catalyzing both rooftop and utility scale solar energy adoption across the U.S. The multi-year extension from late 2015 has caused the cost of solar to drop, while installation rates and technological efficiencies have improved. The federal solar tax credit is a great example of an innovative tax policy that encourages investment in 21st-century energy systems and technology.

Industry experts estimate a total of 27 gigawatts of solar energy had already been installed in the US by 2015, and they predict we will have nearly 100 GW total by the end of 2020. From 2015 to 2017 there was a 25% increase in the number of solar industry jobs and that number is forecasted to increase throughout the next decade. The federal solar rebate program is proof that long-term federal tax incentives can drive economic growth, technological innovation to reduce costs, and create a new generation of jobs and skillsets. We offer commercial solar in 26 states, Washington D.C., and Puerto Rico, to find out more about the ITC close to you, contact us today.

Atlantic Investment Tax Credit

2.54 The Atlantic investment tax credit in subsection 127 is a credit equal to 10% of the capital cost of prescribed energy generation and conservation properties that are used primarily for the purpose of the following activities:

- manufacturing or processing goods for sale or lease

- farming or fishing

- storing grain or

- harvesting peat

and the activities are carried on in the Atlantic provinces, the Gaspé Peninsula and their associated offshore regions.

2.55 The Atlantic investment tax credit applies to the following qualified properties which are defined in subsection 127:

- prescribed energy generation and conservation property which includes all the properties described in Class 43.1and 43.2 acquired by the taxpayer after March 28, 2012 and

- prescribed energy generation and conservation properties that are leased in the ordinary course of carrying on business in Canada by a corporation:

- whose principal business is leasing property, lending money, purchasing conditional sales contracts and account receivables

- who manufactured and leased the property and the lessors principal business is manufacturing the property it sells or leases or

- whose principal business is selling or servicing properties described in Classes 43.1or 43.2.

2.56 Where a prescribed energy generation and conservation property is leased, the lessee must use the leased qualified property in the activities described in ¶2.54.

Also Check: What Does Locality Mean On Taxes

The Commence Construction / Safe Harbor Clause

With residential solar installations, our general guidance , is that to qualify for the ITC in a certain year, a project must both be fully installed and receive its permission to operate from the utility. With commercial installations, on the other hand, theres the commence construction and safe harbor clause of the ITC, both of which allow you to claim the full ITC for a certain tax year even if you have not yet completed the installation and interconnected it to the grid.

The commence construction clause states that the construction of the project must have started by the end of the year to qualify under that tax year. In other words, if youve started your installation by December 31, 2021, you can claim the full 26 percent ITC when you file your 2021 taxes during 2022. But in the case of a residential property, you would have to wait to claim the ITC until you file your 2023 taxes in this scenario.

Notably, in each of these scenarios, there is a limit to how far out you can push the construction youll need to complete the project within the next five years or so. But if your goal is to lock in a higher rate of ITC for a certain tax year but move to install right after the start of the new year, this shouldnt be a problem.

Increase Your Home’s Value Reduce Electricity Costs And Save On Federal Taxes All By Going Solar

COVID-19 stimulus bills have been getting all the attention lately, which may mean that you’re not up-to-date on the big win for renewable energy!

The stimulus bill came in just the knick of time, as tax credits were due to drop for new owners of residential solar panels in 2021. Here’s everything you need to know about the investment tax credit extension and what it means for you.

Also Check: How Much Does H& r Block Charge To Do Taxes

What The Solar Tax Credit Extension Means For You

Right before the end of the year, Congress extended the ITC for another two year. This means that the decline from 26% down to 22% is frozen in place at 26% for the remainder of 2021 and 2022, and the end of the residential ITC has been pushed back to 2024!

- 2021: 22% > > 26%

- 2023: 22%

- 2024: 0% and 10% for commercial

So, what does that mean for Arizonans who are looking to go solar this year? It means you have more time to take advantage of the higher rate of the solar tax credit and prepare your home for going solar!

How Do I Make Sure Im Eligible To Claim The Solar Tax Credit

To be on the safe side, your solar project should be fully installed and paid for before 2022 to be absolutely certain that you can claim the tax credit in 2022s taxes.

This isnt a concern in early January 2021, but the urgency increases towards the end of 2022.

Even though physically installing a solar system usually does not take more than a single day, many homeowners do not realize that a solar project may take weeks to complete after contract signing. This is due to factors such as permitting, financing approval, utility approval, and so on. Read more about the solar installation process here.

Therefore, to be 100% sure that you can claim the 26% ITC, the sooner you move forward with your project, the better.

Towards the end of 2022, as word begins to spread about the incentive stepping down, solar installers will likely get busier and busier, meaning your installation may be scheduled farther out than normal.

Also Check: How Much Is H& r Block Charge

When Does The Federal Solar Tax Credit Expire

The federal solar tax credit is set to expire at the end of 2023. There is hope that the tax credit may be extended once again. The Biden Administration has plans to include a 10-year extension of the tax credit in future legislation. But, theres no guarantee that this will be approved by Congress and it may be at a lower rate.

Because of that, our best advice is to try and add solar panels as soon as possible so youre guaranteed to get the 26% credit.

The best time to go solar is now because the 26% ITC will decrease to 22% in 2023 before becoming unavailable for residential solar systems installed in 2024 and beyond.

History Of The Federal Solar Tax Credit

The solar tax credit was originally created through the Energy Policy Act, which was signed way back in 2005. As originally written, the credit was set to expire in 2007. It proved pretty popular with homeowners across the country, however, prompting Congress to renew the credit multiple times.

As it stands, the credit will be available at least through 2023. However, an act of Congress could extend it even further, allowing future homeowners and solar adopters to reap this financial benefit.

Also Check: File Missouri State Taxes Free

How Do I Claim These Tax Credits

For small businesses filing their business taxes as part of their personal tax return, follow these steps:

- First, find the credit application form for the specific tax credit and complete the form.

- Then add the information from the form to Form 3800, the General Tax Credit.

- Finally, add the information from Form 3800 to your tax return.

Partnerships and S corporations must file the form to get the tax credit .

To get the energy investment tax credit, you must file an application Form 3468, along with your business tax return. This is a complicated form, so save your receipts and give them to your tax preparer.

Deductions are a bit easier. This deduction can be included in the “Other Deductions” section of your business tax return. Don’t forget you will need a certification, either before or after you complete the upgrades.

Note: As with all things IRS, there are many restrictions, qualifications, and limitations to these tax credits and tax deductions. The information in this article is intended only as general information, and not tax advice. Check with your tax professional before attempting to take advantage of any of these tax savings.

How Do Other Incentives I Receive Affect The Federal Tax Credit

For current information on incentives, including incentive-specific contact information, visit the Database of State Incentives for Renewables and Efficiency website.

Rebate from My Electric Utility to Install Solar

Under most circumstances, subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law. When this is the case, the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit. For example, if your solar PV system was installed before December 31, 2022, cost $18,000, and your utility gave you a one-time rebate of $1,000 for installing the system, your tax credit would be calculated as follows:

0.26 * = $4,420

Payment for Renewable Energy Certificates

When your utility, or other buyer, gives you cash or an incentive in exchange for renewable energy certificates or other environmental attributes of the electricity generated , the payment likely will be considered taxable income. If that is the case, the payment will increase your gross income, but it will not reduce the federal solar tax credit.

Rebate from My State Government

0.26 * $18,000 = $4,680

State Tax Credit

For example, the net percentage reduction for a homeowner in New York who claims both the 25% state tax credit and the 26% federal tax credit for an $18,000 system is calculated as follows, assuming a federal income tax rate of 22%:

0.26 + * = 45.5%

+ = $4,680 + $3,510 = $8,190

Read Also: How To Buy Tax Lien Properties In California

Other Frequently Asked Questions

If the tax credit exceeds my tax liability, will I get a refund?

This is a nonrefundable tax credit, which means you will not get a tax refund for the amount of the tax credit that exceeds your tax liability. Homeowners may get a tax refund at the end of the year due to the tax credit, if the reduction in tax liability means there was overpayment during the year. This can often occur when employers deduct taxes for employees over the course of the year. However, such refund is still limited by the taxpayers total tax liability. However, you can carry over any unused amount of tax credit to the next tax year.

Can I use the tax credit against the alternative minimum tax?

Yes. The tax credit can be used against either the federal income tax or the alternative minimum tax.

I bought a new house that was constructed in 2020 but I did not move in until 2021.

May I claim a tax credit if it came with solar PV already installed?

Yes. Generally, you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house in other words, you may claim the credit in 2021. For example, you can ask the builder to make a reasonable allocation for these costs for purposes of calculating your tax credit.

How do I claim the federal solar tax credit?