Properties Exempted From Property Tax

There are a few types of properties, which are exempted from property tax. This includes space used for religious worship, public burials or cremation and heritage land. Apart from this, any building that is used for charitable, educational, or agricultural purposes, is also exempted from property tax. In addition to this, the PCMC has also exempted residential structures of less than 500 sq ft from property taxes. This move benefits over 1.5 lakh households in the region.

PCMC property tax relief scheme extended till August 31,2021

With an intent to provide some relief to people, the PCMC property tax relief scheme has been extended for the second consecutive month. Now, the PCMC property tax scheme will be valid till August 31,2021.

While the PCMC property tax relief scheme was initially announced for people who would make an advance payment of their taxes in full by June 30,2021, it was extended by a month till July 31, owing to the impact of the second wave of the coronavirus pandemic.

PCMC to go after 3,500 unassessed properties, to recover dues

The PCMC administration has started a special drive for industrial units under its jurisdiction, to identify instances of unregistered properties on their grounds. According to an estimate, there are nearly 3,500 industrial units that have extended constructions on their premises without permission. Recently, Tata Motors was asked to pay dues of Rs 200 crores over unregistered properties on its premises.

Paid Property Tax Searches

An online search for websites pulls up numerous websites that offer “free” property tax searches. Unfortunately, many of these ultimately require you to pay for the search. This information is a matter of free public record, and with a little due diligence, you can easily obtain this information yourself directly from the auditors or assessors office in the county in which the property is located.

Property taxes are maintained by a number of offices including city hall, the county courthouse and the county recorder. You may have to put in a little footwork, but its free and more than likely you can access these records online yourself. If you still find yourself at a dead end, try searching Trulia®, Zillow® or Realtor.com® for comprehensive and free property searches.

Peek At Irs Form 1098

Every homeowner with an active mortgage should receive IRS Form 1098 from the mortgage servicing company each year. This form is used by the IRS to report and track mortgage interest paid over $600 annually. Interest is deductible on itemized tax returns. So is the property tax assessed and paid during the calendar year. While IRS Form 1098 is not designed specifically for property tax paid, it does list it.

Obtain Form 1098. Scan the form for Box 11. This box is defined as “Other.” The value in the box should be the amount paid during the year for property taxes on the home. This is the amount deductible in itemized tax returned using Schedule A.

Also Check: Have My Taxes Been Accepted

Types Of Property Tax

Properties are classified to help the government streamline the process of estimating taxes basis certain specific criteria. Property in India has been divided into 4 classifications.

-

Personal property: Portable man-made property like cars, buses and cranes

-

Land: Land in its rudimentary form, devoid of any form of construction

-

Improvements and upgrades made to land: Man-made constructions on land that cannot be moved like buildings

-

Intangible property: Property that is not in its tangible form

Your Property Tax Notice

The City is the agent for all property tax collection within its boundaries. Your property tax notice is a statement identifying how much your property tax is for the current tax year, including details of the taxing authorities that receive a portion of your tax dollars.

Supplementary Tax Notice

If you make changes to your home that affect the assessment, you may also receive a Supplementary Tax Notice in addition to your Tax Bill. This notice represents a change in your taxes for a portion of the year.

Read Also: Protesting Property Taxes In Harris County

Review Your Property Tax Statement

Every property owner should receive an annual property tax statement. In San Francisco, the San Francisco Treasurer’s Department issues property tax bills and an annual statement. It will itemize the amount due based on county requirements for collection such as garbage and teachers’ funds. The balance due is listed on the bill but you are normally allowed to pay the bill in two installments.

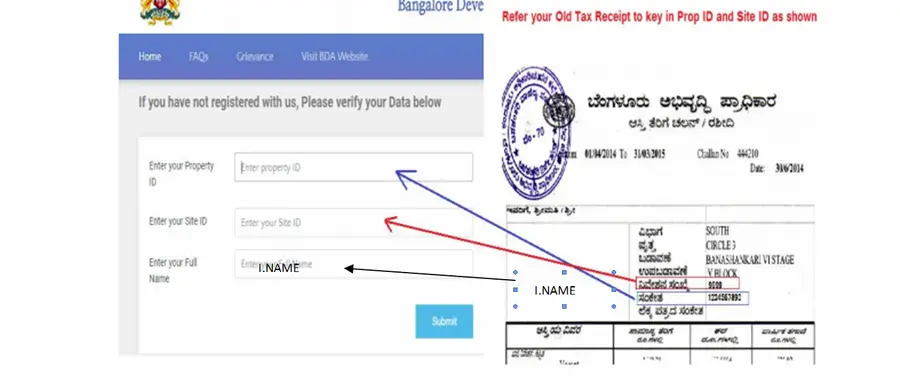

How To Payproperty Tax In Karnataka Hubballi

There is no facility to pay the property tax online in Hubballi-Dharwad. But the public can decide their property tax liability by clicking on

Similarly in all the major towns and corporations of the state, there is no provision to pay the property tax online. One of the main problems is that none of the city corporations are able to issue PID the way BBMP does.

Don’t Miss: How To Buy Tax Lien Properties In California

What Is Property Tax

Property tax is the yearly sum paid by a landowner/property-owner to the municipal corporation of his or her area or local government. Property can include all tangible real estate property, the individuals house, office building and the property that he or she has rented to others.

In India, Property Tax is payable only on property that is real, that is, land with and without man-made constructions. The municipality of an area evaluates different categories of properties, of that area, to decide on the tax as per its value. It also determines its appraisal value. The amount collected through Property Tax is utilised for the improvement of the local infrastructure like maintenance of roads and schools, repairing roads, etc. Property Tax varies between different locations within a city, and between cities and municipalities.

How To Register Complaint On Pcmc Suvidha

All citizens can register their complaints related to the Pimpri-Chinchwad Municipal Corporation on the Suvidha platform. Users need to register themselves, to launch a complaint on the platform. The portal can also be used for tracking the status of complaints. All issues related to property tax, water tax, building plan approval, civil works and public establishment systems can be filed on the Suvidha platform.

See also: All you need to know about PCMC Sarathi

You May Like: Www.1040paytax.com

Searching Property Tax Records

Once you locate the correct office, you can search for a property using different parameters. You may have to register or read and agree to a disclaimer before you begin searching. The exact address or parcel identification number is all that is required to perform a property search, in most cases.

Depending on your local assessor or auditor’s office, you may also search by assessment number as well as partial street address. If you don’t know the exact address or parcel number, some sources also let you search by zooming in on a map of a particular area that interests you. Bear in mind, some counties do not allow for searches by owner name or do not display the name of the owner in search results for privacy reasons per local statutes.

Read More:How to Verify Property Ownership

Child Tax Credit: July 15 Deposits

Some families received another form of stimulus aid on July 15 when the IRS deposited the first of six monthly cash payments into bank accounts of parents who qualify for the Child Tax Credit . Families on average received $423 in their first CTC payment, according to an analysis of Census data from the left-leaning advocacy group Economic Security Project.

Eligible families will receive up to $1,800 in cash through December, with the money parceled out in equal installments over the six months from July through December. The aid is due to the expanded CTC, which is part of President Joe Biden’s American Rescue Plan.

Families who qualify will receive $300 per month for each child under 6 and $250 for children between 6 to 17 years old. Several families that spoke to CBS MoneyWatch said the extra money would go toward child care, back-to-school supplies and other essentials.

Families may enjoy more of a tax break in coming years, if Mr. Biden’s American Families Plan moves forward. Under that plan, the Child Tax Credit’s expansion would last through 2025, giving families an additional four years of bigger tax breaks for children.

Don’t Miss: Turbo Tax 1099q

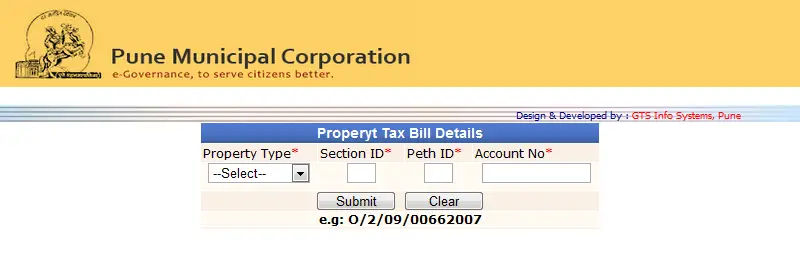

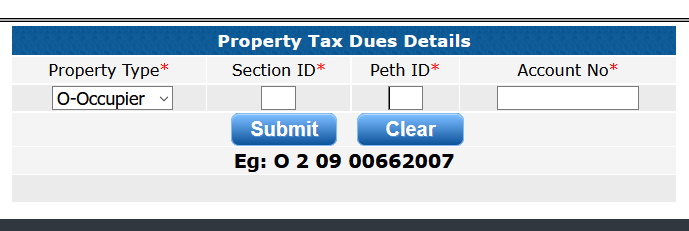

How To Pay Pcmc Property Tax

Step 1: Visit the PCMC India portal and click on Resident, from the top menu.

Step 2: Select Property Tax option, which will take you to an external website.

Step 3: Click on Property Bill option after which you will be redirected to a new page.

Step 4: You will see four options to search your property details By Property Code, Search in Marathi, Search in English and Back to Home page.

Step 5: Enter the zone number, Gat number, owner name and address, to get your property bill.

Step 6: Click on Show, once you are prompted to display the property details on the screen.

Step 7: Scroll down to find the Make Payment option.

Step 8: Enter your email-id and mobile number, choose the payment option and make the payment.

How Likely Is A Fourth Stimulus Check

Don’t hold your breath, according to Wall Street analysts. “I think it’s unlikely at this time,” Raymond James analyst Ed Mills told CNBC. One reason is that the Biden administration is focused on advancing its infrastructure plan, which would reshape the economy by rebuilding aging schools, roads and airports, as well as investing in projects ranging from affordable housing to broadband.

The proposal, which the White House says would be funded by boosting the corporate tax rate from 21% to 28%, will likely consume lawmakers this fall, said Stifel’s Brian Gardner in an August 11 research note.

“The fall is shaping up to be a busy time in Washington as Congress tries to finish two infrastructure bills , approve the annual spending bills, and raise the debt ceiling,” he noted.

Recommended Reading: How Can I Make Payments For My Taxes

How Do I Check Property Taxes

Related Articles

As a homeowner, you pay property taxes to the county where your home sits. Property taxes are paid directly to the county assessors or through your mortgage escrow company with a prorated amount included in your monthly mortgage payment. To determine the exact amount owed and determine if taxes are paid appropriately, you have several places to check.

Tip

Checking property taxes is easy as looking at your tax bill, form 1098 or visiting the county assessor’s office or website.

Add Calgary Property Tax As A Payee

Before making payment at an ATM add Calgary Property Tax as a payee and register your current roll number online, by phone or in person at a branch.

Add Calgary Property Tax payee to your bank accounts bill payment profile:Search keywords: Calgary property tax and select the payee name closest to Calgary Property Tax or Calgary Property Tax.

Cant find Calgary property tax as a payee or are unsure which payee to select?

Contact your bank for more information.

Read Also: How To Get Tax Preparer License

Secured Property Taxes Terms

Annual Secured Property Tax BillThe annual bill, which includes the General Tax Levy, Voted Indebtedness, and Direct Assessments, that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1, due in two installments.

Adjusted Annual Secured Property Tax BillA bill that replaces the Annual Secured Property Tax Bill due to the following reasons: a change or correction to the assessed value of the property the allowance of an exemption that was previously omitted the correction of a Direct Assessment placed on the property from a municipality or special district or the inclusion of a penalty for failure to comply with certain requirements of the Office of the Assessor prescribed by law .

Ad ValoremAccording to the value Based on value. For example, the Office of the Assessor calculates property taxes based on the assessed value of a property.

Non-Ad Valorem Not according to the value.

AssessmentThe rate or value of a property for taxation purposes.

Assessors Identification Number A 10-digit number that identifies each piece of real property for property tax purposes, e.g., 1234-567-890.

California Relay ServiceA telecommunications relay service that provides full telephone accessibility to people who are deaf, hard of hearing, or speech impaired.

Current YearThe current fiscal tax year in which the Department of Treasurer and Tax Collector issues an Annual Secured Property Tax Bill.

Testate

Easy Way To Determine Your Property Tax

Here are the easy step of making the property tax payment. Before making the property tax payment one needs to find out what is the tax amount. It can be found online.

For this, the urban development department introduced an online property tax calculation tool which is made available on the website of the state urban development department. You can find the link here

According to the Urban Development department, four different URLs are developed to calculate the property tax

For City CorporationsURL : http://www.< cityname> city.mrc.gov.in/ptaxcalculator. Example:

For the City Municipal CouncilsURL : http://www.< cityname> city.mrc.gov.in/ptaxcalculator. Example:

For Town Municipal Councils URL : http://www.< cityname> town.mrc.gov.in/ptaxcalculator. Example:

Also Check: When Do You Do Tax Returns

Property Tax Payment Options

We encourage you to pay your taxes and utilities online or via telephone banking.

Our customer service team is happy to assist you over the phone or via email if you have any questions. For property tax and utility information, call 604-591-4181 or email .

You can also mail your payment to City Hall or pay in person. Appointments to pay in person are encouraged to avoid wait times.

S To Check Outstanding Tax

How to check your outstanding property tax:

- Ask Jamie, your virtual assistant.

- Use the ‘Check Property Tax Balance’ digitalservice without having to log in to mytax.iras.gov.sg.

- Search using your property address and your tax reference number or your property tax reference number.

- Type in the verification code shown in the image.

- Select ‘Search for property’.

Use the property tax reference number to pay your outstanding tax via the various payment options available.

Alternatively, if you wish to check the details of your past payment transactions, you will need to:

31 Jan1 month from the date of notice

You May Like: How To Appeal Cook County Property Taxes

Roll Number Is The Account Number

Make sure the Calgary property tax account number registered in your banks bill payment profile matches the 9-digit property tax roll number shown on your tax bill or statement, entered without spaces or dashes. If an invalid 9-digit roll number is used it may result in a Payment Alignment fee of $25.

Roll number location on a property tax bill

Roll number location on a property tax statement of account

Apply payment to the correct property – check your roll number

The property tax roll number is linked to the property NOT the owner.

When you sell a property, that propertys tax roll number does not follow you to your next property.

Your new property will have its own roll number, which appears on your bill.

You must register your new propertys 9-digit roll number as the account number before making payment. Not changing the roll number registered with your bank will result in your payment being applied to your previous property, not your current bill. If your previous roll number is used to make the payment, it may result in a Payment Alignment fee of $25.

Need a copy of your tax bill? Visit Property Tax Document Request.

Keep your receipt as proof of the date and time of payment.

Bank Or Financial Institution

You can pay your property taxes through the bank, credit union or other financial institution you have an account with. When you use your bank or financial institution, we recommend that you always confirm when your payment will be processed by your bank to avoid late payment penalties. For example, banks will often process payments received in the afternoon with the date of the next business day.

There are three ways you can pay your property taxes through your bank or financial institution:

Note: You can no longer make a payment at a financial institution you dont have an account with.

Bill payment service

Most banks and financial institutions offer bill payment services for their clients. Bill payment services can generally be accessed through your online banking account, an automated teller machine , telephone banking or in person with a teller at the financial institution that you bank with.

Note: When you pay in person, you need to set up a bill payment service for Rural Property Taxation before you pay with a teller.

To pay your property taxes using a bill payment service you’ll need to add a payee for Rural Property Taxation to your bank account. To add a new payee to your bank account you need to know our payee name and your folio number.

- Our payee name is PROV BC – RURAL PROPERTY TAX

- Your folio number is listed on your Rural Property Tax Notice. It must be entered without spaces or decimals. For example, 012 34567.890 must be entered as 01234567890

Wire transfer

Read Also: How Can I Make Payments For My Taxes

Please Follow Below Mentioned Steps To Use Online Services

- Please register yourself with this website. to register.

- After successful registration, you need to login using OTP received during the online registration process.

- After Logging in, you can link all of your Property Tax and Professional Tax numbers in your profile and thus can make payments to all of them with just one log in id.

- For more information on how to pay tax .

- For User guideline for Birth/Death Certificate delivery by post .

- For user guideline of Professional Tax Payment for PRC .

- For any query regarding online payment of Property and Professional Tax , please contact on :1)079-27556182

- For any other query, please contact on :1) 155303