Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

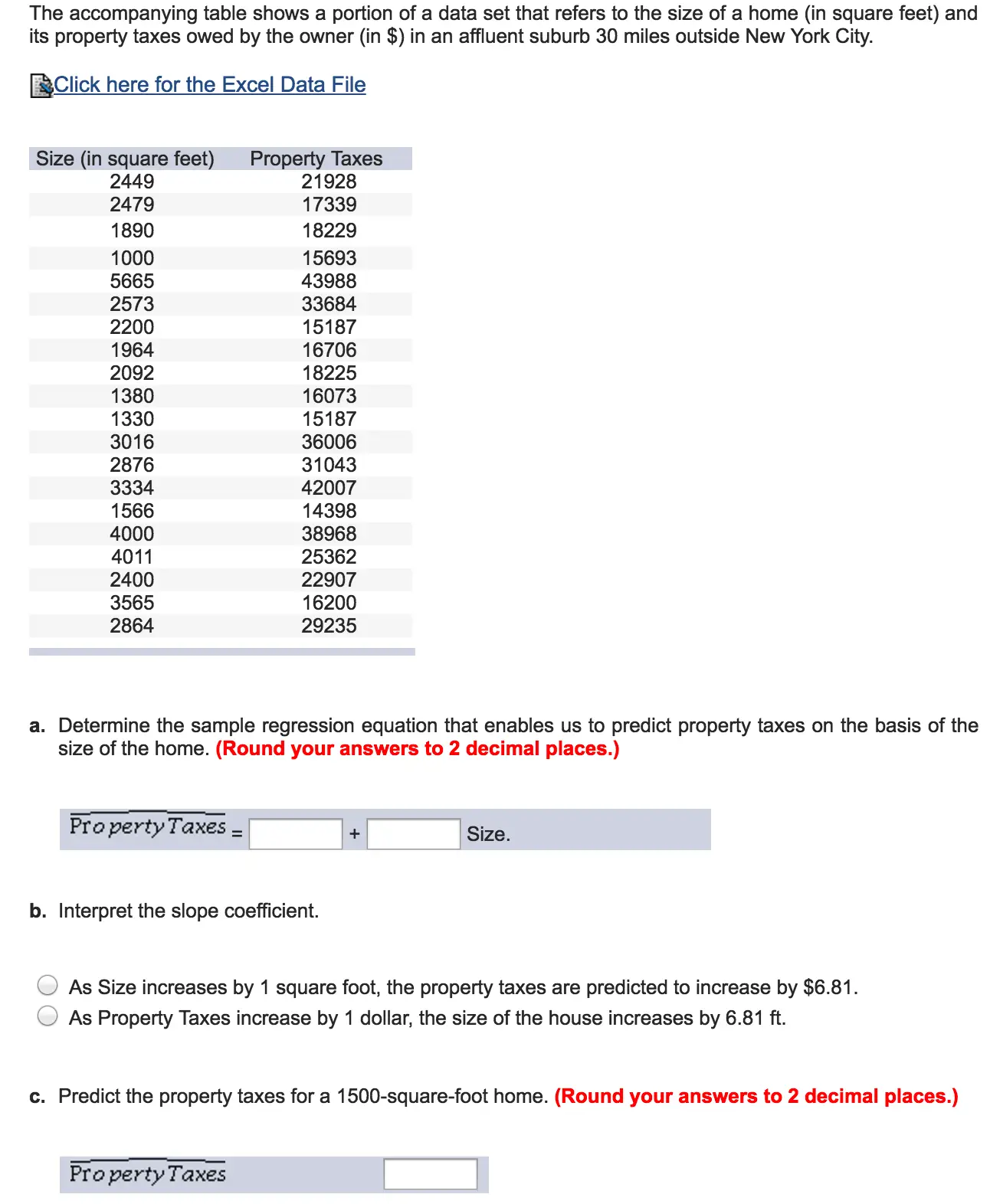

Relationship Between Property Values & Taxes

- Prior to the economic downturn, property values were increasing annually, reaching a high of $58 billion in assessed value in fiscal year 2009.

- In addition, new construction was added to the rolls each year, also increasing the assessed value to be taxed.

- Both these helped keep the tax rate down.

Other Ways To Find Your Account Information

- You can request an Account Transcript by mail. Note that each Account Transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.

- If you’re a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return.

Also Check: What Is Tax Liability Zero

How To Check Your Irs Tax Balance And Pay Back Taxes

At Solvable, we care about your financial well-being and are here to help. Our research, articles and ratings, and assessments are based strict editorial integrity. Our company gets compensated by partners who appear on our website. Here isSee More

- You can check your IRS tax balance online, over the phone, or by mail.

- Youll need to call or log in for the most up-to-date balance information.

- You can pay the amount due immediately or request a payment plan.

Whether you suspect that you owe the Internal Revenue Service a payment or you arent sure how to pay past-due tax bills, its important to address your IRS tax balance before it gets out of hand. Find out how to check what you owe and learn how to pay your IRS tax balance.

Frequently Asked Questions: Ein Number Lookup

Do I need an EIN if Im self-employed?

You dont need an EIN if youre self-employed you can simply use your Social Security number. Some people who are self-employed choose to apply for an EIN instead of using their Social Security number to reduce the risk of identity theft its less likely for someone to break into your accounts when you keep business finances and personal finances separate.

I have a sole proprietorship with a DBA . Do I Need an EIN?

Having a DBA doesnt impact whether or not you are required to have an EIN for your sole proprietorship. The same rules apply to a sole proprietorship with a DBA as apply to a sole proprietorship without a DBA.

Per the IRS, A sole proprietor without employees and who doesnt file any excise or pension plan tax returns doesnt need an EIN. Once you hire employees or file excise or pension plan tax returns, you will immediately require an EIN.

Is there a difference between an EIN and a TIN?

No, there isn’t a difference between an Employer Identification Number and a Taxpayer Identification Number . Both refer to the nine-digit number issued by the IRS to identify your business.

Is there a difference between an EIN and a FEIN?

No, there is not a difference between an EIN and a Federal Employer Identification Number . A FEIN can also be referred to as a Federal Tax Identification Number.

How to establish business credit through your EIN?

Also Check: How Much Is North Carolina Sales Tax

Foreign Persons And Irs Employer Identification Numbers

Foreign entities that are not individuals and that are required to have a federal Employer Identification Number in order to claim an exemption from withholding because of a tax treaty , need to submit Form SS-4 Application for Employer Identification Number to the Internal Revenue Service in order to apply for such an EIN. Those foreign entities filing Form SS-4 for the purpose of obtaining an EIN in order to claim a tax treaty exemption and which otherwise have no requirements to file a U.S. income tax return, employment tax return, or excise tax return, should comply with the following special instructions when filling out Form SS-4. When completing line 7b of Form SS-4, the applicant should write “N/A” in the block asking for an SSN or ITIN, unless the applicant already has an SSN or ITIN. When answering question 10 on Form SS-4, the applicant should check the “other” block and write or type in immediately after it one of the following phrases as most appropriate:

“For W-8BEN Purposes Only””For Tax Treaty Purposes Only””Required under Reg. 1.1441-1″”897 Election”

To expedite the issuance of an EIN for a foreign entity, please call . This is not a toll-free call.

What Is Lake County Doing To Lower My Bill

Lake County has more than 200 individual entities that levy property taxes, which is why the Lake County Board is pursuing partnerships and looking for consolidation opportunities to reduce this number. Consolidation efforts are centered around partnerships that will enhance efficiency, accountability, and cost savings.

- Learn how the County Board has kept the tax levy flat for Fiscal Years 2020 and 2021.

- Learn more about consolidation efforts and how your property tax dollars are used to help make Lake County a great place to live, work and visit.

You May Like: Do You Pay Taxes On Inherited Money

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Review Mailed Irs Notices

In some cases, checking your tax balance is as easy as reviewing the most recent notice you received via mail from the IRS. Keep in mind, however, that mailed notices may not be complete or up to date. A notice thats over a few months old may not include accrued interest or accumulated penalties. Since many notices only cover a single tax year, reviewing your most recent IRS letter may not give you a complete picture of your back taxes. Consider calling or checking online for updated information.

Read Also: How Can I Pay My Property Taxes Online

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

You May Like: What Property Tax Exemptions Are Available In Texas

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Frequently Asked Questions About Your Online Account

Are there plans to make online account available to international taxpayers?

Currently taxpayers have to get through Secure Access to get to online account, and Secure Access is not available for taxpayers who have international addresses. The Taxpayer First Act Report to Congress includes a commitment to better serve international taxpayers and will be built out in the future.

Im unable to access my account with the information I provided what can I do?

Other ways to find your account information

- You can request an Account Transcript. Please note that each Account Transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.

- If you’re a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return.

Can I authorize someone else to access my online account?

No. Only the taxpayer should log into their account. Credentials should never be shared with others.

Why am I getting a message saying that the service is not available after I log into my online account?

What if I filed my tax return or paid my taxes late?

If you filed your tax return or paid your taxes late, the IRS may have assessed one or more penalties on your account. In some cases, the IRS will waive the penalties for filing and paying late. However, youll need to ask the IRS to do this.

Where can I see the details of my payment plan?

You may be able to:

Also Check: Can I Do My Taxes With My Last Pay Stub

Access Tax Records In Online Account

You can view your tax records now in your Online Account. This is the fastest, easiest way to:

- Find out how much you owe

- Look at your payment history

- See your prior year adjusted gross income

- View other tax records

Visit or create your Online Account.The method you used to file your tax return and whether you had a balance due affects your current year transcript availability.

Request your transcript online for the fastest result.

Secured Property Taxes Terms

Annual Secured Property Tax BillThe annual bill, which includes the General Tax Levy, Voted Indebtedness, and Direct Assessments, that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1, due in two installments.

Adjusted Annual Secured Property Tax BillA bill that replaces the Annual Secured Property Tax Bill due to the following reasons: a change or correction to the assessed value of the property the allowance of an exemption that was previously omitted the correction of a Direct Assessment placed on the property from a municipality or special district or the inclusion of a penalty for failure to comply with certain requirements of the Office of the Assessor prescribed by law .

Ad ValoremAccording to the value Based on value. For example, the Office of the Assessor calculates property taxes based on the assessed value of a property.

Non-Ad Valorem Not according to the value.

AssessmentThe rate or value of a property for taxation purposes.

Assessors Identification Number A 10-digit number that identifies each piece of real property for property tax purposes, e.g., 1234-567-890.

California Relay ServiceA telecommunications relay service that provides full telephone accessibility to people who are deaf, hard of hearing, or speech impaired.

Current YearThe current fiscal tax year in which the Department of Treasurer and Tax Collector issues an Annual Secured Property Tax Bill.

Testate

You May Like: How Do I File Last Years Taxes

Request A Payment Plan

Neglecting to pay your tax balance can lead to wage garnishment, liens, and other consequences. If you cant cover the balance, you may be able to space out payments over time to avoid additional penalties.

To set up a payment plan, log in to your online IRS account or call the agencys payments department. Youll need to propose a timeframe and payment frequency and then await approval from the IRS. Keep in mind that long-term installment agreements require setup fees, and youll likely continue to accrue interest and penalties until youve paid your IRS tax balance in full.

Whether you owe a little or a lot, learning that you have an IRS tax balance can have a substantial impact on your bank account. Since putting off your payments can lead to much more serious issues and bigger penalties, get the resources you need to tackle tax matters now. Get a free tax assistance consultation with Solvable, and start getting your finances back on track.

A Right To Know How Your Property Tax Dollars Are Being Spent

The Treasurer sends out tax bills and collects and distributes funds for all Lake County taxing districts. While taxpayers pay their property taxes to the Lake County Treasurer, Lake County government only receives about seven percent of the average tax bill payment. School districts get the biggest portion .

You May Like: How Much Would I Pay In Taxes Calculator

Pay With A Credit Or Debit Card

You can also use a debit card to pay from your checking account or use a credit card to settle your bill. This is an option even if you dont have the funds available today. Since the IRS doesnt accept credit or debit payments directly, youll need to use one of the agencys approved third-party services.

While each service charges a flat fee for debit cards, they all charge a percentage for credit cards. Be sure to confirm the fee in advance so you know exactly how much youll need to pay. Since the IRS also limits the frequency of credit and debit card payments, confirm that you are eligible for this service before initiating a payment.

Use A Voucher To Pay A Lockbox

If youd rather pay your balance by check or money order, youll need to submit the payment along with a voucher. Since the payment voucher includes information that links your payment with your account, be sure to include both when mailing in your check or money order. In the event that you dont have a voucher, you can get one from your nearest IRS office or call and ask the agency to mail one to you.

Read Also: Do You Pay Taxes On Life Insurance Payment

How To Access Old Tax Returns

This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant and a Certified Financial Planner in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006. This article has been viewed 48,000 times.

Accessing old tax returns may be necessary if you need to look up specific information about your income or your expenses. You can also use old tax returns as proof of your financial history for a mortgage or loan application. As a taxpayer, you are able to access a transcript or an official copy of old tax returns in just a few easy steps. A transcript is free to access, but each official copy of your old tax returns will cost you $50 USD as of March 2019.

Please Click On The Accept Link Which Signifies That You Have Read Understood And Agree To The Terms And Conditions Below

General Disclaimer

The maps and information are provided without warranty of any kind, either expressed or implied, including but not limited to warranties of merchantability and fitness for a particular purpose. The City of Detroit assumes no liability arising from the use of any data on this site. The City of Detroit makes every effort to produce and publish on this site the most accurate and current information available to it, however, technical inaccuracies may occur and the information may be changed or updated without notice. Maps and data presented on this Web site or by the City of Detroit’s Geographic Information System are not surveys, and should be treated as reference data only.

The City of Detroit makes no warranty or representation whatsoever, express or implied, with respect to the quality, content, accuracy, completeness, currency, freedom from computer virus, spyware, adware suitability for any particular purpose, or non-infringement of proprietary rights, for any of the information published on this site. While the City of Detroit uses reasonable efforts to provide accurate and up-to-date information, you are fully and solely responsible for your use of the information and for any results or consequences of your use.

The foregoing terms and conditions and all disputes arising under them shall be governed, construed and decided in accordance with the laws of the State of Michigan.

You May Like: Are Charity Donations Tax Deductible