How To Download & Export Bitcoin Trading & Transaction History

Theres a couple of ways to get your Bitcoin transaction history – depending on whether youre doing it yourself or using a Bitcoin tax calculator. Lets take a look.

Cryptocurrency Tax Reporting Clarified: What To Include On Your Tax Return

Confused about what cryptocurrency activity to include on your tax return? You’re not alone. In this post, we’ll demystify cryptocurrency tax reporting, including what crypto activity is taxableand what isn’tso you can properly record these when filing your taxes.

Cryptocurrency is evolving the world of finance, as evident in news headlines around the recent CoinBase IPO and large companies like Venmo and Mastercard announcing support of cryptocurrencies. But its not only the media thats taking notice. The growing use of digital currencies has also caught the attention of the IRS, who will be looking closely at tax returns for proper cryptocurrency tax reporting.

For many that own or interact with digital currencies, the IRSs guidance on cryptocurrency tax reporting has raised more questions than answers. While taxes are not necessarily anyones favorite topic, its important to understand when you need to report taxes on crypto in order to avoid a costly IRS audit.

Gather Information For Bitcoin Tax Reporting

For each transaction, you need to know the following:

- The amount you spent to buy the cryptocurrency

- The date you purchased them

- The date you sold or exchanged the coins

- The amount in dollars the cryptocurrency was worth when you sold it

When you sell stocks, at the end of the year, your broker will send you a Form 1099-B that includes all of the necessary information to report those sales on your tax return. But don’t expect the same service from a cryptocurrency exchange. Most crypto exchanges only send 1099 forms to customers with gross payments over $20,000 or more than 200 cryptocurrency transactions during the year.

However, you can typically generate reports through your cryptocurrency exchange platform that will include all buys, sells, sends, and receipts of cryptocurrency from the account. If all of your cryptocurrency transactions take place on one exchange, gathering the information you need for tax reporting should be relatively easy. If your cryptocurrencies are scattered across several exchanges, you’ll need to download separate reports from each of them.

You May Like: How To File Federal Taxes Electronically

When Youll Owe Taxes On Cryptocurrency

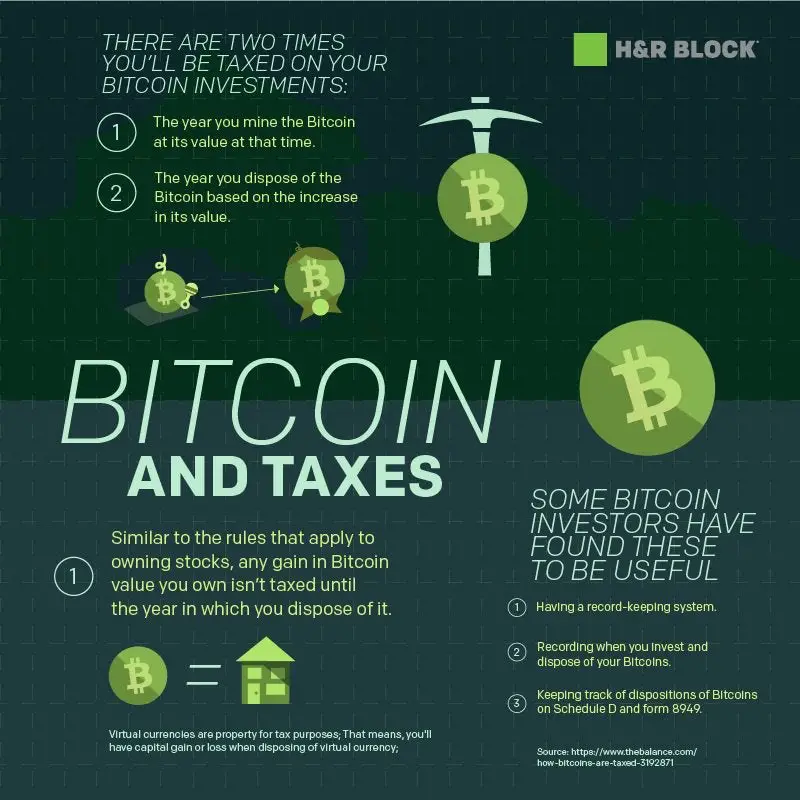

Because the IRS considers virtual currencies property, their taxable value is based on capital gains or losses basically, how much value your holdings gained or lost in a given period.

When you trade cryptocurrencies or when you spend cryptocurrency to buy something, those transactions are subject to capital gains taxes, because youre spending a capital asset to get something or get another asset, says Chandrasekera.

The difference between the amount you spent when you bought or received the crypto and the amount you earn for its sale is the capital gain or capital loss what youll report on your tax return. Broadly speaking, if you bought $100 worth of Bitcoin and sold it for $500, youd see a capital gain of $400. If your Bitcoin lost value in that time, youd instead face a capital loss. If your losses exceed your gains, you can deduct up to $3,000 from your taxable income .

The amount of time you owned the crypto plays a part, too. If you held onto a unit of Bitcoin for more than a year, it would generally qualify as a long-term capital gain. But if you bought and sold it within a year, its a short-term gain. These differences can affect which tax rate is applied. The tax rate also varies based on your overall taxable income, and there are limits to how much you may deduct in capital losses if your crypto asset loses value.

Do I Need To Report Crypto On Form 8621

If your foreign cryptocurrency is held in a Passive Foreign Investment Company, such as a holding company, fund, or other bundled security, it may be considered a PFIC.

Form 8621 is used to report PFIC and it is a very complicated form. We have additional PFIC resourcesto assist you with understanding whether your cryptocurrency may be considered PFIC.

Read Also: Does Dc Have State Income Tax

Example: Crypto Capital Gains Transaction

It’s just as important to calculate your crypto capital losses as your gains because they may significantly reduce your tax liability in current or future tax years.

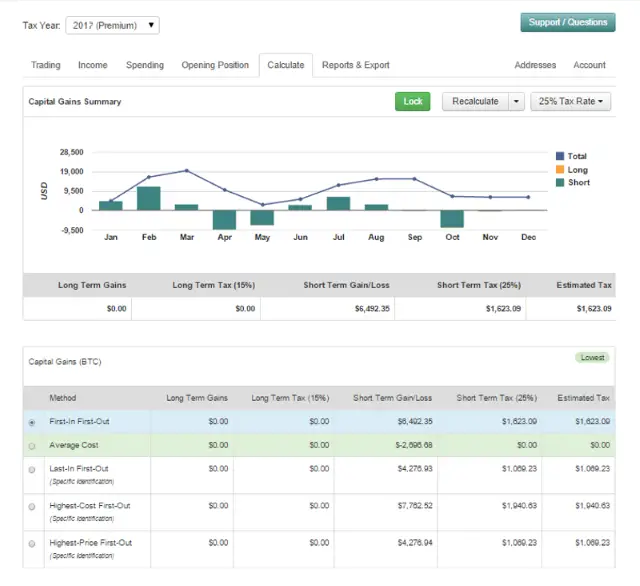

For individual transactions for which cost basis is known, these calculations are relatively easy. However, calculating crypto gains and losses often becomes more difficult as the volume of trades increases and/or you discover you have missing cost bases. In these cases, crypto tax software is a very valuable tool.

Reporting Crypto On Your Tax Form

Any time you make or lose money on your investments, you need to report it on your taxes using Schedule D.

In the past, many people who held blockchain technology and cryptocurrency may not have reported it. But ever since 2020, the IRS has added a question about crypto to page one of Form 1040 tax reporting purposes. Under the section where you put your name, address, and other personal information, it says, At any time during the tax year, did you receive, sell, send, exchange, or otherwise dispose of any financial interest in any virtual currency?

You only need to check Yes if you made any crypto transactions during the tax year if you just purchased crypto with real currency or held cryptocurrency but didnt buy or sell it, you can mark No.

New for tax year 2021: The IRS is requiring all taxpayers to answer Yes or No to the virtual currency question in order to e-file their return this year, so dont skip this question!

Also Check: How To Find Real Estate Taxes Paid

How Are Crypto Transactions Reported

When you place crypto transactions through a brokerage or from using these digital currencies as a means for payment, this constitutes a sale or exchange. As a result, youll need to document your crypto sales details, including how much you bought it for and when. These transactions are typically reported on Form 8949, Schedule D, and Form 1040.

Include Form 8949 With The Form 1040 Schedule D

The Form 8949 is included with the Form 1040 Schedule D, which reports your overall capital gains and losses. On this form, you list your totals for short-term and long-term capital gains and losses separately, as they receive different crypto tax rates.

The Schedule D also includes gains and losses from Schedule K-1s from any businesses, estates, and trusts. It also is where you will report crypto capital losses carried forward from previous years or those that you wish to carry forward to future years.

Recommended Reading: How To Claim Child Care On Taxes

Tax Consequences Of Buying And Selling Virtual Currency

While using virtual currency can save you money in banking fees, it does not free you from scrutiny by the IRS. In recent years as the use of this currency has risen, the IRS has become more serious about its enforcement efforts related to failure to report virtual currency on tax returns as required. The IRS defines virtual currency as a digital representation of value that is not recognized as the legal tender of any country. For tax purposes, this means it is classified as property, like stocks or real estate, rather than as currency, like U.S. dollars.

Virtual currency, as property, is subject to the capital gains tax. You must report all capital gains and losses on Schedule D of your tax return each year. In order to calculate these, you need to keep track of the fair market value of a bitcoin on the dates you bought each of yours. Buying bitcoin is not a taxable event, but when you sell the bitcoin or use it to purchase something, taxes will be calculated based on any capital gains. To calculate capital gains, you subtract the fair market value of bitcoin on the day you purchased it from the price at which you sell the bitcoin.

Calculate Your Crypto Gains And Losses

Every time you dispose of your cryptocurrency, youâll incur capital gains or capital losses. These disposal events include, but are not limited to:

- Selling your cryptocurrency for fiat

- Trading your cryptocurrency for another cryptocurrency

- Buying goods and services with cryptocurrency â

To calculate your gain or loss from each transaction, youâll need to track how the price of each one of your assets changed from the time you originally received them.

Hereâs a formula you can use:

Then, your capital gains and losses for your relevant cryptocurrency transactions should be reported on Form 8949.

Recommended Reading: Can I File My Past Taxes Online

Purchasing Crypto With Dollars

Simply buying virtual currency with U.S. dollars and keeping it within the exchange where you made the purchase or transferring it to your personal wallet does not mean youll owe taxes on it at the end of the year.

If your only crypto-related activity this year was purchasing a virtual currency with U.S. dollars, you dont have to report that to the IRS, based on guidance listed on your Form 1040 tax return.

Selling Crypto For Usd

Selling crypto for fiat currency like USD is a taxable event according to the IRS. If you sell your crypto asset for fiat currency after owning it for less than a year, you’ll pay short-term Capital Gains Tax. This will be at the same tax rate as your Income Tax rate. If you sell your crypto asset for fiat currency after owning it for more than a year, you’ll pay long-term Capital Gains Tax. The amount you pay will depend on how much you earn in regular income, but you’ll pay anywhere between 0% to 20%.

Also Check: When To File Quarterly Taxes

How Bitcoin Might Impact Your Income Taxes

Bitcoin is a relatively new e-currency payment system that is not operated by a centralized government authority like most other currencies. Popular for online payments and transfers due to its built-in encryption and security methods, Bitcoin has captured the attention of many non-traditionalists and tech-minded people. It has also captured the attention of the Canada Revenue Agency, who has altered existing tax codes to help address profits and transactions associated with virtual currencies.

What If You Dont Receive A 1099 From Your Crypto Exchange

All brokers and some crypto exchanges provide detailed information on your trades each year on a Form 1099. The tax form typically provides all the information you need to fill out Form 8949. However, many crypto exchanges dont provide a 1099, leaving you with work to do.

Most crypto exchanges dont do 1099 reporting, and theyre not yet required to, Harris says. He notes, however, that laws are already in place that require crypto exchanges to report trades in tax year 2023 for filing in 2024. Until then, its up to traders to figure their tax liability.

Without that reporting, its quite a bit more difficult for traders to figure their potential gains and losses.

Its going to be up to you to establish your holding period, your cost basis and your proceeds, Harris says.

That means digging through the records of your transactions, noting the purchase and sale dates, proceeds and anything else required on Form 8949. Thats no ones idea of a fun Saturday afternoon, but it can become even more complex due to whats called ordering rules.

Ordering rules govern which tax lots are sold when, meaning they determine whether a given sale is a short- or long-term investment.

For example, imagine you purchased 100 bitcoins in January, 100 in February and then another 100 in December. Then in March of the following year you sold just 250 of them for a profit. Youll have both a short-term gain and a long-term gain . But how do you split the tax between short- and long-term?

You May Like: How Much To Set Aside For Taxes

Frequently Asked Questions On Virtual Currency Transactions

In 2014, the IRS issued Notice 2014-21, 2014-16 I.R.B. 938PDF, explaining that virtual currency is treated as property for Federal income tax purposes and providing examples of how longstanding tax principles applicable to transactions involving property apply to virtual currency. The frequently asked questions below expand upon the examples provided in Notice 2014-21 and apply those same longstanding tax principles to additional situations.

Note: Except as otherwise noted, these FAQs apply only to taxpayers who hold virtual currency as a capital asset. For more information on the definition of a capital asset, examples of what is and is not a capital asset, and the tax treatment of property transactions generally, see Publication 544, Sales and Other Dispositions of Assets.

Q1. What is virtual currency?

Q2. How is virtual currency treated for Federal income tax purposes?

A2. Virtual currency is treated as property and general tax principles applicable to property transactions apply to transactions using virtual currency. For more information on the tax treatment of virtual currency, see Notice 2014-21. For more information on the tax treatment of property transactions, see Publication 544, Sales and Other Dispositions of Assets.

Q3. What is cryptocurrency?

Q4. Will I recognize a gain or loss when I sell my virtual currency for real currency?

Q6. How do I determine if my gain or loss is a short-term or long-term capital gain or loss?

Who Can Help Me Figure Out My Bitcoin Taxes

If you’re looking for more guidance, we urge you to consult a tax professional. The basic tax code is notoriously complex, and crypto activity can get awfully complicated quickly. When in doubt, hire a pro.

“I always tell people to inform your tax return preparer early on that you invest in cryptocurrency. Tell them during the year that you have crypto and you’re going to transact in crypto,” said Hunley. “And if you’re going to invest in cryptocurrency, if you can hold it for more than one year, you need to do that. Then you get a lower tax rate, and you want to take advantage of that.”

And, as with everything cryptocurrency-related: Do your research, pay your taxes and caveat emptor.

Also Check: How Do You Calculate Tax

Why You Need To File Crypto Taxes

The first reason you need to file crypto taxes is that it is the law, and its always better to stay on the good side of the tax authorities. In the early days, crypto was seen by many as a financial gray area, with regulators calling it out for being used for illicit transactions and to hide income or launder money.

As with any other means of payment, this still occurs in the cryptocurrency world. However, governments have now started to implement tools that make use of one of the core characteristics of blockchain technology: transparency.

While the reporting done by exchanges does not reach the very high standards related to more conventional investments like stocks, compliance is building with every passing year. Authorities are focusing on crypto more than ever, and they are starting to demand more reporting from exchanges. The United States Internal Revenue Service is also seeking a budget increase that would strengthen crypto tax enforcement.

Even if you havent received any tax documents associated with crypto trading, that does not mean you do not have any taxable events. You need to report all of your activities, regardless of whether you believe the exchange reported them or not. If you fail to do this, you could be the subject of an audit.

Selling A Crypto Gift

You’ll pay Capital Gains Tax if you dispose of your gifted crypto by selling it, trading it or spending it.

The cost base of gifted crypto is inherited. This means the recipient takes on the cost base of the original asset from the sender. If the cost base of the sender is unknown, you can use the fair market value of the crypto on the day you received it as the cost base.

Don’t Miss: When Do I Get My Tax Return 2021

If You Participate In An Airdrop Or Fork

An airdrop is when a new crypto project launches and sends out several free tokens to early adopters and their communities to encourage adoption as part of a broader marketing effort to promote the projects inception. If you frequently interact with crypto platforms and exchanges, you may receive airdrops of new tokens in your account. These new coins count as a taxable event, causing you to pay taxes on these virtual coins.

A hard fork is a wholesale change in a blockchain networks protocol that invalidates previously-verified transaction history blocks or vice versa. Many times, a cryptocurrency will engage in a hard fork as the result of wanting to create a new rule for the blockchain. The new, upgraded blockchain contains the new rule while the old chain doesnt. Many users of the old blockchain quickly realize their old version of the blockchain is outdated or irrelevant now that the new blockchain exists following the hard fork, forcing them to upgrade to the latest version of the blockchain protocol. For a hard fork to work properly, all nodes or blockchain users must upgrade to the latest version of the protocol software.

A hard fork doesnt always result in new cryptocurrency issued to the taxpayer, and doesnt necessarily generate a taxable event as a result. However, in the event a hard fork occurs and is followed by an airdrop where you receive new virtual currency, this generates ordinary income.