Why Is It Taking So Long For The Irs To Accept My Return

Whats Taking So Long? If you dont receive your refund in 21 days, your tax return might need further review. This may happen if your return was incomplete or incorrect. You may also experience delays if you claimed the Earned Income Tax Credit or the Additional Child Tax Credit.

Why Has My Tax Return Not Been Accepted Yet

The following are some of the most common causes for a return to be rejected: The prior year Adjusted Gross Income for the taxpayer does not match what the IRS shows. The taxpayers prior year AGI is what is being used to digitally sign their return and to help combat fraud. It must match what the IRS shows.

Check The Status Of Your Income Tax Refund

ONLINE:

- Click on TSC-IND to reach the Welcome Page

- Select Check the Status of Your Refund found on the left side of the Welcome Page.

-

You must have your social security number and the exact amount of the refund request as reported on your Connecticut income tax return. Enter the whole dollar amount of the refund you requested. For example, if you requested a refund of $375, enter 375.

NOTE: Please be aware that for all direct deposit refunds you must allow at least two business days after the date the refund is processed for the credit to be in the account.

TELEPHONE:

- Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962 . You will need your social security number and the exact amount of the refund request as reported on your income tax return. Enter the whole dollar amount of the refund you requested followed by the # sign. For example, if you requested a refund of $375, enter 375#. You can only check the status of the refund for the current filing season by telephone.

Paper Returns: Due to the volume during the filing season, it takes 10 – 12 weeks to process paper returns. Until the return is processed, your return will not appear on our computer system and we will not be able to check its status or to give you information about your refund. NOTE: Please consider using one of the electronic filing options. Visit our Online Filing Page for more information.

Don’t Miss: Can I Claim Donations On My Taxes

How Do Tax Returns Work

In the United States, tax returns are documented with the Internal Revenue Service or with the state or local tax collection organizations containing data used to ascertain taxes. Tax returns are by and large arranged utilizing structures recommended by the IRS or other important power.

In the U.S, people use varieties of the Internal Revenue Systems Form 1040 to document federal income taxes. Organizations will utilize Form 1120 and partnerships will utilize Form 1065 to record their yearly returns. An assortment of 1099 structures are utilized to report pay from non-business related sources. Application for programmed expansion of time to document U.S. individual income tax return is through Form 4868. Typically, a tax return starts with the citizen giving individual data, which incorporates their documenting status, and ward data.

Can I Call The Irs To Get Answers

While you could try calling the IRS to check your status, the agency’s live phone assistance is extremely limited.

The IRS is directing taxpayers to the Let Us Help You page on its website and to get in-person help at Taxpayer Assistance Centers around the country. You can contact your local IRS office or call to make an appointment: 844-545-5640. You can also contact the Taxpayer Advocate Service if you’re eligible for assistance by calling: 877-777-4778.

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if it’s been 21 days or more since you filed your taxes online, or if the Where’s My Refund tool tells you to. You can call 800-829-1040 or 800-829-8374 during regular business hours. If you have not received a refund yet, you shouldn’t file a second tax return.

Also Check: Do You File For Use Tax

How Long Does It Take The Irs To Issue A Refund Once Your Return Is Accepted And Approved

If the IRS accepts and approves your tax return, the agency says it typically issues refunds within 21 days. If your refund includes the CTC or EITC , the IRS says it wont begin issuing refunds for these types of tax returns until mid-February. This means even if you file on Jan. 24, 2022, you may have to wait more than 21 days before receiving your refund. Also, the IRS can experience technical issues, like it did in 2021 with its Wheres My Refund tool.

To avoid tax refund delays, do not file on paper use software, a trusted tax professional or #IRSFreeFile. For other critical steps this filing season, see #IRS tips at

How Do I Know If My Tax Return Was Filed

In the event that you have documented your government annual expenses and hope to get a discount, you can follow its status. Have your Social Security number, documenting status, and the specific entire dollar measure of your discount prepared. You can likewise check the status of your one-time Covid stimulus check.

You can use the Wheres My Refund tool or the IRS2Go portable application to check your refund on the web. This is the quickest and most direct approach to follow your refund. The frameworks are refreshed once like clockwork.

You can call the IRS to beware of the status of your discount. Be that as it may, IRS live telephone help is amazingly restricted right now. Stand by times to talk with a delegate can be long. In any case, you can stay away from the stand by utilizing the mechanized telephone framework. Follow the message prompts when you call.

You can document your expense form via mail, through an e-recording site or programming, or by utilizing the administrations of a duty preparer. Regardless of whether you owe expenses or youre anticipating a discount, you can discover your assessment forms status by:

- Using the IRS Wheres My Refund apparatus

- Survey your IRS account data

- Searching for messages or announcements from your e-documenting site or software

In the event that you call the IRS, you ought to have the accompanying data prepared when you get some information about your assessment forms status:

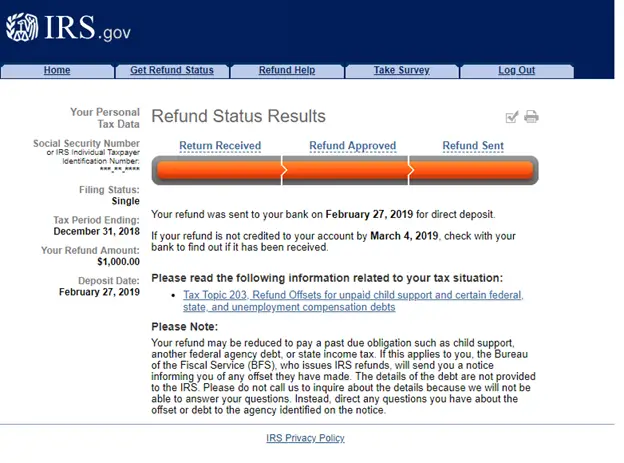

- Return received.

- Discount endorsed.

- Discount sent.

Don’t Miss: How Do You Check On Your Tax Return

How To Know If Your Return Has Been Filed

To file a return in TaxAct®, you MUST complete the filing steps in the program. If you have not completed the steps below for filing electronically or filing a paper return, your return has NOT been filed. Review the information for your filing method to ensure your return has been filed.

Filing Electronically

To file your return electronically, you must choose E-File My Return on the Filing screen. Follow ALL of the steps. After answering a series of questions, you will reach a screen with a Submit button. Your return will not be transmitted unless you click the Submit button. You will then see a screen confirming that your return has been submitted. If you do not see this screen, repeat the filing steps to ensure your return is transmitted.

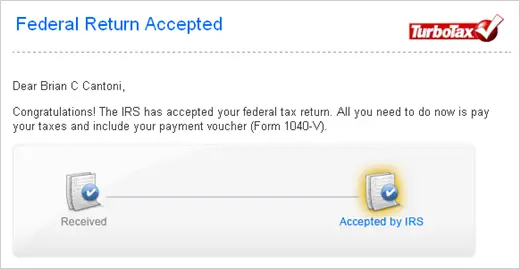

If you provided an email address during the filing process, you should receive an email within 24-48 hours indicating that your return has been received by TaxAct and transmitted to the IRS. Later, you will receive a second e-mail indicating the status of your return .

After transmitting your return, it is your responsibility to ensure that it is accepted by the IRS or state agency. If you do not receive an email confirmation or acceptance, you can check the status of your electronically filed returns at efstatus.TaxAct.com, or Electronic Filing Status.

You may also check your e-file status from your mobile phone via TaxAct Mobile Edition at m.TaxAct.com.

Filing a Paper Return

Also Check: Do You Have To Pay Taxes On Plasma Donations

How Do I Find Out If My Tax Return Was Accepted

Over the last decade, the United States Internal Revenue Service has implemented guidelines that have helped simplify the filling and tracking of how long it takes for the IRS to accept your e-file. E-filing a tax return is not only superior in terms of speeding up the time it takes for the treasury to receive a tax return, but it also speeds up the process of entering the information and providing acknowledgment that the federal return was accepted.

When e-filing with an authorized provider, such as this website, there are a variety of status responses sent to you from the IRS. Successfully transmitted, received by the IRS, errors or problems with the transmission and confirmations that a tax return has been accepted are all responses that may be provided to you.

Typically, we receive notifications from the IRS within a couple of hours at which time we will notify you that the IRS has either accepted your e-file or if you need to make changes to it. With that said, the IRS does state that it can take them up to 48hrs to return this notice.

Once we notify you that your e-file was accepted, if you are expecting a refund, you can now check your refund’s status. If there is information that causes your IRS filing to be rejected, you will receive a notification of this as well as details on what information is causing the rejection.

Also Check: Can I File My Taxes Without My Social Security Card

What Happens After The Irs Accepts Your Tax Return

After the IRS accepts your tax return, the next step is for the agency to approve it. To do this, the IRS will look at whether you have any unpaid taxes and compare the figures you provided to determine if an error was made or your refund needs to be adjusted.

For instance, if you owe taxes from the prior year or dont qualify for a credit you thought you could claim, the IRS will reduce your refund accordingly. For the 2021 tax filing season, the IRS is urging taxpayers to wait for Form 6419, which outlines how much they received in CTC payments in 2021.

If you fail to record an item accurately, the IRS will likely reject your return and request the necessary corrections. This could result in your refund being delayed by weeks or even months, depending on how far behind the IRS gets during the tax filing season.

If all the information you provided was accurate and matched the IRSs records, your return could take anywhere from a few days to a few weeks to go from accepted to approved. The best way to determine the status of your return is using the IRS Wheres My Refund tool.

Use the Wheres My Refund? tool to start checking the status of your refund 24 hours after #IRS acknowledges receipt of your e-filed tax return. To access the tool visit

IRSnews

Can You Check Your Refund Status Too Much

You can check the status of your tax refund within 24 hours after the IRS has acknowledged receipt of your e-filed tax return or 4 weeks after you mail a paper tax return. There’s no advantage to checking several times throughout the day: the IRS only updates the site once per day, usually overnight.

Recommended Reading: When Will I Get My Tax Refund

Find Out When Your Refund Will Be Approved If It Has Already Been Accepted By Continuing To Read On Ahead

Quite possibly the most important question in the life of an early tax filer is: My tax refund was accepted when will it be approved? Before e-filing, this was consistently hard to anticipate. To start with, you mail in your return. After that somebody inputs all your data . When this is done, the Treasury needs to issue a check, which is then sent to you. Presently, with a free IRS e-file, you can get your discount in a minimum of 8 days from when you have filed, in the event that you choose a direct deposit.

For 9 out of 10 citizens, the IRS gave discounts in under 21 days from the date the return was received a year ago. The IRS has not declared when they will open eFile yet for 2021. In any case, in light of our discussions with a few huge tax preparers, it shows up the speculative date to begin handling eFile government forms will probably be January 25, 2021. Nonetheless, many expense programs do permit you to document early and some fortunate filers even get acknowledged into test clumps with the IRS.

Receive An Initial Acceptance

When you file your tax return, the IRS checks your basic information, such as social security number and address, for legitimacy. If there are no data errors, the return is usually accepted. Youâll know the government accepted your return when you receive an electronic notification that says something like âweâve accepted your tax return.â After this, your return enters the processing stage, where the IRS checks all of your exemptions and credits for inaccuracies.

Donât Miss: How To Calculate Your Tax Bracket

Read Also: What Is The Sales Tax In Colorado

About Tracking Your Refund

How fast will I receive my refund?

How quickly you receive your tax refund depends on when you file, how you file, how you choose to receive your refund, and whether you claim certain credits and deductions.

When you file your return electronically, most refunds are funded within 21 days of filing, according to the IRS. That clock starts after the IRS begins processing tax returns for the year.

Please note that due to tax laws in place to reduce fraudulent claims for refunds, taxpayers who claim the EITC or refundable Child Tax Credit will not receive a refund before February 15th.

How fast can I get my refund?

If you chose direct deposit, your tax refund will be sent to your bank the same day the IRS sends your tax refund. It will typically take 3-5 days for your bank to process, depending on your bank.

You may receive your refund as early as the same day it was sent by the IRS up to two days faster* than standard direct deposit if you chose to have it loaded onto an American Express Serve® Card.

How can I check the status of my return on the MyJH account I created?

You’ll be able to see your return status!

How can I access my tax documents on the MyJH account I created?

Make A Plan For Your Refund

If youre expecting a refund this year, you should plan the best way to use it. With the economic effects of the COVID-19 pandemic ongoing across the country, take time to figure out the best way to leverage that refund to remain in a solid financial position for the remainder of 2021. If youve been putting off home repairs or improvements due to cash problems, getting your home back into top shape could be a great way to put your refund to work. Paying off your credit card or other debt balances is another great choice for spending your refund. Finally, it may make sense to start an emergency fund to be prepared for unexpected expenses that may rise up later in the year.

Also Check: How Much Is Georgia State Tax

What Is Happening When Wheres My Refund Shows My Refunds Status As Approved

Weve approved your refund. We are preparing to send your refund to your bank or directly to you in the mail. This status will tell you when we will send the refund to your bank . Please wait 5 days after weve sent the refund to check with your bank about your refund, since banks vary in how and when they credit funds.

Why Haven’t I Gotten My Refund Yet

There are numerous reasons why your tax return may not have been completely processed yet, resulting in a delayed refund. Here are the most common.

- Your return had errors or was incomplete

- You owe the IRS money

- Your bank account info was incorrect

- You filed a paper return

- You didn’t properly enter your stimulus payments

- The IRS suspects identity theft

- You filed an amended return

- Your return needs further review

In testimony to the House Ways and Means Committee, IRS Commissioner Charles P. Retting said that, in 2021, the agency received “far more than 10 million returns” in which taxpayers failed to properly reconcile their stimulus payments with their recovery rebate credit, which required a manual review and resolution.

If the delay is due to a necessary tax correction made to a recovery rebate credit, earned income tax or additional child tax credit claimed on your return, the IRS will send you an explanation. If there’s a problem that needs to be fixed, the IRS will first try to proceed without contacting you. However, if it needs any more information, it will write you a letter.

If you’ve requested a paper check for your tax refund, that’ll take longer, too — about six to eight weeks, according to the IRS.

Read Also: How Are Home Taxes Calculated

How To Know If Irs Has Received My Return

If youre unsure, you can call Customer Support. Customers are always happy to help and are available to answer your questions. So, if youre wondering, How do I know if the IRS has received my tax return? take advantage of this helpful tool. Filing early helps ensure that your refund will be quicker than usual.

Youll also be less likely to be the victim of tax identity thieves. Also, you can use the IRS Tax Withholding Estimator to find out how much youll receive in your paycheck. The earlier you file, the more money you can save on taxes. Youll even be able to use the IRSs free tool to find out how much youll owe and what to do to get your refund faster.