No Sales Tax Due For A Filing Period

You must file a sales tax return every filing period, even if no sales are made and no tax has been collected. Failure to file will result in the Department filing a return on your behalf and estimating the amount to be billed. These estimated returns will be due and payable until an actual return is filed. If you no longer need your sales tax account , notify the Colorado Department of Revenue as soon as possible.

What City Has The Highest Sales Tax

Some of the highest combined state and local sales taxes: Chicago , Illinois and Long Beach , California: 10.25 percent. Birmingham and Montgomery, Alabama and Baton Rouge and New Orleans, Louisiana: 10 percent. Seattle and Tacoma, Washington: 9.6 percent.

How To Register For Sales Tax In Colorado

Okay, so you have nexus! Now what?

The next crucial step in complying with Colorado sales tax is to register for a sales tax permit. Itâs actually illegal to collect tax without a permit. So to get all your ducks in a row, start with tax registration first.

You can find directions about how to register in Colorado on their Department of Revenue website.

When registering for sales tax, you should have at least the following information at hand:

- Your personal contact info

- Social security number or Employer Identification Number

- Business entity

- Bank account info where youâll deposit the collected sales tax

Read Also: How Much Does H & R Block Charge For Taxes

Filing When There Are No Sales

Once you have a Colorado sales tax license, youre required to file returns at the completion of each assigned collection period regardless of whether any sales tax was collected. When no sales tax was collected, you must file a “zero return.

Failure to submit a zero return can result in penalties and interest charges.

When You Need To Collect Colorado Sales Tax

In Colorado, sales tax is levied on the sale of tangible goods and some services. The tax is collected by the seller and remitted to state tax authorities. The seller acts as a de facto collector.

To help you determine whether you need to collect sales tax in Colorado, start by answering these three questions:

If the answer to all three questions is yes, youre required to register with the state tax authority, collect the correct amount of sales tax per sale, file returns, and remit to the state.

Read Also: Www.1040paytax.com Official Site

How Often Should You File

- Annual filing: If your business collects less than $15.00 in sales tax per month then your business should file returns on an annual basis.

- Quarterly filing: If your business collects between $15.00 and $300.00 in sales tax per month then your business should file returns on a quarterly basis.

- Monthly filing: If your business collects more than $300.00 in sales tax per month then your business should file returns on a monthly basis.

Note: Colorado requires you to file a sales tax return even if you have no sales tax to report.

What Steps Should A Business Take To Accept An Exemption Certificate

When a business is presented with a resale certificate, the burden of proof is on the seller to verify that the buyers information is correct and to keep these records. Failing to verify this information may put the liability of paying Colorado sales taxes on the seller.

To verify whether a Colorado exemption certificate is valid

- Review the certificate to make sure it is completely filled out.

- Verify the purchasers Colorado Sales Tax License by visiting the Colorado Department of Revenues website and click on the Verify a License or Certificate link.

- Sellers are also responsible for considering whether the goods and services sold are consistent with the purchasers claim that the sale is exempt from sales taxes if the purchases are over $250. For example, if the buyers business is a car dealership, but they want to purchase office supplies tax-free, the seller should investigate further.

- Keep a file of exemption certificates.

More information regarding the documentation of exempt sales can be found from the Colorado Department of Revenue 1 CCR 201-4.

Don’t Miss: Where’s My Tax Refund Ga

Misplacing A Sales Tax Exemption/resale Certificate

Colorado sales tax exemption and resale certificates are worth far more than the paper theyre written on. If youre audited and cannot validate an exempt transaction, the DOR may hold you responsible for the uncollected sales tax. In some cases, late fees and interest will be applied and can result in large, unexpected bills.

Colorado State Rate For 2021

2.9% is the smallest possible tax rate 3.25%, 3.3%, 3.7%, 3.75%, 3.9%, 4%, 4.15%, 4.2%, 4.4%, 4.5%, 4.55%, 4.65%, 4.75%, 4.9%, 4.985%, 5%, 5.13%, 5.27%, 5.4%, 5.45%, 5.5%, 5.65%, 5.7%, 5.9%, 5.985%, 6.375%, 6.4%, 6.5%, 6.7%, 6.75%, 6.813%, 6.85%, 6.9%, 7%, 7.01%, 7.13%, 7.25%, 7.27%, 7.35%, 7.4%, 7.5%, 7.53%, 7.55%, 7.6%, 7.65%, 7.7%, 7.75%, 7.9%, 7.96%, 8%, 8.13%, 8.15%, 8.2%, 8.25%, 8.27%, 8.31%, 8.35%, 8.375%, 8.4%, 8.485%, 8.49%, 8.5%, 8.515%, 8.52%, 8.53%, 8.6%, 8.635%, 8.65%, 8.7%, 8.75%, 8.81%, 8.845%, 8.875%, 8.9%, 9.03%, 9.05%, 9.2%, 9.25%, 9.3%, 9.4%, 9.45%, 9.55%, 9.9%, 10.4% are all the other possible sales tax rates of Colorado cities.11.2% is the highest possible tax rate

The average combined rate of every zip code in Colorado is 6.078%

You May Like: How Does H& r Block Charge

What Is The Car Sales Tax In Colorado

Colorado collects a 2.9% state sales tax rate on the purchase of all vehicles. However, a county tax of up to 5% and a city or local tax of up to 8% can also be applicable in addition to the state sales tax.

What is Durango Colorado sales tax? The City of Durango collects 3.5% in city sales tax. Both a city and a state sales tax license are required to sell retail merchandise anywhere within the city limits. City sales tax licensing is administered by the City Clerks Office. What is the tax rate in Durango Colorado?

What Is A Sales Tax Exemption Certificate

When retailers purchase products to resell, they often dont pay sales tax to the supplier on the purchase. The sales tax will still be paid, but instead of the retailer paying sales tax, the retailer charges sales tax to their customer on the final value of the merchandise. The collected sales tax is then sent by the retailer to the Colorado Department of Revenue.

For example, when a pet store purchases dog toys from their supplier to sell in the store, the pet store owner wont typically have to pay sales tax to their supplier. When a customer purchases the dog toy, the retailer will charge sales tax to the customer based on the full price of the toy. The retailer will collect the sales tax from all their transactions and periodically send the sales tax to the state.

The purpose of the certificate is to provide evidence of why sales tax was not collected on a transaction. Similar names for a resale certificate include reseller number, sellers permit, exemption certificate, wholesale license, or resellers license. In order for the supplier to allow the tax-exempt purchase, the seller needs proof the buyer intends to resell the product by providing a valid resale certificate.

The sales tax exemption is only intended to be used for inventory that will be resold and not intended for the tax-free purchase of items used in normal business operations such as paper, pens, etc.

Don’t Miss: How Can I Make Payments For My Taxes

Using A Third Party To File Returns

To save time and avoid costly errors, many businesses outsource their sales and use tax filing to an accountant, bookkeeper, or sales tax automation company like Avalara. This is a normal business practice that can save business owners time and help them steer clear of costly mistakes due to inexperience and a lack of deep knowledge about Colorado sales tax code.

Avalara Returns for Small Business is an affordable third-party solution that helps business owners simplify the sales tax returns process and stay focused on growing their business. Learn how automating the sales tax returns process could help your business. See our offer to try Returns for Small Business free for up to 60 days. Terms and conditions apply.

Amazon To Begin Collecting Sales Tax For Colorado Residents

According to an article, “Colorado Department of Revenue officials confirmed Amazon’s plan to charge and remit collections from Colorado’s 2.9 percent sales tax.”

“State law requires online retailers to track purchases made by people in Colorado and to report the amount of sales tax that should have been paid. The companies also must advise the buyers of their tax obligations. Under federal law, retailers that don’t have a presence in the state can’t be forced to collect the taxes, triggering the self-reporting requirement by consumers.”

A handful of states have already joined Colorado by taxing Amazon sales. For example, Michigan began collecting sales tax in October 2015.

Legislation is being proposed and considered that will change tax laws across the country and online. Vertex Inc. has designed an innovative interface and user experience that reduces the time, effort, and risk of managing sales tax compliance.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

Sales & Special District Taxes

Since sales and special district taxes for Gunnison County are administered by the state, if you would like more information regarding collection guidelines, licensure, reporting, or compliance please contact the State of Colorado directly as these questions cannot be answered by Gunnison County staff: State of Colorado Department of Revenue

Phone: 303-238-7378

Is A Resale Certificate The Same As A Sales Tax Id

The sales tax license and exemption certificate are commonly thought of as the same thing, but they are actually two separate documents. The sales tax license allows a business to sell and collect sales tax from taxable products and services in the state, while the exemption certificate allows the retailer to make tax-exempt purchases for products they intend to resell.

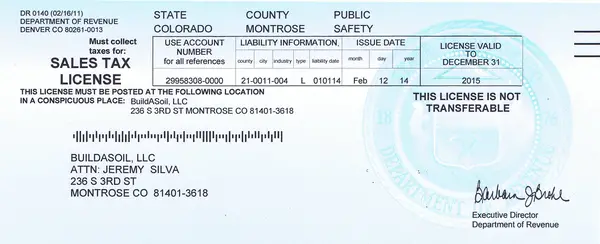

Related: How to register for a Colorado Sales Tax License

After registering, a sales tax number will be provided by the Department of Revenue. This number will be listed on the Sales Tax Exemption Certificate.

A Sales Tax Exemption Certificate is provided by the Department of Revenue to document tax-free transactions.

Don’t Miss: Where Is My State Refund Ga

Business Guide To Sales Tax In Colorado

So, you need to know about sales tax in The Centennial State. Look no further!

Whether youâve fully set up shop in Colorado, or simply ship there once in a while, itâs important you know whether your business is liable to their sales taxes. This guide will tell you everything you need to know, plus direct you to the right places for handling any sales tax responsibility you may have.

How To Register For A Colorado Seller’s Permit

You can register for a Colorado sales tax license online through the DOR. To apply, youll need to provide the DOR with certain information about your business, including but not limited to:

- Business name, address, and contact information

- Federal EIN number

- Date business activities began or will begin

- Projected monthly sales

There may be additional licensing requirements in home rule cities.

Don’t Miss: Where’s My Refund Ga State Taxes

Sales Taxes Restricted For Capital Improvements And Capital Expenditures

On February 14, 1978, the county’s electorate approved the following ballot question:

“Shall the County of Gunnison, Colorado, impose a one percent sales tax upon the retail sale of tangible personal property and the furnishing of certain services as provided for in Article 2, Title 29, Colorado Revised Statutes as amended with one-half of the revenues collected from such one percent sales tax within any municipality to be returned to such municipality and the balance of the revenues collected from such tax to be paid to Gunnison County for capital improvements and capital expenditures.”

What State Has The Highest Sales Tax

Five states do not have statewide sales taxes: Alaska, Delaware, Montana, New Hampshire, and Oregon. California has the highest state-level sales tax rate, at 7.25 percent. Four states tie for the second-highest statewide rate, at 7 percent: Indiana, Mississippi, Rhode Island, and Tennessee .

Recommended Reading: How Much Does H & R Block Charge To Do Taxes

Do I Need To Collect Sales Tax In Colorado

Colorado imposes sales tax on retail sales of tangible personal property. In general, the tax does not apply to sales of services, except for those services specifically taxed by law. In general, any retailer making sales in Colorado is required to collect the applicable state and state- administered local sales taxes .

How To File Taxes In Colorado

When tax time rolls around in Colorado, whether itâs monthly or annually, you must do three things:

Colorado requires that any seller with a sales tax permit file a sales tax return on your due date, even if you donât have any sales tax to report or pay. Even if you didnât make a single sale in Colorado during the reporting period, you should must do a âzero tax filing.â

Read Also: How To Buy Tax Lien Certificates In California

Filing Requirements & Frequency

Filing Requirements

If your business will be selling, renting or leasing tangible personal property, you must get a Sales Tax Account / License and file sales tax returns. Colorado generally does not impose a state sales tax on services. Some Colorado home-rule cities charge a sales tax on certain services. Contact those cities directly for further information.

Filing Frequency & Due Dates

Filing frequency is determined by the amount of sales tax collected monthly.

- $15 or less per month: Sales tax returns may be filed annually. Annual returns are due January 20.

- Under $300 per month: Sales tax returns may be filed quarterly.

- Due dates:

Note: If the 20th day falls on a weekend or holiday, the due date is the next business day.

Sourcing Sales Tax In Colorado: Which Rate To Collect

In some states, sales tax rates, rules, and regulations are based on the location of the seller and the origin of the sale . In others, sales tax is based on the location of the buyer and the destination of the sale .

As of April 2019, Colorado is in the process of changing its sales tax sourcing rules for in-state sellers. Prior to December 1, 2018, Colorado retailers were only required to collect the taxes they had in common with Colorado consumers. Effective December 1, 2018, with a grace period through May 31, 2019, the state is switching to destination sourcing. Colorado businesses must collect and remit the full sales tax rate in effect at the location of the consumer the destination of the sale when taxable goods are delivered to a Colorado address. Destination sourcing also applies to out-of-state sellers.

For additional information, see Information for in-state retailers Information for out-of-state retailers and Colorado adopts new sales tax collection requirements for in-state sellers in the wake of Wayfair.

Also Check: How Much H And R Block Charge For Taxes

Collecting Local Marketing District Taxes

The Local Marketing District Tax is levied on lodging establishments. Generally, if you rent rooms and accommodations to customers for less than 30 day periods, a local marketing district tax should charged to the customer. This includes lodging provided by hotels and motels, as well as condominium rentals and space rentals. This tax is remitted quarterly to the Department of Revenue on the “Local Marketing District Tax Return” .

Do You Have Nexus In Colorado

The word ânexusâ refers to a commercial connection in the state. Nexus determines the following questions for a state tax agency: Do you do business here, what kind, and how much? And when you do have nexus, that means youâre obligated to collect tax on your sales there.

So the first question for you to answer is whether you have nexus in Colorado.

You probably have nexus in Colorado if any of the following points describe your business:

- A physical presence in Colorado: a store, an office, a warehouse or distribution center, storage space, you, an employee, a representative, etc.

- A significant amount of sales in Colorado within twelve months. *

* This is called an economic nexus, a sales tax nexus determined by economic activity, i.e. – the amount of sales you make in a particular state. Any kind of economic activity could trigger the nexus, once your total sales reach a certain threshold amount.

The threshold in Colorado is $100,000 in annual sales. To learn more about how this works, check out the Ultimate Guide to US Economic Nexus.

You May Like: Cook County Assessor Deadlines

When To File Taxes In Colorado

When you register for sales tax, Colorado will assign you a certain filing frequency. Youâll be asked to file and pay sales tax either monthly, quarterly, or annually.

Usually the frequency they choose is based on the amount of sales tax you collect from buyers in Colorado. High-revenue businesses file more frequently than lower volume businesses, for example.

Colorado sales tax returns are due on the 20th day of the month following the reporting period. If the due date falls on a weekend or holiday, then your sales tax filing is generally due the next business day.