How To Find The Ein For Your Business

More often than not, there will be an instance when you’re working through a business document or application, and you come upon a question asking for your EIN. What if you cant remember it? The three best places to find your business EIN are:

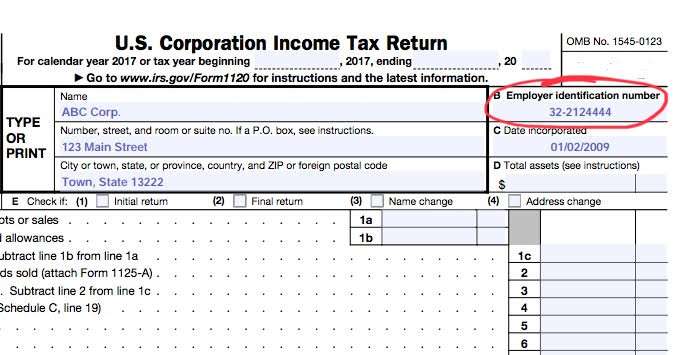

- Your business tax return from a previous year

- The original document of your receipt or the document you received from the IRS when you applied for your EIN

- Your states business division website, if you registered your partnership, LLC, or corporation with your state

You could also look for your EIN on other business documents or applications, including:

- A business bank account application

- An application for a business loan

- The application for a business credit card

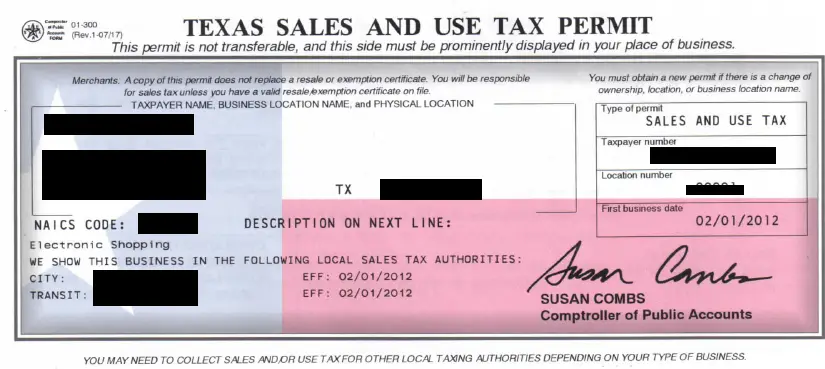

- A copy of a state or local license or tax permit

- On a 1099-NEC form you received for your work as an independent contractor or freelancer

- On the 1099-MISC form or 1099-NEC form that you used to report payments by your business

Get An Ein For Small Business Disaster Loans

- Your business will need an EIN to apply for Small Business Administration loans, including disaster loans for businesses affected by the public health crisis and economic downturn, as well as the 2021 winter storms.

- The Economic Injury Disaster Loanprogram is an SBA disaster loan program for businesses with fewer than 500 employees, including sole proprietors, independent contractors, and self-employed persons. Check with your local lender to see whether they participate in this program.

What Is A Tax Id

- A tax ID or Tax Identification Number is a nine-digit number assigned to businesses by the IRS.

- Every company conducting business in the United States must have a tax ID.

- Since there can be multiple businesses with the same name, a tax ID serves as a unique identifier for taxation and several other business purposes.

- In addition to the federal government, your tax ID is also used by state and local governments, banks, creditors, and vendors to identify your business.

- You often need a tax ID for opening a business bank account, hiring employees, obtaining business licenses, and filing payroll taxes.

You May Like: How Can I Make Payments For My Taxes

Can An Ein Be Used For Multiple Businesses

In some cases, an EIN can be used for multiple businesses, much like having a holding company or parent company. In order for this to happen, both businesses will both operate under the same business entity .

Both legally and for tax purposes, there is actually only one business. A couple of issues to be aware of.

While it sounds like it would be better to have an EIN for each business venture, there are some restrictions.

Who Needs A Tax Id

You usually need to obtain a tax identification number in the following cases:

- You have employees or you file any employment related tax return.

- You withhold income tax while making any sort of payment.

- You are conducting business as a corporation, LLC, or limited partnership.

- Your business transacts in any manner with trusts, estates, nonprofit organizations, individual retirement accounts, or farmers’ cooperatives.

- You do not want to use your social security number for your business.

- You want your business financial year to be the same as the calendar year closing in December.

Thus, even sole ownerships and general partnerships may need to obtain a tax identification number.

Recommended Reading: How To File Taxes Without Income To Get Stimulus Check

When Your Business Needs An Ein

Your business will need an EIN when:

- You have employees

- You are starting a business that is registered with a state, like a partnership, LLC, or corporation

- Your business must pay excise taxes, or you are subject to alcohol, tobacco, or firearms regulations

- You withhold taxes on income, not including wages, paid to a non-resident alien

- You use a Keough Plan or tax-deferred pension plan

- Your business works with certain organizations like nonprofits, trusts, estates, and farm cooperatives

Direct And Predominant Use

Tangible personal property is considered to be used “directly” when the use of the property is integral and essential to the production activity the use occurs where the production activity is carried on and occurs during the production activity. The property is considered to be used “predominantly” when the property is used directly in production activities more than 50 percent of the time.

You May Like: Reverse Ein Lookup Irs

Understanding Tax Identification Number

The Tax Identification Number is also known as the Taxpayer Identification Number and it is used primarily for tax purposes in the United States. It is also known as the Federal Taxpayer Identification Number and can be issued by the Internal Revenue Service or the Social Security Administration . The issue and use of this Tax ID number is governed by Title 26 of the Internal Revenue Code and while 26 U.S.C. § 6109 defines identifying taxpayer ID numbers along with sharing of information and safeguards, confidentiality and nondisclosure rules, and sanctions among others.

It is important to understand the purpose of the Taxpayer Identification Numbers , and when you compare Tax ID number vs. Social Security Number, what type of business requires it.

Tax Id Numbers Vs Resale Certificates

Some people confuse state tax ID numbers with resale certificates, although they are two different things. A tax ID number permits a business to collect and submit sales taxes. A resale certificate, on the other hand, prevents double-taxation on an item that will be resold to someone else.

Here’s how a resale certificate works:

Let’s say you own a vintage jewelry business, and you visit an antique mall and find several pieces that you think you can resell at a profit in your boutique. While the seller of these pieces would normally be required to charge you sales tax on the retail value of these pieces, but because you are not the end user of the items and you plan to resell them, you provide the vendor with a resale certificate. The vendor then charges you for the jewelry itself, but not the sales tax. Check your state’s tax authority to see if it provides blank resale certificates or guidance for creating your own.

Don’t Miss: How To Get Tax Preparer License

How Do I Register For An Ein

Most states allow you to register online for an EIN. You can do this through the IRS website, which is a secure way to ensure a quick and easy registration for your sales tax number. Make sure to contact your states tax authority, however, to make sure that you are able to apply online. It is important to register for an EIN as quickly as possible because in some states you will not be allowed to open for business until you have your federal tax identification number. To apply, make sure you have the following information at hand:

- The business name

Different states will need different information, but the above information should cover most states.

Ssn For Sole Proprietorship

It is important to understand that in the context of tax id number vs. Social Security Number, the SSN has an exception for businesses like sole proprietorship or single member LLC without any employees. A sole proprietorship is a type of business that is owned and operated by an individual. It is considered to be a self employed type of business and doesnt need to be registered with the state where it is being formed. That being said, the owners of sole proprietorships should have a Social Security number for tax as well as legal purposes.

A sole proprietorship is considered to be a pass-through entity as the profit or loss incurred by the business will pass through the personal tax return of the owner. The sole proprietorship business actually doesnt have to pay tax but the owner has to, using Form 1040. The social security number is used as the tax ID number because the business and individual is considered to be the same.

Recommended Reading: Is Plasma Donation Taxable Income

Information Required For Obtaining A Tax Id

You must provide the following information while applying for a tax ID:

- Your business address

- Complete name of the owner, manager, and principal officer

- In case of an LLC, total number of members

- Primary activities your business is involved in

- The date of commencement of business

- The accounting year that your business follows

- An estimated number of employees you’d be hiring next year

- Details of any previous EIN that you hold

- Your telephone and fax number

Further Sales Tax Responsibilities

Once you have your sales tax ID number, you’ll be expected to:

- Display your sales tax ID certificate in accordance with state law: Some states, such as New York, require businesses to display their tax certificate in an area where customers can see it. Review your state’s laws to make sure you are in compliance.

- Accurately calculate and collect taxes: You will need to calculate sales taxes on the items or services that you sell. Some of these items may be taxed at a different rate, or not taxed at all. Point-of-sale systems can calculate these taxes for you.

- Submit your taxes to the state: Submit sales taxes and tax returns to the state on-time and according to state rules. You may be required to file a return even if you don’t make any sales during a given reporting period.

- Renew your tax ID number as required: Check with your state to find out whether you will need to renew your tax ID number.

- Notify the state about changes in your business: If you close your business, change its legal structure or relocate, contact your state’s tax authority.

Tip

Some areas require the collection of additional county or local sales taxes. Make sure that you understand the requirements in your location before opening for business.

References

You May Like: How To Buy Tax Lien Properties In California

Whats A Sales Tax Id Number

Before you start selling on Etsy , you should apply for a sales tax permit in your state . Each state has their own rules and regulations regarding the collection and payment of sales taxes. In most states, you can apply online and the process is free and painless. Once you receive your permit, you should have it on display in your place of business, and always bring it with you to any craft shows or fairs.

What Is Tax Identification Number

A Tax Identification Number is a generic term used by the IRS for the tax identification purposes. TIN is a unique nine-digit number issued to individuals, businesses or other entities to track tax obligations and payments made to the Internal Revenue Service . Tax ID numbers are primarily used to track payments to individuals for tax purposes in the United States. Mainly, you are required to apply for a TIN on or before application for business registration is submitted and filed before filing a return statement or declaration as specified in the tax code. Typically, there are three common types of tax ID numbers Social Security Number , Taxpayer ID Number and Employer ID Number .

Also Check: When Do You Do Tax Returns

How Do State Tax Ids Vs Federal Ein Tax Ids Differ

Whats the difference between Employer Identification Number and State Identification Number or also known as ?

An EIN is assigned by the IRS A State ID Number is Assigned by the state An EIN is used to hire employees State ID Numbers are used to collect sales tax from clients and to avoid sales tax to suppliers An EIN is used to file business taxes State ID Numbers are used to file Sales Taxes A State ID Number is also known as Sales Tax permit, Certificate of Authority, Reseller Permit, Sales and Use Tax Number, Excise business Tax and Taxpayer ID Number An Employer Identification Number is also known as Federal Employer Identification Number .

The Employer identification Number and State Identification Number are two separate documents assigned by the federal and state respectively.

Member of NSTP

Legal Info & amp Disclaimer

What Accounts Can Be Opened Under The Federal Business Number

Accounts can then be opened up under this Business Number for GST/HST, Payroll, Import/Export and Income Tax.

Each GST/HST, Payroll, Import/Export and Income Tax account can have more than one account for different businesses. Refer to the following Revenue Canada Agency Guide for more information about all of the accounts: The Business Number and Your Canada Revenue Agency Program Accounts.

Read Also: Where Is My State Tax Refund Ga

Register A Foreign Business For Hst Or Gst

All foreign businesses registered in Canada must have a Federal Business Number and register for HST/GST. Foreign companies will be required to collect HST/GST on all sales in Canada in the case where the foreign companys Worldwide sales are over $30,000. The foreign business must first be registered in Canada before it can apply for this number.

What Is An Ein Number

An EIN or sales tax number is used to keep track of your companys tax responsibilities, and means that your business can collect and submit sales tax to your states relevant authority. Without this number, your business will not be able to collect taxes, and runs the risk of receiving fines, or more serious legal consequences. The IRS uses an EIN number to identify businesses that need to submit various tax returns. An EIN number is not the same as a social security number , although the two numbers are similar in their intended use.

Read Also: Prontotaxclass

So Why All The Confusion

A lot of times creative biz owners get confused when theyre filling out paperwork and asked for a tax ID number. For some reason, many people incorrectly assume this means EIN and frantically research how to apply for one. But in most situations, the paperwork is requesting your sales tax ID number from your sales tax permit. This ID number is usually needed to buy from wholesale suppliers, apply for craft shows, or apply for a DBA or business license.

I will add that in a few states, the state will issue you a sales tax ID number that is identical to your EIN, thus causing conflicting answers and confusion for everyone.

Just make sure to pay attention to what the paperwork or agency is actually asking you for. When in doubt, just ask!

What If I Forget My Ein

Sometimes, businesses fill out the EIN application to receive a new one, but the IRS will probably reject your application because you already have an associated EIN. There are a few things you can do to find your EIN:

- Check with the IRS If you forget the number, you can call the IRS at 829-4933 and select EIN from the list of options. You will be connected with an IRS employee who can look it up.

- Check your bank records You may find a copy of your EIN on your bank records or paperwork.

- Check your tax paperwork If you have access to your old tax returns, you should be able to find your EIN. You can also ask your accountant for the number.

- Check other paperwork You may find your EIN listed on other business paperwork such as employee paperwork, sales tax ID number, business licenses, or other paperwork.

Don’t Miss: How To Buy Tax Lien Certificates In California

Understanding The Difference Between Federal And State Tax Ids And How To Apply For Each

Tax identification numbers are a common source of confusion and frustration for new business owners.

While it might just seem like one more bureaucratic piece of red tape keeping you from starting a business, tax IDs are indispensable for daily functioning.

The difference between federal and state tax systems arent always clear. To complicate matters, regulations can vary by state.

However, understanding both state and federal tax law is essential for keeping your business on a solid legal footing. Furthermore, you will need a tax ID to carry out a variety of standard business operations.

To help clear up confusion, weve put together this guide to explain the key differences between federal and state tax IDs.

Heres what youll learn:

- The purpose of tax IDs

- The difference between federal and state tax IDs

- How to register a tax ID

Whats The Purpose Of Tax Ids

Essentially, tax IDs are social security numbers for businesses. They serve the same function SSNs do for individuals.

Each business receives a unique number from both federal and state governments, which act as their tax IDs. Primarily, you need a tax ID to file your businesss taxes, including income and payroll taxes.

However, other essential business operations require a tax ID, as well. Therefore, once youve determined your businesss legal structure, its a good idea to obtain relevant tax IDs as soon as possible.

Start with making sure you understand the difference between federal and state tax systems.

You May Like: How Much Is H& r Block Charge

Federal Tax Id Numbers/ State Tax Id Numbers/ Federal Employer Identification Number

An Employer Identification Number is also known as a Taxpayer Identification Number . A sole proprietorship that has no employees and files no excise or pension tax returns is the only business that does not need an employer identification number. In this instance, the sole proprietor uses his or her social security number as the taxpayer identification number. To obtain an EIN, you must complete Form SS-4, Application for Employer Identification Number. After you have completed the Form SS-4, you can apply online, by mail, fax or by phone. Further information can be found at the Internal Revenue Service website:

Connecticut State Identification Number

You must obtain a Sales and Use Tax Permit from the Connecticut Department of Revenue Services if you intend to engage in any of the following activities in Connecticut:

- Sale, rental or lease of goods

- Sale of a taxable service or

- Operation of a hotel, motel or lodging house

To register for sales and use taxes, use Form REG-1, Business Taxes Registration Application. See the section titled, Applying for a Sales Tax Permit , at the Department of Revenue Services website: