How Can I Tell If My Time In The State Was Permanent Or Temporary

You have to decide whether the time you spent in each state was permanent or temporary. The answer to this question determines which tax forms you need to fill out for each state, and how you calculate your state taxes.

- If you made a permanent move from one state to another, you are considered a part-year resident of each state.

- If your work in the other state is temporary and you maintain a permanent residence in the state you left to go do this work, you may be considered a nonresident of the other state.

The most important factor in determining the kind of move you made is your intent. States want to know:

- Did you intend to make a permanent move?

- How much time did you live in the other state?

- Did your immediate family move to the new state with you?

Acquire A State Certificate

After the LLCs formation files are filed and also approved, the state will issue a certification or other paper that confirms that your LLC officially exists.

With the certificate in hand, you can currently get both a tax obligation ID number as well as organization licenses, along with open an account for your business.

Proving Your Move Was Permanent

You can show you intend to establish permanent residency in your new state by:

- Registering to vote in your new state

- Registering your car with the Department of Motor Vehicles in your new state

- Changing your driver’s license to your new state

- Purchasing property in your new state, and moving your household to the new property

- Applying for any property tax exemption or other special privilege the law allows you because your home in your new state is now your primary residence

- Sending your children to school in your new state

- Moving your primary bank accounts to your new state

- Having your membership in any social or business organizations changed to chapters or groups in your new state

Read Also: Efstatus/taxact

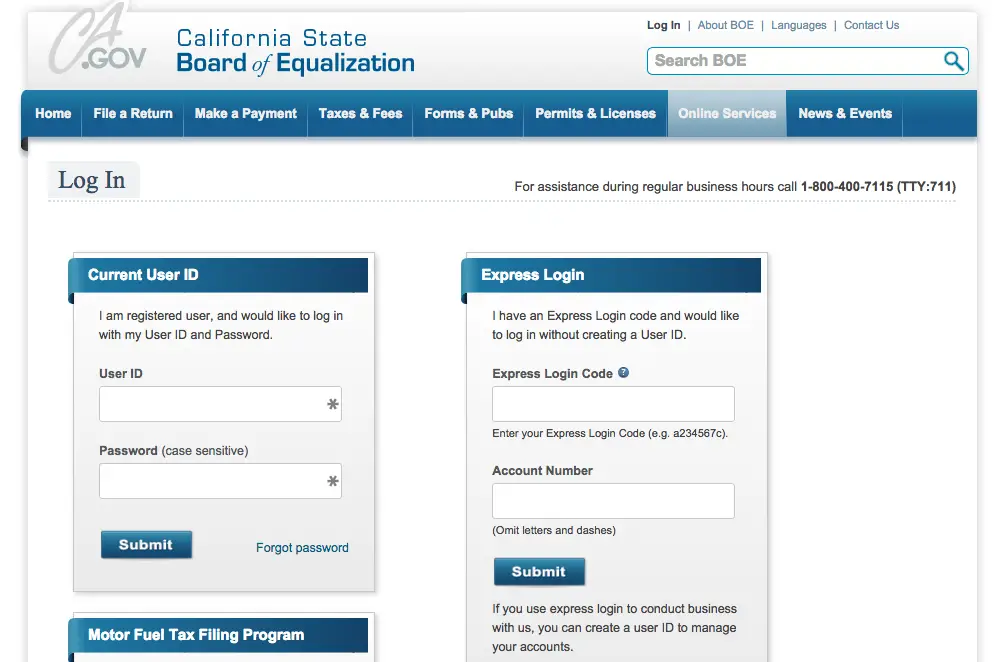

California Direct Tax Filing

California has an online tax preparation tool called CalFile. For 2020 returns, CalFile is open to taxpayers of all filing statuses with federal adjusted gross incomes of up to $203,341 if you’re single or married and filing a separate return. The limit increases to $305,016 for those filing as head of household, and $406,687 if you’re married and filing a joint return. You must have lived in California the entire year, and you can claim no more than 10 dependents.

Out Of State Employment

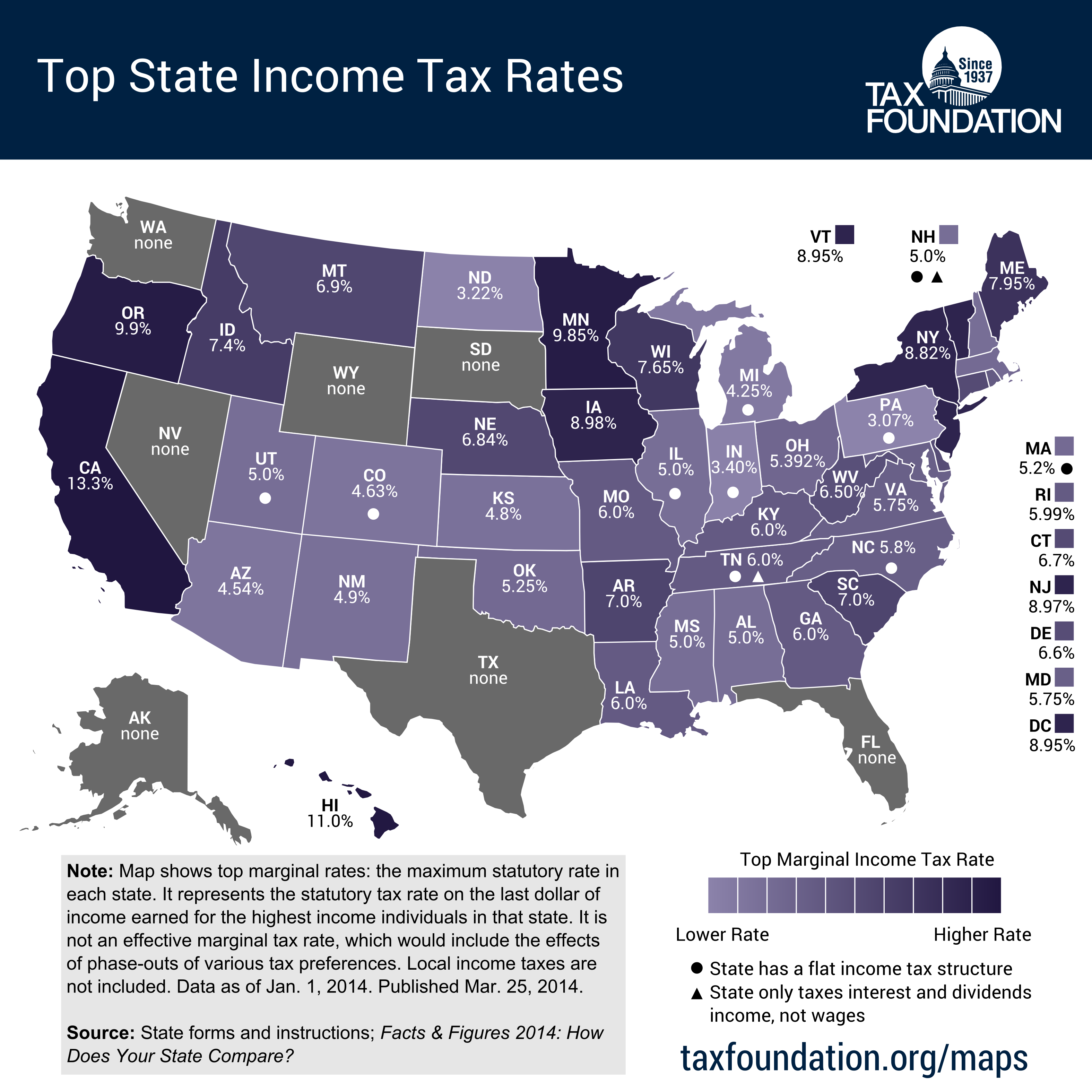

Residents living in northern California and working in may also be responsible for filing California taxes with that state. The same is true for residents of SoCal working . However, this does not apply to residents working in Nevada, as this state does not currently collect income tax.

Note: States & U.S. territories may make changes to their tax laws with little notice. We do our best to keep this information up-to-date, but it is provided on an “AS IS” basis. For more see our terms.

Don’t Miss: Efstatus Taxact Online

How To Collect Sales Tax In California

If you have an in-state location in California, you are required to collect both state and district sales taxes. District sales taxes vary between 0.10% and 1.00%, and in some cases more than one district tax will apply to any given location.If you have a single location, in-state buyers who are buying from outside your district will only be charged the state sales tax .If you have multiple locations, you must also collect district sales taxes from any buyer who resides in a district in which you have nexus .

Tax Information For International Students And Scholars

The tax deadline for 2020 Federal IRS Tax Returns and California State Tax Returns has been extended to May 17, 2021. Other states may not have extended their state tax deadlines. If you are filing state taxes for another state please check whether their deadline has been extended.

Bechtel International Center cannot provide individual tax advice. We can only provide basic general guidelines to get you started in preparing your taxes. No information on this site may be considered formal tax advice. Consult an appropriate tax advisor as necessary.

The Internal Revenue Service requires all international students and scholars to file federal tax forms, whether or not they had earned income during the tax year. In addition, F-2 and J-2 dependents must also file certain tax forms. In the U.S., tax forms are filed in the current year for the previous year.

If you had any U.S. source income in 2020, the tax deadline for 2020 Federal IRS Tax Returns and California State Tax Returns has been extended to May 17, 2021. Other states may not have extended their state tax deadlines. If you are filing state taxes for another state please check whether their deadline has been extended. If you had no U.S. source income in 2020, you also have until June 15, 2021 to file appropriate forms.

All international students and scholars must also file state tax forms if their income in 2020 was more than a certain amount. J-2s may also need to file.

You May Like: How Do I Protest My Property Taxes In Harris County

California State Taxes For Americans Living Abroad A Guide For Expats

09/21/2020

Americans living abroad who previously lived in California may still be liable to pay California state income taxes.

California is among the states with the most stringent income tax regimes, and similarly to the Hotel California lyric, you can check out any time you like, , it can be hard to actually leave!

Where To File California State Taxes For Llc

A new company can find it testing to sign up an LLC in Cali. It is critical that you obtain it right the first time as well as make sure that all needed records and service charges are sent with your LLC registration. Where To File California State Taxes For Llc

You choose your company structure based on a variety of variables, including your everyday procedures, tax obligations, and also the sort of danger you carry. You need to select a business framework that provides you the appropriate equilibrium of legal securities and benefits.

In order to get state permits or licenses, there are several mistakes that you have to stay clear of. Make use of this short article to assist you along the way.

Don’t Miss: How Much Is Payroll Tax In Louisiana

Do Us Citizens Living Abroad Need To File State Taxes

If Americans abroad must still file a state tax return depends on the state. In some states, US citizens living abroad are required to file and may owe state taxes. In other states, expats neither file nor owe state taxes. We discuss the easy and difficult states further below.

You might think the state doesnt know or care. In our experience though, some states can be quite aggressive in pursuing their taxpayers, even abroad. And if you dont file while you are abroad, a big tax bill might await you when you move back to the state.

After a few years abroad, you may end up returning to your old home state and start filing tax returns again. The state will notice the gap and can notify you that you owe back taxes, potentially with penalties and interest.

In addition, some states do not allow the Foreign Earned Income Exclusion, e.g. California. So you may have to pay full state income tax of income earned abroad.l

If you cannot prove that you were resident in another state during that time, they may require you to pay your taxes for those missing years.

And its not just that expats pay state income tax in some states. Depending on the state, US citizens abroad may also owe dividend taxes, estate taxes, corporate taxes, and more. Furthermore, if you failed to file and pay state taxes while you were abroad, you may owe penalties or interest. In short, misunderstanding your states filing requirements and failing to make other arrangements, can be costly.

Safe Harbor Exceptions For Taxpayers Living Overseas

The above categories include general definitions that apply to most taxpayers, but determining a persons exact tax status can be tricky in certain cases. For example, there are instances where a person with a home in California can be treated as a nonresident, provided they meet certain criteria. This is referred to as safe harbor.

Under the California tax code, a resident of the state can be treated as a nonresident as long as they leave for the purpose of employment and maintain a residence outside the state for at least 546 consecutive days. This applies even if a taxpayer living outside the U.S. has a domicile in California or a spouse or children who remain in the state.

One thing to note is that temporary visits home do not interfere with your 546-day count, up to a point. As long as your trips to California add up to less than 45 days in-state during the tax year, you can still qualify for the safe harbor exemption. A knowledgeable accountant can help you figure out whether you can benefit from this provision.

Also Check: Have My Taxes Been Accepted

How Expats Can Avoid Paying State Tax

Expats from the difficult tax states should consider moving to another state before moving abroad, ideally to one without a state income tax.

Moving from a difficult state to a tax-free state requires more than just changing your address. These difficult states can be really sticky. You must show your intent of leaving for good by cutting ties to the state.

You have to be able to prove to your old state that you moved permanently to the new state. That means if you have any intention of moving back to your state, you may have a hard time proving otherwise. Also, if you plan to keep ties to your old state, that will make it difficult.

The tax authorities will look at your intent to establish a permanent home elsewhere with no intention of returning. While intent is a very subjective notion, you can take the right actions to show your intent.

Common Errors With Individual E

| Business Rule | ||

|---|---|---|

| F540N/NR/NRS/2EZ-180 | Electronic Signature Taxpayer’s Prior Year AGI does not match FTB records. | Double check the Taxpayer’s Prior Year AGI from last year’s CA tax return or sign the e-file return using form FTB 8453/8453-OL. |

| F540/NR/NRS/2EZ-320 F540/NR/NRS/2EZ-330 | Taxpayer SSN or Spouse SSN has been previously used on an e-filed return. | To avoid sending duplicate returns, do not retransmit an accepted California return when retransmitting a corrected federal return. |

| F540/NR/NRS/2EZ-240 | The Primary Taxpayer or Spouse’s signature date must be within the current processing year. | Double check the signature date is within the current processing year. |

If you’re unable to resolve the error, please contact your software provider for assistance.

Also Check: Www.1040paytax

Step : State Taxes With The Franchise Tax Board

Your PTA will need to file its state taxes annually:

- If your PTA has gross receipts of $50,000 or less, you can file a 199N electronically.

- If your PTA has gross receipts that are normally greater than $50,000, your PTA will need to file a Form 199.

- Once you have filed the 199N or Form 199, go to Step 4.

YOURE ALMOST DONE!

Step : Charitable Trusts With The Attorney General

Your PTA will need to file an RRF-1 with the Attorney Generals Office of Charitable Trust annually.

Once you have filed all taxes, this is the last step:

- Complete the Registration Renewal form

- To assist in preparing your RRF-1 download the annotated RRF-1

- Complete, print and mail RRF-1.

If gross annual receipts are normally $50,000 or less and your PTA filed a 990N, form CT-TR-1 is also required.

- Complete the Treasurers Report form

- To assist in preparing your CT-TR-1, download the annotated CT-TR-1

- Include lists of Other Assets, Other Liabilities, Other Revenue and Other Expenses

- Complete, print and mail CT-TR-1 along with form RRF-1

NOTE: Dont forget to include your fee and a copy of your PTAs Form 990EZ or 990. If you filed a 990N a copy of the confirmation is not required. Also, if you filed for an extension with the IRS, you are also granted an extension for the RRF-1.

You May Like: How Can I Make Payments For My Taxes

Are California State Taxes Delayed This Year

Sacramento The Franchise Tax Board today announced that, consistent with the Internal Revenue Service, it has postponed the state tax filing and payment deadline for individual taxpayers to May 17, 2021. Taxpayers do not need to claim any special treatment or call FTB to qualify for this postponement.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Don’t Miss: Turbo Tax 1099q

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

International Tax Assistance Available Today From Us Tax Help

Navigating the nuances of the U.S. tax code can be challenging all the more so when you also have a states stringent requirements to meet. If you or someone you know lives abroad but is taxed in the U.S., or in the state of California specifically, the team of skilled accountants at U.S. Tax Help are available to provide assistance. With decades of experience in international tax preparation and planning, the team at U.S. Tax Help can make sure you stay in full compliance with the law while working to secure every deduction, exemption, exclusion, and tax credit for which you qualify. To hear more about our services or to speak with a qualified tax professional, visit us online or call 362-9127 today.

Let Us Tackle Your U.S. Tax Issues

Don’t Miss: Www.1040paytax.com Official Site

Identify Your California Llc

In order to start an LLC, you should pick a firm name. If you desire your business to be able to be easily located by prospective customers, you have to pick a name that complies with Calis naming regulations.

If you select one more name, the phrase limited liability company or a tightening must be consisted of .

Names that might perplex your clients with government companies can not be utilized.

You may require added paperwork for incorporated words like financial institution,lawyer or college and the inclusion of a licensee, such as a doctor.

How Do I File Only State Taxes

Yes, to only file a state return you will need to mail your state return. You can only e-file a state return on FreeTaxUSA if you also e-file your federal return on FreeTaxUSA. If you filed your federal return with us: You can file any number of state returns with your federal return or after it has been accepted.

Don’t Miss: How Can I Make Payments For My Taxes

Proving Your Move Was Temporary

The IRS considers your move to be temporary if you are in the new state for work, and you expect your job in that area to last less than a year.

Caution: Although many states follow the IRS rules about how to decide if your move is permanent or temporary, some states presume that you’ve made a permanent move if you live there for six months or more.

The truth is that it’s often easier to become a permanent resident in your new state than it is to stop being a permanent resident in your old state. In most states, even though you are presumed to be a resident after you’ve lived there six months, you may have to be gone from your old state for 18 months before you are considered by the time test to be a nonresident.

So, it is often more important to show your intent to leave a state than it is to show your intent to become a resident in a new one. If you end up with both states wanting to claim taxes on your income, your evidence of intent will be crucial.

If you intend for your move to be temporary, avoid doing the things we just listed for proving permanent resident status, and do the following instead:

Most important, be sure to move back to your old state when your temporary period of residence is over.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.