What Are Individual Taxpayer Identification Numbers

Undocumented workers have another option: the Individual Taxpayer Identification Number or ITIN. An ITIN can be used in place of an SSN. The IRS created the ITIN back in 1996 to encourage those who are ineligible for an SSN to file tax returns and pay taxes.

But an ITIN is not an authorization to work in the U.S. Receiving one doesnt mean that youre a documented alien or resident. It simply allows you to file a tax return and pay taxes.

Why Would An Undocumented Immigrant Pay Taxes

Though there are many undocumented immigrants who are paid under the table for their work and do not pay taxes on their income, many others do pay in the hope that it will someday help them become citizens. Much of the evidence for this motivation is anecdotal, but various attempts at comprehensive immigration reform legislation over the last decade, including the Gang of Eight bill S.744, have included provisions like good moral character and paying back taxes as requirements for obtaining legalization. A provable history of paying taxes is seen as one way to show good faith, should such a bill ever pass.

Data On Immigrant Tax Contributions Isnt Perfect

Its important to keep in mind that these numbers are just estimates, but theyre the best that exist. To come up with state and local tax contributions, economists at the Institute on Taxation & Economic Policy crunched data from the US Census Bureau and the Migration Policy Institute to determine the likely number of undocumented immigrants in each state, their average incomes, and their homeownership rates. Researchers used that data to calculate how much they pay in sales tax, property taxes, and excise taxes, based on tax rates in each state.

Its most difficult to estimate how much undocumented workers pay in state income taxes. The IRS withholds taxes from immigrants hired with fake Social Security numbers, but workers who get paid in cash could simply choose not to report their income, unless they voluntarily file a return with an Individual Taxpayer Identification number, which is also common.

Past research has determined that the share of unauthorized workers who pay income taxes is anywhere from 50 percent to 75 percent, so the report uses the most conservative estimate: 50 percent.

Overall, researchers said undocumented immigrants paid an effective tax rate of 8 percent in state and local taxes, compared to the 5.6 percent top tax rate. They paid the highest tax rates in Washington, 10.7 percent, and Illinois, 10.3 percent.

Don’t Miss: When Do People Get Tax Returns

How Do Illegal Immigrants Pay Taxes

Now that youre convinced its a good idea to pay your taxes, how do you do it? The long answer is you may need to speak with an immigration attorney or an accountant who specializes in immigration and tax law, but the short answer is you can file income taxes with an Individual Tax Identification Number, or ITIN.

ITINs are issued by the Internal Revenue Service to foreign nationals and individuals who dont qualify for a social security number. Immigration status is irrelevant, so ITINs are available to undocumented immigrants. An ITIN does not provide work authorization or eligibility for Social Security benefits, but it does allow you to pay your taxes without risking alerting immigration officials to your immigration status.

The IRS estimates that over three million people file taxes with ITINs each year. ITINs are responsible for over $870 million in income taxes, and over $9 billion in payroll taxes each year.

Those figures reflect federal income taxes, but keep in mind that ITINs may also be used for state income taxes. In fact, if your employer withholds a portion of your paycheck each month, theres a chance that applying for an ITIN and filing a proper state tax return may result in a state tax refund.

Employers Of Immigrants Should Still Withhold Wages

Most immigrants on work visas continue to pay into Social Security and Medicare during their time in the United States. Many Silicon Valley companies sponsor skilled immigrants to work in the technology and engineering industries. Since they’re not citizens of the U.S., they will not qualify to receive Medicare or Medicaid. However, employers are still required to withhold taxes for these programs from all employees.

Employees on work visas will need to complete the same W-4 withholding paperwork as all employees. This, and all other employment paperwork, should remain with the company and be updated whenever necessary as long as they are employed by the business.

Also Check: What Do I Do If I Owe Taxes

The Cost Of Illegal Immigration To The United States

At the federal, state, and local levels, taxpayers shell out approximately $134.9 billion to cover the costs incurred by the presence of more than 12.5 million illegal aliens, and about 4.2 million citizen children of illegal aliens. That amounts to a tax burden of approximately $8,075 per illegal alien family member and a total of $115,894,597,664. The total cost of illegal immigration to U.S. taxpayers is both staggering and crippling. In 2013, FAIR estimated the total cost to be approximately $113 billion. So, in under four years, the cost has risen nearly $3 billion. This is a disturbing and unsustainable trend. The sections below will break down and further explain these numbers at the federal, state, and local levels.

How Do Undocumented Immigrants Pay Federal Taxes An Explainer

As Tax Day 2018 approaches, it is worth exploring a pressing question that is widely misunderstood: do undocumented immigrants pay federal taxes?

The short answer is yes. Many undocumented immigrants find ways to legally pay both federal income and payroll taxes even if they dont have a Social Security number and even if their income was earned by working illegally.

Don’t Miss: How Much Income To File Tax Return

Individual Taxpayer Identification Number

Unauthorized immigrants are also eligible to file taxes using whats called an ITIN number.

These numbers allow individuals who are not eligible for a Social Security number to pay taxes they are required to pay to the federal government.

The IRS estimated that in 2015, about 4.4. million people paid their taxes using ITIN numbers. They paid about $5.5 million in Medicare and payroll taxes and about $23.6 billion in total taxes.

And while those figures are not exclusively attributed to unauthorized immigrants, using ITIN numbers to pay taxes is one of the most popular ways for them to do so, said Alex Nowrasteh, director of immigration studies at the libertarian Cato Institute.

This is a nice workaround for everybody and especially for unauthorized immigrants who want to keep their noses clean and attract as little attention as possible, Nowrasteh said.

Nowrasteh said that upwards of 75% of unauthorized immigrants file taxes with the federal government. He added that the existence of ITIN numbers is a sign of the governments desire to collect taxes regardless of status.

Its an indication of how broken a lot of the immigration system is, but it is a workaround that is probably the least bad option when compared to the other options, which are identity theft and borrowing someone elses Social Security number, Nowrasteh said.

Learning How Undocumented Immigrants Pay Taxes

For some undocumented workers, the benefits and the importance of filing taxes are less significant than the potential risks.

In addition, undocumented immigrants assume that the current law that maintains privacy over peoples IRS tax information and keeps that information separate from immigration officials could change in the future.

For others, however, the risk may be too small. They dont want to give up the chance to develop evidence that could help them in immigration court if a positive immigration reform ever happens.

The vast majority of immigrants pay taxes hoping that doing so could help them become U.S. citizens.

Also, it is essential to note that undocumented immigrants pay social security payroll taxes but are not eligible for benefits.

At Camino Financial, we dont just offer business loans we want to provide you with a whole educational experience to make your business thrive in the U.S.

You can receive, directly into your email, tips, tools, valuable information on finances, and the latest trends in business by subscribing to our newsletter.

Also Check: How Much Do Rich People Pay In Taxes

What Deductions Can You Claim

You may be able to reduce your total income by claiming deductions that you qualify for. A deduction is an amount that is allowed to you provided that you qualify for it. If so, its subtracted from your total income. The result is called taxable income which is used to calculate your federal and provincial or territorial tax. The following deductions are some of the most common.

Registered retirement savings plan contributions

Generally, you cannot deduct contributions you made to a registered retirement savings plan in 2021 if this is the first year that you will be filing a return in Canada.

If you filed a return in Canada for any tax year from 1990 to 2020, you may be able to claim a deduction for RRSP contributions that you made in Canada for 2021. The CRA determines the maximum amount you can deduct based on certain types of income you earned in previous years.

You can view yourRRSP deduction limit online on My Account or on the MyCRA mobile app.

For more information, go to Line 20800 RRSP deduction.

Pension income splitting

If you and your spouse or common-law partner were residents of Canada on December 31, 2021, you can elect to split pension income that qualifies for the pension income amount . To make this election, you and your spouse or common-law partner must complete and attach Form T1032, Joint Election to Split Pension Income, to your returns.

For more information, go to Pension income splitting.

Moving expenses

Recommended Reading: Efstatus Taxactcom

How Illegal Immigrants Pay Taxes Canada

Taxes are not paid by illegal immigrants. Taxation of income cannot be imposed because illegal immigrants do not have legitimate employment. Yet, they may still be subject to property taxes and all associated sales taxes, yet are still required not to receive any of the services and benefits these taxes actually provide.

Don’t Miss: How Much Property Tax Can I Deduct

Effect On Income Inequality

Economist David Card wrote in 2009 that immigration has a minor impact on income inequality and wages: “Together these results imply that the impacts of recent immigrant inflows on the relative wages of U.S. natives are small. The effects on overall wage inequality are larger, reflecting the concentration of immigrants in the tails of the skill distribution and higher residual inequality among immigrants than natives. Even so, immigration accounts for a small share of the increase in U.S. wage inequality between 1980 and 2000.”

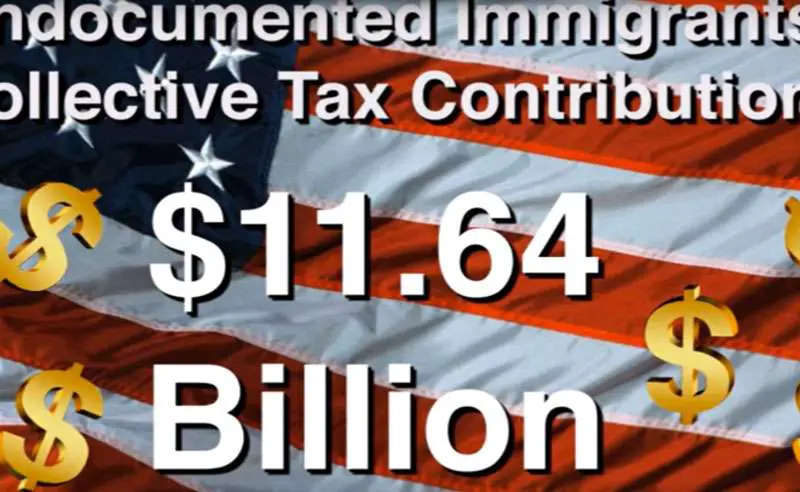

Undocumented Immigrants State & Local Tax Contributions

Released March 2nd, 2017

A newly updated report released today provides data that helps dispute the erroneous idea espoused during President Trumps address to Congress that undocumented immigrants are a drain to taxpayers. In fact, like all others living and working in the United States, undocumented immigrants are taxpayers too and collectively contribute an estimated $11.74 billion to state and local coffers each year via a combination of sales and excise, personal income, and property taxes, according to Undocumented Immigrants State and Local Tax Contributions by the Institute on Taxation and Economic Policy.

On average, the nations estimated 11 million undocumented immigrants pay 8 percent of their incomes in state and local taxes every year. While it is unlikely to happen in the current political environment, undocumented immigrants state and local tax contributions could increase by up to $2.1 billion under comprehensive immigration reform, boosting their effective tax rate to 8.6 percent.

Don’t Miss: How Do Tax Right Offs Work

Unauthorized Workersalso Fund The Federal Government

Undocumented immigrants pay even more federal taxes than state taxes.

Millions of undocumented immigrants file tax returns each year, and they are paying taxes for many benefits they cant even use.

The most recent IRS data, from 2015, shows that the agency received 4.4 million income tax returns from workers who dont have Social Security numbers, which includes a large number of undocumented immigrants. That year, they paid $23.6 billion in income taxes. That doesnt even include workers who paid taxes with fake Social Security numbers on their W-2 forms, which is also common.

These undocumented workers pay taxes for benefits they cant access, like Social Security and Medicare. They also arent eligible for benefits like the Earned Income Tax Credit. But the IRS still expects unauthorized immigrants to file their taxes, and many of them do so.

Theres a clear reason why. Filing taxes helps immigrants create a paper trail to show when they entered the country and how long theyve been contributing tax dollars. Many are hoping it will help them get legal status one day. That has happened in past reform efforts, and one of the first requirements is usually to prove that a person has been paying taxes. That was the case for the undocumented youth granted temporary work permits under President Barack Obamas Deferred Action for Childhood Arrivals deportation relief program.

Why Would An Undocumented Immigrant Want To Document Their Work

My wife is an immigrant, and when we went through the naturalization process, checking for a criminal record was an important part of that process. Having a criminal record or documented history of illegal activity is a red flag that will hurt an individuals chances of their visa or permanent residence application being approved. And while its highly unlikely that DHS will obtain the ITINs of undocumented immigrants illegally working in the US, its not impossible. If amnesty is offered and youre proven to be a tax evader, you most likely will be rejected.So why risk exposing yourself to the possibility of future prosecution?

If theres one thing people, in general, dislike more than paying taxes, its people who commit tax evasion. Every American who works for a living pays taxes on their income, and most undocumented immigrants have decided its worth the risk to document themselves as law-abiding taxpayers so they will have good standing legally and socially if one day amnestyand with it, permanent legal statusis offered by the federal government. Otherwise, if amnesty is offered and youre proven to be a tax evader, you most likely will be rejected.

Recommended Reading: How To Get The Most Out Of Tax Return

As Aoc Says The Rich Elites In America Have Enormous Class Solidarity

Find your bookmarks in your Independent Premium section, under my profile

Find your bookmarks in your Independent Premium section, under my profile

It has been Americas worst kept secret: Sitting President Donald Trump has paid next to nothing over the past 15 years in taxes. In a damning report released by the New York Times over the weekend, it was found that in 10 of the last 15 years, the self-proclaimed successful businessman paid not a dollar in federal taxes. In what can only be classed as irony befitting 2020, the tax returns prove that Trump has paid less tax than the very immigrants he has been waging war against since before taking office.

Being voted in on a platform of anti-immigration, Trump proudly made his supporters chant build the wall at rallies and protests He has repeatedly, and incorrectly, claimed that immigrants cost the US taxpayer billions and billions of dollars a month. Despite being questioned by journalists for supportive data, Trump even declared a spurious national emergency in 2018. But the reality is that the very immigrants he tries to keep out contribute more to the US federal reserve than he does himself. And, yes, that includes undocumented immigrants.

How Do Undocumented Immigrants Pay Taxes Without A Social Security Number

A tax identification number is mandatory to pay taxes. The most common identification number used to pay taxes is a Social Security Number.

It is important to note that undocumented immigrants do not qualify for an SSN.

Only some groups of immigrants qualify for an SSN, depending on their circumstances:

- lawful permanent residents

- people granted asylum

- refugees people who have a certain kind of visa that allows them to work in the United States

- people who naturalized and became a U.S. citizen

An undocumented immigrant or another immigrant not in one of these groups will likely not be able to get an SSN.

However, an undocumented immigrant can apply for an Individual Tax Identification Number .

Also Check: How To Calculate Taxes Taken Out Of Paycheck

How Much Do Undocumented Immigrants Pay In Taxes

Donald Trump may not have paid federal income taxes for 20 years, but the undocumented immigrants he rails against certainly have, according to the head of a Latino civic engagement organization.

Maria Teresa Kumar, CEO and president of Voto Latino, said on NBCs Meet the Press that no one is surprised by the New York Times report on Trumps personal finances and pointed out Trumps hypocrisy.

He keeps talking about undocumented immigrants. Undocumented immigrants pay $12 billion of taxes every single year. They pay their taxes. They have skin in the game. He is not contributing to a system that he says hes going to go in and fix, Kumar said.

Kumar referred us to an Atlanticpiece about undocumented immigrants paying Social Security taxes. It cites a note issued by the Social Security Administration in 2013 that contains the $12 billion figure. But the calculation is based on contributions from immigrants and their employers, not just the immigrants themselves.

According to the Social Security Administration, there were nearly 11 million undocumented immigrants in the United States in January 2009. Factoring out kids, nonworking immigrants and those working in the underground economy and not paying taxes, the Social Security Administration estimated about 3.1 million unauthorized immigrants who worked and paid Social Security taxes in 2010.

Social Security Administration analysts said a relatively small portion of those who could draw benefits do so.

Our ruling