The Social Security Tax Rate

Here’s the easy part. The Social Security tax rate in the United States is currently 12.4%, but only half of this amount is paid by employees, with the other half paid by the employer. If you’re self-employed, you are considered to be both the employer and employee, so you pay the entire Social Security tax as part of your self-employment tax.

In a nutshell, one of two Social Security tax rates applies to you:

- 6.2% if you’re an employee

- 12.4% if you’re self-employed

If some of your income comes from an employer, and you also have some self-employment income, you will pay the corresponding rates on each type of income.

Will I Pay The Tax If I Continue Working After I Start Claiming Social Security

You may still be working when you begin drawing Social Security benefits. It may seem counterintuitive to continue paying the tax once you start taking benefits. However, you must pay the Social Security payroll tax as long as you earn wages or self-employment income that isn’t exempt from FICA or SECA taxes.

At What Age Is Social Security Not Taxable

For Social Security benefits to stop being taxable, you will need to fit certain prerequisites. In most cases, after you reach the age of 64 you can access your Social Security benefits without having to pay taxes on them. However, there is one small caveat to this. If even after the age of 62 you are depending on income other than the one you get from your social security benefits to sustain a major part of your life then you may be required to continue paying taxes on your social security benefits even after the age of 62.

Don’t Miss: How To File California State Taxes

What Are Payroll Taxes

Medicare and Social Security arent the only taxes that apply to an employees taxable wages. As a business owner, the payroll taxes youre responsible for remitting on each employee include the following:

- Federal income tax

- State and local income tax

- FICA taxes

Read More:What Is the Difference Between Payroll Tax & Income Tax?

How Raising The Wage Base Could Work

Once a worker crosses the threshold of paying Social Security taxes on the first $147,000 of their annual earnings, their paychecks are no longer subject to those levies.

As a result, workers who are above the earnings threshold may pay Social Security payroll taxes for part of the year only.

“A lot of people don’t even know there is a maximum, and when they find out, they think the law should be changed so that everybody pays in all year,” Altman said.

A Medicare tax of 1.45% also applies to wages. Combined with Social Security, this represents a 7.65% tax paid both by employees and employers and is known as FICA, which stands for the Federal Insurance Contributions Act.

Notably, there is no wage limit for the Medicare tax, after Congress did away with it starting in 1994.

Today, lawmakers could choose to make the same change to Social Security. They could also choose to increase the tax rate from 6.2%.

You May Like: Can I File Taxes Without All My W2s

How Much Is Social Security Tax

So, what is the Social Security tax rate? The total amount of Social Security tax is a flat rate of 12.4%. But, both the employer and employee pay half of the tax. The employer pays 6.2%, and the Social Security employee tax is also 6.2%. Withhold the percentage from the employees gross taxable wages and contribute your half based on the employees gross taxable wages.

Social Security taxes have a wage base. So, only a certain amount of employee wages are subject to Social Security tax. The Social Security tax limit 2022 is $147,000.

What does a wage base mean? The wage base for Social Security means that you stop withholding and contributing to the tax for an employee once their wages reach the wage base for the calendar year. Wage bases tend to increase every year to accommodate the rising cost of living.

The combined FICA tax rate is 15.3%. Like Social Security, Medicare tax is split in half and paid by both employers and employees . The wage base for Social Security does not apply to Medicare tax. You must continue withholding Medicare tax once an employees wages hit the Social Security wage base. Medicare includes an additional tax rate of 0.9% on wages over $200,000.

Typically, Social Security tax is paid on an employees wages regardless of their age or if they are receiving Social Security benefits. However, some wages, such as employee expense reimbursements, are exempt from Social Security tax. You can learn more about exempt wages in Publication 15.

How Inflation Impacts Your Pia

Your PIA is calculated at age 62. If you wait beyond age 62, cost-of-living adjustments will be applied to your PIA for each year afterward.

If you have already had most of your 35 years of earnings, and you are near age 62 today, the age 70 benefit amount you see on your Social Security statement will likely be higher due to these cost-of-living adjustments. Many people do not account for this when doing their own calculations, which can lead them to think that taking Social Security early is a better deal, when waiting is often the better deal.

In the table below, our hypothetical worker, born in 1954, is eligible for full retirement at age 66. The column on the right shows the effect of inflation for waiting beyond age 62 to take their benefits.

| Effect of Age on Claiming Benefits |

|---|

| Year |

Read Also: How To Find Property Tax Information

How The Math Works

The math works like this:

- If your wages were less than $137,700 in 2020, multiply your earnings by 6.2% to arrive at the amount you and your employer must each pay for a total of 12.4%. If you were self-employed, multiply your earnings up to this limit by 12.4% to calculate the Social Security portion of your self-employment tax.

- If your wages were more than $137,700 in 2020, multiply $137,700 by 6.2% to arrive at the amount you and your employer must each pay. Anything you earned over this threshold is exempt from Social Security tax. You would do the same but multiply by 12.4% if you’re self-employed.

For taxes due in 2021, refer to the Social Security income maximum of $137,700 as you’re filing for the 2020 tax year.

How Does The Social Security Administration Calculate Benefits

Benefits also depend on how much money youâve earned in life. The Social Security Administration takes your highest-earning 35 years of covered wages and averages them, indexing for inflation. They give you a big fat âzeroâ for each year you donât have earnings, so people who worked for fewer than 35 years may see lower benefits.

The Social Security Administration also makes annual Cost of Living Adjustments, even as you collect benefits. That means the retirement income you collect from Social Security has built-in protection against inflation. For many people, Social Security is the only form of retirement income they have that is directly linked to inflation. Itâs a big perk that doesnât get a lot of attention.

Read Also: Should I Efile My Taxes

State Taxation Of Social Security Benefits

In addition to federal taxes, some states tax Social Security benefits, too. The methods and extent to which states tax benefits vary. For example, New Mexico treats Social Security benefits the same way as the federal government. On the other hand, some states tax Social Security benefits only if income exceeds a specified threshold amount. Missouri, for instance, taxes Social Security benefits only if your income is at least $85,000, or $100,000 if you’re married filing a joint return. Utah includes Social Security benefits in taxable income but allows a tax credit for a portion of the benefits subject to tax.

Although you can’t have state taxes withheld from your Social Security benefits, you generally can make estimated state tax payments. Check with the state tax agency where you live for information about the your state’s estimated tax payment rules.

How Much Tax Do I Have To Pay To Qualify For Social Security Benefits

Figuring out if you qualify for traditional Social Security retirement benefits isn’t as simple as making sure you’ve paid a certain dollar amount of Social Security taxes. Instead, the system uses Social Security credits to determine eligibility. To qualify for traditional Social Security retirement benefits, you must have earned 40 Social Security credits.

Starting in 1978, you could earn up to four Social Security credits per year by paying Social Security taxes. You earn credits based on your wages and self-employment income for the year.

In 2021, you earn one credit for each $1,470 in covered earnings. To earn the full four credits possible in 2021, you must earn at least $5,880. The amount to earn one credit may change from year to year and was lower in years before 2021.

Also Check: How To Figure Out Taxes On Paycheck

Need More Information On Social Security

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my.

Its very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time Ill even drop in to add my thoughts, too.

You should also consider joining the 326,000+ subscribers on myYouTube channel! For visual learners , this is where I break down the complex rules and help you figure out how to use them to your advantage.

One last thing that you dont want to miss: Be sure to get your FREE copy of mySocial Security Cheat Sheet. This handy guide takes all of the most important rules from the massive Social Security website and condenses it all down to just one page.

What If You Paid Too Much In 2016

Since many people will be doing their 2016 tax returns in the coming weeks, it’s worth mentioning the 2016 Social Security taxable wage limit and what happens if you paid too much.

The maximum amount of income that can be taxable for Social Security was $118,500 in 2016, which translates to a maximum Social Security tax of $7,347 per employee. If your employer withheld too much Social Security tax from your paycheck — which isn’t uncommon for high earners with multiple jobs — a refund of the excess can be claimed.

If the excess Social Security tax was the result of multiple employers withholding money from your paychecks, it can be claimed as a credit on your federal tax return . If a single employer withheld too much, you have a couple of options. You can either ask that employer for a refund of the excess and a corrected W-2 or you can claim a refund of the excess with IRS Form 843.

The Motley Fool has a disclosure policy.

Also Check: How Can I Figure Out My Property Taxes

Exemption From Social Security Or Medicare Taxes

Under certain circumstances, New York City employees may be exempt from Social Security and/or Medicare taxes. If you fall into one of the following categories, you may be exempt from Social Security or Medicare taxes:

- Not a pension member and contribute at least 7.5% or more to a single defined contribution plan, such as the Deferred Compensation 401 or 457 plans, or a 403 Tax Deferred Annuity . Get more information about Social Security & Medicare Tax Exemptions for Non-Members of Pension Plans.

- City pension plan member in 1957 electing not to have Social Security

- Half time CUNY student working at CUNY

- Non-resident student or teacher admitted to the US under certain visas

- Foster Grandparent working for the Department of Aging

- Election Inspector/Worker earning less than $2,000 from the Board of Elections in 2021

- Beneficiary of a deceased employee receiving payment after the calendar year of the employee’s death

- Temporary emergency relief employee.

Learn more about Social Security & Medicare Tax Exemptions for Other NYC Employees.

The Social Security Protection Act of 2004 requires newly hired public employees to sign a “Statement Concerning Your Employment in a Job Not Covered by Social Security”. Form SSA-1495 explains the potential effects of two provisions in the Social Security law on workers whose earnings are not covered under Social Security.

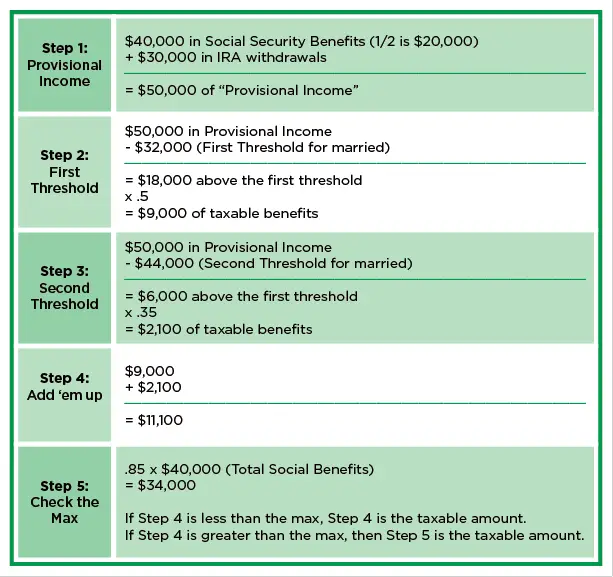

How To Calculate Your Social Security Benefit Taxes

Just because you could owe taxes on up to 50% or 85% of your Social Security benefits doesn’t mean you’ll actually owe taxes on that amount. If you fall into the 50% taxation range, the government says you should owe taxes on the lesser of half of your Social Security benefits or half of the difference between your combined income and the taxation threshold set by the IRS for your tax filing status.

Examples make this easier to understand, so let’s consider an individual who receives $12,000 in Social Security benefits annually and has a combined income of $30,000. You’d calculate the amount they’d owe taxes on this way:

Things get even more complicated if you fall into the 85% taxation range. If our individual had a combined income of $40,000 instead and still received $12,000 in annual Social Security benefits, you would calculate how much they would owe in taxes this way:

Recommended Reading: Do You Pay Taxes On Roth Ira Withdrawals

Social Security Tax And Withholding Calculator

Enter your expected earnings for 2022 :

Social Security Taxes are based on employee wages. There are two components of social security taxes: OASDI and HI. OASDI and HI program. OASDI has been more commonly be known as Federal Insurance Contributions Act . HI has more commonly known as Medicare. For 2017, the OASDI tax rate is set at 6.2% of earnings with a cap at $127,200 . The HI is rate is set at 1.45% and has no earnings cap. Employers must pay a matching amount for each tax component. Self employed persons must pay an amount equal to the sum of both the employeee and employer portions.

Where And How Do You Report Social Security Tax

Most employers must report FICA taxes and federal income tax withholding on a quarterly basis using Form 941, Employers Quarterly Federal Tax Return. Report the total amount withheld and contributed for Social Security for all employees.

Some employers can use Form 944, Employers Annual Federal Tax Return, to report Social Security taxes withheld and contributed. The annual form also reports Medicare and federal income taxes. The IRS notifies applicable employers if their business qualifies to use Form 944. Typically, applicable employers are those with a total federal income, Social Security, and Medicare tax liability of less than $1000 annually. Do not use Form 944 unless the IRS tells you to.

After you complete the appropriate form, mail it to the IRS. Use the IRS Form 941 website to determine where to file your quarterly return. Annual filers can use the IRS Form 944 website for more information on where to mail their return.

By January 31 each year, you will give each of your employees a Form W-2. This form lists the amount of all the employment taxes you withheld from their wages during the previous year.

You will also submit Form W-2 and Form W-3 to the Social Security Administration, which records the taxes withheld for the year. Forms W-2 and W-3 must be filed by January 31. You may also have to submit these forms to the state tax agency.

Don’t Miss: How Much Tax Per Dollar

Social Security Benefits Tax Calculator

Social security benefits tax calculator is in a way concrete answer to often asked question Are social security benefits taxable?. Well, social security benefits are taxable to some people and totally tax-free for others as the taxation depends on the computation of total income and other phaseout values which are again dependent on your tax filing status.

Social security benefits arent taxed for people who only have income from Social Security. For all others , who earn any kind of income, it may or may not be taxable. Also, depending on where you live, your state your Social Security benefits may also be taxable in your state. You can refer section 86 of 26 US Code to know more about taxation of social security taxation

How Much Of My Social Security Is Taxable In 2022

As of 2022, the social security tax rate is divided equally between the employer and the employee. Each one of these two parties is obliged to pay 6.2% for the Social Security tax. The Social Security tax limit is revaluated each year and the Social Security tax limit 2022 specifically will be up to $147,000. This means that the taxable social security was increased from what it previously was set at, which was $142,800. This further means that the maximum Social Security tax any employee will be called to pay from their pay check is $9,114.

Recommended Reading: Where Do I Get Irs Tax Forms