Louisiana Atc Commissioner Elected To Governing Board Of National Liquor Administrators Associationcontinue Reading

BATON ROUGE Ernest P. Legier, Jr., the commissioner of the Louisiana Office of Alcohol and Tobacco Control , will help to lead a national group of state alcoholic beverage regulators. Legier was elected Third Vice President of the National Conference of State Liquor Administrators Executive Committee at the groups annual business meeting on June 22, 2022.

The NCSLA consists of state alcoholic beverage regulators representing 41 states and the District of Columbia. The term of office for the current governing board is July 1, 2022, through June 30, 2023.

I am honored for this opportunity to enhance Louisianas role in promoting the most equitable and effective alcoholic beverage control policies around the country, Legier said.

Governor John Bel Edwards appointed Legier to serve as commissioner of Louisiana ATC in Aug. 2020. He served ATC previously as deputy commissioner and supervising attorney.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

What Happens If You Dont File Your Taxes Or If You File Them Late

If you dont file your taxes, you could face some serious consequences. You could be charged a penalty for not filing, and you may also have to pay interest on any taxes that you owe. If you file your taxes late, you could also face a penalty. The amount of the penalty will depend on how late you file your taxes.

Recommended Reading: How To Use Pay Stub For Taxes

Deadlines For Making Tax Forms Available To You

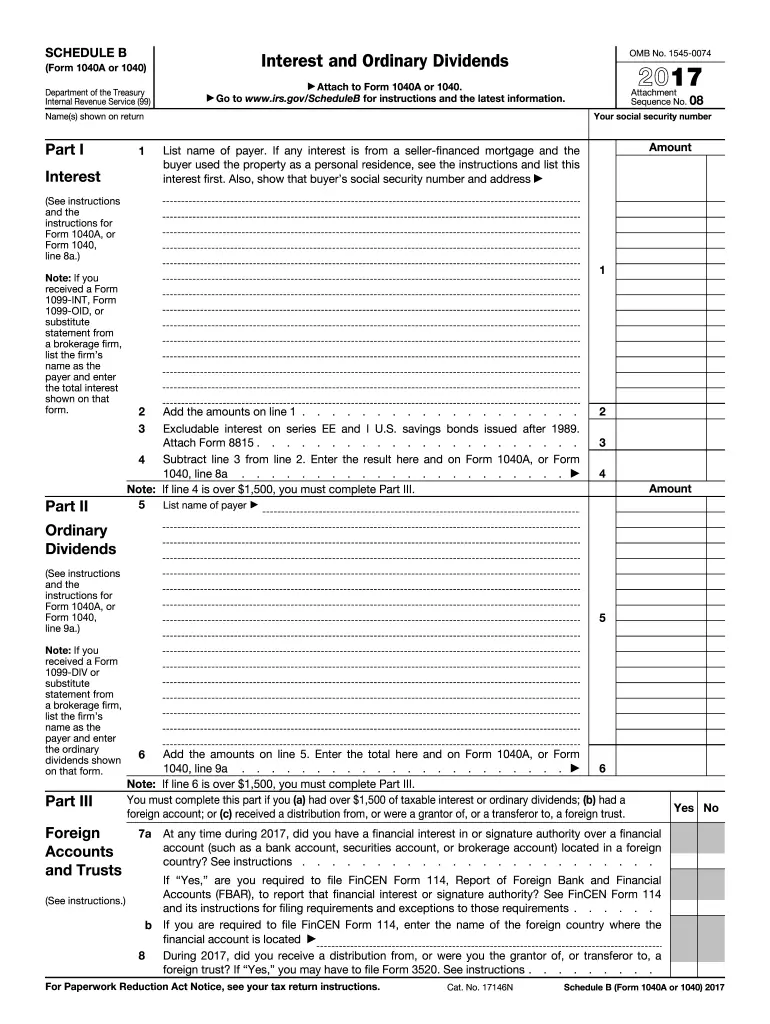

The IRS has established deadlines by which employers and financial institutions must mail you these forms or make them available electronically. Here are the deadlines for when youre supposed to receive some of the most common forms people need to file their 2021 tax returns.

- 1099-S, Proceeds from Real Estate Transactions Feb. 1

- Schedule K-1, Partner’s Share of Income, Deductions, Credits, etc. March 15

Are There Any Other Tax Forms That You Might Need To File Depending On Your Situation

Yes, there are a number of other tax forms that you may need to file depending on your situation. For example, if you have income from self-employment, youll need to file Form SE. If youre claiming a deduction for student loan interest, youll need to file Form 8815. There are also a number of other 1040 forms that you may need to file depending on your specific situation.

Online tax filing is the best way to get your 1040 forms and file your taxes!

Don’t Miss: Is Personal Loan Interest Tax Deductible

Should You File Early

Many American taxpayers wait until the April 15 deadline to complete and file their taxes. However, if procrastination stresses you outor if you’re expecting a refund and you want it as soon as possibleyou can file your 2021 return as early as Jan. 24, 2022.

Another reason to file early is to reduce the risk of someone stealing your identity to file a false return using your Social Security Number and claim a fraudulent refund.

What Is An Ss

If you dont have an employer identification number, or EIN, use Form SS-4 to apply for one. The nine-digit number is assigned to employers, sole proprietors, corporations, partnerships, estates, trusts, certain individuals, and other entities for tax filing and reporting purposes. Use the IRSs Do You Need an EIN? to determine if you need to apply for one. You can receive your number more quickly by applying online.

Best for:Employers who answer yes to any of these questions, and others who need an EIN.

Also Check: What Is Optima Tax Relief

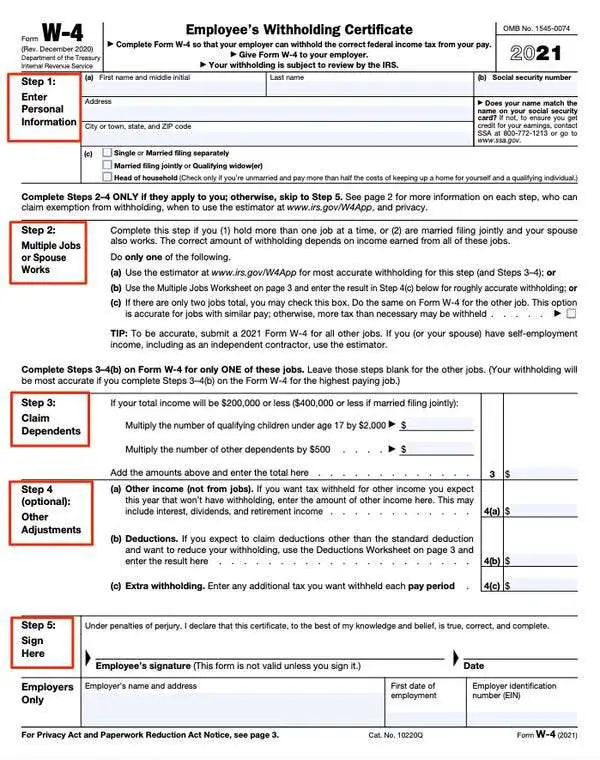

What Is A W

Use Form W-4, also called Employees Withholding Certificate, to tell your employer how much in taxes to withhold from your paycheck. Any time you start a new job, your employer will ask you to fill this out. The W-4 will help you determine the correct amount to have your employer withhold if you ask your employer to withhold less, you will still owe the remaining tax, plus, in some instances, a penalty. The IRS online Tax Withholding Estimator can help you fill out this form correctly.

Best for:People with new jobs, a change in income or other significant financial or family changes.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Recommended Reading: How To Find Out Why I Owe Taxes

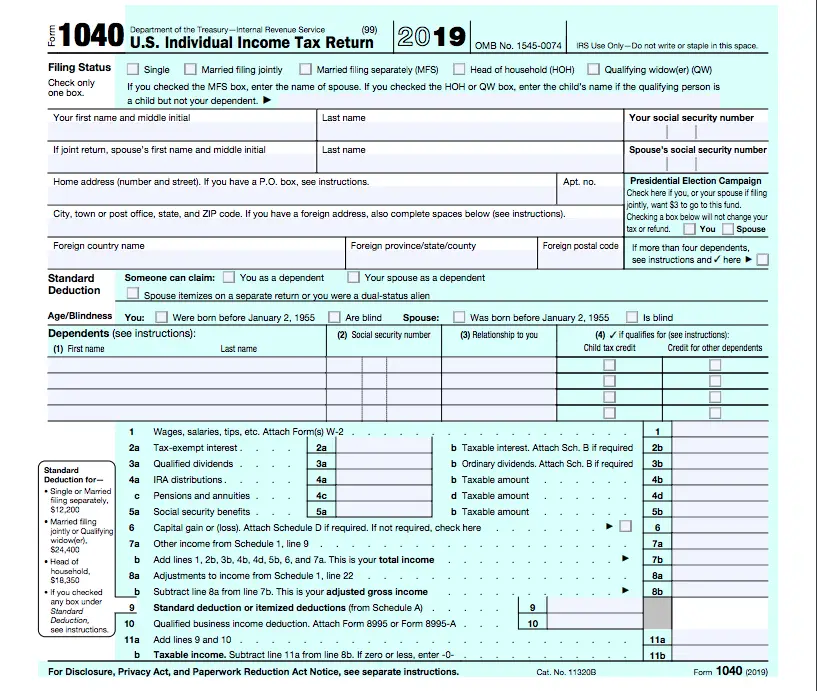

How To File The New 1040 Tax Form

When you file the new 1040 form online, it will be like an interview. They will ask easy-to-answer questions while filling in the correct tax forms for you behind the scenes.

The answers you provide will enable them to see which deductions and credits you qualify for. If you are unsure how to answer a question, tax experts are readily available to help you. Online tax filing ensures that you get the largest refund possible.

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Recommended Reading: What Is Ad Valorem Tax

Paper Returns Have Vulnerabilities Too

Its also important to consider how safe it is to submit your tax return by mail. Paper returns can be lost or stolen. Theyre also more susceptible to error. Unfortunately, your private information is vulnerable no matter how you submit your return.

Certain forms cant be e-filed no matter how you complete them. However, most people wont need to file these forms. The most common circumstance when you might have to submit a paper return is if you need to file an amended return, although it should be noted tax years 2019 and 2020 can be submitted electronically under certain conditions.

Besides the possible security riskswhich may be outweighed by features such as convenience and receiving your refund fasterare there any other cons of filing your tax forms electronically?

What Is A 4506

Use Form 4506-T to request a transcript of previously filed tax returns free of charge. It contains most of the line items on your full return and is widely accepted by most lenders. Mortgage lenders and student loan lenders, for example, will often ask you to fill out this form to verify your income. With COVID-19 delaying processing of paper forms at the IRS, an easier and faster option is the IRS online Get Transcript tool.

Best for:People who need a transcript of their tax return free of charge.

Also Check: When Do We Get Tax Refund

Where To Mail Your Personal Tax Return

The IRS has more addresses than you might imagine because its processing centers are located all around the country. The address you’ll use depends on what you’re mailing and where you live. Go to the Where to File page on the IRS website if you’re sending a personal tax return, an amended return, or if you’re asking for an extension of time to file. The page includes links for every state.

Note that the mailing address is usually different if you’re submitting a payment with your return. You’ll typically mail returns withpayments to the IRS. Returns without payments go to the Department of the Treasury.

IRS addresses change periodically, so dont automaticallysend your tax return to the same place you sent it in previous years.

Note that the IRS uses ZIP codes to help sort incoming mail. Make sure your return gets to the right place as quickly as possible by including the last four digits after the five-digit zip code. For example, the correct address for a California 2021 Form 1040 mailed with a payment in calendar year 2022 is:

Internal Revenue Service45280-2501

What Are Some Of The Common Mistakes People Make When Filling Out Their 1040 Tax Forms

One of the most common mistakes people make is forgetting to sign their tax forms. Another mistake is not including all of their income. People also often forget to claim deductions and credits that theyre entitled to. Make sure you read the instructions so that you dont make any mistakes when filing your taxes.

Also Check: Are Charitable Contributions Still Tax Deductible

How To Order Federal Tax Forms By Mail

The IRS will process and ship your federal tax forms by mail with 10 business days. If the federal income tax form, instructions booklet, or publication is not available when you place your order, the IRS will mail it to you when it becomes available. The hardest part of the ordering process is finding that dated old gray search input box on the IRS Forms and Publications by U.S. Mail page.

Download printable federal income tax forms and instructions booklets in PDF format here if you need to complete your IRS income tax return today.

Where Do You File Late 1099 Forms

File late 1099 forms to the same place as if you weren’t filing late. That is, file online using the IRS Electronic Federal Tax Payment System or on paper to the IRS using the address for the state where your business is located.

The best strategy is to file late forms as soon as possible to avoid interest and penalties. You may be able to get an extension from the IRS using Form 8809 to the mailing address on the form.

Recommended Reading: How To Check My Tax Refund Status

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Also Check: Do You Have To Pay To File Taxes

Where To Send Returns Payments And Extensions

The Balance / Lara Antal

It’s usually best to go the extra mile when you’re dealing with the Internal Revenue Service , even if it feels like a nuisance or a waste of time. That’s even more applicable if you’re one of the few people who still file a paper or “snail mail” tax return rather than filing electronically.

Following a few guidelines will ensure that your tax return goes to the proper address, that it gets there on time, and that you have proof of delivery.

Where Do I Pick Up Tax Forms

Federal tax forms are available on the website of the Internal Revenue Service, at IRS Taxpayer Assistance Centers and at community locations, such as local libraries, post offices, banks and grocery stores. Taxpayers can also call the IRS and request tax forms by mail.

In addition to providing forms, these locations also offer IRS publication materials that include instructions and advice for filling out the forms and filing taxes. State tax forms may be available from state government websites, which may also offer a paperless e-filing option for both state and federal taxes. The IRS and state tax agencies provide the forms free of cost.

Read Also: What Is The Penalty For Not Paying Taxes

Irs Form 1040 Is Known As The Long Form

Form 1040 is the usual federal income tax form widely used to record an individuals gross earnings . It is usually referred to as the long-form since it is more in-depth than the shorter 1040A and 1040EZ income tax forms.

Also, in contrast to the various other tax forms, IRS form 1040 permits taxpayers to claim several expenditures and tax incentives, list deductions, and modify income. Although the 1040 usually takes more time to fill out, it rewards taxpayers by offering them extra possibilities to reduce their income tax bills.

The 1040 Form is usually due by April 15, except if you request an automatic tax extension. You are usually subject to fines and/or overdue charges if you do not submit by this date. It is possible to ask for a tax extension by sending in IRS Tax Form 4868 by the initial submitting due date .

The Best Way To Fill Out Form 1040

Form 1040 can be managed in a far superior way by using online tax preparation software. Online tax filing will enable you to enter your information into the system, and the software will do all the calculations.

It will take the information you enter and populate the relevant parts of your 1040 for you. You dont need to use a professional tax preparer or an accountant if your tax affairs are relatively simple.

Recommended Reading: How To File California State Taxes

How To Get Federal Income Tax Forms By Mail

Federal income tax forms and instructions booklet can be obtained by mail, please just don’t ask us to mail them to you. You can request most of the federal tax forms by mail directly from the Internal Revenue Service free of charge. The IRS allows you to order up to 100 copies of each federal tax form by mail, along with five copies of each instruction booklet by mail. That’s more than enough for the individual taxpayer.

Court Bars Monroe Man From Working As A Tax Preparer In Louisianacontinue Reading

BATON ROUGE A Monroe man who pleaded guilty to a tax fraud-related felony is barred permanently from working as a tax preparer in Louisiana.

Courtney C. Blockson was arrested in Dec. 2019 for a tax fraud scheme involving state child care tax credits. According to the charging document, Blockson improperly claimed the credits of behalf of hundreds of clients by falsely identifying them as day care center operators. None of the taxpayers involved were aware of Blocksons scheme. The illegitimate credits initially cost the state $131,000 in fraudulent income tax refunds, which the Louisiana Department of Revenue recovered through the collection process.

Blockson pleaded guilty to Filing False Public Records. As a condition of the plea, the court issued an injunction prohibiting him permanently from participating directly or indirectly in the preparation or filing of any Louisiana tax return except his own.

Read Also: Can You E File Arkansas State Taxes

How To Find And File Your Federal Tax Forms

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Michelle P. Scott is a New York attorney with extensive experience in tax, corporate, financial, and nonprofit law, and public policy. As General Counsel, private practitioner, and Congressional counsel, she has advised financial institutions, businesses, charities, individuals, and public officials, and written and lectured extensively.

If bureaucracies are good at anything, its creating paperwork, and the Internal Revenue Service is the king of all bureaucracies, especially when it comes to tax forms. Most paperwork needed for filing your federal tax return can be completed and submitted electronically, but youll need to acquire some forms, on paper or via the web, to get the job done. Well explain how to find and obtain the forms you need, how often the IRS updates its forms, and the options for filing your tax forms online.

For the 2021 tax year, the U.S. tax season began on Monday, January 24, 2022, which is when the IRS begins accepting and processing 2021 returns.