Is Incapacity Insurance Coverage For Self Employment Tax Deductible

No, the quantity you pay for incapacity insurance coverage is NOT tax deductible. That doesnt imply you must go with out it. The truth is, incapacity insurance coverage is comparatively cheap, particularly compared to the distinction itll make for you must you turn out to be injured indirectly, and unable to work.

Nevertheless, you must have the ability to deduct dental, imaginative and prescient and medical bills should you spend greater than your adjusted gross revenue.

For instance, lets say you earned $40,000 gross final 12 months. You contributed $6,000 to an IRA, bringing the adjustment to $34,000.

Youll have reasonably priced medical health insurance, however a excessive deductible that you just paid out of pocket. Or you could not have imaginative and prescient or dental insurance coverage. What should you wanted two root canals, and paid greater than $5,000 whole for each? Within the instance, thats greater than 7.5% of the AGI.

You might be able to deduct these prices. After all, youll want documentation together with payments and information of your funds. When you had a number of medical bills, it could be time to make use of a tax skilled, or tax software program that features skilled help.

But Doing My Own Finances Saves Me Money

Well, possibly⦠But with certain tasks, if you work out the number of hours you spend doing them each week at the rate you could earn by doing something else, including making sales, you could find you would be better off outsourcing. Providing your business can afford to do so, of course. That includes getting an accountant to look after your tax returns, even if you decide to do your own basic bookkeeping. Any money you spend on an accountant’s services can be claimed as a business expense, of course. You can even save some money by taking care of basic record keeping, and then get an accountant to do your returns or company accounts.

Written with expert input from James McBrearty of taxhelp.uk.com.

How Do I Know If I Owe Quarterly Taxes

If you are self-employed and turning a profit, you probably owe quarterly taxes.

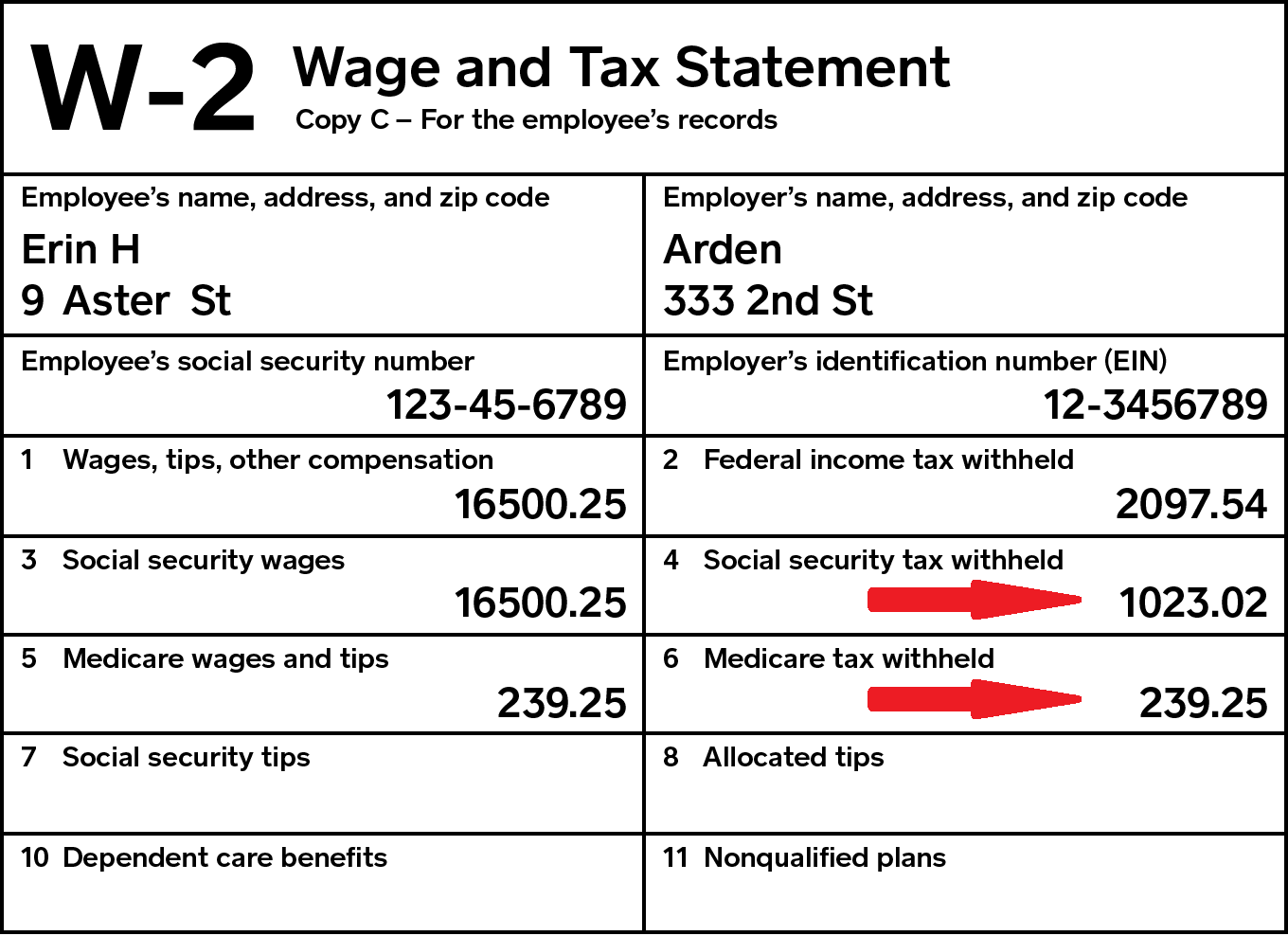

However, its possible that youre already paying enough in taxes during the year. For example, if you have a W-2 full-time or part-time job where your taxes are already being withheld for you and you typically get a tax refund, you may not need to pay quarterly taxes.

Alternatively, you do not need to pay quarterly if you have already paid at least:

90% of your estimated tax owed for the current year

100% of the tax amount owed shown on your return for the prior year

In this case, your tax liability is already almost completely covered. Keep in mind, this is most common for people who have received a refund for the previous years tax and use that to pay their upcoming years taxes. For example, if you received a refund on your 2019 taxes last year and elected to pay it toward your 2020 taxes, you may be covered for estimated taxes, but only if that refund equals 90% of your expected 2020 taxes or was equal to 100% of your 2019 taxes owed.

Also Check: Doordash State Id Number For Unemployment California

What Youre Required To Pay As A Self

Okay, with all of that knowledge in your head now, lets talk about what youre on the hook to pay to the government come tax time. When youre self-employed, and youre operating your business as a sole proprietorship, you must pay:

- Personal income tax on your business earnings minus business expenses

- Contributions to the Canada Pension Plan

- Contributions to Employment Insurance voluntary

Schedule C: Revenue And Loss Assertion For Self Employed

That is the shape the place you document your small business bills, akin to what you spent for journey, schooling and certifications, workplace gear and provides, supplies and related. Your bills might be particular to the kind of work you do as an unbiased contractor/self employed particular person.

Youll add up your whole revenue and the whole of your bills. The totally different between the 2 is both revenue or loss utilized to your tax invoice.

Its essential to maintain the usual deduction in thoughts as you add up deductions. The usual deduction is $12,550. In case your deductions might be lower than that quantity, youll simply use the usual deduction.

Recommended Reading: Efstatus Taxact Online

I Have Already Paid A Payment On Account But Now Realise I Paid Too Much What Can I Do

You should still complete form SA303. Any excess that you have paid can be refunded to you as long as it is at least 30 days until your next payment is due, or it can be held by HMRC and set against the next payment when it becomes due. If your next payment is due within 30 days, the refund will automatically be held and will be set against the next payment due.

How To Calculate Your Ei Contributions

I want to make it clear that contributing to the EI program is not mandatory when youre self-employed. It is 100% voluntary. However, by not contributing to EI, that means you are ineligible to take advantage of all the benefits EI has to offer, such as maternity/parental leave or being a caregiver to a family member who is ill or injured. Then again, it may not be worth it to you and instead you may prefer to just have a very cushy Emergency Fund.

But if you are interested in it, heres how much it costs. As of 2021, the EI rate is 1.58% for self-employed individuals. This means that for every $100 you earn, you need to pay $1.58, to a maximum of $889.54/year . And for insurable earnings, this refers to your gross salary, or your business revenue after youve deducted business expenses but before youve paid income tax and CPP.

Using my earlier example:

Hi Jessica,Thank you so much for this informative post.I registered my business, as to avoid anyone from taking my name. I definitely wont be making more than 30k, Im thinking 10k-15k however I do work for a company with an annual salary of $42 500. With that said, since Im operating my business as a sole proprietorship, when doing my taxes I will need to combine both incomes together correct? How much taxes would I need to pay on that amount? I currently only pay about ~1000/year since I contribute to my RRSP, and I am located in Quebec.Thank you!

Recommended Reading: How Do You File Taxes For Doordash

Schedule C: Profit And Loss Statement For Self Employed

This is the form where you record your business expenses, such as what you spent for travel, education and certifications, office equipment and supplies, materials and similar. Your expenses will be specific to the type of work you do as an independent contractor/self employed person.

Youll add up your total income and the total of your expenses. The different between the two is either profit or loss applied to your tax bill.

Its important to keep the standard deduction in mind as you add up deductions. The standard deduction is $12,550. If your deductions will be less than that amount, youll just use the standard deduction.

Ways To Pay Your Self

The time you need to allow to make your payment to HMRC depends on how you’re choosing to pay.

Make sure the payment deadlines are in your diary – 31 January for any tax you owe for the previous tax year plus your first payment on account and 31 July for your second payment on account.

HMRC has outlined how long various forms of payment can take.

Read Also: How Much Money Should I Save For Taxes Doordash

Use Our Money Navigator Tool

Have you got money worries because of coronavirus? If so, youre not alone.

For instant money guidance based on your circumstances, get started with ourMoney Navigator Tool

The very latest you can register with HMRC is by 5 October after the end of the tax year during which you became self-employed.

For example, if you started your business in June 2020, you would need to register with HMRC by 5 October 2021.

The tax year runs from 6 April one year to 5 April the next. If you register too late, you might need to pay a penalty.

To register with HMRC, go to the GOV.UK website

Dont Forget Your Business Tax Deductions

When it comes to taxes, knowing your tax bracket and setting up a quarterly payment schedule isnt enough. Youll want to plan on accounting for all of your business deductions in order to avoid any unnecessary financial loss.

Keeping impeccable business records will help you properly account for any money you spend on your business. There may be some deductions available to you for the small business you havent considered yet.

Also Check: 1040paytaxcom

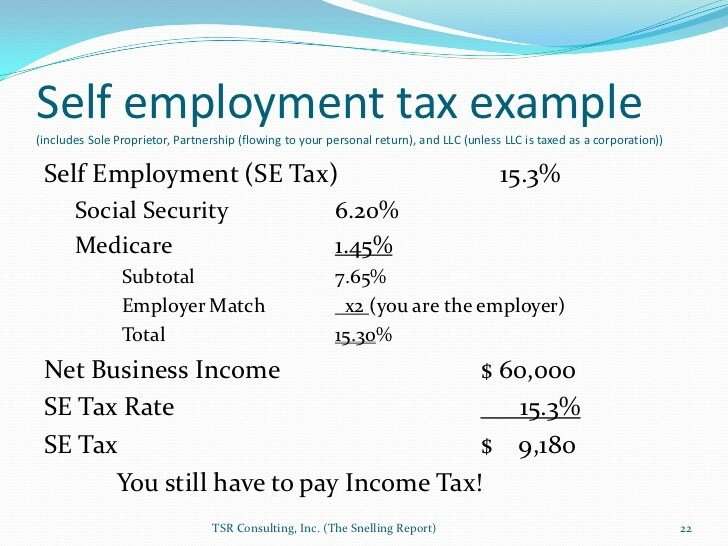

How To Calculate Your Self

The self-employment tax rate for 2019 is 15.3%, which encompasses the 12.4% Social Security tax and the 2.9% Medicare tax. Self-employment tax applies to your net earnings. For 2019, only the first $132,900 of your earnings is subject to Social Security tax , but a 0.9% additional Medicare tax may also apply to your self-employment earnings if they exceed $200,000 if you’re a single filer, or $250,000 if you’re filing jointly.

As mentioned earlier, to accurately calculate your self-employment tax, you need to calculate your net self-employment earnings for the year which is your self-employment gross income minus your business expenses. Typically, 92.35% of your self-employment net earnings is subject to self-employment tax. Once you have your total net earnings from self-employment that are subject to tax, apply the 15.3% tax rate to determine your total self-employment tax.

If you’ve had a loss or just a little bit of income from self-employment for the year, there are two optional methods to calculate net earnings in the IRS Schedule SE.

How One Can File Your Self Employment Taxes

As an unbiased contractor/self employment particular person, its important to maintain good information to assist in tax preparation.

Much more importantly for the benefit in finishing your tax return, its important to know the place theyre.

Earlier than you begin your federal revenue tax return, collect all of the supporting documentation you should assist enterprise bills and gross revenue. Youll want these gadgets to calculate your internet earnings from self employment. Youll additionally want the documentation out of your quarterly estimated taxes that you just paid, primarily based in your predictions for gross revenue and bills in your estimated revenue tax funds.

You May Like: How To Get Doordash Tax Form

Roth Conversions For The Self

The transition to self-employment may present Roth conversion opportunities, for two reasons. First, as a business starts up, the soloprenuers taxable income might be very low, and thus a start up year might be a great time to execute a Roth conversion s etc. to Roth accounts) and enjoy a low marginal federal income tax rate on the converted amount.

Second, there are instances where Roth conversions by the self-employed can benefit from the Section 199A qualified business income deduction. I blogged about that opportunity here.

Make Your Super Count

Superannuation may not be at the top of your list when you’re starting out by yourself. But it’s important to think about it early. Super is a tax-efficient way of saving money to live on when you stop working.

Since you won’t get regular super contributions from an employer, it’s up to you to make them yourself. As well as investing for your future, adding to your super can reduce the tax on your current income. You may also be eligible for the government super co-contribution.

See super for self-employed people for more information.

Read Also: Is Doordash Pay Taxed

Social Security And Medicare Taxes

It is important to note that the self-employment tax refers to Social Security and Medicare taxes, similar to Federal Insurance Contributions Act tax paid by an employer. When a taxpayer takes a deduction of one-half of the self-employment tax, it is only a deduction for the calculation of that taxpayers income tax. It does not reduce the net earnings from self-employment or reduce the self-employment tax itself.

Remember, youre paying the first 7.65% whether you are self-employed or work for someone else. And when you work for someone else, youre indirectly paying the employer portion because thats money that your employer cant afford to add to your salary.

Self-employed individuals determine their net income from self-employment and deductions based on their method of accounting. Most self-employed individuals use the cash method of accounting and will therefore include all income actually or constructively received during the period and all deductions actually paid during the period when determining their net income from self-employment.

What Happens If I Have Multiple Types Of Income

This is where it can get complicated. Some salaried employees have side businesses, so they earn both types of income.

The IRS says that regular employment income takes precedent against the wage limit. Self-employment taxes continue to apply, but they will likely be less. It all depends on how much you earn from your regular job and how much you paid through that.

Recommended Reading: Do You Have To Do Taxes For Doordash

How To Calculate Your Cpp Contributions

Personally, I just use this tax calculator to ensure Im saving enough for income taxes and my Canada Pension Plan contributions, but if youre curious how the math works, here goes!

For your CPP premiums, you are required to pay these if you are 18 or older and earn more than $3,500/year. Its also interesting to note that if you are an employee, you only pay half of your CPP premiums and your employer pays the other half. When youre self-employed, you arent so lucky and have to pay the full 10.9%. You are required to pay 10.9% on your gross income , minus the $3,500 basic exemption amount. Heres an example:

You earned $100,000 in business revenue

You spent $30,000 on business expenses and operating costs

Youre left with $70,000 in business earnings after expenses

Subtract the $3,500 basic exemption amount to equal $66,500

Multiply $66,500 by 10.9% to equal $7,248.50

$100,000 $30,000 = $70,000 $3,500 = $66,500 x 10.9% = $7,248.50

But thats not all! There is actually a ceiling for CPP premiums. The maximum amount a self-employed individual can contribute to CPP is $6,332.90/year as of 2021. Which means instead of paying $7,248.50 in CPP, you would actually only owe the maximum contribution amount which is $6,332.90.

Since CPP contribution amounts change every year, to keep up to date check out this CPP contribution rates, maximums and exemptions page on the governments website.

Common Business Expenses For Self

If youâre not sure whether something counts as a write-off, check Keeperâs free resources page! Or to make things even easier, download the app and connect your accounts so that we can do the sifting for you. Some common business expenses include:

- ð Auto expenses

- 𪧠Marketing and advertising

Once you have a good idea of your annual business expenses, you can subtract them from your gross income to determine how much youâll actually be taxed on. Doing this at the last minute? Donât feel too bad: itâs not uncommon for freelancers to put off thinking about recordkeeping and taxes until the end of the year, so youâre in good company.

That being said, be better. Use Keeper Tax.

Recommended Reading: Does Doordash Pay Taxes

Protect Your Income And Your Business

Without sick leave, getting sick or injured can mean financial difficulties. Income protection insurance can help you pay your bills if you can’t work. If you have a super fund, find out whether they offer income protection insurance as part of the package.

If youre moving from employee to self-employed, check if this affects the insurance cover through your super. Insurance terms and conditions vary from fund to fund.

Consider other types of insurance that can protect you and your business, such as public liability insurance and workers compensation insurance. See business.gov.au for information about insurance for business.

Nathan stays on top of a variable income

Nathan runs his own business as a landscaper.

Nathan’s income and expenses go up and down through the year. At first, he found this hard to manage. So he added up his monthly expenses to work out an amount to pay himself each month.

Next, he worked out his monthly cash flow by looking at what he earned across the whole year, then dividing it by 12 to get a monthly average. This tells him whether he’s earned extra or not.

When Nathan earns more than usual, he now puts the extra into savings to get him through the leaner months. This means he has funds to cover unexpected business costs, such as an urgent repair.

How One Can Pay Self Employment Tax

Calculate your whole self employment tax primarily based in your internet earnings. After you have the annual whole of what you owe in response to social safety and medicare taxes withheld whenever you made quarterly funds, determine the distinction.

Then, primarily based on internet revenue and former quarterly funds, calculate your self employment taxes owed.

When you owe, youll have the ability to print a fee voucher from Schedule 1040 SE and ship a examine. Or youll be able to pay electronically.

Don’t Miss: Look Ein Number

Estimate How Much You Owe

Now you just have to figure out how much to pay. If this is your first year going solo, be prepared for a much higher tax bill than normal thanks to that 15.3% self-employment tax.

Unfortunately, paying self-employment tax isnât the only thing that makes tax season harder on freelancers. One of the silver linings of W-2 work is fewer surprises when itâs time to pay.

Income and FICA taxes are automatically withheld by the employer and remitted to the IRS at the time theyâre accrued. Self-employed folks, on the other hand, have a harder time automating their tax bill.