Filing Your Tax Return

What you need to know about filing your personal income tax and benefit return.

Get help this tax season with the Ontario Child Care Tax Credit and the Low-Income Workers Tax Credit.

Save your receipts for the new Seniors’ Home Safety Tax Credit in 2021, which you can apply for during the 2022 tax season.

You may be eligible for tax credits and benefits to help you with living costs.

I Have Income Tax Owing: How Do I Pay

If youre one of the unlucky ones who has a balance owing after filing, you can choose from the following payment options:

- Online banking

- CRA My Payment

- Preauthorized Debit Authorize the CRA to debit your bank account

- Wire transfer (for non-residents with taxes owing and no Canadian bank account

- In-person at your bank or a Canada Post location

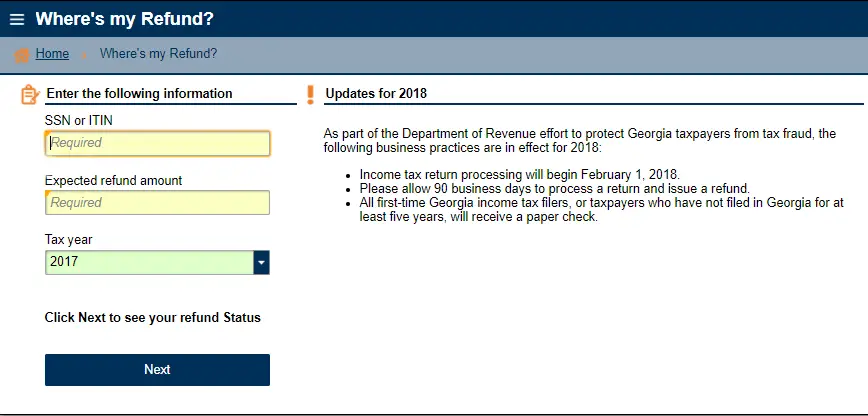

Wheres My Tax Refund Washington Dc

Check the status of your refund by visiting MyTax DC. From there, click on Wheres My Refund? on the right side of the page. Note that it may take some time for your status to appear. If you e-filed, you can expect to see a status within 14 business days of the DC Office of Tax and Revenue receiving your return. The status of a paper return is unlikely to appear in less than four weeks.

Like Alabama and some other states, D.C. will convert some direct deposit requests into paper check refunds. This is a security measure to ensure refunds are not deposited into the incorrect accounts.

Also Check: Doordash Tax Withholding

Wheres My State Tax Refund Tennessee

Tennessee residents do not pay income tax on their income and wages. The tax only applied to interest and dividend income, and only if it exceeded $1,250 . Taxpayers who made under $37,000 annually were also exempt from paying income tax on investment earnings. The state levied a flat 4% tax rate for 2017 and was phased entirely by January 1, 2021. A refund is unlikely for this income tax.

How New Jersey Processes Income Tax Refunds

Beginning in January, we process Individual Income Tax returns daily. Processing includes:

Generally, we process returns filed using computer software faster than returns filed by paper. Electronic returns typically take a minimum of 4 weeks to process.

Processing of paper tax returns typically takes a minimum of 12 weeks.

We process most returns through our automated system. However, staff members do look at some returns manually to see whether the taxpayer filed income, deductions, and credits correctly.

In some cases, they will send a filer a letter asking for more information. In such cases, we cannot send a refund until the filer responds with the requested information.

Returns that require manual processing may take longer regardless of whether the return was filed electronically or by paper.

To mitigate the spread of COVID-19, staffing is extremely limited and may delay the timeframe to review refund requests.

Please allow additional time for processing and review of refunds.

| Sorry your browser does not support inline frames. |

Also Check: Are You Self Employed With Doordash

Wheres My State Tax Refund Maryland

Visit the Comptrollers website to check the status of your Maryland tax refund. All you need to do is enter your SSN and your refund amount. Joint filers can check their status by using the first SSN on their return.

According to the state, it usually processes e-filed returns the same day that it receives them. That means you can expect your refund to arrive not too long after you file your taxes. On the other hand, paper returns typically take 30 days to process. For security reasons, it is not possible to verify any of your tax return information over the phone.

Enter All Your Income And Covid

If you received benefits issued by the CRA in 2021, such as the Canada Recovery Benefit, Canada Recovery Sickness Benefit, or Canada Recovery Caregiving Benefit, you should have received a T4A information slip in the mail by the end of February. Residents of Quebec will receive a T4A information slip and an RL-1 slip.

T4A information slips from the Government of Canada for COVID-19-related benefits will also be provided online if youre registered for My Account and have full access. To have full access to My Account, you need to enter the CRA security code we issued to you after completing the first step of the registration process.

You should have received your T4 slips from your employer by the end of February 2022. You may get slips from other payers, such as pension providers and financial institutions. If you dont have all of your 2021 slips, ask your employer or payer for a copy. If you register for My Account, you may have access to online copies of your slips. If youre still missing information, use your pay stubs or statements to estimate your income to report.

Some income you earn may not be included on an information slip. You should report other types of income such as:

- Tips and gratuities earned at your place of work.

- Income earned through buying and selling cryptoassets.

- Income from sales of goods or services regardless of whether payments were in cryptocurrency or traditional monetary currency.

Don’t Miss: Is A Raffle Ticket Tax Deductible

Wheres My State Tax Refund North Dakota

North Dakotas Income Tax Refund Status page is the place to go to check on your tax refund. Click the link in the center of the page and then enter your SSN, filing status and exact tax refund. The refund status page also has information on how the state handles refunds.

The state advises not to call unless you check your refund status and it says to call.

How To Claim The Credit

You must keep your detailed receipts for any eligible expenses you incur. Those receipts should include at least all of the following information:

- the location of the accommodation

- the amount that can reasonably be considered to be for the accommodation portion of a stay

- the GST/HST paid

- the date of the stay

- the name of the payor

You can claim the credit on your personal Income Tax and Benefit Return for 2022.

The Ontario Staycation Tax Credit is a refundable personal income tax credit. This means that if you are eligible, you can get this tax credit regardless of whether you owe income tax for 2022.

You May Like: Tax Deductible Home Improvements

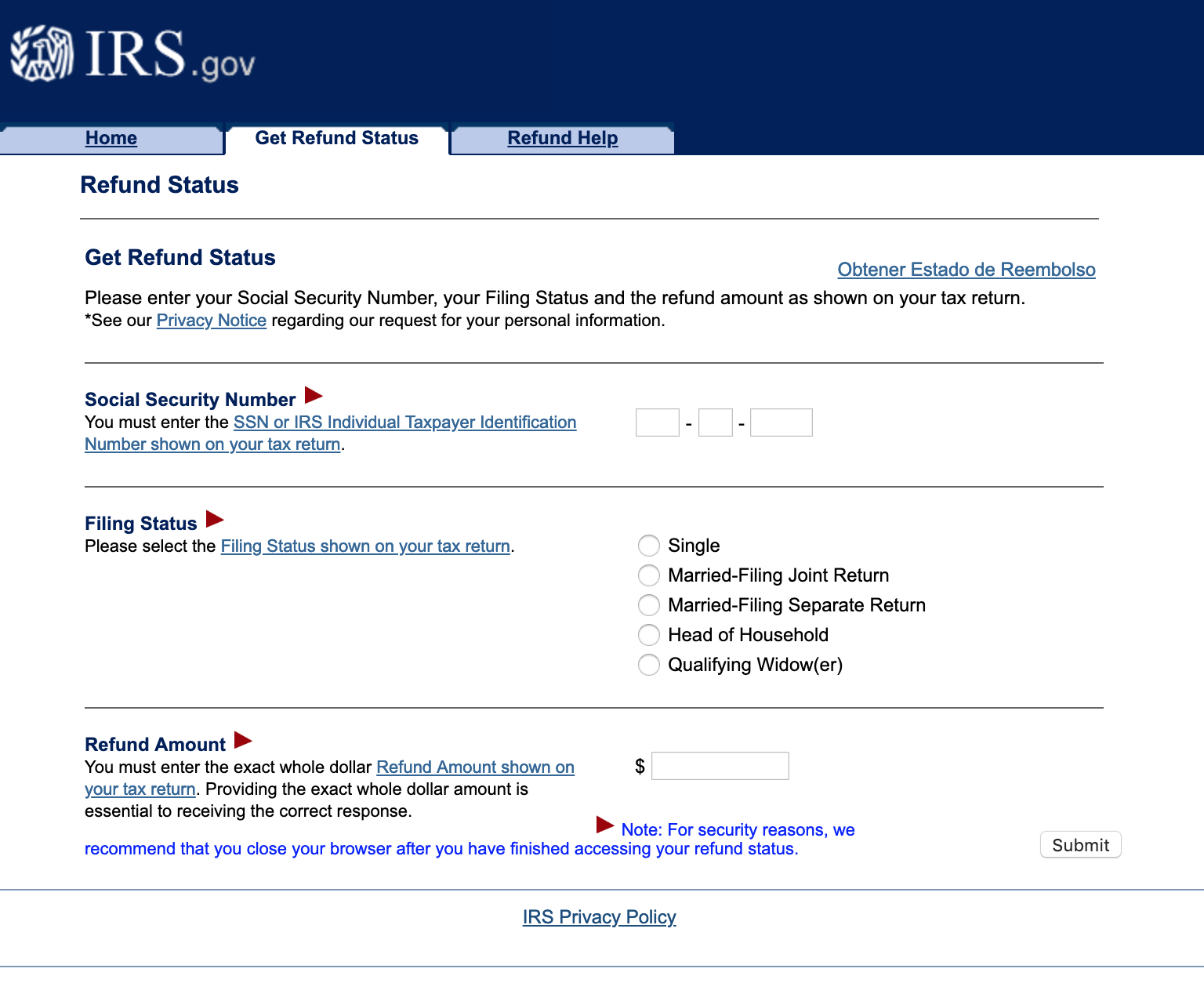

How To Use Irs2go To Check The Status Of Your Refund

The IRS also has a mobile app called IRS2Go, available for both iOS and Android, that checks your tax refund status. It’s available in English and Spanish. You’ll be able to see if your return has been received, approved and sent.

In order to log in, you’ll need your Social Security number, filing status and expected refund amount. The IRS updates the data in this tool overnight, so if you don’t see a status change, check back the following day. Once your return and refund are approved, you’ll receive a personalized date by which to expect your money.

You can check on your refund using the IRS2Go mobile app.

Why Havent You Received Your Refund

The CRA may keep some or all of your refund if you:

- owe or are about to owe a balance

- have a garnishment order under the Family Orders and Agreements Enforcement Assistance Act

- have certain other outstanding federal, provincial, or territorial government debts, such as student loans, employment insurance and social assistance benefit overpayments, immigration loans, and training allowance overpayments

- have any outstanding GST/HST returns from a sole proprietorship or partnership

- have a refund of $2 or less

Recommended Reading: Doordash Tax Write Offs

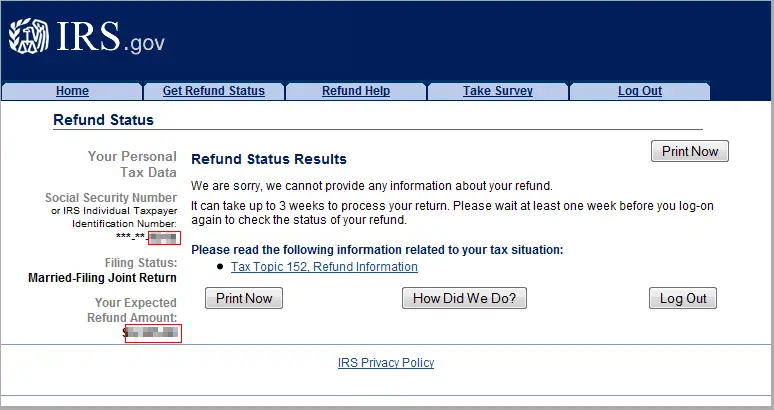

Where Is My Refund

Check your State or Federal refund status with our tax refund trackers.

With the IRS tax refund tracker, you can learn about your federal income tax return and check the status of your federal refund instantly. The IRS’ Wheres My Tax Refund tool provides a safe, fast and easy-to-use portal to track your 2020 refund just 24 hours after it has been received. If youre seeking the status of an amended return, call the IRS directly at 1-800-829-1040. Found your federal return, but looking to get your refund even faster? When you file with Liberty Tax®, you may pre-qualify for an advance loan on your IRS tax refund. Learn more today.

Can You Transfer Your Refund To Another Person

No, you cannot ask the CRA to transfer your refund to pay another persons amount owing. This includes your spouse or common-law partner.

Residents of Quebec can transfer their Revenu Quebec refunds to their spouse. For more detailed information on how to proceed, please review the following link from Revenu Quebec: REFUND TRANSFERRED TO YOUR SPOUSE

Don’t Miss: Doordash Pay Taxes

Wheres My State Tax Refund Iowa

You can check the status of your Iowa state tax return through the states Department of Revenue website. There you will find a page called Where Is My Refund. You will be able to check on your refund and the page also answers common questions about state refunds. This page updates in real time. Once the state has processed your return, you will see the date on which it issued your refund.

One good thing to note is that calling will not get you more information about your refund. When you check your refund status on this page, you will have access to all the same information as phone representatives. So the state asks people not to call unless you receive a message asking you to call.

Wheres My State Tax Refund Minnesota

Through the Wheres My Refund? System, you can check the status of your Minnesota tax refund. You will need to enter your SSN, your date of birth, your return type , the tax year and the refund amount shown on your return. Its important to be aware that if your tax return does not have your date of birth on it, you cannot check its status.

The refund system is updated overnight, Monday through Friday. If you call, the representatives will have the same information that is available to you in this system.

Read Also: How To Pay Doordash Taxes

Tax Refund Status Faqs

The IRS usually sends out refunds within three weeks, but sometimes it can take a bit longer. For example, the IRS may have a question about your return. Here are other common reasons for a delayed tax refund and what you can do.

At H& R Block, you can always count on us to help you get your max refund year after year. You can increase your paycheck withholdings to get a bigger refund at tax time. Our W-4 calculator can help.

The IRS usually sends out most refunds within three weeks, but sometimes it can take a bit longer if the return needs additional review.

The IRS’ refund tracker updates once every 24 hours, typically overnight. That means you don’t need to check your status more than once a day.

Your status messages might include refund received, refund approved, and refund sent. Find out what these e-file status messages mean and what to expect next.

Having your refund direct deposited on your H& R Block Emerald Prepaid Mastercard® Go to disclaimer for more details110 allows you to access the money quicker than by mail. H& R Block’s bank will add your money to your card as soon as the IRS approves your refund.

Amended returns can take longer to process as they go through the mail vs. e-filing. Check out your options for tracking your amended return and how we can help.

Wheres My State Tax Refund Virginia

If you want to check the status of your Virginia tax refund, head to the Wheres My Refund? page. Click on the link to check your refund status and then enter your SSN, the tax year and your refund in whole dollars. You will also need to identify how your filed . It is also possible to check your status using an automated phone service.

Taxpayers who file electronically can start checking the status of their return after 72 hours. You can check the status of paper returns about four weeks after filing.

In terms of refunds, you can expect to wait up to four weeks to get e refund if you e-filed. If you filed a paper return, you can expect to wait up to eight weeks. Allow an additional three weeks if you sent a paper return sent via certified mail.

Read Also: Freetaxusa Legit

Wheres My State Tax Refund Colorado

Taxpayers can check the status of their tax refund by visiting the Colorado Department of Revenues Revenue Online page. You do not need to log in. Click on Wheres My Refund/Rebate? from the Quick Links section. Then you will need to enter your SSN and the amount of your refund.

Colorado has increased its fraud prevention measures in recent years and and warns that it may need take up to 60 days to process returns. Returns will take longest as the April filing deadline approaches. This is when the state receives the largest volume of returns. The state also recommends filing electronically to improve processing time.

The Department Generally Processes Electronically Filed Returns Claiming A Refund Within 6 To 8 Weeks A Paper Return Received By The Department Takes 8 To 12 Weeks To Process

When inquiring about a refund, please allow sufficient time for the Department to process the refund claim.

The status of a refund is available electronically. A Social Security Number and the amount of the refund due are required to check on the status. You are not required to register to use this service.

If it is necessary to ask about a refund check, please allow enough time for the refund to be processed before calling the Department. Keep a copy of the tax return available when checking on the refund status online or by telephone.

Refer to the processing times below to determine when you should be able to view the status of your refund.

- For electronically filed returns, please wait up to 8 weeks before calling the Department. Electronically filed returns claiming a refund are processed within 6 to 8 weeks.

- For paper returns or applications for a tax refund, please wait up to 12 weeks before calling the Department. Paper returns or applications for tax refunds are processed within 8 to 12 weeks.

If sufficient time has passed for your return to be processed, and you are still not able to review the status of your refund, you may:

- Access Taxpayer Access Point for additional information, or

- Contact us at 285-2996.

For refund requests prior to the most recent tax year, please complete form RPD 41071 located at and follow the instructions.

Latest News

Recommended Reading: Does Doordash Take Out Taxes

Tax Situations Requiring A Specific Return Or Form

There are exceptions, such as if you had residential ties in another place, where you would need a specific tax return.

You will also need to file a provincial income tax return for Quebec.

For details: What to do when someone has died

For details: Leaving Canada

Use the income tax package for the province or territory with your most important residential ties.

For example, if you usually live in Ontario, but were going to school in Quebec, use the income tax package for Ontario.

Factual resident

This may also apply to your spouse or common-law partner, dependant children, and other family members.

do not

You may be considered a deemed resident of Canada if you:

- do not have significant residential ties with Canada

- are not considered a resident of another country under a tax treaty between Canada and that country

Use the tax package for non-residents and deemed residents of Canada.

If you are not a factual resident of Canada, or a deemed resident of Canada, you may be considered a non-resident of Canada for tax purposes. Use the tax package for non-residents and deemed residents of Canada.

If you earned employment income or business income with a permanent establishment in a certain province or territory, complete the following instead:

Student Loan Cancellations And Repayment Assistance

Pursuant to the American Rescue Plan Act of 2021, the exclusion from income for forgiveness of student loan debt for post-secondary education is significantly expanded for debt discharges after December 31, 2020 and before January 1, 2026. To qualify for this tax-fee treatment, the loan must have been made by a qualified lender to assist your attendance at an eligible educational institution, i.e., one that has a regular faculty, curriculum, and enrolled body of students.

Loans generally are eligible for this tax treatment if made, insured, or guaranteed by federal, state, or local governments or their agencies, as well as educational institutions and certain nonprofit organizations qualifying under section 501 of the tax code. Also, loan cancellation pursuant to governmental programs that forgive student loan debt for service in certain professions and certain employers is tax-free. However, loan cancellation in return for services rendered to an educational institution or lender does not qualify for tax-free treatment.

Already payments and collections on federal student loans are suspended and the interest rate set at zero through September 30, 2021. Also, loan cancellation pursuant to certain governmental programs that forgive student loan debt for service in certain professions and certain employers is tax-free.

You May Like: 1040paytax Customer Service

How And When To File Your Tax Return

Learn how to fill out your return using tax preparation software or on paper.

The deadline for filing personal income tax returns and paying outstanding income tax is . After April 30, penalties and interest start to apply to any outstanding balance owed.

If you are self-employed or filing for someone who has passed away, please see the CRAs website for filing deadlines.