What If I File For An Extension

Taxpayers have to request an extension by April 18 , but will then have until Oct. 17, 2022, to file their completed 2021 tax return.

Be aware that filing an extension doesn’t push back the deadline for when you need to pay the IRS: You still need to pay an estimate of what you owe to avoid late penalties. An extension just gives you more time to complete your tax return.

Awaiting Processing Of Previous Tax Returns People Can Still File 2021 Returns

Rettig noted that IRS employees continue to work hard on critical areas affected by the pandemic, including processing of tax returns from last year and record levels of phone calls coming in.

“In many areas, we are unable to deliver the amount of service and enforcement that our taxpayers and tax system deserves and needs. This is frustrating for taxpayers, for IRS employees and for me,” Rettig said. “IRS employees want to do more, and we will continue in 2022 to do everything possible with the resources available to us. And we will continue to look for ways to improve. We want to deliver as much as possible while also protecting the health and safety of our employees and taxpayers. Additional resources are essential to helping our employees do more in 2022 and beyond.”

The IRS continues to reduce the inventory of prior-year individual tax returns that have not been fully processed. As of December 3, 2021, the IRS has processed nearly 169 million tax returns. All paper and electronic individual 2020 refund returns received prior to April 2021 have been processed if the return had no errors or did not require further review.

Taxpayers generally will not need to wait for their 2020 return to be fully processed to file their 2021 tax returns and can file when they are ready.

When Will My Refund Be Available

Keep in mind it may take a few days for your financial institution to make your deposit available to you, or it may take several days for the check to arrive in the mail. Keep this in mind when planning to use your tax refund. The IRS states to allow for 5 additional days for the funds to become available to you. In almost all cases a direct deposit will get you your tax refund more quickly than 5 days, and in some cases will be available immediately.

Don’t Miss: Taxes Grieved

Filing If You Received Covid

The CRA and Service Canada processed more than 27 million Canada Emergency Response Benefit applications, totaling more than $81 billion in payments to Canadians. The CRA also processed more than 2 million Canada Emergency Student Benefit applications that totaled more than $2 billion in payments.

If you received CERB, CESB, Canada Recovery Benefit , Canada Recovery Sickness Benefit , or Canada Recovery Caregiving Benefit payments, you will have to enter on your return the total of the amounts you received. You will receive a T4A and/or a T4E tax slip in the mail with the information you need for your return. You can view tax slips online as of February 8, 2021 in My Account. Residents of Quebec will receive both a T4A and RL-1 slip from the CRA, however, the RL-1 slip will not be available for viewing in My Account.

The CRA recognizes that receiving these slips might generate questions for Canadians. Individuals who believe they received a T4A or a RL-1 by mistake or believe there may be discrepancy with the information provided on these slips should contact the CRA.

If you received the CERB or CESB, no tax was withheld when payments were issued. If you received the CRB, CRSB, or CRCB, 10% tax was withheld at source. For Quebec residents who received the CRB, CRSB, and CRCB, 5% of the tax withheld will be reported on the T4A slip and the other 5% will be reported on the RL-1 slip.

Where Else Can I Get Help With My Taxes

You can find helpful and affordable assistance by choosing a provider from CNET’s roundup of the best tax software for 2022 or by talking to a qualified tax professional.

The IRS does offer additional free tax help, too. The Volunteer Income Tax Assistance program is designed to offer guidance to people who make less than $54,000 per year, have disabilities or limited facility with English. And the Tax Counseling for the Elderly program specializes in tax issues that affect people who are 60 or older.

The IRS’ International Taxpayer Service Call Center remains available at 267-941-1000, Monday through Friday, 6 a.m. to 11 p.m. ET.

Don’t Miss: How Do You Pay Taxes On Doordash

When’s The Earliest I Can File My 2021 Taxes

The IRS began accepting and processing 2021 tax returns on Jan. 24, 2022, far earlier than last year’s Feb. 12 start date.

IRS Free File, a partnership between the IRS and leading tax software companies, launched on Jan. 14: The program allows taxpayers who made $72,000 or less in 2021 to file electronically for free, using software provided by participating providers.

Important Dates To Know

The biggest date to know is March 1, which is the deadline for RRSP contributions to count for this tax season.

Josee Cabral, a spokesperson for H& R Block, told CTVNews.ca that there is no golden rule for how much Canadians should be looking to contribute to maximize their tax return, but that tax experts can do that math in advance, if youre prepared early enough.

It all depends on your income and what other deductions that you’re entering, she said in a recent virtual interview.

I always let people know if you get your T4 in advance, send it over to me. I’ll do a simulation. I’ll enter your T4 and I’ll give you examples of what is the best amount in your situation for you to have the best refund possible.

The second big date is traditionally April 30, which is the tax filing deadline if you owe taxes, but because the deadline is a Saturday, Canadians wont have to file until the next business day: May 2.

If you are self-employed, you have until June 15 to file your return, but if you owe taxes, you still need to pay by May 2.

You May Like: Doordash Tax Form

Who Gets A Restitution Waiver Remains Unclear

The state hasnt yet determined when it will resolve the number of restitution waivers it will issue, or how many people will have to repay benefits.

The states accounting shows $8.5 billion in unemployment benefits it shouldnt have paid since the start of the pandemic, including $2.8 billion paid in fraudulent claims, according to a recent audit.

The remaining $5.7 billion represents claims that were later ruled ineligible due to rule changes, UIA error or other reasons. At least 758,000 unemployment claims had to be reconsidered and approved after the state disclosed it hadnt initially followed federal guidance. Roughly half have received waivers of repayment so far.

The agency has not yet made clear how many of those claims have yet to be resolved.

The recent federal labor ruling will allow the state to issue more waivers, but many details remain in flux, including when an individual will learn a waiver has been granted.

UIA spokesperson Nick Assendelft told Bridge this week that the state is reviewing the 40-page federal document on which people who received Pandemic Unemployment Assistance and other temporary programs through last September are waiver eligible. Roughly 70 percent of the 3.46 million residents who filed for unemployment during the pandemic collected temporary benefits.

Tax Refund Schedule For Extensions And Amended Tax Returns

The refund schedule should be the same if you filed for a tax extension, however, there is no official schedule for tax refunds for amended tax returns. The above list only includes dates for e-filing an original tax return. Amended tax returns are processed manually and often take 8-12 weeks to process. If you do not receive an amended tax return refund within 8 weeks after you file it, then you should contact the IRS to check on the status.

Don’t Miss: How To Do Your Taxes For Doordash

Estimated Tax Payment Deadlines For 2021

If you need to pay quarterly estimated taxes for 2021, the four payment deadlines are:

-

May 17, 2021

Note that because of the COVID-19 pandemic, the deadline for the first 2021 estimated tax payment was extended to May 17 along with Tax Day. If you miss the January deadline for the fourth installment, you can also file your full individual income tax return and pay your full tax bill by February 1 in order to avoid tax penalties.

Get your finances right, one money move at a time. Sign up for our free ebook.

An ebook to e-read while youâre e-procrastinating everything else. Download âFinance Your Futureâ today.

Get your copy

What’s The Irs Deadline For Filing Your 2021 Tax Return

The deadline for filing federal taxes for most taxpayers will be Monday, April 18, 2022. That’s because April 15 is recognized as a holiday, Emancipation Day, in Washington, DC.

“By law, Washington, DC, holidays impact tax deadlines for everyone in the same way federal holidays do,” the IRS said in a statement.Taxpayers in Maine and Massachusetts, however, have until April 19, because of the observance of Patriots’ Day in those states.

The IRS also announced an extended tax filing date of May 16 for victims of winter storms in Tennessee, Illinois and Kentucky, and victims of winter wildfires and winds in Colorado. The May 16 extension is limited to affected counties, which can be found on the IRS’ page on tax relief in disaster situations.

Learn smart gadget and internet tips and tricks with our entertaining and ingenious how-tos.

Read Also: How To Calculate Sales Tax Backwards From Total

Do I Even Really Need Irs Letters 6475 And 6419 To File My Taxes

You certainly need to keep any letters received for your records, and the amounts received need to match what you put on your 2021 tax return. Having these official documents makes accurate information much easier to access.

While you could probably find or calculate those amounts on your own, using the letters themselves reduces the risk of mismatched info, which could cause your return to be rejected.

When Is The Tax Filing Deadline In 2022

The deadline to file 2021 income tax returns is Monday, April 18, for most people, three days later than the normal April 15 deadline for filing taxes.

The later date is a result of the Emancipation holiday in the District of Columbia. By law, Washington, D.C., holidays affect tax deadlines for everyone the same way federal holidays do. Taxpayers who live in Maine or Massachusetts have until April 19 to file because of a holiday celebrated in those states, Patriots’ Day.

The IRS has extended the deadline until May 16 for victims of the late 2021 Colorado wildfires as well as victims of the December tornadoes in parts of Illinois, Kentucky, and Tennessee. The extension applies to various individual and business tax returns and tax payments deadlines.

Read Also: Doordash Tax Rate

Do Not Risk Having Your Benefits And Credits Interrupted

Doing taxes on time is the best way to ensure your entitlement to benefits and credits, like the Canada child benefit , the Old Age Security pension payments, and the goods and services tax/harmonized sales tax credit, are not interrupted. Even if you owe tax, dont risk having your benefits and credits interrupted by not filing. If you cannot pay your balance owing, the CRA can work with you on a payment arrangement.

Wheres My State Tax Refund Ohio

The Department of Taxation for Ohio provides an online form to check your refund status. To see the status, you will need to enter your SSN, date of birth and the type of tax return. You also need to specify if it is an amended return.

According to the Department of Taxation, taxpayers who request a direct deposit may get their refund within 15 days. However, paper returns will take significantly longer. You can expect processing time for a paper return to take eight to 10 weeks. If you are expecting a refund and it doesnt arrive within these time frames, you should use the check status form to make sure there arent any issues.

Read Also: Tax Lien Investing California

What If You Didnt File Tax Return Or Register With The Irss Non

You may still be eligible to receive a payment. If you didnt receive a first or second round stimulus payment you may be able to claim the Recovery Rebate Credit when you file your 2020 federal income tax return. For the third round, we will update this page as additional information becomes available from the IRS.

Dont Miss: Was The Stimulus Package Approved

Child Tax Credit Amounts For 2021

The new legislation is only for 2021, but it has raised the eligibility age for child tax credits to now include 17-year-olds. Furthermore, the increased maximum per child is 3,600 dollars for those up to five years of age, which is up from 2,000 dollars. For those between six years of age and 17 years of age, the amount has increased to 3,000 dollars.

The credit is also fully refundable, so low-income taxpayers can receive the full credit amount. Those not earning are also included in this category.

The IRS has been instructed to pay out half the amounts in advance. That’s what is contained in the July payments. Then, over the rest of the year, the remaining amounts will reach the eligible households.

Read Also: Efstatus.taxact 2015

Wheres My State Tax Refund Iowa

You can check the status of your Iowa state tax return through the states Department of Revenue website. There you will find a page called Where Is My Refund. You will be able to check on your refund and the page also answers common questions about state refunds. This page updates in real time. Once the state has processed your return, you will see the date on which it issued your refund.

One good thing to note is that calling will not get you more information about your refund. When you check your refund status on this page, you will have access to all the same information as phone representatives. So the state asks people not to call unless you receive a message asking you to call.

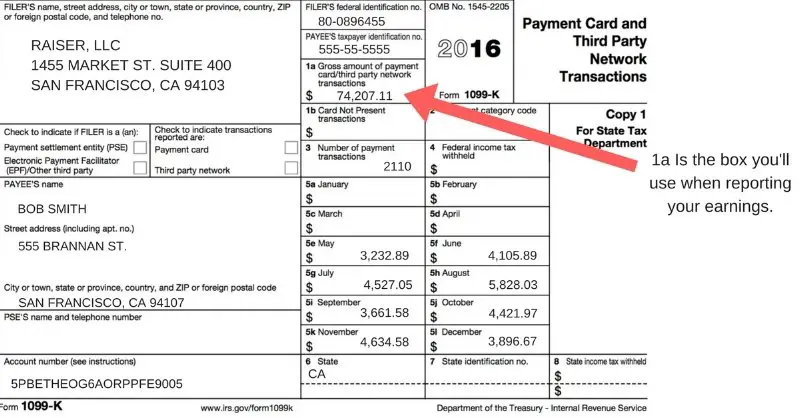

Check Your Mailbox For Your Tax Form

Keep an eye out for hard copies of your W-2 and 1099-R forms if you didnt opt out of paper tax forms. We have mailed your tax forms to the addresses we have on record. The 1042-S forms are also already mailed out.

For more information, check out our quick tip video on preparing for tax season. You can learn more about your 1099-R tax form and changing your tax withholding on our website.

You May Like: Pay Taxes On Plasma Donation

What Does Irs Letter 6475 Mean For My Third Stimulus Payment

Letter 6475 lists the amount of your third stimulus payment delivered by the IRS in 2021. Having this info will help you figure out if you should claim the Recovery Rebate Credit .

The letter includes information on any plus-up payments, too. Plus-up payments were sent to those who did receive an EIP3, but didnt get the full amount because their stimulus payment was initially based on outdated information .

While most taxpayers should have the correct EIP3 amount now, Letter 6475 lists the amount you have been sent in 2021if its still not as much as you qualify for, you can claim the Recovery Rebate Credit.

Okay, but is that hard to do?

Not a chance. When you file with 1040.com, we calculate what you qualify for as you answer simple questions about yourself and your finances. Once you fill in the info from your Letter 6475, well calculate your Recovery Rebate Credit in the background.

Just another way you can feel good about getting your maximum tax breaks with the simplest process.

People Who Dont File A Tax Return

Question: What if I dont file a 2019 or 2020 tax return?

Answer: Some people dont file a tax return because their income doesnt reach the filing requirement threshold. If thats the case, the IRS will send a third stimulus check based on whatever information, if any, is available to it. That information potentially could come from the Social Security Administration, Railroad Retirement Board, or Veterans Administration if youre currently receiving benefits from one of those federal agencies. If thats the case, youll generally receive your third stimulus payment the same way that you get your regular benefits. If you supplied the IRS information last year through its online Non-Filers tool or by submitting a special simplified tax return, the tax agency can use that information, too.

Some people who receive a third stimulus check based on information from the SSA, RRB, or VA may still want to file a 2020 tax return even if they arent required to file to get an additional payment for a spouse or dependent.

Read Also: Doordash Driver Tax Calculator

Florida Michigan Tennessee And Georgia Are Giving $1000 To Teachers

Florida will be distributing stimulus payments in December for first responders and educators who work with students. Teachers and principals are eligible for payments of up to $1,000.

Georgia has implemented a similar policy, giving teachers and principals $1,000 in stimulus cash for their work during the pandemic.

Michigan is giving $1,000 bonuses to every full-time child care professional as part of its Child Care Stabilization Grant. Licensed child care providers are eligible to apply and should visit Michigan.gov/childcare to apply. Child care professionals will be awarded bonuses directly from their employer and do not need to apply.

Tennessee will be doling out $1,000 of hazard pay bonus to full-time teachers and $500 to part-time educators. They should expected to receive their checks before Jan. 1. The hazard pay came at the cost of an expected 2% raise that educators had been expecting in a bill passed in June.