Llc Tax Filing Deadline

LLCs are company structures that provide various financial and legal benefits for their owners.

If you choose to treat your LLC as a corporation, your tax dates are:

-

overall tax due date if you follow the calendar year for your fiscal year

-

15th day of the fourth month after your fiscal year ends: overall tax due date if you have a different fiscal year

If you choose to run your LLC as a sole proprietorship:

The IRS taxes you like an individual. Your income and expenses are therefore reported on your personal tax return.

Without an extension, the personal tax return is due on April 18. File Form 1040, and youll be good to go.

When The Deadline Is Different

Submit your online return by 30 December if you want HMRC to automatically collect tax you owe from your wages and pension. You must be eligible.

HMRC must receive a paper tax return by 31 January if youre a trustee of a registered pension scheme or a non-resident company. You cannot send a return online.

HMRC might also email or write to you giving you a different deadline.

Government Has Extended The Deadline For Filing Income Tax Returns To March 15 2022

Deadline for filing income tax returns has been extended to March 15, 2022

Government has extended the deadline for filing income tax returns to March 15, according to a notification issued by the department of revenue of the finance ministry.

The last date for filing returns was December 31, 2021.

The income tax department also tweeted about the extension of return filing deadline.

On consideration of difficulties reported by taxpayers/stakeholders due to Covid & in e-filing of Audit reports for AY 2021-22 under the IT Act, 1961, CBDT further extends due dates for filing of Audit reports & ITRs for AY 21-22. Circular No. 01/2022 dated 11.01.2022 issued.

Income Tax India

The deadline has been extended due to difficulties being faced by the taxpayers because of the prevailing Coronavirus situation, the notification said, adding that it has also been done due to problems being faced while e-filing of various audit reports under the provisions of the Income Tax Act 1961.

“The due date for furnishing of Return of Income for the Assessment Year 2021-22, which was 30th November 2021 under sub-section of section 139 of the Act, as extended to 31st December 2021 and 28th February 2022… is further extended to 15th March, 2022,” the notification issued by the finance ministry said.

Apart from Income Tax Returns, the due date for filing of various audit reports has also been extended by the Ministry of Finance’s Central Board of Direct Taxes. The new deadline is February 15, 2022.

Don’t Miss: Plasma Donation Tax

The Deadline For Filing The Income Tax Return For Ay 2021

Reported By:| |Source: DNA webdesk |Updated: Jan 11, 2022, 08:33 PM IST

The central government has extended the deadline for filing the income tax returns for the AY 2021-22 to March 15, 2022, as per the latest notification issued on Tuesday. Prior to this, the last date to file the income tax returns was December 31, 2021.

The Ministry of Finance, in a circular issued on Tuesday, said that the deadline for the income tax returns filing for the assessment year 2021-22 has been extended to March 15 in view of the difficulties faced by taxpayers in the electronic filing of various reports.

In the official circular, it is mentioned that the deadline has been extended “on consideration of difficulties reported by taxpayers and stakeholders due to Covid and in electronic filing of various reports”.

On consideration of difficulties reported by taxpayers/stakeholders due to Covid & in e-filing of Audit reports for AY 2021-22 under the IT Act, 1961, CBDT further extends due dates for filing of Audit reports & ITRs for AY 21-22. Circular No. 01/2022 dated 11.01.2022 issued. Income Tax India

The Finance Ministry notice further states, The due date of furnishing of Return of Income for the Assessment Year 2021-22, which was 30th November 2021 under sub-section of section 139 of the Act, as extended to 31st December 2021 and 28th February 2022 by Circular No.9/2021 dated 20.05.2021 and Circular No.17/2021 dated 09.09.2021 respectively, is further extended to 15th March 2022.

Where Else Can I Get Help With My Taxes

You can find helpful and affordable assistance by choosing a provider from CNET’s roundup of the best tax software for 2022 or by talking to a qualified tax professional.

The IRS does offer additional free tax help, too. The Volunteer Income Tax Assistance program is designed to offer guidance to people who make less than $54,000 per year, have disabilities or limited facility with English. And the Tax Counseling for the Elderly program specializes in tax issues that affect people who are 60 or older.

The IRS’ International Taxpayer Service Call Center remains available at 267-941-1000, Monday through Friday, 6 a.m. to 11 p.m. ET.

Also Check: Does Door Dash Take Out Taxes

Last Date For Filing Itr On December 31 Taxpayers Risk Penalty Of Upto 5000 On Missing Deadline

The last date for filing your income tax returns for the financial year 2020 to 2021 is fast approaching and the deadline is set for midnight on December 31, 2021. Failing to file the returns before the mentioned deadline can attract penalties of upto 5,000.

The maximum penalty amount was 10,000 until last year which was then reduced to 5,000. Taxpayers were levied a fine of 10,000 if they filed their returns late between December 31 and March 31 and a penalty of 5,000 for filing their returns between August and December. However, from this year, the maximum penalty has been reduced to 5,000.

The last date for filing the income tax returns for the financial year was initially extended from July 31, 2021 to September 30, 2021 due to the disastrous second Covid-19 wave in the country. It was then extended to the year end after complaints about technical glitches in the new IT portal to file the returns.

Meanwhile, the Income Tax department on Wednesday said that over 5 crore returns were filed as of the date and urged people who were yet to file to do so before the deadline.

More than 5 crore Income Tax Returns for AY 2021-22 filed till 5:45pm today! Hope you have filed yours too! If not, please file your #ITR for AY 2021-22 before the extended due date of 31st December, 2021. Please visit http://incometax.gov.in, the department said in a tweet.

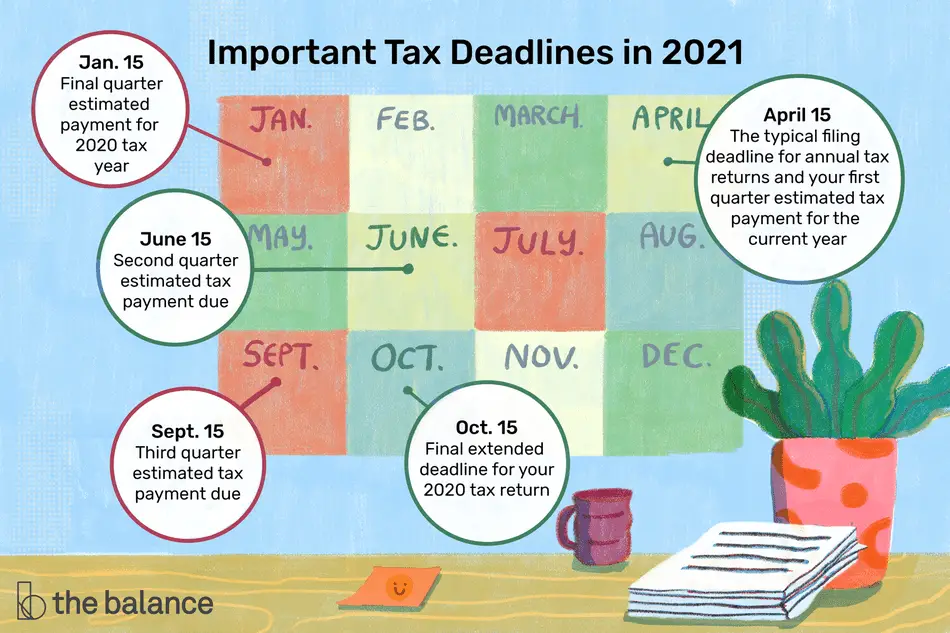

There Are Several Important Dates Taxpayers Should Keep In Mind For This Year’s Filing Season:

- IRS Free File opens. Taxpayers can begin filing returns through Free File partners tax returns will be transmitted to the IRS starting Feb. 12. Tax software companies also are accepting tax filings in advance.

- Earned Income Tax Credit Awareness Day to raise awareness of valuable tax credits available to many people including the option to use prior-year income to qualify.

- IRS begins 2021 tax season. Individual tax returns begin being accepted and processing begins.

- Projected date for the IRS.gov Where’s My Refund tool being updated for those claiming EITC and ACTC, also referred to as PATH Act returns.

- First week of March. Tax refunds begin reaching those claiming EITC and ACTC for those who file electronically with direct deposit and there are no issues with their tax returns.

- Deadline for filing 2020 tax returns.

Recommended Reading: Doordash Taxes Percentage

S Corp Tax Extension Deadline 2021

If you have requested for an extension for 2021 taxes by timely filing form 7004 with the IRS. Then you will have till to file your form 1120S.

If you didnt file request for extension form 7004, you need to file your 1120S as soon as possible as the penalties for late filing will continue to accrue.

Penalty For Late Filing S Corp Tax Return

If you are unable to file your taxes by March 15th and dont obtain extension or file after the extension time frame and file your tax by Sept 15th , the IRS will impose a minimum penalty of $205 for each month or part of the month the return is late multiplied by the number of shareholders.

IRS is very strict about enforcing these penalties. You will typically get a letter from the IRS regarding Late Filing. Make sure you respond to this letter promptly.

Recommended Reading: Ct Tsc Ind

What If You Miss A Date

You’ll probably be hit with a financial penalty, if only an extra interest charge, if you don’t submit a tax return and make any payment that is due by its appropriate deadline. There are two main penalties you may face:

- The failure-to-file penalty for a 1040 return is 5% of the tax due per month as of tax year 2021, up to a cap of 25% overall, with additional fees piling up after 60 days.

- The failure-to-paypenalty is one-half of 1% for each month, or part of a month, up to a maximum of 25%, of the amount of tax that remains unpaid from the due date of the return until the tax is paid in full.

Generally, interest accrues on any unpaid tax from the due date of the return until the date of payment in full. To avoid fees and required payments, the IRS recommends you should file your return as soon as possible if you miss a deadline.

Alignment With State And District Of Columbia Holidays And Changes In Date

Tax Day occasionally falls on Patriots’ Day, a civic holiday in the Commonwealth of Massachusetts and state of Maine, or the preceding weekend. When this occurred for some time, the federal tax deadline was extended by a day for the residents of Maine, , Massachusetts, New Hampshire, New York, Vermont, and the District of Columbia, because the IRS processing center for these areas was located in Andover, Massachusetts and the unionized IRS employees got the day off. In 2011 and 2015, Tax Day fell on Patriots’ Day. However, federal filings were directed to Hartford, Connecticut, Charlotte, North Carolina and Kansas City, Missouri, and there was no further extension for Maine, Massachusetts or other surrounding states’ residents. In 2019 and 2021, when Patriots Day was again observed on the tax filing deadline, residents of Maine and Massachusetts were given extra time to file as post offices in those states would be closed on normal deadline.

Emancipation Day is celebrated in Washington, D.C. on the weekday nearest April 16, and under a federal statute enacted decades ago, holidays observed in the District of Columbia have an impact nationwide. If April 15 falls on a Friday then Emancipation Day is celebrated on the same day and tax returns are instead due the following Monday, April 18. When April 15 falls on a Saturday or Sunday then Emancipation Day is celebrated on the following Monday and tax returns are instead due on Tuesday.

Read Also: Is A Raffle Ticket Tax Deductible

What Are The New Deadlines For Filing Itrs

Income tax return filing deadlines have been extended due to the new portals glitches but experts say taxpayers should file returns at the earliest to avoid interest or penalty payments. The new deadlines for filing the various ITRs are as follows:

- Individuals/non-audit cases: December 31, 202

- Corporates/audit cases: February 15, 202

- Transfer pricing cases: February 28, 202

- Revised returns in all categories: March 31, 2022.

To Speed Refunds And Help With Their Tax Filing The Irs Urges People To Follow These Simple Steps:

- File electronically and use direct deposit for the quickest refunds.

- Check IRS.gov for the latest tax information, including the latest on Economic Impact Payments. There is no need to call.

- For those who may be eligible for stimulus payments, they should carefully review the guidelines for the Recovery Rebate Credit. Most people received Economic Impact Payments automatically, and anyone who received the maximum amount does not need to include any information about their payments when they file. However, those who didn’t receive a payment or only received a partial payment may be eligible to claim the Recovery Rebate Credit when they file their 2020 tax return. Tax preparation software, including IRS Free File, will help taxpayers figure the amount.

- Remember, advance stimulus payments received separately are not taxable, and they do not reduce the taxpayer’s refund when they file in 2021.

Recommended Reading: Highest Paying Plasma Donation Center Near Me

What To Do If You Miss A Deadline

The action you need to take depends on the type of deadline you have missed and whether or not you owe tax. If you expect a tax refund but are late filing your income tax return, theres no penalty. That said, you should file your return as soon as you are able and perhaps expect to wait a little longer than usual for that refund, given IRS backlogs.

If you wait more than three years from the date the return was due to file, you could be out of luck after that period, unclaimed refunds generally become the property of the U.S. Treasury. According to Forbes Magazine, the IRS had more than $1.4 billion in unclaimed refunds from tax year 2015. That represents roughly one million taxpayers who would have gotten a refund had they filed their tax return.

If you missed a tax filing deadline and owe tax, there is more urgency to the need to file as soon as possible. For every day your filing is delayed, the IRS may impose penalties for failure to file and failure to pay your taxes. In addition, interest accrues on the amount of tax owed. If you need help, contact a professional tax preparer as soon as possible.

If you missed an estimated payment deadline, the best thing to do is to make the payment as quickly as possible to minimize interest and the risk of penalties.

Filing A Tax Extension Next Month All The Money You’ll Delay If You Do

With just a month left to file your taxes, you may be planning to file a tax extension — but you could be delaying thousands of dollars.

Katie Teague

Writer

Katie is a Writer at CNET, covering all things how-to. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

Laura Michelle Davis

Copy Editor

Laura is a professional nitpicker and good-humored troubleshooter who has worked as an English teacher, Spanish medical interpreter, copy editor and proofreader. She is a fearless but flexible defender of both grammar and weightlifting, and firmly believes that technology should serve the people. Her first computer was a Macintosh Plus.

Filing for an extension gives taxpayers extra time, but there are some consequences to be aware of.

The IRS has sent out roughly 38 million tax refunds for those who’ve submitted their 2021 tax returns. And now that there’s only one month left to file your taxes, you shouldn’t procrastinate. However, if it’s not possible to submit your taxes by the April 18 deadline, we understand — but you could be delaying thousands of dollars.

Don’t Miss: How Much Is Taxes For Doordash

Other Income Tax Debts Including:

- Tax in respect of Over-contributions to Deferred Income Plans .

- Tax in respect of Registered Investments

- Tax in respect of overpayments to Registered Education Savings Plan .

- Payments under Registered Education Savings Plan

| Filing dates |

Part X.1 Within 90 days after the end of its taxation year . Part X.2 Within 90 days from the end of its taxation year. Part X.4 Within 90 days after the end of the year . Part X.5 Persons regular filing due date . |

|---|---|

| Payment dates |

Am I Eligible To File A Tax Extension

If you’re planning to file a tax extension this year, you’ll need to submit Form 4868 to the IRS either by paper or electronically using e-file before the April 18 deadline. Note that you’ll still have to pay all or part of your estimated income tax due using Direct Pay, the Electronic Federal Tax Payment System, or using a debit or , and note that you’re filing for an extension.

Some taxpayers are automatically granted more time to file. This includes military personnel who are serving in a combat zone or persons in federally declared disaster areas.

Also Check: Is Freetaxusa Legitimate

Winter Storm Disaster Relief For Louisiana Oklahoma And Texas

Earlier this year, following the disaster declarations issued by the Federal Emergency Management Agency , the IRS announced relief for victims of the February winter storms in Texas, Oklahoma and Louisiana. These states have until June 15, 2021, to file various individual and business tax returns and make tax payments. This extension to May 17 does not affect the June deadline.

For more information about this disaster relief, visit the disaster relief page on IRS.gov.

How Are 2021 Tax Returns Related To Stimulus Payments

If the IRS owes you money for the third stimulus check due to a new qualifying dependent you gained in 2021, you can file for that payment through a recovery rebate credit when you file your taxes. You could get up to $1,400 for your dependent — that includes a new baby born or adopted. Keep an eye out for Letter 6475 from the IRS as it will have all the details you need about last year’s stimulus check when you file.

As for the first two stimulus checks, if you didn’t receive either check or received less than you qualified for, you could still be eligible to claim the money through a recovery rebate credit. You’ll either need to file a 2020 tax return if you haven’t yet, or amend your 2020 tax return if it’s already been processed.

At the end of 2021, the IRS still had some 6 million unprocessed tax returns to go through and advises you not to file a second return if your 2020 tax return still hasn’t been processed yet.

Between the child tax credit and child care expenses, you could get a lot of money back this year.

You May Like: How To Report Plasma Donation On Taxes