Affordable Care Act Premium Credit Claim

If you got health care coverage as required by the Affordable Care Act, also known as ACA or Obamacare, you might need to file a return.

This is the case if you qualified for federal help in buying your health care coverage through the health insurance marketplace or exchange. If advance payments of the ACA premium tax credit were made for you, your spouse, or a dependent who obtained such marketplace medical coverage, that amount must be reported by filing a Form 1040 tax return and Form 8962, Premium Tax Credit.

This will ensure that you got the appropriate tax credit in advance. If you received too much premium help, youll have to repay it when you file your return. If you did not get enough, you can collect the extra when you file.

Quarterly Tax Payments Throughout The Year

The IRS expects tax payments to be made quarterly to cover income thats been made in the previous three months. In normal years, these are the due dates.

- The first quarter is due on April 15.

- Second quarter payments are due on June 15.

- The third quarter is due on September 15.

- Fourth quarter payments are due January 15 of the following year.

If those dates fall on a weekend or a Federal holiday, then the payment is due on the next open business day.

Some of my self-employed friends employ a useful strategy for these quarterly payments. They make an estimated monthly tax payment into their own high yield savings accounts. Those payments earn a little bit of money, before they are sent to the IRS every three months. It also helps them avoid coming up with a large payment every three months something that many self-employed people end up struggling with if they dont budget properly.

They just take the amount that they owed the previous year and divide it by 12. Then, they transfer that amount into a high-yield bank account every month. When its time to make their quarterly tax payment, they transfer the payment via EFTPS.gov .

Internet And Program Use

The IRS does allow a partial deduction for expenses required for the business operations that might be used for personal activities. A primary example of this is the internet.

As most streamers broadcast from home, generally the internet is also used for non-streaming activities. For this reason, only a portion of the internet bill would be deductible. In this case, the content creator must estimate the percentage that the internet is used for streaming or personal purposes.

The percent used for streaming is deductible. This is the case with all the equipment or bills that may be present.

Recommended Reading: How Do I Change My Tax Withholding On Unemployment

No Exemption For Age Or Occupation

Whether youre 9 or 90, age has no effect on your requirement to file a tax return. If you meet one of the above requirements, the CRA expects to receive an income tax return from you.

Students are not exempt from filing either. If your 20-year-old child is an entrepreneur who made over $3,500 running a small business last summer, they must file an income tax return even if theyre still in school. All working children should file a tax return as soon as they start earning income.

Dependents May Have To File

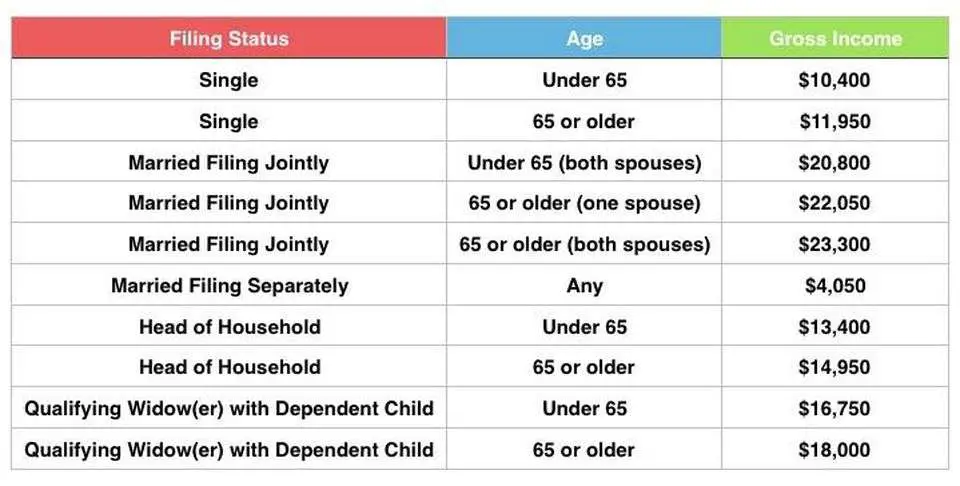

If you are a dependent of another taxpayer, then you follow a different set of rules.

The rules determining whether a dependent needs to file a tax return are somewhat complicated, but Ill try my best to keep it simple. Dependents who are under 65 and have unearned income over $1,100, or earned income over the standard deduction of $12,200, must file a tax return.

That parts pretty easy. Heres where it gets more complex: If you received both earned and unearned income in 2019, you must file a return if your combined income adds up to more than the larger of $1,100 or total earned income plus $350.

For example, 18-year-old Danielle is claimed as a dependent by her parents. In 2019, she received $200 in unearned income from taxable interest from an investment and also earned $4,050 from her part-time job at the library. Danielles unearned income and earned income each fall below the individual thresholds. Her total income of $4,250 is also less than her earned income plus $350 . Since all three of these factors apply, Danielle does not have to file a 2019 tax return.

Still confused? Understandable. Basically, if you are a dependent and have both earned and unearned income you have to file a tax return if your total income was more than $1,100 and your unearned income was more than $350.

Related:Where to Get Your Taxes Done

Recommended Reading: How To Lower Property Taxes In Florida

What If You Need Help

If you need more information after reading this guide, go to Taxes, or contact the CRA.

If you work in the film or video production industry and you need more information, go to Film and Media Tax Credits. You can find the telephone numbers, fax numbers, and addresses for the film services units on our website.

What Happens If You File Taxes A Day Late

Northwestern Mutual

While taxes are one of the few certainties in life, youâre only human if youâve ever looked at the calendar and realized Tax Day is just around the corner â and youâre nowhere near prepared. And in a year like 2021 when the tax deadline has been pushed back to May 17, it can throw off your schedule even more.

But what happens if you file taxes a day late? Here’s what to know.

Also Check: When Do You Get The Child Tax Credit

Meet The Deadline For The Extension

The IRS must receive Form 4868 on or before the tax filing deadline, which is usually April 15 unless that day falls on a weekend or holiday. In this case, it would be the next business day.

The IRS will charge a late filing penalty, a late payment penalty, and interest on any unpaid balance you owe if you don’t file your return or an extension on time and if you also fail to pay on time. But you’ll at least avoid the late-filing penaltywhich is a hefty 5% of the taxes you owe for every month your return is lateif you file an extension by the April due date, then file your return by the extended deadline in October.

This penalty increases to $435 or 100% of the taxes you owe, whichever is less, if you’re 60 days late or more. The penalty applies to all returns due from Jan. 1, 2020 onward.

Its Better To File Late Than Not At All

You might be thinking, âIf Iâve already missed the deadline, whatâs a few more weeks?â But the sooner you submit your tax return, the better . So do your best to file the next day or soon thereafter.

If you earn $72,000 or less per year, you can file your return online using one of the IRSâ free federal tax filing options, which provide complimentary tax preparation software. If you earn more than $72,000, you can still file online using the IRSâ free electronic forms, but youâll need some tax-prep knowledge if you choose to go this route.

Recommended Reading: How To Claim Independent On Taxes

Why Do You Need To Make Quarterly Payments

We know what you might be thinking. Why not just pay your taxes once a year, when you file your return? However, the IRS doesnt look too kindly on those who dont make enough tax payments throughout the year. It may be tempting to simply save all your tax payments for the year and throw them into a high-yield savings account. After all, Uncle Sam will still get paid in the end. In the meantime, maybe youll be able to make a few extra bucks in interest payments.

Unfortunately for you, the IRS frowns upon this practice. You can be charged interest and other penalties if you dont make at least quarterly payments. Do not wait until tax season to pay what you owe.

How Does Federal Tax For Streamers Work

Two notes of importance. Firstly, all of your deductions and such come out of your total earnings before you can determine the taxable earnings. You will fill out the Schedule SE to determine your taxable earnings. You will need Schedule C to fill it out.

Secondly, this is a stair-step method. Just because you may have taxable earnings of say $100,000 does not mean that your tax rate on all of it would be the 24% . The first $9,875 is still at 10%, the profits between $9875 and $40125 are taxed at 12%, and so on. The only amount taxed at 24% is any profit you receive over $85,526.

The income tax brackets change yearly, so dont rely on this years numbers for next year. . Here is the table you will use in 2021 to file your taxes for 2020:

2020 Federal Income Tax Table

| Tax Rates |

|---|

| $518,401 + |

You May Like: Do I Have To Pay Taxes On Stimulus Check

How Much Might It Cost To Have A Professional Prepare Your Tax Returns

According to the National Society of Accountants 20182019 Income and Fees Survey, the average tax preparation fee for a tax professional to prepare a Form 1040 and state return with no itemized deductions is $188. Itemizing deductions bumps the average fee by more than $100 to $294.

If your financial situation is a bit more complex or requires filing additional IRS forms, other fees could apply and add up. Here are some average filing charges by form, according to the National Society of Accountants.

- $187 for Schedule C, for business income

- $109 for Schedule D, for gains and losses

- $136 for Schedule E, for rental income

- $175 for Schedule F, for farm income

- $65 for Form 940, for federal unemployment

- $49 for Form 8965, for health coverage exemptions

- $52 for Form 1095-A, for health insurance marketplace statement

And if you have to file an estate tax return on behalf of a deceased taxpayer, the average cost for preparing the form is $1,784. Considering that generally only estates worth more than $11.4 million are required to file an estate tax return, it may seem fair for tax professionals to charge more to prepare these complex forms.

What Is The Difference Between The Executor And Administrator As The Legal Representative

In most cases, people die with a will that states who is the executor, the inheritors, and the beneficiaries. The executor has the authority to collect information and to distribute the deceased assets according to the will. The probate letter is obtained from Probate or Surrogate Court in the deceased province of residence to validate the will.

People who die intestate would take longer for their estates to be distributed. Someone has to apply to the Surrogate court to be appointed the administrator. In most cases, the court appoints the surviving wife or one of the children to be the administrator. The administrator has to submit an affidavit form to the deceased tax center at his province or territory of residence prior to death. In Quebec, you will need to apply for the BD-81.7-V form.

Read Also: How To Check Income Tax Return Status

What Is Irs Free File

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry leaders who provide their brand-name products for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

- Traditional IRS Free File provides free online tax preparation and filing options on IRS partner sites. Our partners are online tax preparation companies that develop and deliver this service at no cost to qualifying taxpayers. Please note, only taxpayers whose adjusted gross income is $72,000 or less qualify for any IRS Free File partner offers.

- Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free. If you choose this option, you should know how to prepare your own tax return. Please note, it is the only IRS Free File option available for taxpayers whose income is greater than $72,000.

Find what you need to get started, your protections and security, available forms and more about IRS Free File below.

About IRS Free File Partnership with Online Tax Preparation Companies

The IRS does not endorse any individual partner company.

- A copy of last year’s tax return in order to access your Adjusted Gross Income

- Valid Social Security numbers for yourself, your spouse, and any dependent, if applicable

Income and Receipts

Other income

ACA Filers

File Electronically

Contact Information

Tax On Taxable Income

Certain types of income you earn in Canada must be reported on a Canadian tax return. The most common types of income include:

- income from employment in Canada

- income from a business carried on in Canada

- the taxable part of Canadian scholarships, fellowships, bursaries, and research grants

- taxable capital gains from disposing of taxable Canadian property

You may be entitled to claim certain deductions from income to arrive at the taxable amount. You can also claim a credit for any tax withheld at source or paid on this income.

If there is a tax treaty between Canada and your country or region of residence, the terms of the treaty may reduce or eliminate the tax on certain types of income. To find out if Canada has a tax treaty with your country or region of residence, see Tax Treaties. If it does, contact the CRA to find out if the provisions of the treaty apply.

Don’t Miss: How Can I Pay Taxes I Owe

More Info For Explore Filing Options For Massachusetts Personal Income Tax Returns

Payment Agreements

If you cant make your tax payment in full, pay as much as you can with your tax return. After you are billed for the balance, you can set up a payment plan online through MassTaxConnect or by calling 887-6367.

To set up a payment plan with MassTaxConnect, you need to:

If you owe $5001 or greater, a payment agreement cannot be set up with MassTaxConnect. You would need to set up a payment agreement by calling Collections at 887-6400.

What Taxes Do I Pay If I Own An Llc

As the member of an LLC is the owner and not the employee, they must pay self-employment tax, just as if they were a sole proprietor. Domestic LLCs with at least two members are treated as partnerships for federal income tax purposes unless they file Form 8832 and elect to be treated as corporations.

Read Also: How To Calculate 1099 Taxes

The Irs Interactive Tax Assistant

There are a series of questions you should answer to help you determine the minimum income amount that applies to you. Lets start with the IRS questionnaire found on their do you need to file page. This questionnaire is provided through the IRS interactive tax assistant , which is a remarkably easy-to-use program found on the IRS website.

The questions are designed to help you determine whether you need to file a federal tax return and if you need to adjust your Form W-4 to eliminate tax withholding.

The IRS has stated that they want to help eliminate wasted time and money from returns that are filed when they dont need to be. I recommend that you take them up on that offer and work through the questions.

According to the IRS website, answering these questions should take you no longer than 10-15 minutes. This is certainly worth your time, especially if it saves the time it would take you to file or if it saves you from having money withheld unnecessarily.

What Taxes Can I Pay With Webfile

- Sales and Use

- Boat and Motor Boat Sales and Use

- Cement Production

- Compressed Natural Gas/Liquefied Natural Gas Dealer

- CNG/LNG Interstate Trucker

- Direct Pay Sales and Use

- Fireworks

- International Fuel Tax Agreement

- Loan Administration Fee

- Manufactured Housing Sales and Use

- Maquiladora Export

- Mixed Beverage Sales and Gross Receipts

- Motor Fuel

- Motor Vehicle Sales and Use

- Motor Vehicle Seller-Financed

- Oil and Gas Well Servicing

- Oyster Sales

Taxpayers who paid $500,000 or more for a specific tax in the preceding state fiscal year are required to pay using TEXNET.

Paying by credit card will incur a non-refundable processing fee:

| Amount Paid |

|---|

| 2.25% of the amount plus a $0.25 processing fee |

Payment Deadlines

- TEXNET ACH Debit payment of $100,000 or less, must be scheduled by 10:00 a.m. on the due date. Payments above $100,000 must be initiated in the TEXNET system by 8:00 p.m. the business day before the due date.

- and loss of timely filing and/or prepayment discounts.

- If you are required to pay electronically, there is an additional 5% penalty for failure to do so.

Read Also: How To Pay Ny State Taxes

How Much Can A Small Business Make Before Paying Taxes

If you operate a small business, you must pay taxes on the income, regardless of the profit and loss. The tax return you must file depends on how your business is structured. For example, if you have a sole proprietorship youll file the schedule C with your personal tax return.

If youre a freelancer, you must also pay self-employment taxes for income more than $400. These taxes cover Medicare and social security taxes.

Sole proprietors must file IRS Form 1040, Schedule C and Schedule SE if your net income is greater than $400. If you have an employee, you will need to withhold federal and state income taxes and Social Security and Medicare taxes for each employee.