Types Of Taxable Income

You have to report any taxable income you earn inside and outside Canada when you file your tax return. This includes:

- any full-time or part-time work

- self-generated income

- rental income, including renting out a portion of your home

- investments

- your pension

You do not have to report certain non-taxable amounts as income, including:

- allowances

- elementary, secondary and post-secondary school scholarships

Where Can I Find Irs Form 1040 And Instructions

Category: FormsTags: 1040, 2019, 2020, find, form, instructions, irs

IRS Form 1040 is the basic tax form many Americans will use. It also recently received an overhaul.

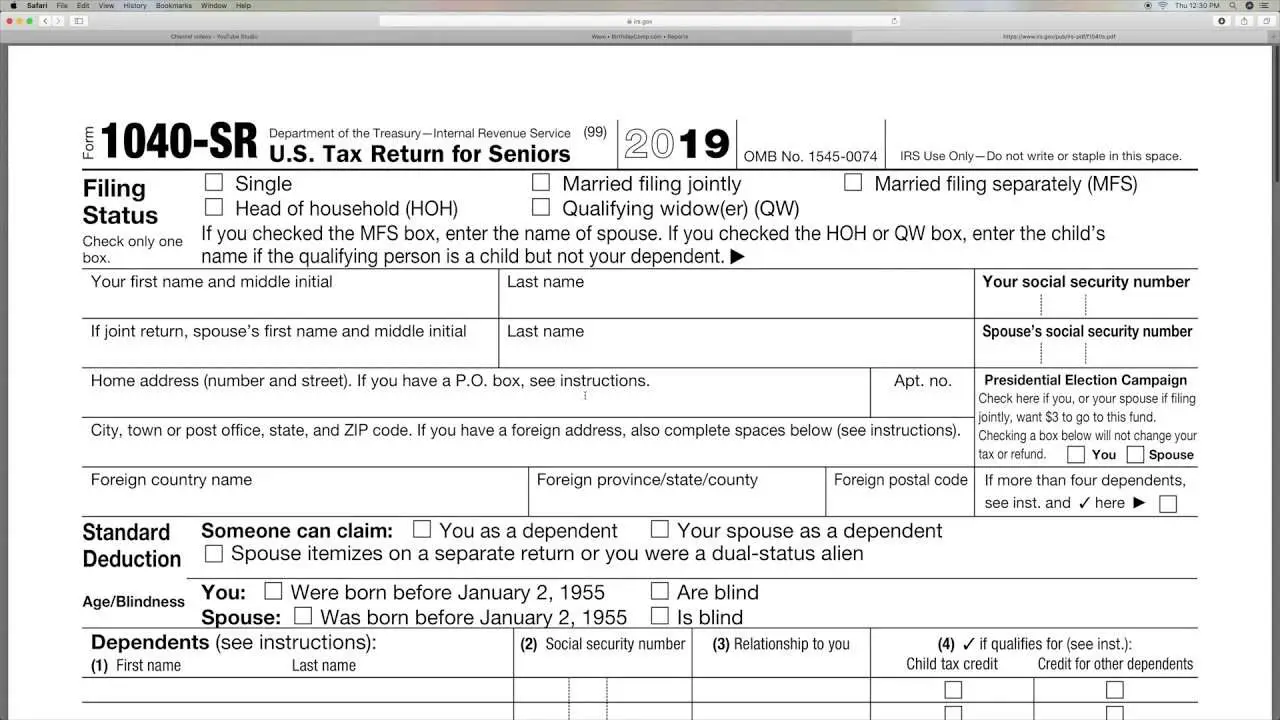

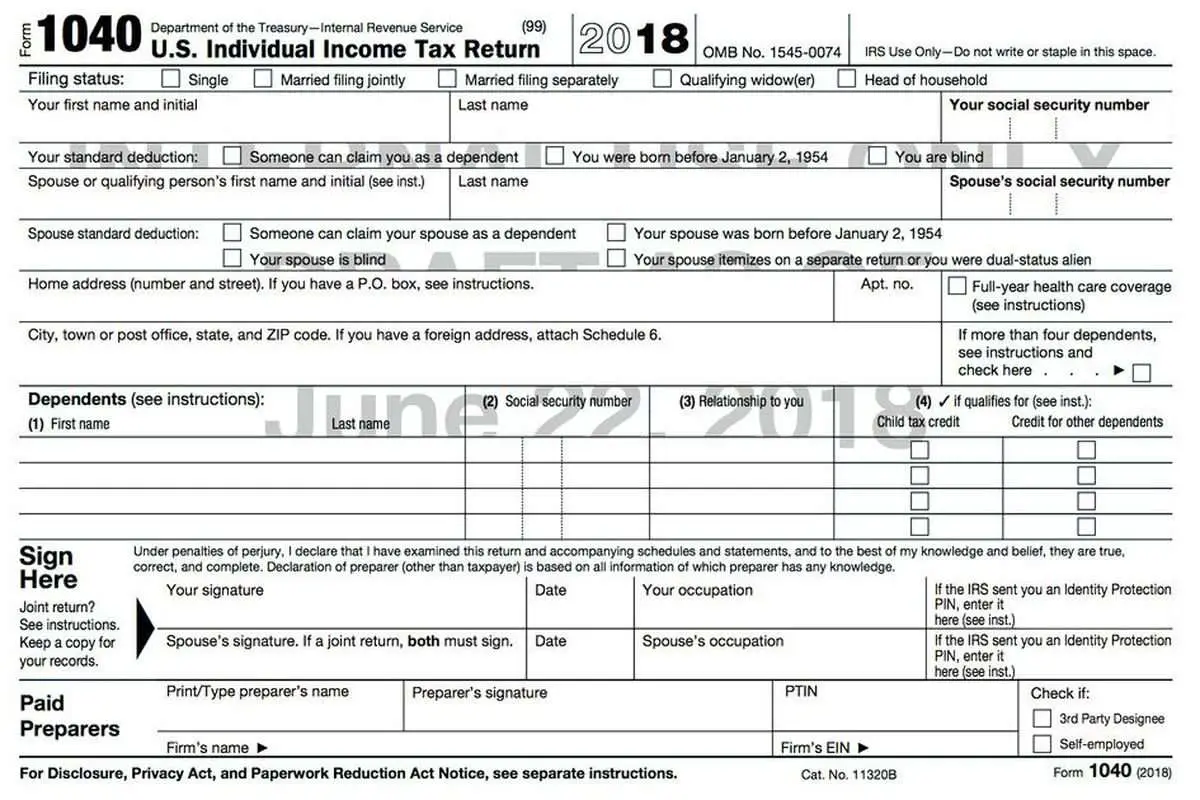

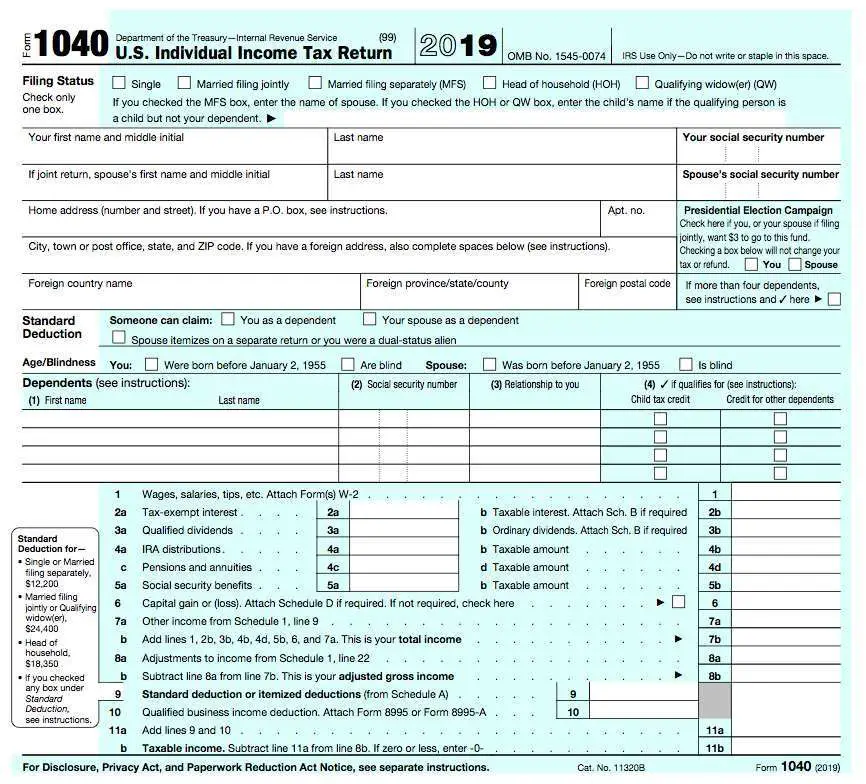

The new Form 1040 is now going to be the size of a postcard with 1040EZ and 1040-A removed from circulation entirely. However, there are a variety of new schedules, so you need to be aware that you dont need to give less information theyve just been moved to other forms.

So, lets look at where you can find IRS Form 1040 and instructions.

The Irs Free File And Tax Map

This IRS Tax Map program assists taxpayers in understanding their tax issues and determining which form they must complete. It divides tax issues by topics and provides a list of -and live link to- forms applicable for each topic. It also provides live links to publications concerning the searched-for topic.

The IRS also offers taxpayers the “IRS Free File” program, which assists medium to low-income individuals earning less than $58,000 per year with free tax preparation services. The program is the result of an alliance between the IRS and tax software companies. Free File allows users to complete their taxes online, then print and mail the completed form. This format ensures that the completed form will be legible. However, the service requires users to calculate their annual income independently.

Also Check: Tax Lien Investing California

Should You File Early

Many American taxpayers wait until the April 15 deadline to complete and file their taxes. However, if procrastination stresses you outor if you’re expecting a refund and you want it as soon as possibleyou can file your 2020 return as early as Feb. 12, 2021.

That’s a little later than usual, and the reason is important: If you didn’t receive the economic stimulus check approved by Congress by the end of 2020, you can claim it on your 2020 return.

Another reason to file early is to reduce the risk of someone stealing your identity to file a false return using your Social Security Number and claim a fraudulent refund.

Electronic Pitfalls To Avoid

If you do file your tax forms electronically, dont complete them on a public computer, and dont transmit your return over public WiFi.

Use a personal computer with antivirus and firewall software and a secure, password-protected private WiFi network, such as your home or work network. Dont transmit your tax returns over an unsecured coffee shop, airplane, or library network.

Also Check: How Can I Make Payments For My Taxes

Can I Still File My 2019 Taxes

Yes, you can still file a 2019 tax return. You generally have up to three years to claim a federal income tax refund. After three years the IRS simply won’t pay you the refund. If you are owed a refund, you will not be charged a late filing penalty.

If you can’t afford to pay the back taxes you owe, ask the IRS for a reduction due to a hardship and create a payment schedule. See the 2019 Form 1040 instructions booklet below for more information about late filing penalties and how to request a payment schedule.

Irs Form 1040 Is Known As The Long Form

Form 1040 is the usual federal income tax form widely used to record an individuals gross earnings . It is usually referred to as the long-form since it is more in-depth compared to the shorter 1040A and 1040EZ income tax form.

Also, in contrast to the various other tax forms, IRS form 1040 permits taxpayers to claim several expenditures and tax incentives, list deductions, and modify income. Although the 1040 usually takes more time to fill out, it rewards taxpayers by offering them extra possibilities to reduce their income tax bills.

The 1040 Form is usually due by April 15th, except if you request an automatic tax extension. Should you not submit by this date, you are usually subject to fines and/or overdue charges. It is possible to ask for a tax extension by sending in IRS Tax Form 4868 by the initial submitting due date .

Don’t Miss: Where’s My Tax Refund Ga

Is Filing Electronically Safe

The appeal of electronic filing is obvious, but is it safe? Your tax filing contains some of the most sensitive data about you: where you live, how much you earn, how many dependents you have, your Social Security number, how high your medical expenses were, and how much you gained or lost from selling investments.

Can you trust the tax software companies and the government to have employed best-in-class security to protect your data both as its being transmitted and while its being stored? If you use online tax software, your information is also being stored in the cloud, creating another point of vulnerability.

For this reason, some people prefer to purchase downloadable software so their data is stored only on their own computer. That way, they are vulnerable to one less data breach possibility.

In this era of data breaches and identity theft, security and privacy questions are important to ask. The table below shows what security features online tax services provide as of January 2021 for the 2020 tax return season. Note that the absence of a feature in the table doesnt necessarily mean the software provider doesnt have it, just that the information wasnt available on the companys data security page. Also, while each service describes its encryption practices differently, all appear to be using appropriate methods.

| Security and Fraud Prevention Features in Popular Tax Preparation Software, January 2021 | |

|---|---|

| Software Brand | |

| not advertised | not advertised |

How Often The Irs Changes Its Tax Forms

The IRS has to update many of its forms annually. Even if the forms content doesnt change, the form needs to state the current year so that taxpayers can be confident theyre filing the correct paperwork and calculating the right amount of tax due. The IRS updates its forms because of new laws or guidance, new addresses or phone numbers, or the need to make a correction or clarification.

A big reason for tax form changes is new legislation, such as the Tax Cuts and Jobs Act of 2017. This legislation required the IRS to create new 1040 forms and new schedules. , standard deductions, itemized deductions, and more changed under the new law. Another major piece of legislation, the Affordable Care Act, necessitated changes to tax forms because of the subsidies, penalties, and new taxes the law mandated.

Read Also: How To Correct State Tax Return

Get Your Refund Faster By Filing Online

Filing income taxes online is usually safer, quicker, and more straight forward. Also, you can get your tax refund a lot faster should you opt for the Direct Deposit method. While there are a few income tax forms to pick from when preparing your federal income taxes, a reliable option is to use IRS Form 1040 when you are not sure if you will be eligible for the 1040A or 1040EZ.

- The standard guideline is: If uncertain, submit Tax Form 1040.

- You have to submit Form 1040 once any of the following apply:

- You have taxable earnings of $100,000 or higher

- You have self-employment earnings of $400 and up

- You had income tax being taken from paychecks

- You made anticipated income tax payments, or have overpayment that applies to the current tax year

- You have listed deductions

- You generate revenue from a company, S-corporation, partnership, trust, rental, or farm

- You have sold real estate, stocks, bonds, or mutual funds

- You are claiming revenue alterations

- You got an advance payment for Earned Income Tax Credit from a company

- You have a W-2 that indicates uncollected tax , or a W-2 that demonstrates a code Z

- You owe excise tax on insider stock payment

- You are a person in debt in a Chapter 11 personal bankruptcy case

- You make foreign income, paid foreign income taxes, or are claiming tax treaty benefits

- You are obligated to repay any further special taxes

Easily Switch Between Tax Forms View And Interview Mode

TurboTax download software comes with Forms Mode for your convenience, but if you ever want to go back to filing your return with step-by-step guidance, you can easily switch back with the click of a button, and TurboTax will put your information in the right place on all the tax forms you need based on your tax situation.

Don’t Miss: How Much Time To File Taxes

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Locations To Pickup Tax Forms

OTR Customer Service Center1101 4th Street, SW, Suite W2708:15 am to 5:30 pm

John A. Wilson Building1350 Pennsylvania Avenue, NW, lobby8 am to 6 pm

Judiciary Square441 4th Street, NW, lobby7 am – 7 pm

901 G Street, NWNote: MLK Library is closed for renovations but can be obtained from libraries across the city

Municipal Center6:30 am to 8 pm

Reeves Center7 am to 7 pm

You May Like: Www Michigan Gov Collectionseservice

What Are The Requirements For Td Bank To Send Me A Form 1099

$10 minimum requirementForm 1099-INT is produced if the aggregated interest earned for a particular Tax ID number is $10 or more. For individuals, the Tax ID number is typically your Social Security number.

Primary owner requirementOnly the primary owner will receive a Form 1099-INT. If you are listed first on an account, you are considered the primary owner. You may co-own an account with another person spouse, partner, child, etc. If they are listed second on the account, they would be considered the secondary owner.

Typically, TD Bank mails 1099 tax forms to applicable customers in late January. If this applies to you, then you can expect to receive your tax information within the first two weeks of February.

To issue you a Form 1099-INT, TD Bank reviews all of your account relationships and sends one Form 1099-INT to cover all of your accounts in which you are the primary owner.

Special note about Individual Retirement Accounts IRAs do not receive a Form 1099-INT. Interest postings to IRAs are not reportable. However, distributions from an IRA are reported to you and the IRS on a Form 1099-R. This form is mailed out in late January for the prior tax year.

When Getting Ready To Fill Out Your Tax Forms

Even before you start doing your 1040 tax forms, you need to have the following material ready:

- Valid identification

- Submitting status and Residency status

- Social Security Numbers for yourself

- Birth dates for yourself

- A duplicate of your previous income tax return

- Documents of salary received

- Statements of interest/dividends from finance institutions, brokerages, etc.

- Evidence of any tax credits, tax deductions, or tax exemption

- Your checking account number and routing number

Keep in mind that IRS Tax Form 1040, with the payment amount, is owed by April 15th. A 6-month tax continuance may be allowed for overdue submitting. However, payments still have to be made by April 15th. You can file Form 1040 by paper mail, via IRS e-file, or by way of a certified tax preparer.

Also Check: How To Get A Pin To File Taxes

The Best Way To Fill Out Form 1040

Form 1040 can be managed in a far superior way by using online tax preparation software. Online tax filing will enable you to enter your information into the system, and the software will do all the calculations.

It will take the information you enter and populate the relevant parts of your 1040 for you. You dont need to use a professional tax preparer or an accountant if your tax affairs are relatively simple.

Federal Income Tax Forms

Printable 2019 federal tax forms are listed below along with their most commonly filed supporting IRS schedules, worksheets, 2019 tax tables, and instructions for easy one page access. For most US individual tax payers, your 2019 federal income tax forms were due on July 15, 2020 for income earned January 1, 2019 through December 31, 2019.

Recommended Reading: How To Buy Tax Liens In California

What If I Dont Receive My 1099 Or 1098 Forms

Remember: you can expect to receive a 1099-INT form if you earn at least $10 in aggregated interest on your account.

Typically, TD Bank mails 1099 and 1098 tax forms to customers in late January. If this applies to you, then you should receive your tax information within the first two weeks of February.

If you did not receive a 1099 or 1098 from us and you think you should have, please contact us by secure message using the instructions below. Remember, never send your account information or any other personal information by unsecured e-mail.

To send a secure message through the Online Banking Message Center:

- Select the Customer Service tab

- Under “Secure Message and Inquiries,” select “Send a Message”

- Under the “New Message to TD Bank Customer Service,” select “General Customer Service”

- In the Subject Line, enter “1099 or 1098 Request”

- To expedite your request, please include the following information in the comments section of your message:

- Primary account number

- Address on tax form

- Your current mailing address

- Any general comments to clarify your request

- You’ll hear back from us by secure message within 24-48 hours

- To view new messages:

- Go to the message center

What’s In Your Mailbox

From the IRS you should expect little or nothing. If you used TurboTax to file electronically last year, youll receive no tax forms by mail from the IRS. If you filed on paper, youll receive a postcard explaining your options for obtaining the forms. While you can pick them up at a post office or print them from www.irs.gov, TurboTax will ask simple questions and automatically fill in all of the appropriate tax forms you need to file your tax return.

However, you can expect to receive a number of forms reporting your income from your employer, bank or credit union, mutual fund companies and other entities you did business with throughout the year. The most common of these forms are:

Remember, no matter which IRS tax forms you need, TurboTax does the work of selecting and filling in the right formsit can even import W-2 forms from more than 100,000 employers.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

Also Check: Where’s My Tax Refund Ga

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Get the IRS tax forms and publications you need to file taxes.

Filing Your Tax Return

What you need to know about filing your personal income tax and benefit return.

Get help this tax season with the Ontario Child Care Tax Credit and the Low-Income Workers Tax Credit.

Save your receipts for the new Seniors’ Home Safety Tax Credit in 2021, which you can apply for during the 2022 tax season.

You may be eligible for tax credits and benefits to help you with living costs.

You May Like: How To Look Up Employer Tax Id Number