Uncle Sam May Keep Your Refund

Generally, you dont need to file a federal extension if youre owed a refund unless youre also planning to request a state extension. While that means you wont have to worry about getting hit with a failure-to-file penalty, you cant put off your filing forever. The IRS gives you three years from the original filing deadline to submit your return and claim a refund. If you dont take action before then, Uncle Sam gets to keep your money. If you applied for state and federal extensions and youre expecting a refund, it doesnt make sense to delay your filing any longer.

Time is running out to get your return filed so its in your best interest to act quickly, especially if you owe the IRS money. Procrastinating only increases the amount of penalties and interest due, which can take an even bigger bite out of your wallet.

Is It Worth Filing A Tax Extension

The answer to it depends largely on your current situation. Sometimes we may not be ready to file our tax returns due to missing information we have. Not having the necessary tax forms to report the income earned or waiting for information returns from the people and companies that weve worked with can also cause us to wait longer. Although the Internal Revenue Service has substitute forms to report income earned, its safer to wait for them to be furnished to you rather than reporting income on your own.

These can be overwhelming especially when the tax filing deadline approaches. The simple solution to it all and what makes sense is filing an extension. Simply file your extension and dont worry about the filing deadline, at least for some time. While filing an extension is the answer to get more time to file your return, you must pay any tax owed by the original deadline, whether it be April 15 or another deadline the Internal Revenue Service sets.

Filing An Income Tax Extension: How To Guide

Tax deadlines tend to sneak up on you, so you may find yourself in need of filing for a tax extension at some point in your life.

When you find yourself unable to complete your federal tax return by the 2021 deadline, you’ll need to file an extension with the IRS in order to avoid any potential penalties for late filing or late payments. By filing an extension, you can extend your deadline to October 15.

Keep in mind that an extension simply pushes back the deadline for filing your taxes. There is no extension of time for you to pay your taxes. When you file for an extension, you will need to estimate how much you owe and pay by the filing deadline.

There’s no need to panic if you don’t think you’ll be ready to file your taxes by the April 15 deadline. The process of filing an extension is a relatively easy one, but there are a few things to know before you do it.

Read Also: Does Contributing To Roth Ira Reduce Taxes

Preserve Your Tax Refund

Some people end up filing several years late, and there’s a three-year deadline for receiving a refund check from the IRS if it turns out that you’re due one. This three-year statute of limitations begins on the original filing deadline for that year .

The refund statute of limitations is also extended by six months when you file for an extension, which can preserve the ability of taxpayers to receive their federal tax refunds, even if they’re behind with submitting their tax returns.

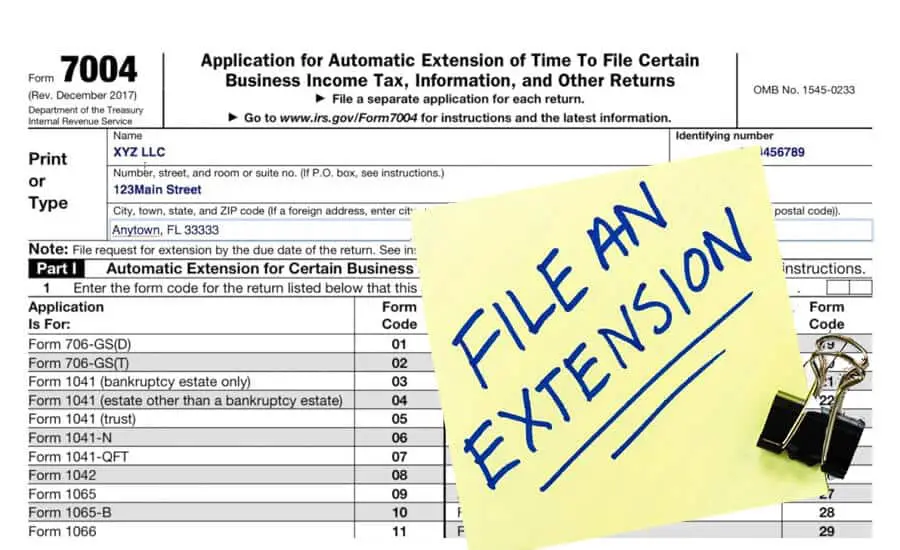

Filing A Business Tax Extension

The IRS posts the proper forms for filing an extension on its site, along with instructions and specifics about the regulations. IRS form 4868 can also be used by sole proprietorships that file a Schedule C with a personal return and single member limited liability companies .

Corporations, LLCs and more expansive businesses use IRS form 7004. As with an individual return, submitting this form is an automatic request for a six-month extension to file your business’s income taxes.

Federal tax extension forms can be submitted electronically. The IRS offers details on its site with online fillable forms, as well as details for . Many bookkeeping platforms integrate filing taxes into their platforms explore this option with your preferred tax filing or bookkeeping service.

Filing an official extension is not a way to avoid paying the taxes you owe. The expectation is to pay the anticipated amount of tax owed. The extension is for the sole purpose of providing the flexibility to file the remaining paperwork within the six-month extension.

There is no process for filing an additional extension beyond the one you’re granted through October 15. A return can still be completed after this date, just expect to pay additional penalties. However, it’s a case where it’s definitely better late than never as to avoid additional penalties by further delaying the filing of a return. The IRS notes that a failure-to-file penalty is generally more than the failure-to-pay penalty.

Recommended Reading: Is Donating Plasma Taxable Income

Do You Have To File Extension For S Corp

Yes, they do. Filing extensions for S corps are, like for individuals, considered automatic. However, the IRS might still turn down an automatic extension for a couple of specific reasons. If the extension application is filed after the tax return deadline, the IRS is likely to refuse the extension.

When You Need More Time To Finish Your Tax Return

Filing a tax extension request using IRS Form 4868 asks the Internal Revenue Service to give you additional time to file your personal tax return.

An extension moves the filing deadline from April 15 to October 15, but it doesn’t give you extra time to pay taxes you might owe on that return.

Is taking one always a wise move?

In 2021, most taxpayers receive an automatic extension on filing and paying their taxes. All individual tax returns are due on May 17, 2021, rather than April 15. Individuals and businesses in Texas, Oklahoma, or other areas impacted by winter storm emergencies, have until June 15, 2021, to file. For individuals and businesses in Louisiana, New Jersey, New York, and Mississippi who were affected by Hurricane Ida, the filing date is further extended to January 3, 2022.

Recommended Reading: Do You Have To Report Plasma Donations On Taxes

Dealing With Economic Uncertainty

- The coronavirus pandemic has pushed millions into unemployment and the economy into a recession. Financial advisors can help navigate these troubled times. To simplify the search, use SmartAssets free tool. It will match you with financial advisors in your area in just 5 minutes. If youre ready to find an advisor, get started now.

- There are certain personal finance fundamentals that you need to get in order, ideally before a recession hits. Heres how to prepare for a recession.

- Extending the tax deadline isnt the only thing the government is doing to take the economic pressure off Americans. Learn what relief is available to you.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Don’t Miss: How To Look Up Employer Tax Id Number

I Have Questions About My Taxes Can I Call The Irs

There are numerous ways to contact the IRS. The agency no longer offers live online chatting, but you can still submit questions through its online form. If you prefer to talk to a person, the IRS maintains a number of dedicated phone lines that are open Monday through Friday, from 7 a.m. to 7 p.m. . Individuals can call 800-829-1040 and businesses can call 800-829-4933. Note, however, that the IRS says “live phone assistance is extremely limited at this time.”

And there’s always the Interactive Tax Assistant, an automated online tool that provides answers to a number of tax law questions. It can determine if a type of income is taxable, if you’re eligible to claim certain credits and whether you can deduct expenses on your tax return. It also provides answers for general questions, such as determining your filing status, whether you can claim dependents or if you even have to file a tax return.

If you have a question for the IRS specifically related to stimulus checks and your taxes, the IRS recommends that you check IRS.gov and the Get My Payment application.

How A Filing Extension Works

Taxpayers who cannot pay their taxes will not only not gain anything by not filing an extension, they will also pay a much greater penalty than those who file and cannot pay. The failure-to-file penalty is usually 5% of the total amount owed per monthand can go as high as 25%while the failure-to-pay penalty is only 0.5% of the amount owed per month. The interest runs until the tax is paid in full. Beginning with returns due after Dec. 31, 2019, if a return is more than 60 days late, the additional tax is $435 or 100% of the amount due, whichever is less, an increase from $330.

There are three ways for a taxpayer to request an automatic extension of time to file an individual tax return:

U.S. citizen and resident taxpayers who are out of the country on the regular due date are allowed two extra months to file returnsand pay any amount duewithout requesting an extension. However, interest will still be charged on payments made after the regular due date, without regard to the extension.

You May Like: Do You Have To Pay Taxes On Plasma Donations

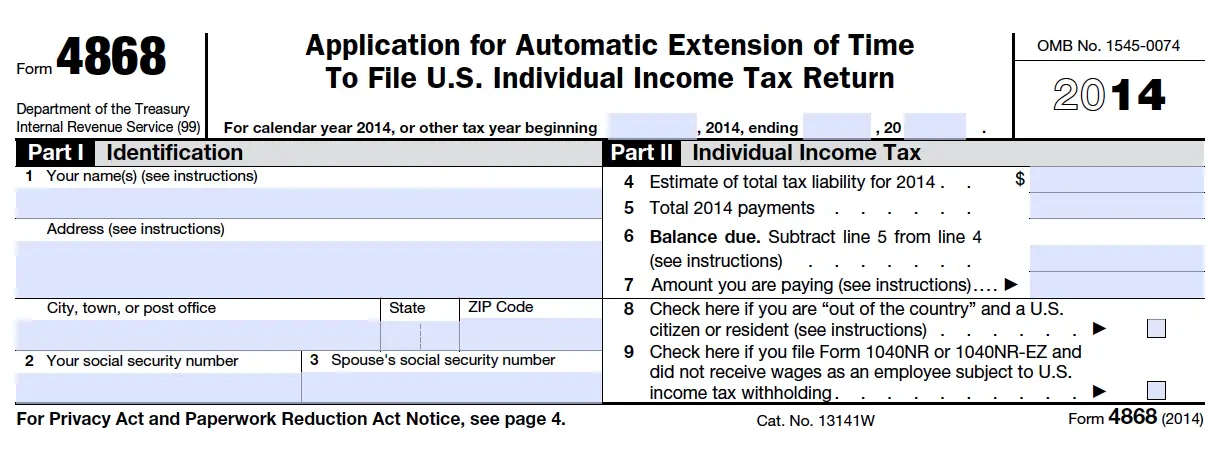

Form 4868 Part Ii: Individual Income Tax

Part II has six lines that require you to put more information about your expected tax return. Line 4 asks for your expected tax liability. This is an estimate of how much tax youâre supposed to pay for the year. You can estimate your tax liability using an online calculator, which many tax services offer for free. Looking at your tax liability from last year’s return is also helpful, especially if your finances haven’t changed much. Since this is just an estimate, itâs fine if you donât know your exact liability.

If you prefer, you can also manually calculate your tax liability by using thefederal income tax brackets. If you do your own calculations, donât forget to account for tax deductions, including your standard deduction or itemized deductions.

Line 5 asks how much you already made in tax payments over the year. You can find this amount by looking at yourW-2 forms or your pay stubs. Also include any estimated tax payments you made throughout the year.

Line 6 is your “balance due” and you get it by subtracting the amount on line 5 from line 4 . This value is negative for most people since most taxpayers overpay throughout the year and get atax refund. If your line 6 value is negative, enter â0â on Line 6. If you do owe money, pay that bill by Tax Day to avoid penalties. You can still get an extension if you donât pay your tax bill, though.

Related: 53 tax deductions and credits you can claim in 2021

If You Miss The Extended Filing Deadline

If you fail to file your extended taxes on time , youll be on the hook for the same penalties you would pay if you missed the original deadline.

Essentially, this means that you will owe 5% of the additional taxes owed for the period between the filing deadline and the day you actually file, compounded monthly, to a maximum of 25%.

Example:

If you owe $1000 in taxes but dont file by October 17, then by November 17, you will owe $1050.

Near the end of February, the amount owing will be $1250, at which point you have reached the 25% limit set by the IRS.

Don’t Miss: Where Do I File My Illinois Tax Return

What If I Don’t File For An Extension

If you don’t file for an extension, your taxes are essentially late, and you may face stiff fees and penalties on top of any other charges you may accrue for not paying on time.

Inform the IRS of your late filing, gain an extension, and take care of your taxes by the new due date. The IRS may be strict, but as long as you keep them informed and file the proper forms, they’re usually willing to work with you.

Avoid The Hectic Tax Season

Having more time to file can improve the accuracy of your return. Accountants and taxpayers are both extremely busy during tax season, and it is possible for mistakes to be made. During the tax season rush, many accountants will be overwhelmed and may miss important deductions that could save you money. Filing for an extension can help you avoid the mad rush and will allow you to take your time and make sure your taxes are filed correctly.

Read Also: Notice Of Tax Return Change Revised Balance

Which Tax Extension Form Should You Use

For small businesses, including partnerships, multimember LLCs, corporations, S corporations, IRS Form 7004 is the form you will need.

The form also requires businesses to declare whether they are a foreign corporation that doesn’t have a location in the United States, among other questions. Other important information includes whether the company is a corporation or partnership that falls under Regulations section 1.6081-5 and how much the total balance due is for that tax year’s return.

If you are operating a business as a sole proprietor or single-member LLC, the form you would fill out for a tax extension is the same as the one that normal taxpayers file: IRS Form 4868. This is because in the eyes of the IRS, there’s very little distinction between your business and your personal finances.

Key takeaway:There are two types of IRS tax extension forms that could apply to your specific situation. Be sure to use the right one when filing for an extension.

If You Owe The Irs Money

Unfortunately, your payment is still due by the initial filing deadline if you owe the IRS. Filing an extension doesn’t normally give you additional time to address any taxes that are owed, and the IRS charges interest and sometimes penalties on tax payments that are made after the deadline.

An extension gives you more time to file, but it doesn’t give you more time to pay.

It’s usually a good idea to go ahead and prepare your tax return, even if you don’t file it yet, so you have a rough idea of what you owe, if anything. It’s best to send a payment for the amount you’ve estimated you’ll owe when you submit your extension form.

You’re entitled to a refund if you miscalculate your estimate and end up overpaying. It’s better to be safe than penalized and sorry. You’ll have cut your penalties and interest to just the portion of the tax debt that you were short if you end up owing more than what you estimated.

Read Also: Efstatus/taxact

Form 4868 Part I: Identification

Part I has three lines and theyâre all for identification. Enter your name and address on Line 1. If youâre filing a joint return, donât forget to put both of your names. The name you put first should be whichever name you plan to put first on your actual tax return.

Line 2 is for your Social Security number and line 3 is for your spouseâs Social Security number if youâre filing jointly. Write your Social Security numbers in the same order that you wrote your names.

Learn more: Should spouses file jointly or separately?

What Doesnt The Tax Deadline Extension Apply To

Remember that the federal governments May 17 income tax deadline extension only applies to your federal taxes. Most states have left their normal tax deadlines in place, but five states have later tax filing deadlines.

Find your state governments tax agency website on the Federation of Tax Administrators list to learn more.

| 2021 State Income Tax Deadlines | |

| State | |

| Wyoming | No state return necessary |

If you need even more time to complete your 2020 federal returns you can request an extension to Oct. 15 by filing Form 4868 through your tax professional, tax software or using the Free File link on IRS.gov. Filing Form 4868 gives taxpayers until Oct. 15 to file their 2021 tax return but does not grant an extension of time to pay taxes due. Taxpayers should pay their federal income tax due by May 17, 2021, to avoid interest and penalties.

If you mail in your return, it must be postmarked May 17 or sooner. Heres a tax refund schedule to give you an idea when to expect your refund after youve filed. If you cannot file your tax return by the deadline, you need to file for a tax extension by May 17, 2021.

Its also important to note that the income tax refund schedule remains unchanged. This serves as an incentive for people to still file sooner rather than later.

Read Also: Have My Taxes Been Accepted