Why Are My Taxes Higher Than My Neighbors

There are many reasons why the taxes on one property may be different than the taxes on another.

Generally your taxes would be higher than your neighbors because your property value is higher than your neighbors . This may be caused by

-

Improvements to the property made in prior years

-

Differences between your property and your neighbors such as square footage, lot size, condition, construction quality, or other differences.

-

Your neighbor may have an exemption on their property

In some cases, properties in close proximity with similar values may be in different Levy Code areas.

For information regarding the taxes for a specific property, please contact our customer service department by live chat, phone 988-3326 or by email at .

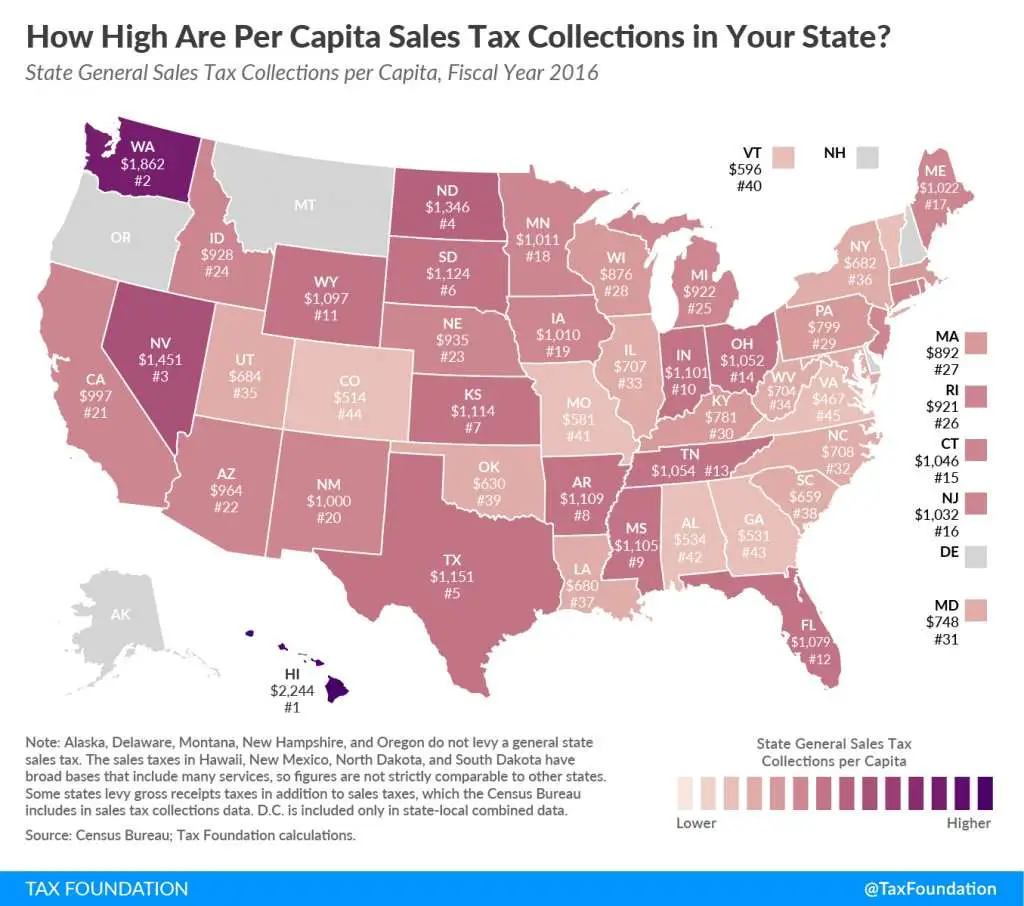

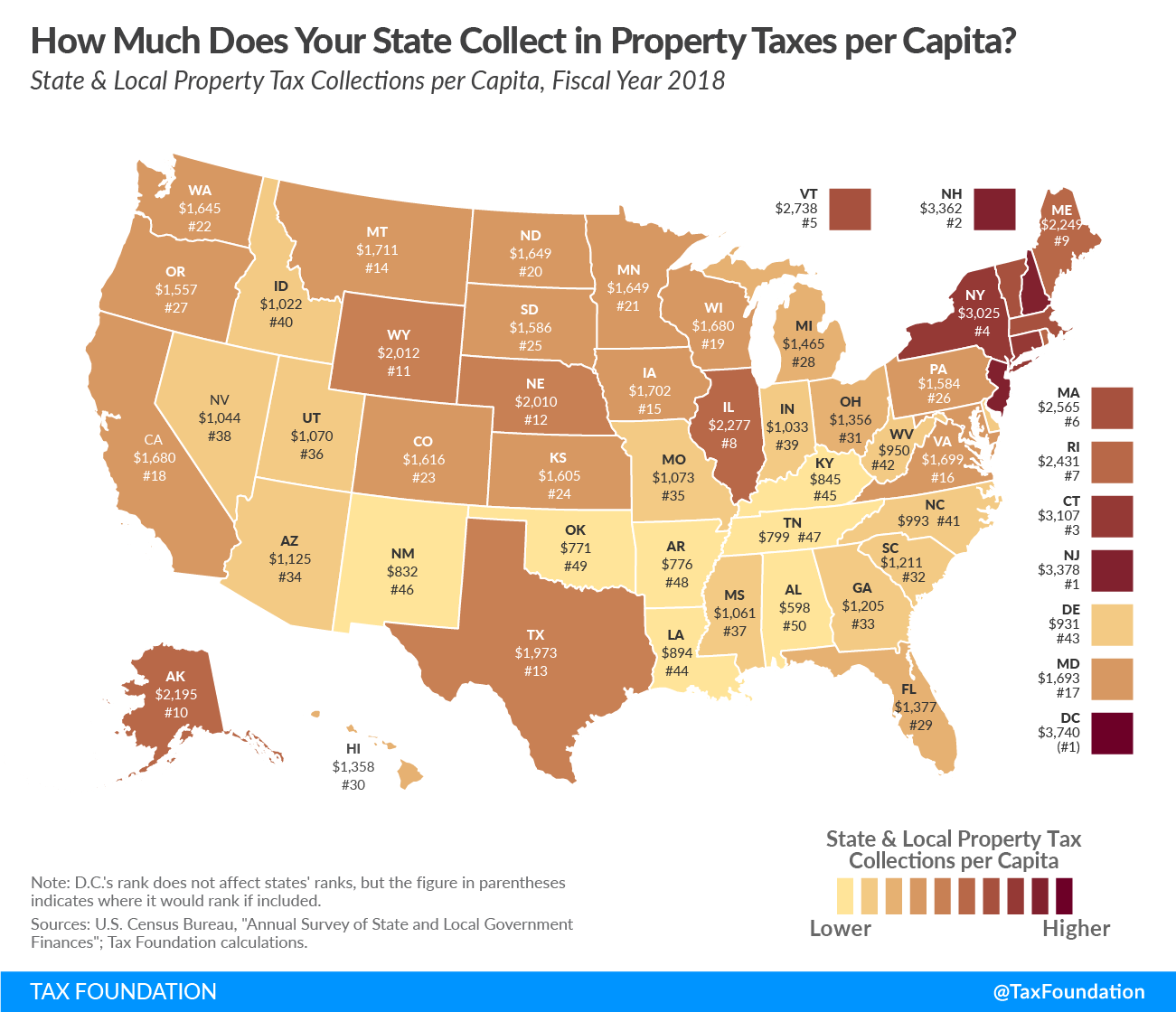

Property Taxes By State

Overall, homeowners pay the most property taxes in New Jersey, which has some of the highest effective tax rates in the country. The states average effective rate is 2.42% of a home’s value, compared to the national average of 1.07%.

With an average effective rate of 0.28%, the least expensive state for property taxes is Hawaii, surprisingly. Despite its reputation as a costly place to live, Hawaii has generous homeowners exemptions for primary residents that lower taxable values considerably. The tax break generally helps those who live in Hawaii full-time, rather than those who own a second home there.

Also of note are Colorado and Oregons property tax laws, which voters put in place to limit large taxable value increases. Many states dont have caps on how much property taxes can change annually, but those two are examples of state governments that put laws in place because of taxpayer concern.

Business Property Tax Change In 2021

The City of Victoria collects property taxes on behalf of other agencies, however these agencies determine their tax rates independently of the City of Victoria. Last year, the Province reduced the school tax rate significantly but has not done so for 2021. That’s why you may see a significant increase for this portion of your tax bill. For more information on Provincial School Tax, please visit gov.bc.ca/schooltax.

For the City of Victoria portion of your tax bill, business properties that have experienced a property assessment change equal to a decrease of 5.29% can expect the Citys portion to decrease by 2.08%. If your property assessment increased at a greater or lower rate than the average, your property tax increase will adjust accordingly.

View your property assessed value change compared to the average assessed value for your property class and total property tax change by entering your Folio Number into the Property Tax Calculator.

You May Like: Can You File Missouri State Taxes Online

Council Pushes Off Tax Rate Question In Hopes That Free Cash Can Reduce The Burden To Residents

Several City Council members are hoping to use free cash leftover unrestricted money for last year’s budget to reduce the tax bill of residents after they said Mayor Linda Tyer’s proposal would create too big a bill for their constituents.

But, given how much property values have increased, many residents will end up paying more in city property taxes this year than they did last year. Over the course of the fiscal year, the owners of an average single-family home will pay $4,121.67, an increase of about $197, or 5 percent more, than their bill from the previous year.

The alternative before the council to use additional free cash to lower the levy further would have set the residential rate at $18.36 per $1,000 in assed value and the commercial rate at $39.48 per $1,000 in assessed value. Over the course of the year, that would mean that the average single-family homes property bill would hit about $4,077 a savings of about $44, or about 1 percent over the approved rates.

I think its irresponsible to say that saving a household $40 a year is more compassionate than having a municipality that cant cover big expenses as they come, Ward 6 Councilor Dina Lampiasi said. As a city, we need to have reserves, because we dont know what is coming our way.

The majority of councilors and Tyer argued that reducing the citys free cash would have a longer impact on residents than the upfront savings would and would break from smart financial planning strategies.

Why Did My Taxes Increase So Much

Tax amounts are not limited to a 3% increase from one year to the next. The Maximum Assessed Value is the only place where a 3% limit applies.

Tax amounts may increase more than 3% due to

-

changes in the tax rate for your Levy Code Area

-

loss of compression savings,

-

combination of any or all of these reasons.

See a graph of the last five years of your property value and taxes.

Recommended Reading: Mcl 206.707

Apply For A Property Tax Exemption

Depending on where you live, some states and local governments offer exemptions to homeowners for real estate taxes owed on their property. These protect certain classes of homeowners and reduce the amount they must pay for their property.

A few classes of homeowners that may be eligible for a property tax exemption include seniors and people with disabilities. Some states offer tax exemptions for seniors that have reached a certain age, but seniors of a certain income level or residency situation may not qualify.

If you have a disability, you may be eligible for an exemption from a portion of your property taxes. Policies vary by where you live, but even if you dont qualify for an exemption there are other credits you can look into in other tax categories, such as a medical expense deductible on your taxes for adding a ramp to your home.

Members of the Armed Forces and veterans also qualify for property tax exemptions in certain areas of the country. You may also be exempt for a complete waiver from property taxes in certain areas.

Actual Value Assessment Rate And Mill Levy

Property taxes are calculated using the actual property value, the assessment rate, and the mill levy using the formula: Actual Value x Assessment Rate = Assessed Value x Mill Levy = Taxes Due. More information is available in the Calculating Your Property Taxes flyer. For example:

For a residential property with an Actual Value of $350,00, an Assessment Rate of 7.15%,and a Mill Levy of 86, there will be $2,152 in taxes due.

Additional details on the Assessment Rate and Mill Levy are below. Seniors and disabled veterans may qualify for certain property tax exemptions.

Much more information on property taxes, including Property Tax Search, due dates, and paying taxes online, is available on the Boulder County Treasurer page.

Recommended Reading: How To Buy Tax Lien Properties In California

How Real Estate Values Impact Property Tax Policy

Municipalities with higher local real estate prices and larger populations tend to have lower property tax rates as there are more taxpayers funding the citys pot and floating their operating budget. For example, Toronto has long boasted the lowest tax rate in the province, given its population size and expensive home prices.Similarly, GTA cities and Richmond Hill, round out the lowest three with rates of 0.632908% and 0.659549% respectively, and have among the highest average home prices in the region at $1,352,869 and $1,441,035.

In contrast, the cities with the highest tax rates often have the lowest-priced real estate.

Another factor is the citys commercial-to-residential tax ratio in most municipalities, businesses pay at least double the amount of tax than homeowners, with the Canadian average at 2.73. Generally, a higher commercial property tax rate translates to a lower residential rate, and vice-versa a local council may opt to hike the latter if they feel their community needs to offer more competitive advantages to businesses.To learn more about how property taxes work in Ontario, check out our property tax FAQs for home buyers here.

Home prices:

Home prices are all average prices, except for Thunder Bay, where the benchmark price was used.

Home prices were for October 2021.

Property tax rates:

Property tax rates for 2021 were sourced from each municipalitys website.

About Zoocasa

Average Property Tax Rate By Region

Looking at regions across the country, the Northeast has the highest average property tax rate at 1.41%. This makes sense, as five out of 10 of the states with the highest effective property tax rates are found in that region of the country.

Coming in at the lowest average property tax rate by region is the Southeast. States like Alabama and Louisiana have notably low property tax rates. In Louisiana, the state offers an attractive homestead exemption that reduces the taxable value of owner-occupied properties .

A Look At Average Property Tax Rates By Region

Recommended Reading: How To Buy Tax Lien Properties In California

How Property Taxes Are Determined

Property taxes are determined by multiplying the assessed value of your property by the tax rate. The tax rate and mill levy are two different methods of expressing the same information. A tax rate is expressed as a percentage, whereas a mill levy is expressed in mills Assessed values are derived by multiplying the actual value of the property by 7.15% for residential property and by 29% for other property.

How Do Property Tax Comparisons By State Play Out

Property taxes across the US vary quite a bit. When you compare property taxes by state, there are many factors to take into account. Unlike Texas, most states must pay income tax, so while they may pay less in property taxes, they make up for it in income tax or through other means. Of the 50 United States plus the District of Columbia, the following are the five states with the lowest property taxes:

- Hawaii

- Louisiana

- District of Columbia

You may look at those numbers and wonder why these states have the lowest property tax percentage. Lets take a closer look. For example, while Hawaii has the lowest rate, they also have the highest state median home value at $615,300. And, unlike Texas, Hawaiians have to pay state income tax.

Read Also: Michigan Gov Collectionseservice

Commercial Real Estate Tax Calculation Formula

The current statewide assessment rate for commercial real estate property is 32%. To determine how much you owe, perform the following two-part calculation:

1. Estimated Market Value of the Property X Assessment Rate = Estimated Assessed Value

2. Estimated Assessed Value / 100 X Total Tax Rate = Estimated Tax Bill

Heres an example of how this formula works

To calculate taxes owed on a $100,000 commercial property at 6.5694 total tax rate plus Commercial sur tax of 0.53 for a total tax rate of 7.0994 per $100 of assessed valuation:

Where Does The Money From Property Taxes Go

Property taxes are used by local governments to raise revenue so that they can provide certain public services. Exemptions and the amount of money that goes towards these services will change depending on where you live. However, the main areas that property tax money goes toward include:

- Public schools: Building a new school or making improvements to an existing one will often lead to an increase in property taxes, while also making your area more desirable for newcomers.

- City parks and green spaces: Property taxes go toward maintaining parks, planting flowers and trees and hosting community programs that take place in the park like festivals and summer camps.

- Additional services: Property taxes also help pay for portions of museums, public swimming pools and libraries.

- Road safety and repair: Property taxes help pay for road construction and repair, public transport facilities and traffic signs and lights.

- Emergency services: Property taxes help pay the salaries of emergency personnel including the fire department, ambulance services and law enforcement. Property taxes also help purchase vehicles, build and improve infrastructure and cover training costs.

- Local government and administration: The salaries of local government employees are paid for in part by property taxes. Property taxes also help fund local infrastructure like the sewer system.

Don’t Miss: Can Home Improvement Be Tax Deductible

Calculating Your Annual Property Tax

taxable valuecurrent tax rateExample

| 1. Enter the Taxable Value from the Notice | $16,000.00 |

| 2. Multiply Taxable Value by the Tax Rate | X .20385 |

| $3,261.60 |

| Calculating Your Taxes with a Veteran’s Exemption Homeowners with a Veterans’ Exemption are required to pay tax to support public schools. Further reductions may be added if the veteran served in a combat zone or was disabled. | |

| 1. Enter the Taxable Value from the Notice | $16,000.00 |

| 2. Multiply Taxable Value by the Tax Rate | |

| Your Taxes | $1,362.56 |

Calculating the Taxable ValueStep 1Step 2For Class 1 Properties and Class 2 Properties with 10 Units or Less

| Class 1: | Assessed Value cannot increase more than 6 percent each year or more than 20 percent in five years. |

| Class 2: | Assessed Value cannot increase more than 8 percent each year or more than 30 percent in five years. |

Step 2a:

| Example: |

How To Find Out How Much Property Taxes Are

BC Assessment determines the assessed value of your property based on a valuation date of July 1st of each year. Your assessment notice is mailed to you by BC Assessment in January and contains your assessed value, property classification, and tax exemption* status. In early spring, your taxing authority sets its property tax rates for each of the nine property classes and applies the applicable rate, i.e. residential, to your property’s assessed value, less the value of any applicable tax exemptions. The taxing authority mails you a property tax notice which details the property taxes payable by you to them.

*A tax exemption is a release from paying all, or a portion of property tax levied by a taxing authority, i.e. a municipality, Indigenous community, or the surveyor of taxes in rural areas.

How are assessed values, property tax rates, and property taxes related and what influences your property taxes?

YOUR PROPERTY ASSESSMENT RELATIVE TO YOUR PROPERTY TAXES

* Unless your taxing authority has enacted an alternative municipal tax collection structure under Section 235 of the Community Charter.

Recommended Reading: Www.1040paytax.com Official Site

Which Ontario Municipalities Have The Highest Property Tax Rates In 2021

To see how tax rates differ across the province, and how theyve fluctuated from 2020, Zoocasa has compiled 2021 property tax rates for 35 Ontario municipalities. This years edition also calculates how much homeowners would pay in taxes in each municipality, based on four sample assessment values: $500,000, $750,000, $1 million, and $1.5 million.

For example, a Toronto homeowner with a property valued at $500,000 would pay $3,055.07 in property taxes based on the citys rate of 0.611013, the lowest on the list. In comparison, a similarly-priced home in Windsor, which has the highest tax rate of 1.818668, would have a tax bill of $9,093.34.However, its important to note that a $500,000 budget would go considerably farther in the latter, as the average home price in Windsor was $535,452 in September, compared to $1,090,096 in Toronto. As well, a lower or higher property tax rate and amount shouldnt be the only indicator that guides a home buying decision. Buyers should consider the big picture of their lifestyle and financial needs when determining what properties, budget or cities fit them best property taxes are just one financial consideration to be aware of.

Compared to 2020, theres been very little fluctuation in municipalities rankings the lowest five remain unchanged, with all located within the Greater Toronto Area:

- Toronto: 0.611013

- Sudbury: 1.546783

Property Assessment Update And Covid

As a result of the pandemic surrounding COVID-19, the reassessment originally scheduled to be completed for the 2021-2024 taxation years has been postponed.

Please visit the following link to the Municipal Property Assessment Corporation for updates regarding the reassessment.

For the 2021 taxation year, your propertys assessed value will be the same value as that from the 2020 taxation year unless there have been changes to your property.

For information regarding an appeal of your property assessment, please visit the appeals page.

Also Check: How Much Does H& r Block Charge To Do Taxes

California Property Tax Rates

Property taxes in California are applied to assessed values. Each county collects a general property tax equal to 1% of assessed value. This is the single largest tax, but there are other smaller taxes that vary by city and district.

Voter-approved taxes for specific projects or purposes are common, as are Mello-Roos taxes. Mello-Roos taxes are voted on by property owners and are used to support special districts through financing for services, public works or other improvements.

A good rule of thumb for California homebuyers who are trying to estimate what their property taxes will be is to multiply their home’s purchase price by 1.25%. This incorporates the base rate of 1% and additional local taxes, which are usually about 0.25%.

The table below shows effective property tax rates, as well as median annual property tax payments and median home values, for each county in California. Assessed value is often lower than market value, so effective tax rates in California are typically lower than 1%, even though nominal tax rates are always at least 1%.

| County |

|---|

Want to learn more about your mortgage payments? Check out our mortgage payment calculator.

Did You Move During The Pandemic Heres Why You Should Pay Attention

Your municipalitys tax rate is just one factor the second element is the most recent value assessment of your home, which is determined by the Municipal Property Assessment Corporation . The amount you actually pay in tax is calculated by multiplying your citys residential tax rate by this assessment value.

MPAC usually provides this assessment every four years, and 2020 was slated for the next update however, as part of COVID-19 tax relief efforts, theyve opted to freeze property value assessments at 2016 levels through the 2024 tax year, providing locals and newly-relocated homeowners a temporary reprieve.

However, as Ontario home prices saw unprecedented growth over the last year the benchmark home value for the province rose 19.7% between September 2020 and 2021, with the average property selling for more than $1 million in many local markets its important for homeowners to be aware of how their value assessments may change over the coming years.

How does your city stack up? #torontolife#torontorealestate#ontariotiktok#ontariocanada#gtarealestate#foryou#foryoupage Road Trip with Ali Mint Fin

Recommended Reading: Michigan.gov/collectionseservice