You Need To Make Estimated Income Tax Payments:

-

if you are self-employed, you must pay your own estimated income taxes to the Department, usually quarterly. You must pay all other Vermont business taxes as they apply to your business.

-

if you think that your withholding will be less than 90% of your tax liability.

-

if you are a Vermont resident working in another state.

When To Start Paying Estimated Tax

You normally pay estimated taxes in four installments. Yet, you don’t have to start making payments until you actually earn income. You can skip the first payment if you don’t receive any income by March 31. In this event, you’d ordinarily make three payments for the year starting on June 15. If you don’t receive any income by May 31, you can skip the June 15 payment as well. The following chart shows the due dates and the periods each installment covers.

You Dont Need To Pay Estimated Taxes If

Youâre an employee If youâre an employee, your employer should be withholding quarterly taxes on your behalf. That being said, sometimes they can get the amounts wrongâfill out Form-W4 and give it to your employer to make sure that theyâre deducting the correct amount.

Youâre a special case If you meet three very specific conditions below, then you donât have to pay estimated quarterly taxes:

- You did not owe any taxes in the previous tax year, and did not have to file a tax return

- You were a US citizen or resident for the entire year

- Your tax year was 12 months long

If you donât meet all of the criteria for non-payment above, then youâre one of the many Americans who needs to pay estimated quarterly taxesâread on!

Read Also: Cook County Assessor Deadlines

Escape The Underpayment Penalty

You may be liable for an underpayment penalty if you pay less than 100% of your tax liability by the tax filing deadline. You can avoid the penalty if you meet one of the exceptions below:

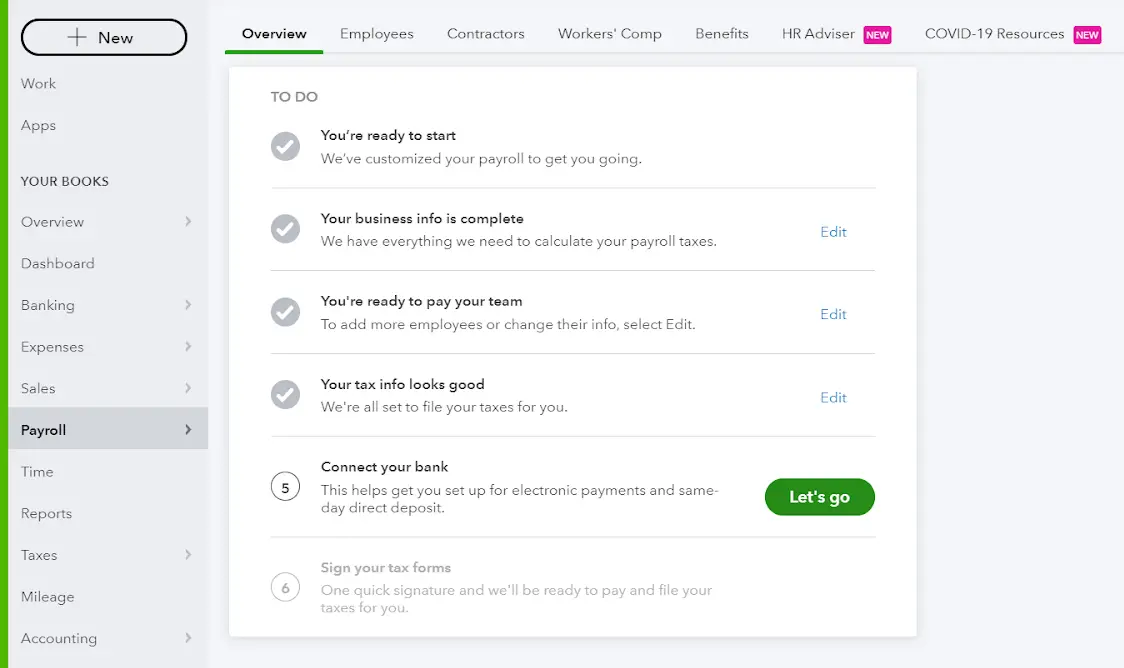

Payment Of Estimated Taxes

Payment of estimated taxes is due in installments. Due dates are mid-April, June, September, and the January following the last month of the calendar year. If the due date falls on a national or state holiday, Saturday or Sunday, payment postmarked by the day following that holiday or Sunday is considered on time.

Estimated payments can be made by one of the following methods:

Filling out ES-40.

Recommended Reading: How To Buy Tax Lien Properties In California

How To Avoid Penalties

If you dont pay your estimated taxes, you will be penalized by the IRS. You can also incur penalties if you underpay. Sometimes it can be hard to estimate taxes, so the IRS created safe harbor calculations. If you use these calculations you will not be penalized, even if you underpay. You should be safe from penalties if you:

- Expect to owe less than $1,000

- Pay 100% of your previous years tax liability if your adjusted gross income is under $150,000. If it is over that, you have to pay 110% of the previous years tax liability.

- Pay within 90% of your actual tax liability for the year

What Are Estimated Taxes

Income that is not subject to federal tax withholding during the course of the year is still subject to tax, requiring you to pay estimated taxes to ensure that you pay as you go. Wage earners can get around this by increasing the amount withheld at their regular job.

Examples of income not normally subject to tax withholding include:

- Interest.

- Unemployment compensation.

- Social Security benefits in some cases.

The IRS wants Americans to pay taxes as they earn money. Normally, penalties and interest apply for underpayments and late payments.

Because of the pandemic in 2020, some tax filing deadlines were relaxed and extended. Similarly, interest and penalties were waived and didnt begin accruing until mid-July.

Keep in mind that due to COVID-19 the 1040 returns for 2019 were moved from being due on April 15 to July 15, says Judy OConnor of accounting firm OConnor & Rodriguez, PA, in Miami Shores, Florida. And then due to COVID the first two quarterly payments for estimated taxes were moved from April 15 and June 15 to July 15.

But as of now, no changes are planned for the 2021 tax year due to the pandemic, she adds. But that could change. There is so much up in the air still with COVID-19, and there could be changes once again.

Also Check: How Much Does H & R Block Charge For Taxes

How To Pay Estimated Quarterly Taxes

You can mail your estimated tax payments with IRS Form 1040-ES. You can pay electronically as well using the IRSs Direct Pay system or the U.S. Treasurys Electronic Federal Tax Payment System, for example. Paying with a credit card carries of fee of around 2%.

You can even pay in cash at certain IRS retail partners.

» MORE:See all the ways you can make a payment to the IRS

How To Pay Estimated Taxes

You have a range of options for submitting estimated tax payments. Besides mailing your payment, you can pay online by debit or credit card, which incurs a convenience fee, or by using the EFTPS system, which has no fee, but you have to enroll. You can pay by ACH transfer from your checking account using free IRS Direct Pay or pay by phone using the EFTPS system.

Registering with EFTPS isnt complicated. You just need a bank account, Social Security Number or Employer Identification Number, and a mailing address. You must use the mailing address the IRS has on file. The IRS will mail you a PIN in about a week. Using that PIN, you can get into their website anytime to schedule a payment. Once you set up your bank account with EFTPS, you can schedule withdrawals.

Most tax software packages have the option to schedule estimated tax payments for the coming year by direct debit. You can schedule the amount of the payment and the date youd like the payment deducted from your account.

If you want a little help saving money for your quarterly tax payment, you can set up a savings builder account through CIT Bank and move money into it each month. This account is one of the highest-interest-earning savings accounts available.

You May Like: How Much Does H& r Block Charge To Do Taxes

How To Figure Estimated Tax

Individuals, including sole proprietors, partners, and S corporation shareholders, generally use Form 1040-ES, to figure estimated tax.

To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year.

When figuring your estimated tax for the current year, it may be helpful to use your income, deductions, and credits for the prior year as a starting point. Use your prior year’s federal tax return as a guide. You can use the worksheet in Form 1040-ES to figure your estimated tax. You need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated tax for the next quarter. You want to estimate your income as accurately as you can to avoid penalties.

You must make adjustments both for changes in your own situation and for recent changes in the tax law.

Corporations generally use Form 1120-W, to figure estimated tax.

How To Determine What You Should Pay

Form 1040-ES helps you figure your estimated taxes and provides vouchers to send along with your estimated tax amounts if you opt to pay by check or money order. Tax preparation software or your accountant can do the calculations for you. To determine how much you owe, check the income claimed and deductions taken on the previous years federal tax return to see if it will be comparable in the current year.

Dont forget to check if youve applied your previous years tax refund to this years taxes.

High earners, defined as those making $150,000 or more if single or married filing jointly , should pay 110 percent of last years tax liability to meet safe harbor rules.

Example: If your tax bill last year was $30,000, this year you would pay $33,000 in estimated and withholding taxes to avoid paying any underpayment penalties.

Recommended Reading: Where’s My Tax Refund Ga

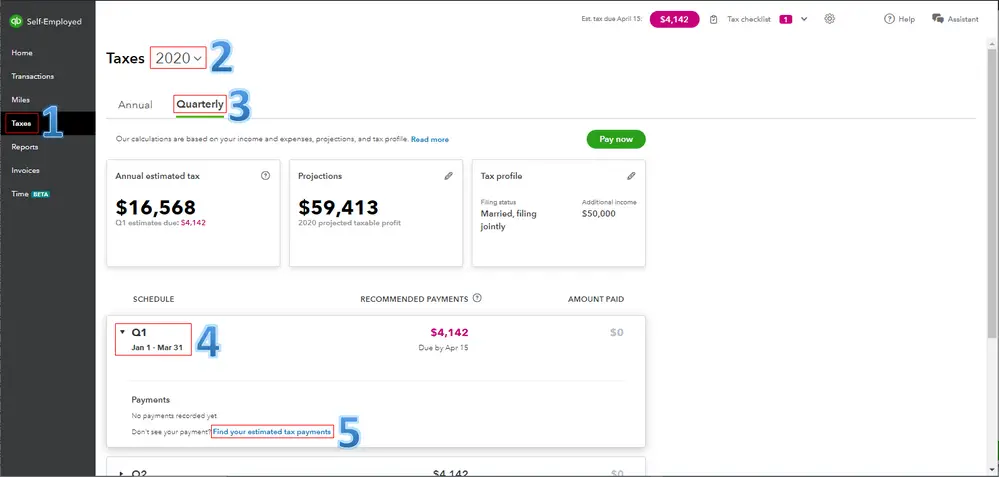

When To Pay Estimated Quarterly Taxes

For 2021, here’s when estimated quarterly tax payments are due:

|

If you earned income during this period |

Estimated tax payment deadline |

|---|

» MORE:Learn about important changes to this year’s tax-filing deadline

These dates dont coincide with regular calendar quarters, so plan ahead. And you dont have to make the payment due in mid-January if you file your tax return and pay what you owe by the end of the month.

You can make payments more often if you like, Kane says.

I think it’s easier to make 12 smaller payments than four larger payments,” she says. “If you owe $1,200 for the year, I would rather pay $100 a month than $300 four times a year. And if we’re talking bigger numbers, it gets pretty extreme.

Extended Due Date Of First Estimated Tax Payment

Pursuant toNotice 2020-18, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to , the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

Don’t Miss: Michigan.gov/collectionseservice

For Fishermen And Farmers

You have special criteria to meet, but you may end up paying less in estimated taxes. You’re considered a qualified farmer or fisherman if you earn more than two thirds of your taxable gross income from farming or commercial fishing.

If you’re not sure you qualify, or how this all works, TurboTax can help you figure your taxable gross income and what fishing and farming income you can include as qualified income.

Dont worry about knowing which tax forms to fill out when you are self-employed, TurboTax Self-Employed will ask you simple questions about you and your business and give you the business deductions you deserve based on your answers. TurboTax Self-Employed uncovers industry-specific deductions. Some you may not even be aware of.

Limit On The Use Of Prior Years Tax

If youre required to make estimated tax payments and your prior year California adjusted gross income is more than:

- $150,000

- $75,000 if married/RDP filing separately

Then you must base your estimated tax based on the lesser of:

- 90% of your tax for the current tax year

- 110% of your tax for the prior tax year

This rule does not apply to farmers or fishermen.

Recommended Reading: Buying Tax Liens In California

Who Pays Estimated Taxes

The IRS expects to collect federal income taxes as you earn or receive income. That’s why employees have a portion of each paycheck withheld for taxes. But if you’re a company owner, your quarterly estimated tax payments serve the same pay-as-you-go purpose.

You may also have to pay estimated taxes if:

- Your spouse is self-employed

- You have other income not subject to withholding like interest, dividends, rent or alimony

- You employ a nanny for whom you pay federal payroll taxes

- You have additional sources of income that you didn’t account for when you filled out your W-4 for the current year

Quarterly tax payments are ordinarily due on the 15th of April, June, September and January. If one of those dates falls on a Saturday, Sunday or legal holiday, the payment will be on time if you make it on the next business day. The next payment deadlines for the tax year are April 17, 2018 June 15, 2018 September 17, 2018 and January 15, 2019.

You Must Estimate Your Income Tax And Pay The Tax Each Quarter If You:

-

do not have Vermont income tax withheld from your pay

-

do not have enough Vermont income tax withheld each pay period

-

have Vermont income not subject to withholding tax

For example, if you are self-employed, you should pay estimated income tax or if you receive a substantial income in the form of dividends or interest.

Read Also: What Does Locality Mean On Taxes

Find Out If You Have To Pay Gst/hst By Instalments

Special rules for first time filers explains how to determine if you need to pay the GST/HST by instalments in your second fiscal year.

If you are an annual filer and your net tax for your previous fiscal year is $3,000 or more, you may have to make quarterly instalment payments in the current fiscal year.

If your business has branches or divisions that file separate returns, the threshold limit of $3,000 applies to the total net tax for the whole business, including all branches and divisions.

A Guide To Paying Quarterly Taxes

OVERVIEW

Self-employed taxpayers likely need to pay quarterly tax payments and meet key IRS deadlines. Heres a closer look at how quarterly taxes work and what you need to know when filing your tax returns.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Working for yourself presents a host of benefits, such as never having to report to a boss and setting your own hours. It also carries a few added tax requirements, such as paying your taxes quarterly instead of with each paycheck as a W-2 employee would.

Keep reading to learn answers to questions like, “Who has to pay quarterly taxes?” “When are quarterly taxes due?” and “How do I pay quarterly taxes?”

Recommended Reading: How To Correct State Tax Return

Penalty For Underpayment Of Estimated Tax

If you didnt pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller. There are special rules for farmers, fishermen, and certain higher income taxpayers. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

However, if your income is received unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts , to see if you owe a penalty for underpaying your estimated tax. Please refer to the Form 1040 and 1040-SR Instructions or Form 1120 Instructions , for where to report the estimated tax penalty on your return.

The penalty may also be waived if:

- The failure to make estimated payments was caused by a casualty, disaster, or other unusual circumstance and it would be inequitable to impose the penalty, or

- You retired or became disabled during the tax year for which estimated payments were required to be made or in the preceding tax year, and the underpayment was due to reasonable cause and not willful neglect.

What Taxes Do Self

As a self-employed individual, you file an annual return but usually pay estimated taxes every quarter. Quarterly taxes generally fall into two categories:

- The self-employment tax

- Income tax on the profits that your business made and any other income

For example, in the 2021 tax year:

- The self-employment tax rate on net income up to $142,800 for tax year 2021 is 15.3%. That breaks down to 12.4% Social Security tax and 2.9% Medicare tax. As your income increases past this amount, the 2.9% Medicare tax continues but the Social Security portion stops.

- High earners generally, individuals with incomes of $200,000 and above or married couples with incomes of $250,000 or more are subject to an additional Medicare tax of 0.9%.

To calculate your taxable income as a business owner:

- Take your expected annual gross income the total revenue you received and deduct expenses and any deductions you’re eligible for. For example, if your annual revenue came to $100,000 and you had business deductions that total $30,000, your taxable income amounts to $70,000.

- $100,000 – $30,000 = $70,000 taxable income

Recommended Reading: Www.myillinoistax