Fill Out Your Tax Forms

Once youve used your 1099 forms to accurately calculate your income, youll need to fill out a few additional tax forms to file with the IRS:

- Form 1040. This form reports your individual income to the IRS. Sole proprietors, freelancers, contractors, and any other self-employed persons will file their income taxes with Form 1040.

- Schedule C. This form attaches to Form 1040 and breaks down your businesss profits and losses over the course of the year.

- Schedule SE. This form also attaches to Form 1040. It helps you calculate the self-employment tax, or the combined Social Security and Medicare taxes all contractors are required to pay. The self-employment tax is 15.3% of your annual income.

Most self-employed individuals, including freelancers and sole proprietors, are required to pay estimated taxes quarterly and file a tax return annually. You can learn more about who should pay quarterly taxes on the IRSs estimated taxes info page.

Independent Contractor Sole Proprietor And Self

- The term “independent contractor” describes how the person works and how much control the worker has over their work. The independent contractor isn’t controlled by an employer as an employee is.

- Independent contractors are considered self-employed, because they are in business for themselves.

- The term “sole proprietor” is a tax designation. It’s how a single owner of a business that is not a corporation pays taxes.

Do Realtors Pay Taxes On Commission

4.5/5real estatetaxpaytaxespaidtaxestaxes

Similarly one may ask, how much tax do you pay on real estate commission?

it is about 7% of the first $100,000 and then 3% on the balance if you‘re using the big brokerages . This is split between the buying and the selling real estate agent, and usually it is split 50/50. So the seller of the home paid $24,500 out of their home sale for the real estate commissions.

Similarly, is realtor credit taxable? According to the IRS, a taxpayer does not have an obligation to report payment or at the closing of a real estate transaction. This is because a rebate is classed as an adjustment to the overall purchase price of the home, not a taxable income.

Similarly, can I deduct Realtor commission on my taxes?

Some real estate commissions are tax–deductible and some aren’t. If you pay it to sell your house, it’s not deductible although it is a part of the cost of selling your house. Commissions paid on investment properties get treated differently since the IRS lets you write off most of those properties’ expenses.

Do Realtors get a 1099?

Real Estate Agent Tax TipsTypically, Real Estate Agents receive a 1099-MISC tax form and receive compensation as an independent contractor. This means that for tax purposes, real estate agents are considered self-employed. As such, a schedule C must be filed.

Don’t Miss: How Much Does H& r Block Cost To File Taxes

Whats Better 1099 Or W2

is a 1099 or a W2 better?

Form 1099

but What to expect on a 1099:

- Form 1099 will only show the amount the client has paid you in a year

- Form 1099 will not show you payroll taxes youve paid

Form W2

What to expect on a W2:

- Your total income earned

- The total amount of federal and state payroll taxes withheld from your paychecks

Tax Accountants For Independent Contractors In Roseville And Sacramento Ca

Complying with tax laws can be tricky, particularly if this is your first time operating a sole proprietorship or working as an independent contractor. If you are self-employed, make sure you have small business accounting support from a skilled and experienced tax professional.

Cook CPA Group works with independent contractors in all types of industries throughout the Sacramento and Roseville, CA areas. For a free consultation about taxes for independent contractors in California, contact our Sacramento CPA firm online, or call our law offices today at 432-2218.

Auditing Services

Read Also: Do I Need W2 To File Taxes

Keep Track Of Your Paperwork

Understanding how self-employed taxes work, staying organized, and keeping track of your payment history can vastly streamline the tax filing process. For example, if youâre a seasoned independent contractor, being able to refer to your income records for the past few years will make it much easier to estimate your average annual income as well as your taxes owed.

There are also numerous self-employed tax deductions available, so be sure to save receipts and keep detailed records of things like business travel, transportation expenses, and insurance costs to take advantage of deductions for these expenses.

Set aside a little time once a week to categorize receipts, document expenses, and file any tax-related paperwork or documents. Getting in the habit of this process will help to ease the burden of quarterly and annual filing and ensure you donât overlook deduction opportunities.

Know Your Deadlines And Pay On Time

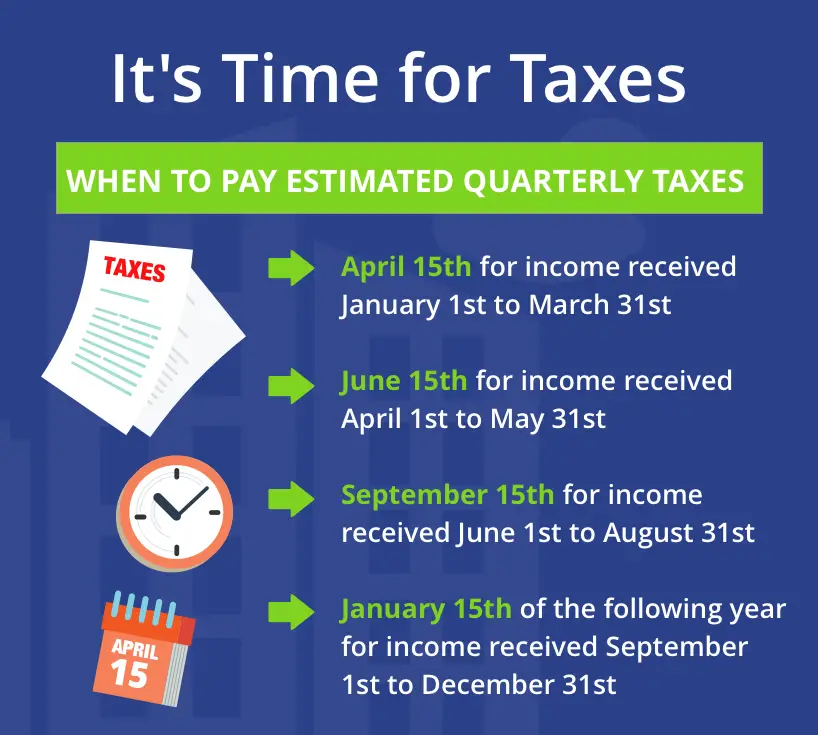

If you are self-employed and expect to owe $1,000 or more in taxes , youâll need to make quarterly estimated tax payments throughout the year. Paying taxes quarterly helps to eliminate a massive tax burden at the end of the year both for you and for the government.

Quarterly payments are due on April 15, June 15, September 15, and January 15 of each year. In order to calculate quarterly payments, use Form 1040-ES, Estimated Tax for Individuals, which contains blank vouchers you can use to mail in your estimates, or pay online with the Electronic Federal Tax Payment System .

Whether youâre mailing in your vouchers or paying online, set a reminder for at least a week beforehand so your payment arrives on time.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Will I Get A W

Instead of receiving a W-2 in January of each year, you’ll receive a form called a 1099-NEC from any client or customer that paid you $600 or more during the year. If your payments from any single client are less than $600, you wont receive a 1099-NEC form from them, but you still must include the amount you were paid on your business tax return.

When Quarterly Payments Are Necessary

Any Virginia independent contractor or freelancer is required to make quarterly tax payments if their estimated tax burden exceeds $150 for the year. The best way to calculate this is to estimate your income and expenses at the start of the year and prepare to set aside funds on a monthly basis to pay your quarterly taxes. Remember, you have to pay federal as well as state payments quarterly to avoid paying a penalty.

Don’t Miss: File Missouri State Taxes Free

How Much Should I Charge Clients And How Can I Make Sure They Pay Me

When you’re just starting out as an independent contractor, it can be tough to figure out what to charge your clients. You’ll want to come up with a figure that pays your expenses, adequately compensates you for your time, and allows you to earn at least some profit. And, of course, you’ll have to make sure not to charge more than the market will bear — if freelancers in your area are willing to perform the same work for a much lower fee, you probably won’t drum up much business. For tips on coming up with the right price, see How Much Should You Charge for Your Service?

Just as important as doing the work is making sure you get paid. Many contractors and consultants spend too much time acting as collection agencies, going after deadbeat clients who refuse to pay their bills. If a client won’t pay after being properly invoiced, you’ll need to turn up the heat by persistently demanding payment and pursuing your legal options, if necessary. For tips on collecting what you’re owed, see Get Clients to Pay Up.

Independent Contractor Tax Deductions

What is a tax deduction? Well, deductions reduce your taxable income and therefore, help you to keep more of your money. They are a big part of the taxable income equation. Deductions take into consideration all that it costs you to run your business or provide a particular good or service.

Employees are not entitled to deduct business expenses, but as an independent contractor, you may. In fact, itâs encouraged! Hereâs a list of common deductions that you may be eligible for as an independent contractor.

For each of the expense types, there are guidelines for how they should be accounted for and sometimes limits to what can be deducted. For example, car and truck expenses cover miles traveled or vehicle used for the purpose of conducting business are deductible. If you use your car a lot for business, you might want to track your miles for taxes. You can opt to deduct actual expenses or take the standard mileage deduction which is adjusted annually.

Some deduction types, like depreciation, come with special rules. Depreciation is an annual income tax deduction that allows you to recover the cost of an asset over the time you use it.

To illustrate how you could apply deductions in real life letâs consider deductions a freelance real estate agent, photographer, rideshare driver might each be able to take.

Don’t Miss: How To Buy Tax Lien Properties In California

What Is An Independent Contractor

How does a business determine whether you are an independent contractor or employee? The IRS has rules and tests to help make the decision, but at a high level, if a business only has the ability to control the result of the work you perform, not how you perform the work, you might be considered an independent contractor.

If you are an independent contractor, the IRS considers you to be self-employed you arent an employee of any company. As an independent contractor, you can operate as a sole proprietor, a limited liability company or an S-corporation. The majority of businesses in the U.S. are run as sole proprietorships, so well focus on that structure in this article.

What Is Flsa Classification And Where Did It Come From

FLSA stands for Fair Labor Standards Act, and the requirements have actually been around since 1938. The FLSA has gone through some changes since then, but its main purpose is to ensure that employees get paid fairly for their work, whether thats setting the minimum wage at a federal level, or establishing the 40-hour workweek.

The process of FLSA classification is usually concerned with deciding whether you need to pay overtime or not, and thats where well focus our discussion.

If your employees are covered by FLSA, and they are nonexempt, they will be entitled to overtime pay. This is time and a half of their regular pay for every hour they worked over the standard 40-hour working week in a seven-day period.

Read Also: Do You Have To Report Roth Ira On Taxes

How To Estimate Your Income Tax Bill As An Independent Contractor

Becoming an independent contractor in Canada has many advantages, but it does put the onus on you to properly estimate and remit income taxes on a regularly scheduled basis as dictated by the Canada Revenue Agency . “How do I pay income tax as an independent contractor in Canada?” is a common question for new entrepreneurs.

Getting Help With Independent Contractor Taxes

Business taxes are complex, and there are many qualifications, limits, and exceptions to consider. For instance, even a seemingly simple deduction, like the one for business use of your home, has many issues. Finding a licensed tax professional to help you with your business taxes can save you money and help you survive a tax audit.

Recommended Reading: Reverse Ein Lookup Irs

Getting Paid As An Independent Contractor

Employees who work for someone else have state, federal, Social Security and Medicare taxes withheld from every paycheck they receive. But if youre an independent contractor, it doesnt work that way.

When your clients send payment for your work, no one takes money out of your paycheck for taxes. Instead, youre responsible for setting aside enough money to pay your taxes when theyre due. Well talk more about how to pay your taxes in a little bit.

T5018 Statement Of Contract Payments

It can take a lot of time for self-employed workers and independent contractors to navigate Canadas complex tax legislation. It also takes time for businesses to understand the tax essentials of self-employed contractors.

A good example is understanding what needs to get reported on the T5018 information return. If youre an individual, partnership, trust, or corporation and more than 50% of the business income comes from construction, and you make payments to subcontractors for construction services, you need to report the amount paid or credited.

Payments to independent contractors and subcontractors can be reported on either a calendar-year or fiscal-year basis, and are due 6 months after the reporting period.

A T5018 slip must be filed for any payment over $500. One T5018 slip is filed for each independent contractor and a summary slip is also reported to the CRA.

Failing to file a T5018 will result in penalties. And it can get costly. The CRA issues late filing penalties based on the number of T5018 slips filed late and the number of days late. The late filing penalty continues to accrue interest until paid in full.

To report payments to subcontractors for construction work, including any GST/HST and provincial/territorial sales tax, you must:

- Complete the T5018 slip

- Complete the Statement of Contract Payments, or

- Provide a listing of all payments made to subcontractors, on a line-by-line basis in column format with all the information required on the slip.

Recommended Reading: How To Buy Tax Lien Properties In California

How Does A 1099 Contractor Get Paid

Independent contractors get paid in all the normal ways that are available to regular employees or businesses. Some may receive payment electronically on a project basis while others may contract their services on an hourly basis. There are also more formal arrangements where there is an agreement in place for services to be provided on an on-going basis for a period of time.

Are you a podcast host or a speaker? Have you provided a service or delivered a program for a school district or private organization. If so, you may have been asked to complete a Form W-9. Form W-9 is used to collect your taxpayer information so that organizations can maintain accurate records and report any payments made to you in a given year on Form 1099.Many contractors donât have a designated pay day in the same way an employee would. In some cases they may be paid upon completion of a product or service which for some independent contractors may be daily. Payday every day is a concept I can get behind! The main takeaway when it comes to payment, a freelancer has no tax of any kind withheld. Weâll explore exactly which independent contractor taxes you need to be on the lookout for later in the guide.

Tax Penalties For Incorrect Classification

The IRS strictly enforces worker classification status. Businesses that misclassify an employee as an independent contractor, even if unintentionally, may face serious repercussions, including taxes and penalties. They may also have to reimburse misclassified workers for unpaid overtime in accordance with the Fair Labor Standards Act .

Recommended Reading: What Does Agi Mean In Taxes

How To Report And Pay Independent Contractor Taxes

If you are working on your own providing services to individuals or businesses, you are most likely an independent contractor. The money you make is considered business income, and you must pay income taxes along with other taxes. If you have employees, there are additional taxes you will owe.

This article is an overview of the taxes that an independent contractor must report and pay, so that you know what to expect and can plan ahead for tax time.

The Gig Economy Taxes

The starting point for independent contractor taxes is income. Income refers to compensation in any form including cash, property, goods or virtual currency. Itâll be up to you to keep track of how much you earn including the value of goods received throughout the year because youâre responsible to pay tax on it even if you donât receive any documents from the payer.

As a self-employed tax payer, youâre required to file a return once your net earnings are $400 or more. The simple equation for the total amount youâll have to pay taxes on is Income – Expenses = Net Profit or Loss. If you realize a net profit, that amount will be used to figure the tax you owe.

Check out this self-employed taxes for dummies guide for a simple breakdown of the taxes you’ll owe.

Recommended Reading: How To File Missouri State Taxes For Free

What Kind Of Work Does My Employee Do

So far, if you pay your workers hourly and they earn less than $35,568, they are classified as nonexempt, and you will need to pay overtime.

However, the last consideration is the kind of work that your employees perform. Certain job duties will mean they gain the exempt status.

This doesnt mean their job title. This is specifically about the work that they do, and will usually fall into three categories, administrative, professional and executive. Lets think about three hypothetical employees who would be exempt, with the relevant criteria called out for each.

- Administrative: Aisha is working hourly as an administrative assistant. Her salary falls under the threshold for FLSA classification as exempt. However, her primary duties involve office work that directly relates to business operations, such as handling front-desk operations, and shes given a lot of freedom and discretion on how to perform her duties, such as what tasks should take priority. While Aisha doesnt get involved in sales itself, she supports other employees in keeping business running as usual.Aisha cannot claim overtime, as she falls under administrative exemption.