Paying Tax As A New York S Corporation

Under the corporation franchise tax , you pay a fixed dollar minimum tax based on New York receipts.

The metropolitan transportation business tax doesn’t apply to a New York S corporation.

S corporations may earn tax credits that flow-through to the S corporation shareholders to be claimed on the shareholders’ individual returns.

Top S Corporation Disadvantages

- S Corps need accounting and bookkeeping specialists to accurately determine salaries, distributions, and taxes. They will also have to ensure the payroll system is working appropriately.

- They must follow certain requirements such as coordinating reoccurring meetings for board directors and shareholders. All meetings must be recorded in detailed minutes for reference.

- S Corps arent an investment that will appreciate over time. Any profit on the sale of the business will be taxed higher than other business tax models.

- Owners and shareholders that own 2% or more of the company cant receive tax-free benefits.

- If the tax status of an S Corp is compromised at any time, the IRS has the ability to charge back-taxes for three years and impose a five-year waiting period to reclaim tax subsection S.

- C Corps can own shares of stock to increase capital. Those stocks can also be transferred easily. In comparison, S Corps have limitations on stock ownership and stock transfers can be hindered by IRS regulations.

When Would The Pros Of A C Corporation Outweigh The Cons

Again, there is no one right answer to that question, but here are some situations where a C corp may be a good option:

- Taxation under Subchapter C will result in lower taxes than taxation under Subchapter S.

- Distributions will not be made to shareholders.

- You plan on an IPO or seeking investors not allowed for an S corporation.

- You want shares to be freely transferable.

- You want to issue preferred stock.

You May Like: How Much Does H& r Block Charge To Do Taxes

Losing S Corporation Status

- There are various scenarios under which an entity can lose this status. Let us look at a particular case as S Corporation examples.

- Suppose, for instance, if any one of the shareholders elected is a foreign national i.e. a non-U.S resident or if the number of shareholders exceeds 100 due to the transfer of shares to a new shareholder then the entity stands to lose its S corp status.

- Now that we have listed down the features of an S corp, let us dive deeper into the concept of what an S corp actually means.

Comparison To Partnerships And Limited Liability Companies

In the partnership context, no gain or loss is recognized on a distribution of money or property to a partner.20 This allows partners to defer recognition of gain in appreciated property that they receive from the partnership. In contrast, distributions of appreciated property by C corporations and S corporations are treated as though the property were sold to the shareholder at fair market value.21

Legal References

Read Also: How To Correct State Tax Return

A New Carve Out To The S

In 2013, Congress passed Section 1411 of the IRS Code in connection with the Affordable Care Act. This new provision applies a 3.8% tax on the lesser of net investment income or modified adjusted gross income above certain thresholds. Net investment income includes gross income from a business to a taxpayer who does not personally materially participate in the business and businesses involved in trading financial instruments and commodities. For a shareholder who isnt active in an S-corporation, some of the savings from passing through distributions will be recaptured by the IRS.

The Ultimate Guide To Understanding S Corp Tax Rates

Since the passing of the Tax Cuts and Jobs Act of 2017, there have been many questions and concerns involving S Corporations. Due to its complexity, its important to start with the basics. Weve created a users guide to S Corporations thats designed to help ease confusion amongst business owners. What is an S Corp? What are some S Corp advantages? Heres your chance to find out!

Don’t Miss: How To Appeal Property Taxes Cook County

Can A Single Member Llc Be Taxed As An S Corp

A single-member LLC is automatically taxed as a disregarded entity: the income from the LLC is reported on the personal income tax return. However, even single-member LLCs can choose to be taxed as an S corp. They still need to meet eligibility requirements, such as having a consent form signed by all LLC members, filing for this change on a predetermined date, and designating a tax year with a clearly stated date that will serve as the beginning of the tax year.

If these requirements are met, an LLC can file for an S corp status and get the most important S corp advantage no double taxation. In cases where a single-member company becomes an S corp for taxation purposes, the owner can make themselves an employee, pay their reasonable salary, and retain any other profits as distribution. The owner doesnt have to pay self-employment taxes on income they earn from the LLC.

| DID YOU KNOW? Every LLC has to list a registered agent in the companys formation documents. If youre having trouble locating one for your LLC, you can find one here. |

Us Income Tax Return For An S Corporation

Although they are largely exempt from corporate taxes, S corporations must still report their earnings to the federal government and file tax returns.

Form 1120-S is essentially an S corp’s tax return. Often accompanied by a Schedule K-1, which delineates the percentage of company shares owned by each individual shareholder, Form 1120-S reports the income, losses, dividends, and other distributions the corporation has passed onto its shareholders.

Unlike C corps, which must file quarterly, S corps only file once a year, like individual taxpayers. Form 1120-S is simpler than tax forms for C corporations, too. The version for 2020 ran five pages.

As long as a company elects S corporation status , it must file Form 1120-S. The form is due by the 15th day of the third month after the end of its fiscal yeargenerally, March 15 for companies that follow a calendar year.

Like individuals, S corporations can request a six-month extension to file their tax returns. To do so, they must file Form 7004: Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns by their return’s regular due date.

Read Also: Buying Tax Liens California

How To Reach This Business Lawyer

I am a business lawyer with offices in Austin and Houston, Texas and helping business clients throughout the U.S. If you have questions about S-Corporations or other issues regarding formation of entities, taxation and structure, or other corporate law questions, please get in touch.

Brett Cenkus is a business attorney with 18+ years experience based in Austin, Texas. He has worked with a variety of businesses and has clients throughout Texas as well as many technology clients throughout the United States. Brett is a Harvard Law graduate with a sharply seasoned mind and an entrepreneurial heart. As a founder of 6 companies himself, he is especially passionate about helping startups succeed. In 2016 Brett was named the winner in the Individual category for RecognizeGoods Ethics in Business & Community Award. He offers businesses solutions that are in sync with their culture, goals and values. You can learn more about Brett by visiting the About page on this website.

How Is An Llc Taxed

United States law doesnt regard LLCs as separate taxable entities, meaning that the LLC owner is responsible for determining the tax status of the company. There are multiple ways that an LLC can be taxed, such as a single-member LLC, multi-member LLC, an S corp, or a C corp. Since owners can choose the way their company is taxed, Limited Liability Companies are among the most popular types of businesses an LLC filing as an S corp is one common occurrence.

The basic taxation principle of LLCs is pass-through taxation: the companys income is reported on the personal income tax return of the LLCs owner based on their share in the company. However, local and state governments may impose additional taxes on LLCs, meaning they would be obliged to pay federal income tax on their companys profits.

An LLC tax classification often depends on the number of owners or members operating the LLC, as well as the location of the company and the extent of its operations.

| DID YOU KNOW? LLCs are among the most popular types of businesses in the US if youre thinking about starting your own business, you can read this article on how to start an LLC. |

Read Also: Where Is My State Refund Ga

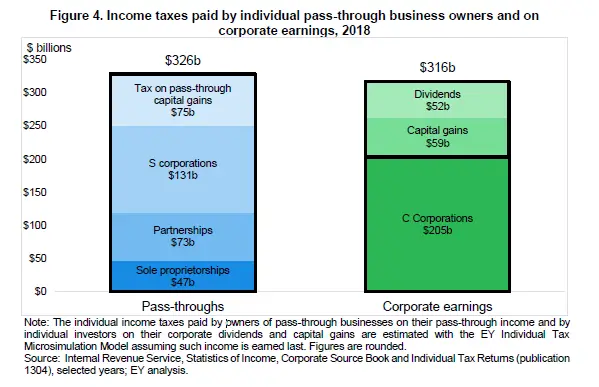

Double Taxation: The Bane Of C

The IRS describes double taxation as being taxed on both corporate earnings and then again at the individual stockholder level when corporate earnings are distributed to stockholders as dividends. Why does this happen? Well, corporations are treated as separate legal entities from individual owners , so the IRS, in taxing both the corporation on its earnings and stockholders on any dividends received from those earnings, is essentially taxing two separate entities or persons . Or, so thats how the argument goes. There is a lot of debate around this topic, which you can read about on Investopedia. The bottom line is that having a corporation can result in being taxed twice once on the earnings of the business and once on distributions from the business to the owners.

I like to pay taxes. With them, I buy civilization.

-Oliver Wendell Holmes

However, theres a way to get around the double taxation issue even if you initially form a C-corporation. You can do it by electing for S-Corp treatment through the IRS if it is available for your entity and depending on the specifics of your enterprise .

NOTE: The Subchapter S election isnt a silver bullet for all corporate gains and income. S-Corps are still responsible for paying taxes on certain built-in gains and passive income. And, as I mentioned, there are rules .

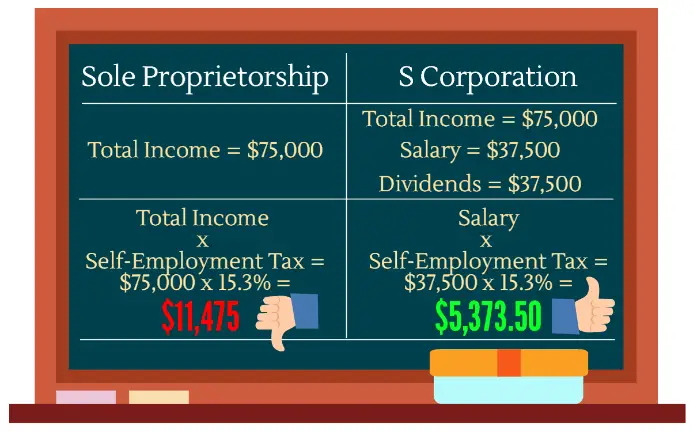

Determining A Reasonable Salary

So whats a reasonable salary? This exact question is frequently the topic of debate in court cases between the IRS and business owners who are, allegedly, paying themselves an unreasonably small salary in order to save on self-employment taxes.

What makes the situation tricky is that the tax code itself does not provide any specific guidelines for whats reasonable. That said, the following factors are frequently considered by courts when ruling on the issue:

- The duties and responsibilities of the shareholder-employee,

- The training and experience of the shareholder-employee,

- The amount of time and effort devoted to the business,

- The amount of dividends paid to shareholders ,

- The wages of the businesss other employees , and

- What comparable businesses pay for similar services.

You May Like: What Does Locality Mean On Taxes

Overview Of S Corporation Taxation

S Corporations are taxed at the shareholder rate on personal returns with a 20% deduction on income from the pass-through entity.

Example: Like the C Corp example, you are the owner of your business that has a profit of $100,000. Twenty percent of would be deducted, leaving you with $80,000. The $80,000 passes through to your personal account as income and is taxed on your return at 22%. Twenty-two percent of $80,000 is $17,600, so youd be left with $62,400, which is more than what youd be left with as a C Corp.

S Corporations And Federal Income Taxes

For tax purposes, an S corporation is considered a pass-through taxing mechanism. That is, the tax on the S corporation is passed through to the owners for federal income tax purposes.

- First, the corporation files a business tax return on Form 1120-S.

- Then each shareholder’s share of the profit or loss of the corporation is recorded on a Schedule K-1.

- The K-1 information for each shareholder is reported on Schedule E of the person’s individual income tax return.

Most states use federal information to determine total income for state tax determination.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Key Features Of S Corporation

To begin with, the study let us first understand some of the basic features of the S corp. Mentioned below are the following key features:

- The entity must be a domestic corporation. A domestic corporation refers to an entity that cannot have non-resident shareholders as its owners.

- An entity must be having its shareholders to be less than or equal to 100.

- All shareholders must be individuals. However, there are certain aspects to this requirement that need to be discussed further.

- Trusts and estates that are considered as charity organizations and which get exemptions from taxation and can be considered as a shareholder.

- Partnerships or other corporations are not eligible to be shareholders. Family members are treated as a single shareholder in S corp. This implies that spouses or individual descendants of the elected shareholder will be considered as a single shareholder.

- An entity that owns one class of stock .

The entity must comply with all such requirements as listed above. In the event it fails to do so, the entity will no more be granted the S corp status.

Which Is Better An Llc Or S Corp

Whether an LLC or an S corp is better depends on the size and nature of the business and its aspirations for growth.

An LLC tends to be preferable for sole proprietors or enterprises with just a few partners, due to its flexibility and ease of establishment If a business is largeror aspires to bethe S corp might work better. S corps have more financing options: Unlike LLCs, they are allowed to offer equity stakes to investors in return for capital, for example. And if their operations are complex, they would benefit from establishing the formal structures, compliance procedures, and other protocols required of corporations.

Don’t Miss: Turbo Tax 1099q

Should I File My Llc As An S Corp

Before filing for an S corp status, you should carefully consider if that is the best course of action for your business. You should only file for this type of status if:

- Your business is well-established and produces stable profits

- You are familiar with bookkeeping and payroll taxes

- You can afford to pay the reasonable salary

- You need to have at least $10.000 in annual distributions

Before reaching a final decision regarding the status of your company, you should also be aware of LLC taxed as S corp disadvantages. The rules for filing company taxes are stricter if the company is taxed as an S corp LLC owners need to adopt a calendar year as the companys tax year, unless they can list a reason for having a fiscal year. There is less flexibility in allocating income and losses, and the IRS pays more attention to these entities, meaning the chances of an audit are significantly higher. Another disadvantage is that 1099 forms arent available for an LLC taxed as S Corp LLCs taxed as S corps arent entitled to non-employment compensation.

If youre still uncertain as to whether you should file for an S corp status, you can always consult a financial advisor that can help you reach the right decision.

| DID YOU KNOW? A multi-member LLC is, by default, treated as a general partnership the amount of taxable income they have to pay depends on their share in the company. Even if they dont have any profits, they still have to report taxes. |

Benefits Of S Corporation Tax Treatment For Washington Llcs

The LLC is a popular entity choice for small businesses in Washington, and its easy to see why. LLCs offer the limited liability of a corporation but without many of the burdensome corporate formalities required to maintain a liability shield. They also provide plenty of flexibility for structuring the economic and control arrangements for the company.

But thats not all. LLCs also offer flexibility in how theyre taxed. One notable example, and the subject of this post, is when LLCs elect to be taxed as S corporations.

Related: How To Form A Washington LLC

Read Also: What Does H& r Block Charge

Whats A Reasonable Salary

Wait a minute, you might be thinking, why not just pay yourself a measly salary and maximize the remaining profit to save on self-employment taxes? The answer is that the salary you pay yourself must be reasonable in the eyes of the IRS. Any gamesmanship here could wipe out your saving on self-employment taxes if the IRS comes knocking.

But what exactly is reasonable? Unfortunately this a fact-specific question. There are guidelines to considerfor instance, the market salary range in the industry and region for a comparable jobbut when in doubt, its a good idea to consult with an accountant. But at the very least, youll want to make sure you can pass the laugh test when setting your salary.

A Special Tax Deduction For S Corp Owners

Like other pass-through businesses, S corporation owners may be eligible to take a Qualified Business Income Deduction to deduct up to 20% of their business income . This deduction is in addition to the normal business expense deductions the S corporation can use to reduce its taxes The QBI deduction is taken off the owner’s tax return, not the business return.

Don’t Miss: Www Aztaxes Net