Wheres My Refund Arkansas

To check the status of your Arkansas state refund online, navigate here.

- Enter your SSN

- Enter your refund amount from your tax return

You also may check the status of your refund by calling or toll free at .

If you e-filed, your refund should be issued within twenty-one business days after acknowledgment of the receipt of the return. The average processing time for a complete paper tax return is up to 10 weeks from the time you mailed it. Please allow 10 weeks from the date you filed before calling.

How Do You Check If You Paid Your Income Taxes In Arkansas

If you want to make sure your state taxes were paid, contact the Arkansas Department of Revenue to see if your payment was received. The contact information is as follows:

Email: [email protected]

1816 W 7th St, Rm 2300Little Rock, AR 72201

View more contact information for the Arkansas Department of Revenue.

How Much Does It Cost To E

If you’re looking for an excuse not to e-file, it isn’t cost, because the IRS and states do not charge for e-filing. The only costs associated with e-filing are those charged by a tax preparer or tax software. Depending on the software brand and version, electronic filing charges have ranged from free to around $25. Tax preparers may charge more.

Recommended Reading: Is Doordash A 1099

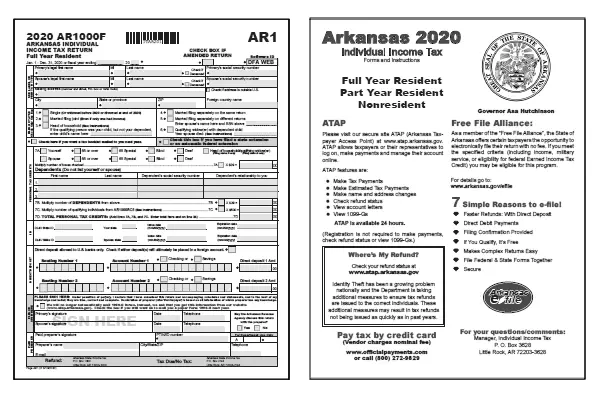

State Filing Instructions And Forms

Nonresident and resident aliens who have income as noted on a W-2 or 1099 in the state of Arkansas may have to file an Arkansas state income tax return. This return is due on . Scholarships and tuition waivers are NOT considered income for Arkansas tax purposes. Please contact our HR Expert and they will be happy to assist you with your state of Arkansas tax return each year.

If you had Arkansas Income in 2014, complete: AR1000S

Arkansas Income Tax Forms

The main Arkansas tax forms are:AR1000 | 2018 Arkansas Individual Income Tax Return| InstructionsAR1000S | Short State Income Tax Return | InstructionsSchedule AR4 | Interest and Dividends If you need Arkansas income tax forms that are not listed here, you can download them from the Arkansas tax forms site.Or, just simply e-file!

Read Also: Do You Claim Plasma Donation On Taxes

Where Do I Mail 1099 Forms When Filing With The State Of Arkansas

If you want to file paper copies of 1099, you must attach a copy of 1096 and send it to the State of Arkansas. Remember, e-filing is the most convenient way to file your tax returns with the IRS and state. When you e-file, you can easily track your returns from anywhere.

If you still want to file 1099 forms by paper, send the forms with a copy of 1096 to the following mailing address:

Withholding Tax

More Help With Taxes In Arkansas

Understanding your tax obligation takes time. Whats takes even more time is figuring out how to deduct Arkansas income tax from your federal taxes as an itemized deduction.

So, get help with H& R Block Virtual! With this service, well match you with a tax pro with Arkansas tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your AR taxes, including federal deductions for paying state taxes.

Prefer a different way to file? No problem you can find Arkansas state tax expertise with all of our ways to file taxes.

Related Topics

Getting married? Having a baby? Buying a house? Go through your life events checklist and see how each can affect your tax return with the experts at H& R Block.

Don’t Miss: Tax Preparer License Requirements

Income Tax Filing Requirements

In the state of Arizona, full-year resident or part-year resident individuals must file a tax return if they are:

- Single or married filing separately and gross income is greater than $12,550

- Head of household and GI is greater than $18,800 or

Note: For non-resident individuals the threshold numbers above are prorated based on the individual’s Arizona gross income to their federal adjusted gross income.

The filing requirements are explained at the beginning of the instructions on all Arizona income tax returns. All tax forms and instructions are available to download under Individual Forms, or by visiting ADOR offices.

To expedite the processing of an income tax return, ADOR strongly encourages taxpayers to use the fillable Arizona tax forms or electronic file . Fillable Forms and e-file information are available. Each year, ADOR provides opportunities for taxpayers to file their individual income tax returns electronically at no cost to those who qualify.

File Electronically And Choose Direct Deposit

To speed refunds, the IRS urges taxpayers to file electronically with direct deposit information as soon as they have everything they need to file an accurate return. If the return includes errors or is incomplete, it may require further review that may slow the tax refund. Having all information available when preparing the 2021 tax return can reduce errors and avoid delays in processing.

Most individual taxpayers file IRS Form 1040 or Form 1040-SR once they receive Forms W-2 and other earnings information from their employers, issuers like state agencies and payers. The IRS has incorporated recent changes to the tax laws into the forms and instructions and shared the updates with its partners who develop the software used by individuals and tax professionals to prepare and file their returns. Forms 1040 and 1040-SR and the associated instructions are available now on IRS.gov. For the latest IRS forms and instructions, visit the IRS website at IRS.gov/forms.

Also Check: Doordash How Much Should I Set Aside For Taxes

Arkansas Individual Income Tax Returns Are Due By April 15 If You Need More Time To File You Can Request A State Tax Extension Using Form Ar1055 The State Of Arkansas Grants 180

You do not need to file a separate Arkansas tax extension if you have a valid Federal extension . In this case, the Arkansas Department of Finance and Administration will automatically grant you a state extension. The deadline for your state tax return will then be the same as the extended deadline for your Federal return.

If you wont be able to file your Arkansas return on time, getting a state tax extension will help you avoid Arkansas late filing fee. But note that this is an extension of time to file, not an extension of time to pay your Arkansas taxes. You are still expected to pay your tax balance by the original due date , or interest and penalties will be assessed. Make a tax payment with your extension using Form AR1000ES, Voucher 5 and attach it to Form AR1055 or IRS Form 4868.

If you dont have a valid Federal tax extension, you must specifically apply for an Arkansas extension with Form AR 1055. This form is due by the original deadline of your return .

For more information, visit the Arkansas Department of Finance and Administration website: www.dfa.arkansas.gov

Who Needs To File An Amended Return

Arkansas taxpayers should file an amended state return if they meet certain criteria. If they claimed exemptions to which they were not entitled. While this is optional, they may wish to file an amended return if they failed to claim exemptions to which they were entitled. Also, AR tax filers must submit an amended return if they were at anytime audited by the IRS and the IRS’ finding impacted the status of their state return.

Don’t Miss: How To Get A 1099 From Doordash

Guidelines For Who Must File Ar Taxes

Individual taxpayers who are filing single must have earned at least $11,592 before they are required to file an Arkansas taxes. People who file as Head of Household with one dependent must have earned $16,480 while an HOH filer with two or more qualifying dependents needs to earn $19,465 before filing.

Self-employed taxpayers must file state income taxes regardless of their filing status or income levels.

Those who are non-residents of Arkansas, yet earned incomes at least part of the year within the state are also required to file Arkansas taxes.

Individuals With An A

Glacier Tax Prep is web bases tax preparation software designed to help Nonresident Aliens prepares a U.S federal Nonresident Alien Income Tax Return and Form 8843.

Individuals who had a Glacier account provided by Arkansas State during 2018 may access GTP directly though their existing Glacier account id they wish to obtain free access to the GTP software.

Free access to GTP will be made available to individuals affiliated with Arkansas State in February. They will be notified at that time by email.

Individuals who do not remember the login or password for their regular Glacier account should select LOGIN, then FORGOT LOGIN. Once they enter the email address associated with their Glacier account and submit their request, they will receive an email containing Glacier access information.

Returns prepared through GTP are NOT electronically submitted to the IRS. Each individual must print, sign and mail their federal tax return to the Internal Revenue Service by the April 15, 2019 tax filing deadline.

Federal tax returns , Form 8843, and state tax returns should not be submitted to Arkansas State University.

Individuals with questions while preparing their tax return through GTP should contact the GTP support team. Help links are available on all pages within the GTP website. Individuals who do not wish to use GTP to prepare their federal income tax return may obtain tax forms and more information directly from the Internal Revenue Service website.

You May Like: Does Doordash Take Taxes Out Of Your Check

Tips To Make Filing Easier

To avoid processing delays and speed refunds, the IRS urges people to follow these steps:

Organize and gather 2021 tax records including Social Security numbers, Individual Taxpayer Identification Numbers, Adoption Taxpayer Identification Numbers, and this years Identity Protection Personal Identification Numbers valid for calendar year 2022.

Check IRS.gov for the latest tax information, including the latest on reconciling advance payments of the Child Tax Credit or claiming a Recovery Rebate Credit for missing stimulus payments. There is no need to call.

Set up or log in securely at IRS.gov/account to access personal tax account information including balance, payments, and tax records including adjusted gross income.

Make final estimated tax payments for 2021 by Tuesday, Jan.18, 2022, to help avoid a tax-time bill and possible penalties.

Individuals can use a bank account, prepaid debit card or mobile app to use direct deposit and will need to provide routing and account numbers. Learn how to open an account at an FDIC-Insured bank or through the National .

File a complete and accurate return electronically when ready and choose direct deposit for the quickest refund.

There are several important dates taxpayers should keep in mind for this year’s filing season:

: Due date for tax year 2021 fourth quarter estimated tax payment.

IRS begins 2022 tax season. Individual 2021 tax returns begin being accepted and processing begins

Arkansas Income Tax Rates

Arkansas has a progressive tax code, which means your tax rate goes up with your income. But with 12 tax brackets, two separate individual income tax tables , and rates of 2%, 3%, 3.4%, 5%, 6% and 6.9%, depending on your income, youll need to do some calculations to determine your state tax liability.

For 2020, Arkansas state income tax rates have changed significantly. Early in 2019, the state passed the 5.9 Tax Cut Plan, which reduces the number of tax brackets and lowers income tax rates to 2%, 4%, 5.9% and 6.6% In 2021, the top rate will drop to 5.9%.

Read Also: What Home Improvement Expenses Are Tax Deductible

Can I File W

Yes, you can file W-2c with the State of Arkansas to correct the previously filed W-2 forms. You can submit this by paper filing or electronic filing. If you want to paper file W-2c with Arkansas, you should submit the corrected ARW-3 as well.

As of now, TaxBandits is not supporting e-filing of W-2c with the State of Arkansas. However, we support W-2c with the SSA. Using TaxBandits, you can complete the W-2c with the Federal. Then, download a copy of W-2c, attach the corrected ARW-3, and mail them to the State of Arkansas. The mailing address to send W-2c is as follows:

Withholding TaxP.O. Box 8055Little Rock,AR 72203-8055

Note: Make sure you send the corrected W-2 and ARW-3 as soon as you discover the errors.

Who Has To File An Income Tax Return

According to the Department of Finance and Administration, full-year residents of Arkansas for 2020 must file a tax return if they are:

Single with a gross income of at least $12,675

Head of household with one or no dependents and a gross income of at least $18,021 or with at least two dependents and a gross income of at least $21,482

Married filing a joint return with one or no dependents and a gross income of at least $21,375 or at least two dependents with a gross income was at least $25,726

Widowed in 2018 or 2019 and not remarried in 2020 with one dependent and a gross income of at least $18,021 or at least two dependents and a gross income of at least $21,482

Nonresidents or part-year residents who moved into or out of Arkansas during 2020 must file a return regardless of income.

Recommended Reading: Is Donating Plasma Considered Income

How Do You Pay Arkansas Taxes

To pay Arkansas income tax, you can pay online using the Arkansas Taxpayer Access Point. From there, you can select Make Income Tax Payment under the Income Tax menu, then select the payment method. From there you will be navigated to . You can make an online payment there.

You can also mail your Arkansas income tax payment to:

P.O. Box 3628Little Rock, AR 72203

Please affix payment along with your Arkansas tax forms.

General Tax Return Information

Due Date – Individual Returns – April 15, or same as IRS

Extensions – Taxpayers that have requested an extension of time to file their federal income tax return are entitled to receive the same extension on their Arkansas income tax return. The federal automatic extension extends the deadline to file until October 15th.

Taxpayers who do not file a federal extension, can file an Arkansas extension using Form AR1055 before the filing due date of April 15th. Inability to pay is not a valid reason to request an Arkansas extension. The Arkansas Extension of Time to File can be accessed from the main menu of the Arkansas return by selecting Arkansas Extension of Time to File.

Drivers License/Government Issued Photo Identification: Arkansas does not require this information to file the tax return. Providing the information will help identify the taxpayer’s identity and can help process the tax return quicker. To enter Identification Information, from the main menu of the Arkansas return select Personal Information > Driver’s License Information.

Unemployment Compensation and PPP Loan Forgiveness

Update: On March 1, 2021, the Governor signed 2021 AR SB 236 into law. The following changes affect the 2020 tax year.

Unemployment compensation. This law exempts unemployment compensation benefits from tax for:

Unemployment compensation benefits paid from federal unemployment funds for calendar years 2020 and 2021, and

You May Like: Harris County Property Tax Protest Services

Key Information To Help Taxpayers

The IRS encourages people to use online resources before calling. Last filing season, as a result of COVID-era tax changes and broader pandemic challenges, the IRS phone systems received more than 145 million calls from January 1 May 17, more than four times more calls than in an average year. In addition to IRS.gov, the IRS has a variety of other free options available to help taxpayers, ranging from free assistance at Volunteer Income Tax Assistance and Tax Counseling for the Elderly locations across the country to the availability of the IRS Free File program.

Our phone volumes continue to remain at record-setting levels, Rettig said. We urge people to check IRS.gov and establish an online account to help them access information more quickly. We have invested in developing new online capacities to make this a quick and easy way for taxpayers to get the information they need.

Last year’s average tax refund was more than $2,800. More than 160 million individual tax returns for the 2021 tax year are expected to be filed, with the vast majority of those coming before the traditional April tax deadline.

Overall, the IRS anticipates most taxpayers will receive their refund within 21 days of when they file electronically if they choose direct deposit and there are no issues with their tax return. The IRS urges taxpayers and tax professionals to file electronically. To avoid delays in processing, people should avoid filing paper returns wherever possible.

Arkansas Tax Credits And Deductions

Arkansas offers several deductions and credits to those who qualify. To be eligible, youll have to meet different criteria on income, filing status and other conditions. Here are some deductions and credits available for 2019.

- Deduction for interest paid on student loans

- Postsecondary tuition deduction for you, your spouse or dependents to attend a postsecondary educational institution

- Deduction for qualified medical and dental expenses

- Childcare credit

- Self-employed health insurance deduction for you, your spouse and your dependents

- Home mortgage interest

- Deduction for caring for a dependent with total and personal disabilities in your home

- State political contribution credit

Recommended Reading: Payable.com Doordash