How Much Do You Pay In Taxes For Instacart And Does Instacart Take Out Taxes

On the off chance that youre thinking about this inquiry: How much do you pay in taxes for Instacart and does Instacart take out taxes? You are in the ideal spot and I have put together some tips for you in this article.

Related To How Much Do You Pay in Taxes for Instacart and Does Instacart Take out Taxes?:

Disclosure: This post contains affiliate links and I will be compensated when you make a purchase after clicking on my links, there is no extra cost to you

Staple conveyance administration Instacart speaks to a chance to profit while enjoying adaptable hours and tips. When contrasted with minimum compensation, low maintenance employments, Instacart pay is significantly higher while offering more freedom and self-rule .Check out my favourite picks-

As an Instacart driver, you make cash by delivering staple goods to your clients home. You visit stores, for example, Whole Foods, Costco and other participating nearby supermarkets search for the clients things and then convey them to their door. The client pays a conveyance expense in return for this shopping for food administration, and you get the opportunity to keep a bit of the charge. In any case, how much do Instacart drivers make? And what expenses would it be a good idea for you to know about? We set out to respond to these inquiries by looking at all the accessible information on both how much Instacart drivers are making and how much they can hope to spend on costs identified with their work.

What Key Information Is On Irs Letter 6419

The letter itself spells out two key components that were used to calculate your advance child tax credit payments in 2021.

Box 1, which is at the very top of this letter, will tell you the total dollar amount of money you received for the advance child tax credit payments over six months in 2021. You need to enter that amount on Schedule 8812 called “Credits for Qualifying Children and Other Dependents” on line 14f or line 15e, whichever applies.

Box 2, which is right under Box 1, lists the number of qualifying children that were taken into account when the advance payments were determined for 2021.

The IRS notes that “families who received advance payments need to file a 2021 tax return and compare the advance payments they received in 2021 with the amount of the child tax credit they can properly claim on their 2021 tax return.”

When You Should File Even If You Aren’t Required To

Filing a tax return isn’t just for paying taxes. If you don’t owe income tax and aren’t required to file for any other reason, you may still want to so that you can get money back in your pocket.

If you had a job in 2021 that withheld taxes from your paycheck, you may be entitled to a refund if you paid too much. Filing a tax return is the only way to get that money.

Also, if you qualify for any of the following tax credits, you should file to get your refund:

- Earned income tax credit

- Child tax credit or additional child tax credit

- Child and dependent care credit

- American opportunity tax credit

- Premium tax credit

- Recovery rebate credit

Notes: The IRS begins issuing refunds for the child tax credit and the earned income tax credit in mid-February.

If you received advance child tax credit payments during 2021, you should get a notice from the IRS Letter 6419 detailing the amount you received. Use this to file your 2021 tax return and claim any remaining credit.

Also Check: Does Doordash Take Out Taxes

How Are Babysitters Categorized By Tax Authorities

Babysitters are normally considered childcare providers, regardless of their age.

That means there’s no distinction between babysitters and other kinds of childcare providers like daycares or nannies.

It doesn’t matter if you babysit in your own home, in the child’s home, or at a different location. You still need to include any compensation that you received for babysitting on your tax return.

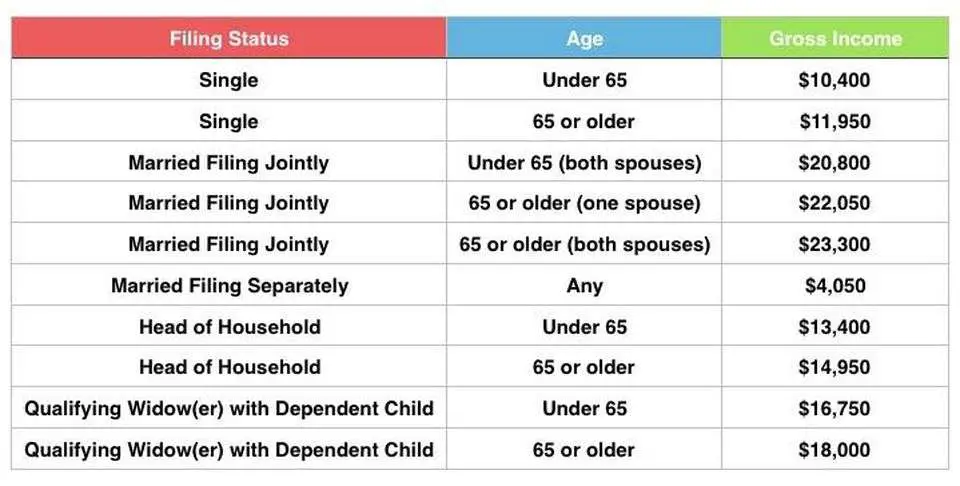

Does Everyone Need To File An Income Tax Return

OVERVIEW

Not everyone is required to file an income tax return each year. Generally, if your total income for the year doesn’t exceed certain thresholds, then you don’t need to file a federal tax return. The amount of income that you can earn before you are required to file a tax return also depends on the type of income, your age and your filing status.

Apple Podcasts | Spotify | iHeartRadio

Also Check: How Much Do I Pay In Taxes For Doordash

How Much Does A Physician Earn On Average

Figures for the typical physicians salary vary depending on the data source. According to ZipRecruiter, the median annual compensation for a physician in 2018 was $224,190. It has the highest earnings in the $397,000 range and the lowest salaries at $23,500. Thus, most physicians earn between $150,000 and $312,000 per year.

According to separate statistics from Medscapes eighth physician compensation report for 2018, the average primary care physician in the United States earns $223,000 per year. On the other hand, medical specialists earned an average of $329,000 in 2018. Physicians earn an average of $299,000 across all specialties.

These numbers were up a bit from 2017 when primary care physicians earned an average of $217,000 per year while specialists earned $316,000.

How Can A Foreigner Start A Business In Uk

How to Start a Business in the UK for Foreigners

Recommended Reading: Do Doordash Pay Taxes

Is The Nanny Tax Good Or Bad For Me As A Babysitter

On the surface, the nanny tax might seem like a bad thing because you’re getting a bunch of deductions taken off of your paycheck during each pay period. But it comes with a lot of benefits too.

If you qualify for the nanny tax and you’re an employee, that entitles you to benefits and protections such as unemployment benefits, social security, and health insurance. It also provides you with a verifiable employment history that you may need to apply for a credit card, mortgage, or loan.

If you’re babysitting as an independent contractor and lose your regular babysitting job, then you may not be entitled to unemployment or other benefits. So the nanny tax can actually be a good safety net, especially if all of your babysitting income is coming from one family.

Learn more about which employment category you fall under by reading our guide: Is babysitting considered self-employment?

Why Do You Need To Make Quarterly Payments

We know what you might be thinking. Why not just pay your taxes once a year, when you file your return? However, the IRS doesnt look too kindly on those who dont make enough tax payments throughout the year. It may be tempting to simply save all your tax payments for the year and throw them into a high-yield savings account. After all, Uncle Sam will still get paid in the end. In the meantime, maybe youll be able to make a few extra bucks in interest payments.

Unfortunately for you, the IRS frowns upon this practice. You can be charged interest and other penalties if you dont make at least quarterly payments. Do not wait until tax season to pay what you owe.

Read Also: How Much Are Taxes For Doordash

What Tax Deadlines Apply In 2021

Different due dates apply for tax returns in Australia. If you do your own tax return, you need to lodge it with the ATO by 31 October, 2021. If you use a registered tax agent, the ATO says to engage them before 31 October, 2021. You can usually submit after this date, as registered tax agents generally have special lodgement schedules that apply. There are also due dates for paying the ATO if you owe money as part of your individual tax assessment. Generally if you submit on or before lodgement due dates, any tax you owe needs to be paid to the ATO on the later of 21 days after the relevant lodgement date, or when the notice of assessment is received. Tax due dates apply for businesses too, including for business activity statements and 2021 fringe benefits tax annual returns.

What Is Taxable Income

Income tax is applied to taxable income. So, what is your taxable income? The ATO defines taxable income as follows: Your taxable income is the income you have to pay tax on. It is the term used for the amount left after you have deducted all the expenses you are allowed to claim from your assessable income. Assessable income allowable deductions = taxable income.

Read Also: Donating Plasma Taxes

What Percentage Of Social Security Is Taxable

If you file as an individual, your Social Security is not taxable only if your total income for the year is below $25,000. Half of it is taxable if your income is in the $25,000$34,000 range. If your income is higher than that, then up to 85% of your benefits may be taxable.

If you and your spouse file jointly, youll owe taxes on half of your benefits if your joint income is in the $32,000$44,000 range. If your income is above that, then up to 85% is taxable income.

How Much Do You Have To Make If You’re A Dependent

You may still have to file a tax return even if you’re being claimed as a dependent, depending on a number of factors. There’s the earned income you make, the unearned income you make and your gross income, and the minimums for all of these will be determined by either your age or whether or not you are blind.

If you are a single dependent under the age of 65 and not blind, you will have to file a tax return if:

Don’t Miss: Doordash Deductions

What Is Income Tax

Income tax is a type of tax you pay to the government on income earned from a job or your investments, such as shares and ETFs. Income tax is worked out based on what you earn in a financial year such as from 1 July, 2020, to 30 June, 2021 or from 1 July, 2021, to 30 June, 2022 and any tax deductions or tax offsets you can claim during that time.

How Do I File My Annual Return

To file your annual tax return, you will need to use Schedule C PDF to report your income or loss from a business you operated or a profession you practiced as a sole proprietor. Schedule C Instructions PDF may be helpful in filling out this form.

In order to report your Social Security and Medicare taxes, you must file Schedule SE , Self-Employment Tax PDF. Use the income or loss calculated on Schedule C to calculate the amount of Social Security and Medicare taxes you should have paid during the year. The Instructions PDF for Schedule SE may be helpful in filing out the form.

You May Like: How Much Tax Do You Pay On Doordash

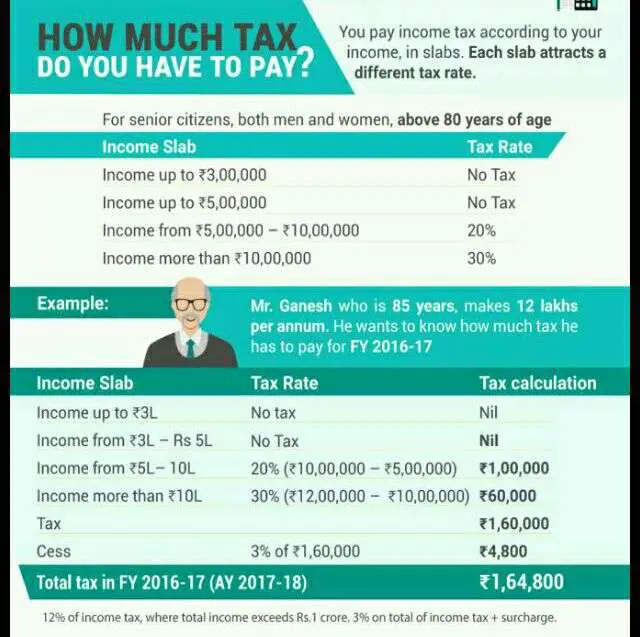

How Tax Brackets Work

As mentioned earlier, the United States follows a progressive income tax system. In that scheme, not all income is treated equally.

Which, as long as we lack an appetite for a flat tax plan, makes a certain amount of sense as we shall attempt to demonstrate.

When someone talks about being in the 24% bracket, then, that doesnt mean all of their taxable income endures the same 24% bite, but instead only their taxable income above a certain amount .

This is the headache-inducing beauty of the American system of marginal rates.

Watch For Your Income Documents To Arrive

You should receive forms about how much income youve earned from your employers and other income sources in January or February. If you are a full-time employee, you will receive a Form W-2 detailing your earnings, as well as which taxes were withheld. If you work freelance or on a contract, you may receive a Form 1099-NEC detailing what you earned. You may also receive documents showing dividends or interest earned on investments , or student loan interest youve paid . If youre a college student , youll receive a Form 1098-T that shows how much you paid in tuition, as well as any amounts you received from grants or fellowships, to help you figure out deductions and credits related to education expenses.

Don’t Miss: Is A Raffle Ticket Tax Deductible

Save The Right Paperwork All Year Long

Stay on top of tax-related paperwork throughout the year it will make your life easier during tax season. You might want to keep receipts for things like charitable donations, work-related expenses and medical bills, or other items from step 4. You may also want to keep statements from student loans or investments and any grants or fellowships. Having these handy and organized can help you determine whether to itemize and make the process easier. You should keep your paperwork after you file, too. The IRS recommends keeping records for at least three years.

When To File A Return Even If Not Required

Just because you are not legally required to file a tax return, that doesn’t mean that you shouldn’t. You should file if one of the following applies.

- Income tax was withheld from your pay

- You made estimated tax payments for the year

- You had any part of a tax overpayment for last year applied to this year’s estimated tax

- Qualified for the earned income tax credit

- Qualified for the child tax credit

- Eligible for the refundable American opportunity education credit

Read Also: Doordash Tax Calculator

What Is A Child’s Income Tax Rate

The Tax Cuts and Jobs Act changed the rates for the kiddie taxes. During 2018 through 2025 all net unearned income was to be taxed using the brackets and rates for trusts and estates instead of parent’s individual rates. The new rates were as high as 37% on only $12,070 of income. This change proved so unpopular it was rescinded in 2020 and the old rules put back in place. Starting in 2020, income tax on unearned income over the annual threshold must be paid at the parent’s maximum tax income tax rate, not the rates for trusts and estates. For 2019 and 2018, parents have the option of using either their individual rates or the trust and estates rates. For details, see the article “The Kiddie Tax.”

For federal income tax purposes, the income a child receives for his or her personal services is the child’s, even if, under state law, the parent is entitled to and receives that income. Thus, dependent children pay income tax on their earned income at their own individual tax rates.

For more on tax rules for children, see IRS Publication 929, Tax Rules for Children and Dependents.

Instacart: The True Income

We trust this article how much do you pay in taxes for Instacart and does Instacart take out taxes has helped you understand both. In summary, what you can hope to make as an Instacart driver and the costs you ought to know about will vary but this gives you a good idea.

Finally, with earnings as they may be Instacart is best as a wellspring of supplemental income in many markets in the USA. However, obviously your mileage will change depending on the locality of the clients you serve and your own income needs.

Are you interested to learn more?

Get FREE access to my E-BOOK + TRAINING VIDEO on My #1 Way To Make Money Online from the comfort of your own home:

Also Check: Doordash On Taxes

How Can I Keep Track Of Tax Due Dates

Canstar has an article about tax deadlines. Whether you are an individual taxpayer, small business owner or even a self-managed super fund trustee, you may consider downloading the ATO app. It features a key dates tool. Alternatively, the new Canstar App enables tracking tax-deductible expenses, as do various budgeting and savings apps.

Related: Canstars guide to 2021 tax deadlines

How Much Tax Do I Need To Pay In Australia

How much income tax you pay will depend on your personal situation and criteria such as your residency status, taxable income, and the tax rate and bracket that apply to you based on Australian Taxation Office requirements. If you are an Australian resident for tax purposes with a tax file number, you may be eligible for a tax-free threshold of $18,200. According to the Australian Governments Treasury, the largest amounts of income tax in Australia are paid by high income individuals. OECD figures show Australians had a net average tax rate of 23.6% in a recent year, which was slightly lower than the OECD average at the time of 25.9%.

You May Like: Doordash How Much To Save For Taxes

How To Calculate Your Ei Contributions

I want to make it clear that contributing to the EI program is not mandatory when youre self-employed. It is 100% voluntary. However, by not contributing to EI, that means you are ineligible to take advantage of all the benefits EI has to offer, such as maternity/parental leave or being a caregiver to a family member who is ill or injured. Then again, it may not be worth it to you and instead you may prefer to just have a very cushy Emergency Fund.

But if you are interested in it, heres how much it costs. As of 2021, the EI rate is 1.58% for self-employed individuals. This means that for every $100 you earn, you need to pay $1.58, to a maximum of $889.54/year . And for insurable earnings, this refers to your gross salary, or your business revenue after youve deducted business expenses but before youve paid income tax and CPP.

Using my earlier example:

Hi Jessica,Thank you so much for this informative post.I registered my business, as to avoid anyone from taking my name. I definitely wont be making more than 30k, Im thinking 10k-15k however I do work for a company with an annual salary of $42 500. With that said, since Im operating my business as a sole proprietorship, when doing my taxes I will need to combine both incomes together correct? How much taxes would I need to pay on that amount? I currently only pay about ~1000/year since I contribute to my RRSP, and I am located in Quebec.Thank you!