Ira Qualified Charitable Distribution

On December 18th, 2015, the President signed into law the Protecting Americans from Tax Hikes act, which includes a permanent extension of the Charitable IRA Rollover. Donors may now take advantage of the opportunity to make a Charitable IRA Rollover –a nontaxable distribution made directly by the administrator of an IRA to a qualified public charity.

What Is Considered A Qualified Charitable Contribution

- A nontaxable payout from an IRA owned by an individual who is 701/2 years old or older .

- The QCD is paid directly to an organization that is eligible to receive tax-deductible contributions by the IRA trustee.

- For QCDs, the maximum yearly exclusion is $100,000. Any QCD that exceeds the $100,000 exclusion limit is treated as a regular distribution and is included in income.

- For more information, see IRS Publication 590-B, Distributions from Individual Retirement Arrangements .

How Much Must I Take Out Of My Ira At Age 70 1/2

Required minimum distributions must be taken each year beginning with the year you turn age 72 . The RMD for each year is calculated by dividing the IRA account balance as of December 31 of the prior year by the applicable distribution period or life expectancy. Use the Tables in Appendix B of Publication 590-B, Distributions from Individual Retirement Arrangements . RMDs are not required for your Roth IRA.

See the discussion of required minimum distributions and worksheets to calculate the required amount.

Also Check: Doordash 1099 Example

Frequently Asked Questions About Charitable Ira Rollover Distributions

Now you can reliably plan charitable IRA rollover gifts, year after year. On Dec. 18, 2015, the White House signed legislation indefinitely extending the charitable IRA rollover, making it retroactive to Jan. 1, 2015, with no expiration date.

What is a Charitable IRA Rollover?The charitable IRA rollover, or qualified charitable distribution , is a special provision allowing particular donors of age 70.5 to exclude from taxable incomeand count toward their required minimum distributioncertain transfers of Individual Retirement Account assets that are made directly to public charities, including the American Association for Cancer Research .

Generally, a qualified charitable distribution is an otherwise taxable distribution from an IRA owned by an individual who is age 70½ or over that is paid directly from the IRA to a qualified charity. for additional information.) This is granted in the Consolidated Appropriations Act of 2016.

Since it was first made available in tax year 2006, many donors age 70.5 or older have used this popular option to support the areas of their choice with tax-wise gifts ranging from $100 to $100,000.

My Spouse also Supports the AACR. Can We Both Take Advantage of the IRA Charitable Distribution?Yes. The amount that can be excluded from income is limited to any amount up to $100,000 per taxpayer year. As a married couple, you can together donate up to $200,000 provided that each of you own at least one IRA and have reached age 70.5.

How Are Charitable Contributions From An Ira Reported

When reporting a qualified charity distribution on your Form 1040 tax return, you usually record the entire amount on the line for IRA distributions. If the entire amount was an eligible charitable distribution, write zero on the taxable amount line. Next to this line, type QCD. For more information, see the instructions for Form 1040.

- you made an eligible charitable distribution from a traditional IRA in which you had basis and received a distribution from the IRA that was not a qualified charitable distribution during the same year or

Recommended Reading: Efstatus Taxact 2015

Are Contributions To An Ira Fully Deductible

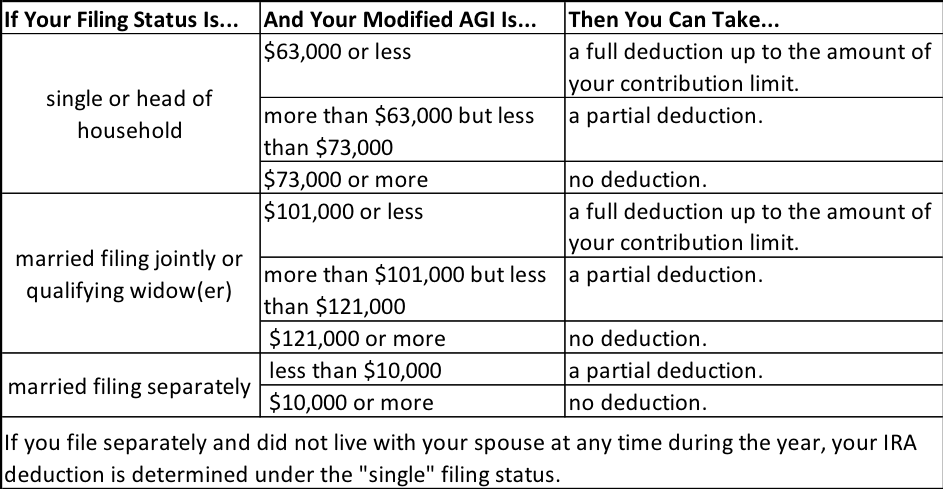

With traditional IRAs, account growth is tax-deferred and distributions are subject to income tax. If you and your spouse dont participate in an employer-sponsored plan such as a 401, the contribution is fully deductible on your 2019 tax return. If you or your spouse do participate in an employer-sponsored plan, your deduction is subject to the following MAGI phaseout:

Temporary Suspension Of Limits On Charitable Contributions

In most cases, the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage of the taxpayers adjusted gross income . Qualified contributions are not subject to this limitation. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year. To qualify, the contribution must be:

- a cash contribution

- made to a qualifying organization

- made during the calendar year 2020

Contributions of non-cash property do not qualify for this relief. Taxpayers may still claim non-cash contributions as a deduction, subject to the normal limits.

The Coronavirus Tax Relief and Economic Impact Payments page provides information about tax help for taxpayers, businesses, tax-exempt organizations and others including health plans affected by coronavirus .

Read Also: How Do Doordash Drivers Pay Taxes

What Assets Can I Donate To A Donor Advised Fund

In addition to cash, there are a wide variety of assets that can be contributed to a donor-advised fund . Among the most common are appreciated assets such as:

- Stocks, bonds and mutual fund shares

- Privately held interests

- Retirement assets

- Life insurance policies

Contributions are generally tax-deductible up to 60% of AGI for cash gifts and 30% for illiquid assets. The donor can take the tax deduction for the year that contribution is made. Any amount that exceeds the donors adjusted gross income can be carried forward for five years.

What Is An Ira Charitable Rollover

The charitable IRA rollover, also known as a qualified charitable distribution , is a special provision that allows certain donors over the age of 70.5 to exclude certain transfers of Individual Retirement Account assets made directly to public charities from taxable income and count toward their required minimum distribution.

You May Like: How To Look Up Employer Tax Id Number

Qualifying For An Ira Charitable Rollover

In order to qualify, a person must adhere to certain requirements:

- The donor must be at least aged 70 ½ at the time of the gift.

- Distributions have to be made from the IRA trustee directly to the charity. If a distribution check is made payable to you, the distribution would NOT qualify as a QCD and would be treated as taxable income.

- Distributions must come from a traditional IRA or Roth IRA. Some plans such as 401k, 403b, and SEPs are not eligible .

- Distributions from a split-interest vehicle such as a charitable lead or remainder trust are not permitted.

- Distributions to donor-advised funds, supporting organizations, and private foundations do not qualify.

- A donor may not retain any benefit that would reduce their charitable deduction.

- The charitable distribution must be completed by December 31 in the year it is claimed.

- Total charitable distributions cannot exceed $100,000, per taxpayer per year. If a married couple files jointly, each may contribute up to $100,000. Any amount over this cannot be excluded from gross income.

- Donors may not retain any benefit in exchange for the donation.

- Donors can exclude their contribution from gross income but cannot claim a charitable deduction.

CHAPTER 4:

Charitable Ira Rollover Gifts May Enhance Your Tax Savings When Compared To Cash Gifts

Whether you are fully or partly retired, you may find that your lifestyle is fine as-is and that you don’t need additional money from your IRA. However, even if you don’t need the extra funds, at age 72 , the IRS requires you to take IRA withdrawals in statutorily-mandated, annual increments known as “Required Minimum Distributions” . What’s wrong with that? RMDs are subject to ordinary income taxes and more taxable income may push you into a higher tax bracket, which can lead to adverse impacts, including effects on your Social Security income and Medicare benefits. What’s more, if you don’t take your RMDs, you could be subject to a 50% penalty on the amount that wasn’t withdrawn.

Thankfully, for charitably-minded retirees with traditional IRAs, there is a tax-relief strategy available: the Qualified Charitable Distribution . The QCD gifting option allows you, starting at age 70½, to instruct your IRA1 administrator to direct IRA distributionsup to $100,000 per year2to a qualified 501 charity.3 Because the IRA income goes directly to charity, you do not report the QCD as taxable income and do not owe any taxes on the QCD, which may be particularly beneficial to you if you are forced to take RMDs and don’t need the extra money. In addition to avoiding taxable income, your IRA distribution can be put to good use by your favorite qualified charity.4 It’s truly a win-win option.

Read Also: Is Plasma Money Taxable

The Rules Are Different For Roth Iras

Roth IRAs have different QCD rules than traditional IRAs. It’s possible to take a QCD out of a Roth IRA, but there’s generally no advantage in doing so because Roth IRA distributions are already tax-free. You can’t deduct contributions made to Roth accounts, so you’ve already paid taxes on those dollars you contributed.

Roth IRAs aren’t subject to RMDs, either , so the more tax-efficient move might be to use a traditional IRA to fund the QCD.

QCDs can’t come out of SEP IRA or SIMPLE IRA plans, either, if they are ongoing plans.

Backdoor And Mega Backdoor Roth

Investors make a non-deductible contribution to a traditional IRA and then swiftly convert to a Roth IRA in a backdoor Roth. When money is withdrawn from a Roth IRA, it is tax-free . If you dont have any additional regular IRAs, this technique will work. The pro rata rule applies in all other cases.

In a massive backdoor Roth, you contribute to your 401 up to the annual maximum before making after-tax contributions . The after-tax contributions can then be rolled into a Roth IRA or rolled into an in-plan Roth 401.

Not all employer plans permit this, and there are other factors to consider before applying this or any of the other tactics discussed in this article.

You May Like: How To Do Taxes On Doordash

How To Donate To Charity From Your Ira

After years of contributing to tax-deferred 401s and IRAs, income tax is due on that money when you take withdrawals in retirement. Annual withdrawals from traditional retirement accounts are required after age 72, and the penalty for skipping a required minimum distribution is 50% of the amount that should have been withdrawn. However, if you are in the fortunate position of not needing your distribution for living expenses and are charitably inclined, you can avoid income tax on your required withdrawal by donating your money directly to a qualifying charity.

What is a Qualified Charitable Distribution?

A qualified charitable distribution is an IRA withdrawal that is paid directly from your IRA to a qualifying charity. While income tax is normally due on each traditional IRA distribution, the account owner does not need to pay taxes on the amount transferred to charity.

How to Set Up an IRA Qualified Charitable Distribution:

— Meet the QCD requirements.

— Calculate your QCD tax break.

— Set up a direct transfer to a charity.

— Select a qualifying charity.

Read on to find out more about how an IRA-qualified charitable distribution can be used to help others and reduce your tax bill.

Meet the QCD Requirements

IRA owners must be age 70 1/2 or older to make a tax-free charitable contribution. Those who meet the age requirement can transfer up to $100,000 per year directly from an IRA to an eligible charity without paying income tax on the transaction.

How Fidelity Charitable Can Help

Since 1991, we have been helping donors like you support their favorite charities in smarter ways. We can help you explore the different charitable vehicles available and explain how you can complement and maximize your current giving strategy with a donor-advised fund. Join more than a quarter million donors who choose Fidelity Charitable to make their giving simple and more effective.

Also Check: Irs Company Lookup

Support The Red Cross With A Qualified Charitable Distribution From Your Ira

What is a qualified charitable distribution?

A qualified charitable distribution is a distribution of funds from your IRA directly to a qualified charitable organization, such as the American Red Cross. Because the gift goes directly to the charity without passing through your hands, the dollar amount of the gift may be excluded from your taxable income up to a maximum of $100,000 annually, with some exceptions. Please consult your tax advisor for information regarding your specific exceptions.

Who can make a qualified charitable distribution?

QCDs can be made by IRA owners who are age 70 1/2 or older. QCDs made prior to the age you are required to take a minimum distribution from your retirement assets will not reduce or otherwise impact future Required Minimum Distribution. Your tax advisor can provide additional information on your particular situation.

Many individuals who are required to take money from their IRA but do not need it for living expenses have chosen to make QCDs from their IRAs to support the work of the Red Cross. This may make sense for you too!

How do I make a qualified charitable distribution to the American Red Cross?

Learn more at the link below:

If you prefer, you can . Send the completed form to your IRA trustee, who will complete your distribution.

Have you already made your qualified charitable distribution?

How will the Red Cross use my gift?

Compare Investment Options For 2022

Table 1 below summarizes the destructibility of traditional IRA contributions for individuals covered by an employer-sponsored retirement plan during 2021. Note that all permanent federal employees are covered by a retirement plan . Table 1 applies to federal employees who are considering making contributions to a traditional IRA for the year 2021. When federal employees receive their 2021 W-2 statement in January, they should note on their W-2 Box 13 Retirement Plan box will be checked.

Table 1. Deductibility of IRA Contributions-Individual Covered by Employer Retirement Plan*

The following example illustrates:

Example 1. Thomas is a federal employee and is married to Julie. They are both 40 years old. Julie is employed part-time in private industry but is not covered by a retirement plan. Their combined MAGI for 2021 is $107,000. Thomas salary is $75,000 and he contributed $6,000 to his traditional IRA for 2021. Since Thomas and Julies MAGI is between $105,000 and $125,000 and Thomas is covered by a retirement plan , Thomas and Julies IRA contributions are subject to the deduction phase-out as follows:

Thomas and Julie can each deduct up to $5,400 of their $6,000 traditional IRA contributions. The amount that each cannot deduct is considered a nondeductible contribution.

You May Like: Buying Tax Liens California

What Kind Of Charities Qualify

The charity must be a 501 entity, which means it can accept tax-deductible donations.

- Charities that carry out exempt purposes by assisting other exempt organizations, mainly other public charities, are known as supporting organizations.

- Public charities handle donor-advised money on behalf of organizations, families, or individuals.

Are Charitable Contributions Made From An Ira Tax Deductible

Charitable contributions can only be made from IRAs, not 401s or similar types of retirement accounts. You dont need to itemize your taxes in order to make an IRA charitable distribution. However, you cannot additionally claim a charitable contribution tax deduction on a charitable distribution from your IRA.

Also Check: Will A Roth Ira Reduce My Taxes

Is A Roth Ira An After Tax Account

If youre wondering how Roth IRA contributions are taxed, keep reading. Heres the solution Although there is no tax deductible for Roth IRA contributions like there is for regular IRA contributions, Roth distributions are tax-free if certain conditions are met.

You can withdraw your contributions tax-free and penalty-free at any time because the funds in your Roth IRA came from your contributions, not from tax-subsidized earnings.

For people who expect their tax rate to be higher in retirement than it is now, a Roth IRA is an appealing savings vehicle to explore. With a Roth IRA, you pay taxes on the money you put into the account, but any future withdrawals are tax-free. Contributions to a Roth IRA arent taxed because theyre frequently made using after-tax money, and you cant deduct them.

Instead of being tax-deferred, earnings in a Roth account can be tax-free. As a result, donations to a Roth IRA are not tax deductible. Withdrawals made during retirement, on the other hand, may be tax-free. The distributions must be qualified.

Risks Of Increasing Adjusted Gross Income

Retirees need to know how more income may affect their entire tax situation, said David Foster, CFP and founder of Gateway Wealth Management in St. Louis.

“You might screw up some of the other deductions,” he said.

For example, if someone’s adjusted gross income is $100,000 and they itemize deductions, they may claim a write-off for qualified medical expenses above 7.5% of their AGI. So with $10,000 in expenses, they may deduct $2,500.

There are so many unintended consequences when you start changing adjusted gross income.JoAnn MayPrincipal at Forest Asset Management

However, bumping up AGI with retirement plan distributions may eliminate that deduction, Foster said.

Increasing income may also affect the cost of Medicare premiums. Although most retirees don’t pay for Medicare Part A, the price for Medicare Part B may jump based on income, with top earners paying $504.90 per month in 2021.

“I think there’s nothing like running the numbers,” said May. “There are so many unintended consequences when you start changing adjusted gross income.”

Recommended Reading: License To Do Taxes

What Is A Donor Advised Fund

A donor-advised fund, or DAF, is an account established as a means to support charities while achieving income tax savings. It allows donors to establish a fund to make charitable contributions over time while receiving an upfront tax deduction. Because any assets transferred into the account must eventually go to charity, the donor is qualified for a charitable deduction at the time of the contribution. Depending on the assets used to establish the fund, a donor can receive an income tax deduction of up to 60% of his or her adjusted gross income on that donation.