When You May Want To Submit A Tax Return To Claim A Tax Refund

With all the above being said, there are years when you might not be required to file a tax return but may want to. If you have federal taxes withheld from your paycheck, the only way you can receive a tax refund when too much was withheld is if you file a tax return.

- For example, if you are a single taxpayer who earns $2,500 during the year, with $300 withheld for federal tax, then you are entitled to a refund for the entire $300 since you earned less than the standard deduction.

- The IRS doesn’t automatically issue refunds without a tax return, so if you want to claim any tax refund due to you, then you should file one.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

Gst/hst Returns Filed By Non

If you are a non-resident, complete your GST/HST return in Canadian dollars, sign the return, and remit any amounts owing in Canadian dollars.

If you choose to make your payment in foreign funds, the exchange rate you receive for converting the payment to Canadian dollars is determined by the financial institution processing your payment, and may be different from the exchange rate that we use.

Age And Status Requirements For Dependents

Being claimed as a dependent on someone elses taxes changes the rules a bit, and it does not rule out the possibility that you will still be required to file. If you are an adult, working dependent, you will likely be required to file your own return.

| Under 65 | $12,400 earned | |

| Single Dependents | 65 or older OR blind | $14,050 earned |

| Single Dependents | 65 or older AND blind | $15,700 earned |

| Under 65 | $12,400earned OR Your gross income was at least $5 and yourspouse files a separate return and itemizes deductions. | |

| 65 or older OR blind | $13,700earned income OR Your gross income was at least $5 and yourspouse files a separate return and itemizes deductions | |

| 65 or older AND blind | $15,000earned OR Your gross income was at least $5 andyour spouse files a separate return and itemizes deductions |

Don’t Miss: 1040paytax.com Official Site

When Seniors Must File

For tax year 2020, you will need to file a return if:

- you are unmarried,

- at least 65 years of age, and

- your gross income is $14,050 or more.

However, if you live on Social Security benefits alone, you don’t include this in gross income. If this is the only income you receive, then your gross income equals zero, and you don’t have to file a federal income tax return.

But if you do earn other income that is not tax-exempt, then each year you must determine whether the total exceeds $14,050.

- For tax years prior to the 2018 tax year , these amounts are based on the year’s standard deduction plus the exemption amount for your age and filing status.

- Beginning in 2018, only your standard deduction is used since exemptions are no longer part of calculating your taxable income under the new tax law passed in late 2017.

For the 2020 tax year,

- If you are married and file a joint return with a spouse who is also 65 or older, you must file a return if your combined gross income is $27,400 or more.

- If your spouse is under 65 years old, then the threshold amount decreases to $26,100.

- Keep in mind that these income thresholds only apply to the 2020 tax year, and generally increase slightly each year.

You Must File An Income Tax Return If:

- You owe tax to the CRA.

- Youve participated in the Home Buyers Plan or Lifelong Learning Plan and have repayments owing.

- You disposed of capital property. If you sold your home, you must file a tax return even if you dont have to pay capital gains tax on the sale .

- You have received a Canada Workers Benefit advance payments in the tax year.

- The CRA has sent you a Request to File.

- If the CRA has sent you a Demand to File, then that means they are serious about your lack of filing and you had better get to it.

Don’t Miss: Michigan Gov Collectionseservice

What Is The Voluntary Disclosures Program

The Voluntary Disclosures Program allows you to come forward and correct inaccurate or incomplete information or to disclose information you had not previously reported to us.

You may avoid penalties and prosecution if you make a valid disclosure before you become aware of any compliance action being initiated against you by us. You will only have to pay the taxes owing plus interest.

A disclosure is valid if it:

- is voluntary

- involves the application or the potential application of a penalty and

- generally includes information that is more than one year overdue.

The VDP provides an avenue for you to correct past errors and omissions and become compliant with tax laws.

For more information, go to Voluntary Disclosures Program, or see GST/HST Memorandum 16.5, Voluntary Disclosures Program or GST/HST Memorandum 16.3, Cancellation or Waiver of Penalties and/or Interest.

Taxpayers With Many Dependents

Lower-income families with dependent children might not have to pay taxes because of the child tax credits they are entitled to claim. Take, for example, a married couple with three children. Depending on their income level, this couple could qualify for a maximum tax credit of $6,728 in 2021 , which would offset their tax bill dollar for dollar. The credits phase out once income thresholds are met.

The limit on the Child Tax Credit, previously $2,000, has been raised to $3,000 for children ages six through 17 and $3,600 for children under six. The credit is also now fully refundable previously, only $1,400 was refundable. These changes are part of the American Relief Act of 2021 and are effective only for the 2021 tax year unless extended by an additional act of Congress. It is phased out for singles with incomes above $75,000 and couples with incomes above $150,000.

It is worth noting that taxpayers who don’t have children can also qualify for a tax credit. A single person with no children can claim a maximum credit of $1508 in 2021, and the income threshold for this taxpayer would be $21,430 in 2021.

Don’t Miss: How Much Time To File Taxes

Schedule C Reconciliation Of Recaptured Input Tax Credits

Complete Schedule C electronically if you are required to recapture ITCs for the provincial part of the HST on specified property and services, and you elected to use the estimation and reconciliation method to report them.

This schedule must be completed within three months of your fiscal year-end. For more information, see Recapture of ITCs and the following publications:

Line 105 Total GST/HST and adjustments for period

Line 105 before RITC reconciliation is calculated automatically based on the information you provided on Schedule A, if applicable.

If Schedule A does not apply, enter on line 105 the total amount of GST/HST you were required to charge during this reporting period and any adjustments that increase your net tax for the reporting period.

Only include amounts for the current reporting period. Do not include amounts for the fiscal year being reconciled.

Line 108 Total ITCs and adjustments

Line 108 before RITC reconciliation is calculated automatically based on the information you provided on Schedule B, if applicable.

If Schedule B is not applicable, enter on line 108 all ITCs and any adjustments that decrease the net tax for this reporting period. Include ITCs for the provincial part of the HST on specified property or services that are subject to recapture.

Line 1402A

Line 1402R

Line 116

Line 105 Total GST/HST and adjustments for period

Four Factors That Impact Income Thresholds

Four factors determine whether you must file, and each circumstance has its own gross income threshold. The four factors are:

- Whether someone else claims you as a dependent

- Whether you’re married or single

- Your age

Some of these factors can overlap, which can change the income thresholds for required filing.

Read Also: How To Buy Tax Lien Certificates In California

How To File Your Return

It is mandatory for many registrants to file electronically. GST/HST registrants, excluding registrants that have accounts administered by Revenu Québec, are eligible to file their GST/HST returns and remit amounts owing electronically. GST/HST returns in paper format can be filed by mail or, if you are making a payment, at your financial institution.

A penalty will apply if you are required to file electronically and you do not do so. For more information, see Failure to file electronically.

There are five methods of electronically filing a GST/HST return. They are:

We offer a printer-friendly version of a GST/HST return working copy. This working copy is provided to enable registrants who file electronically to keep a copy of their GST/HST return calculations for record purposes. Do not use the printer-friendly version to replace and file a lost pre-printed return or to make payments at your financial institution. To print a copy, go to Complete a GST/HST Return.

For payment options, see How to remit an amount owing.

Mandatory electronic filing

You must file your return electronically if you are a registrant who falls under any of the following reporting circumstances:

For builders who need more information, see GST/HST Info Sheet GI-099, Builders and Electronic Filing Requirements, to help determine the filing option that can or must be used. Penalties will be applied if you do not file electronically when you are required to do so.

Notes

Groups That Don’t Pay Taxes

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Every year, millions of Americans patiently wait for weeks to receive all of their necessary tax forms in the mail, dutifully gather them together and prepare their returns, and wistfully contemplate what they could have done with the dollars that went to Uncle Sam and their state governments.

But not everyone is subject to this process some groups of people in America have been exempted from this process under our tax code. There are five main categories of taxpayers that are lucky enough to escape the tax man.

You May Like: What Does Locality Mean On Taxes

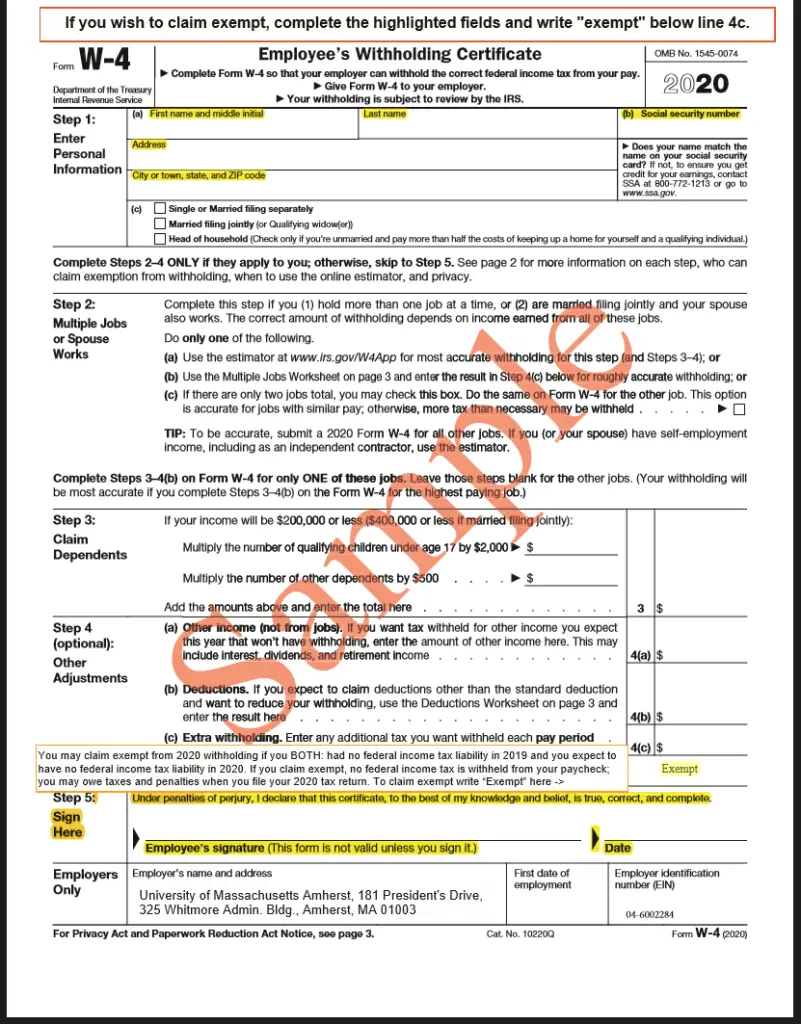

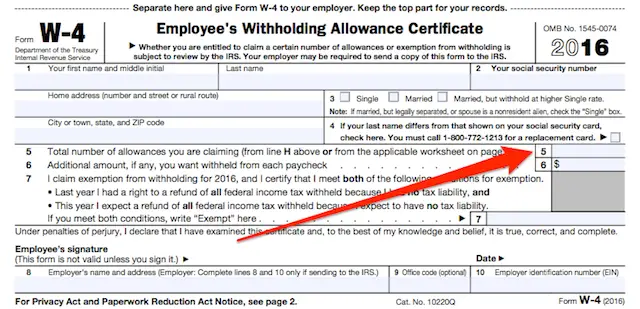

What Does Exempt Mean

Generally, the IRS will issue a tax refund when you pay more tax than what is actually owed in that specific tax year. When you file exempt with your employer, however, this means that you will not make any tax payments whatsoever throughout the tax year. Therefore, you will not qualify for a tax refund unless you are issued a refundable tax credit. Come tax season, your employer will provide you with Form W-2, which identified the total amount of taxes that was withheld throughout the year. If your tax liability is less than the amount withheld, the IRS will issue you a tax refund for the difference.

Rounding Off Fractional Amounts

Round off the GST/HST to the nearest cent:

- If the amount is less than half a cent, you may round down.

- If the amount is equal to or more than half a cent, round up.

If your customer is buying more than one item and tax applies at the same rate on all items, you can total the prices of all taxable supplies of property and services, calculate the GST/HST payable, and then round off the amount.

You May Like: How To Look Up Employer Tax Id Number

Rules For Motor Vehicles

Sales

Sales by registrants

Under the general place of supply rules described on the previous pages for sales of goods, the supply of a specified motor vehicle by way of sale is made in a province if the supplier delivers the vehicle or makes it available in the province to the recipient of the supply.

The application of this place of supply rule is generally based on the province in which legal delivery of the vehicle to the recipient occurs.

However, for purposes of this rule, a vehicle is also deemed to be delivered in a province if the supplier:

- ships the vehicle to a destination in the province specified in the contract for carriage of the vehicle or

- transfers possession of the vehicle to a common carrier or consignee that the supplier has retained on behalf of the recipient to ship the vehicle to the province.

In addition, a special place of supply rule in respect of specified motor vehicles deems the sale of a motor vehicle to be made in a particular province in which the vehicle is registered, other than temporarily, if that registration occurs no more than seven days after the day the vehicle is delivered to the recipient in a participating province and the supplier maintains satisfactory evidence of that registration.

You generally have to self-assess the provincial part of the HST for a motor vehicle, or an amount of the provincial part of the HST, that reflects the difference in the HST rates between the provinces, if you:

Sales by a non-registrant

Note

Rentals

Who Has To Make Instalment Payments

If you are an annual filer and your net tax for the previous fiscal year was $3,000 or more, and your net tax for the current fiscal year is $3,000 or more, you have to make quarterly instalment payments during the current fiscal year, even if you have a rebate that reduces your amount owing to less than $3,000. If you do not remit instalments, you may incur penalty and interest.

To calculate your instalment payments and view the related due dates, go to My Business Account.

These quarterly payments are due within one month after the end of each of your fiscal quarters and are usually equal to one quarter of your net tax from the previous year. You may also choose to base your quarterly instalment payments on an estimate of your net tax for the current year if you expect that your net tax for the current year will be less than it was for the previous year.

Also Check: Cook County Assessor Deadlines

Excise Duties And Taxes

Throughout the following text, for purposes of the tax exemption under section 87 of the Indian Act, the CRA uses the term Indian because it has a legal meaning in the Indian Act.

Excise duties and taxes apply to certain products. The manufacturer or distributor, not the consumer, pays these taxes. The CRA administers the legislation which regulates the products to which these taxes apply. The CRA also licenses the manufacturers of these products. Although an amount equal to the tax may be included in the price, the courts have confirmed that Indian individuals are not exempt from such an indirect tax.

Federal excise duty applies to alcohol and tobacco products. The Excise Act, 2001 is the legislation that imposes excise duty on spirits, wine and tobacco products while the Excise Act governs beer. For information about licensing and paying excise duty, contact the office in your region listed in Excise Duty Memorandum 1.1.2, Regional Excise Duty Offices.

The Excise Tax Act imposes federal excise tax on motive fuel products, automotive air conditioners and certain fuel-inefficient vehicles and insurance premiums. For more information, including where to send requests for excise tax licences, see ETSL74 Notice to all Excise Tax Licensees and Tax Professionals Excise Tax Licensing and Related Enquiries.

Using A Rebate Or Refund To Decrease An Amount Owing On Your Gst/hst Return

You can offset the net tax you owe on your GST/HST return with certain GST/HST rebates to which you are entitled. For more information on the types of rebates that can be applied to an amount owing on your GST/HST return, go to GST/HST.

If you file your return and rebate application together, or if you file your return electronically, remit only the difference between the amount of the rebate and the GST/HST you owe on your return. If the rebate is more than the amount of the GST/HST you owe, we will refund you the difference.

If you file your GST/HST return electronically, send the rebate application by mail to the Prince Edward Island Tax Centre or Sudbury Tax Centre as indicated on the rebate application. Some rebates can be filed electronically with your return. See How to file rebate applications for electronic returns.

If you file a paper return, write the amount of your rebate on line 111 of your return, and include your completed rebate application with the return.

Unless you are required to file electronically , you can also file two or more returns together, offsetting the net tax you owe on one return with a refund claimed on the other. For example, if your business has branches that file separate returns, you can offset your GST/HST remittance by the amount of any refund to which any of your branches are entitled. To do so, file the returns together.

Don’t Miss: How Can I Make Payments For My Taxes

Filing Exempt On Taxes When You Are Not Eligible

If you claim exempt on your Form W-4 without actually being eligible, anticipate a large tax bill and possible penalties after you file your tax return. If both of the following statements apply, you could face a tax penalty: